Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

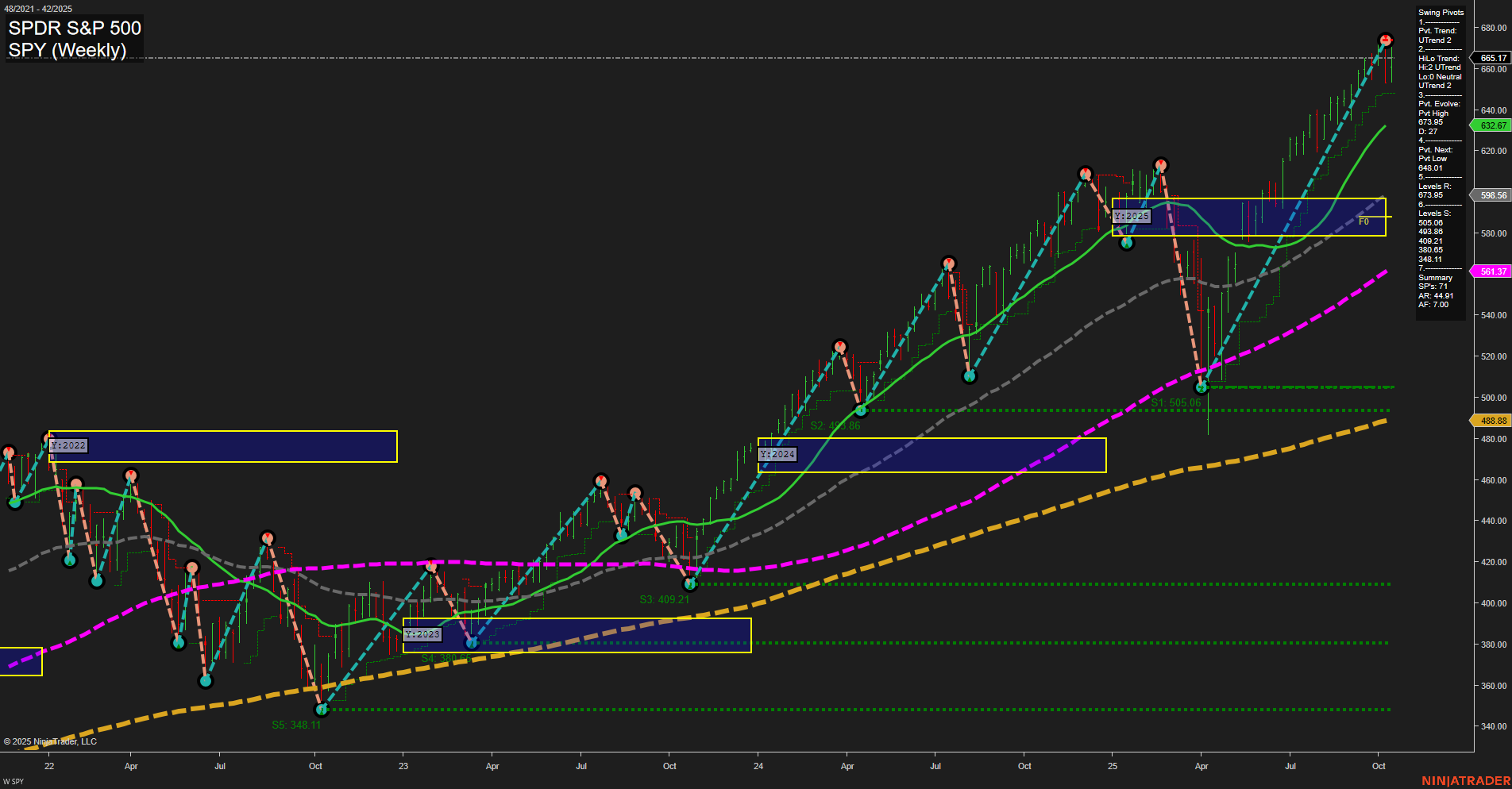

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- 08:33 USD Core PPI m/m, PPI m/m: Key inflation gauges for producers; stronger-than-expected readings may increase expectations for hawkish Fed policy, potentially pressuring equity indices lower.

- 08:33 USD Core Retail Sales m/m, Retail Sales m/m: Direct snapshot of consumer demand; higher figures likely signal a resilient economy and may support near-term market strength, but could also spark speculation about delayed Fed rate cuts.

- 08:33 USD Unemployment Claims: A critical labor market indicator; lower-than-expected claims highlight job market strength, while surprises higher could weigh on market sentiment.

EcoNews Conclusion

- The 08:33 cluster of high-impact data releases is set to drive immediate shifts in market momentum, with inflation and consumer strength in sharp focus for futures traders.

- Combined surprises in either direction across PPI and Retail Sales will likely prompt heightened volatility at the US session open.

For full details visit: Forex Factory EcoNews

Market News Summary

- Banking & Liquidity: U.S. banks increased borrowing from the Federal Reserve’s repo facility amid rising overnight rates, revealing strain ahead of a large Treasury settlement. Despite this, strong bank earnings have provided some positive momentum that tempers these funding concerns.

- Economic & Political Developments: The U.S. government shutdown remains unresolved, fueling uncertainty. Political tensions with China escalated after U.S. officials criticized Chinese export controls, adding to the October market volatility. Pessimism among American consumers is cutting across political divides due to inflation and employment anxieties.

- Federal Reserve & Macro Trends: The Fed’s Beige Book indicates flat growth and rising uncertainty. Markets are increasingly pricing in a 25-basis-point rate cut, which is pressuring the U.S. dollar lower. Technical market trend indicators suggest recent declines are not yet a confirmed reversal.

- Commodities: Gold continues to set record highs, driven by safe-haven demand and expectations of looser Fed policy. The World Gold Council projects strength to persist. Oil saw a bounce after diplomatic headlines (notably, India pledging to halt Russian oil purchases), but technical and demand weakness remain headwinds in the longer term.

- Equities & ETF Flows: Major U.S. indices finished the session with gains, with the Russell 2000 hitting a new closing high and tech stocks showing resilience. Stock futures point higher as the session rolls forward. ETF flows indicate investors are rotating into sectors and quality funds that offer either safety in volatile conditions or fundamental growth potential amid ongoing U.S.-China trade tensions.

- Artificial Intelligence: The cost of AI infrastructure buildout is causing division among money managers, with some seeing it as a source of market concern, while others view AI-related investment as a primary driver of current economic expansion.

- Europe & Global Markets: European equities are set for a weak open, continuing a period of choppy trading. Eurozone bond yields are edging up, though a further rally is possible in the absence of definitive U.S. data. Globally, the decline in the dollar on rate-cut hopes and trade war worries is contributing to mixed performance across regions.

News Conclusion

- Market sentiment remains mixed with a tilt toward caution due to funding strains, political tensions, and slowing economic momentum, as highlighted by central bank and government reports.

- Gold stands out as a continued outperformer in the current environment, while oil’s upside appears capped by technical and demand factors despite short-term geopolitical boosts.

- Bank and technology sector momentum helps buoy major indices, but volatility is elevated, especially as fiscal and trade policy risks persist.

- AI investment continues to be a focal point for both growth prospects and risk, dividing market views and driving sector rotation.

- Market conditions are characterized by choppy trading, polarized investor sentiment, and reactions to evolving global event risks. Near-term direction is unclear, with attention on further data and policy developments.

Market News Sentiment:

Market News Articles: 44

- Neutral: 43.18%

- Positive: 29.55%

- Negative: 27.27%

Sentiment Summary:

Of the 44 market news articles reviewed, 43.18% presented a neutral stance, 29.55% conveyed positive sentiment, and 27.27% reflected negative sentiment.

The current tone in market news is largely balanced, with a slight tilt toward neutral reporting and comparable levels of positive and negative outlooks.

GLD,Gold Articles: 16

- Positive: 68.75%

- Neutral: 25.00%

- Negative: 6.25%

Sentiment Summary: The majority of recent articles on GLD and gold indicate positive sentiment (68.75%), with a smaller portion reflecting neutral sentiment (25.00%) and only a minor share suggesting negative sentiment (6.25%).

This suggests that current market commentary around GLD and gold is largely optimistic, with few negative perspectives reported.

USO,Oil Articles: 6

- Positive: 66.67%

- Negative: 33.33%

Sentiment Summary: The recent news coverage on USO and oil shows a predominantly positive sentiment, with about two-thirds of articles reflecting optimism and one-third indicating a negative outlook.

This suggests that current market sentiment is leaning more towards positive factors influencing USO and oil, though some concerns remain present.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 16, 2025 07:16

- GOOG 251.71 Bullish 2.24%

- GLD 387.39 Bullish 1.73%

- TSLA 435.15 Bullish 1.38%

- META 717.55 Bullish 1.26%

- IWM 250.33 Bullish 0.98%

- QQQ 602.22 Bullish 0.71%

- AAPL 249.34 Bullish 0.63%

- SPY 665.17 Bullish 0.44%

- IJH 65.14 Bullish 0.09%

- DIA 462.71 Bearish 0.00%

- USO 68.99 Bearish -0.01%

- MSFT 513.43 Bearish -0.03%

- NVDA 179.83 Bearish -0.11%

- TLT 90.66 Bearish -0.22%

- AMZN 215.57 Bearish -0.38%

- IBIT 63.17 Bearish -1.16%

ETF Stocks Market Summary

- Bullish: SPY (+0.44%), QQQ (+0.71%), IWM (+0.98%), IJH (+0.09%)

U.S. equity ETFs continue their upward momentum, with Small Caps (IWM) showing relative leadership and Mid Caps (IJH) just above the flat line. The Nasdaq-100 via QQQ posts a firm gain. SPY, representing the S&P 500, remains positive but with a modest advance. No major ETF in this group is in negative territory at the current snapshot. - Bearish/Mixed: DIA (0.00%)

The Dow Jones ETF (DIA) stands flat. No directional strength seen, indicating indecision or pause in large-cap value names.

Magnificent 7 (Mag7) Summary

- Bullish: GOOG (+2.24%), TSLA (+1.38%), META (+1.26%), AAPL (+0.63%)

Tech leaders surge, paced by GOOG with the largest gain in the cohort. TSLA and META also post over 1% gains. Apple continues upward with a moderate gain. - Bearish: MSFT (-0.03%), NVDA (-0.11%), AMZN (-0.38%)

Microsoft, Nvidia, and Amazon trade lower. MSFT’s and NVDA’s declines are subtle, while AMZN is showing more notable underperformance in this group.

Sector & Thematic ETFs

- Bullish: GLD (+1.73%)

Gold ETF resumes strength, benefiting from risk-off or inflation hedging flows. - Bearish: USO (-0.01%), TLT (-0.22%), IBIT (-1.16%)

Crude Oil ETF (USO) is just below unchanged; long-term Treasuries (TLT) remain under pressure, and Bitcoin ETF (IBIT) experiences the largest selloff among listed ETFs.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-16: 07:16 CT.

US Indices Futures

- ES Bullish on YSFG, MSFG, WSFG; price above all major benchmarks; clear uptrend in swing pivots; higher highs/lows; recent support 6588.61, recent high 6812.25; uptrend confirmation.

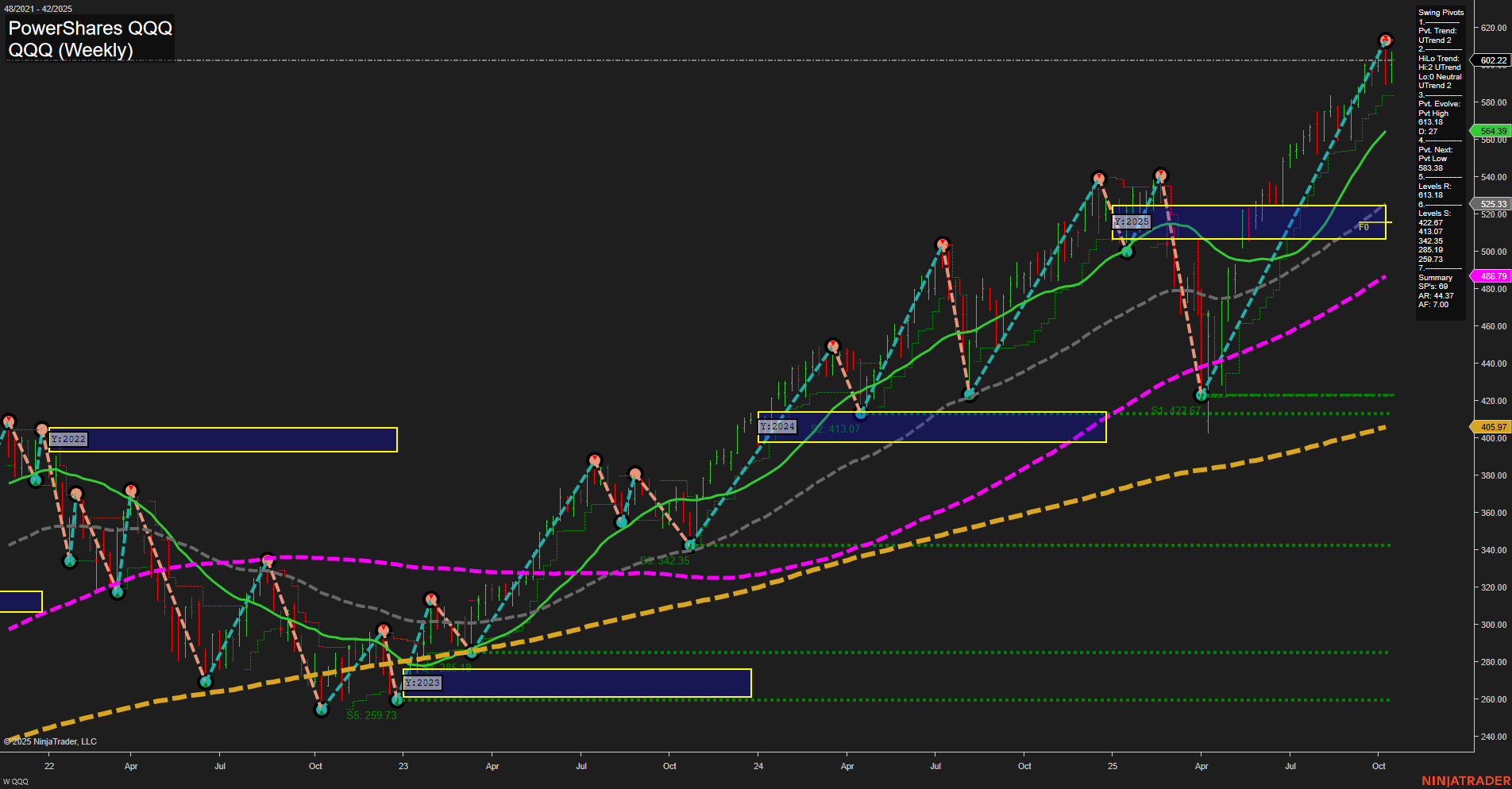

- NQ Bullish across YSFG, MSFG, WSFG; new highs at 25,069.00; price above NTZ center; all MAs up; swing uptrend structure; support at 24,407.00; recent trend continuation signals.

- YM Bullish ST/LT, Neutral IT; above key fibs/MA benchmarks; recent pivot high 46,724; support 44,039; possible consolidation; transition phase after rally; long-term uptrend intact.

- EMD Bullish ST/LT, Neutral IT on weekly, Bullish across all on daily; price above fibs/MA levels; pivots in uptrend; resistance 3352–3523; support 3149, 3124; volatility moderates; trend continuation likely.

- RTY Bullish all HTFs; above MAs/benchmarks; broke resistance; pivot high 2546.4, support 2473.3; higher highs/lows; strong uptrend structure; expansion phase; no exhaustion indication.

- FDAX Neutral ST, Bullish IT/LT (weekly), Bearish ST, Bullish IT/LT (daily); consolidation at resistance; ST WSFG/MA weakness, uptrend in MSFG/YSFG; resistance 24,800, support 23,419; short-term pullback within uptrend.

Overall State

- Short-Term: Bullish (except FDAX: Neutral/Weekly, Bearish/Daily)

- Intermediate-Term: Bullish to Neutral (YM, EMD, FDAX Weekly Neutral)

- Long-Term: Bullish

Conclusion

US indices futures (ES, NQ, YM, EMD, RTY) are exhibiting strong bullish structure across HTFs, with consistent outperformance above YSFG, MSFG, and WSFG levels, as well as above all major moving average benchmarks. ES, NQ, RTY remain in pronounced uptrends, making higher highs and higher lows. YM and EMD show consolidation in intermediate-term sessions but retain bullish long-term structure. FDAX is consolidating, reflecting a short-term pullback below WSFG/NTZ, but maintains intermediate and long-term bullish alignment. All indices display upward trend correlations, robust momentum, and wide support buffers below prior pivots. No immediate reversal signals are present; current technical context reflects trend continuation potential, though corrective pullbacks may develop at resistance or after extended moves.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts