Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

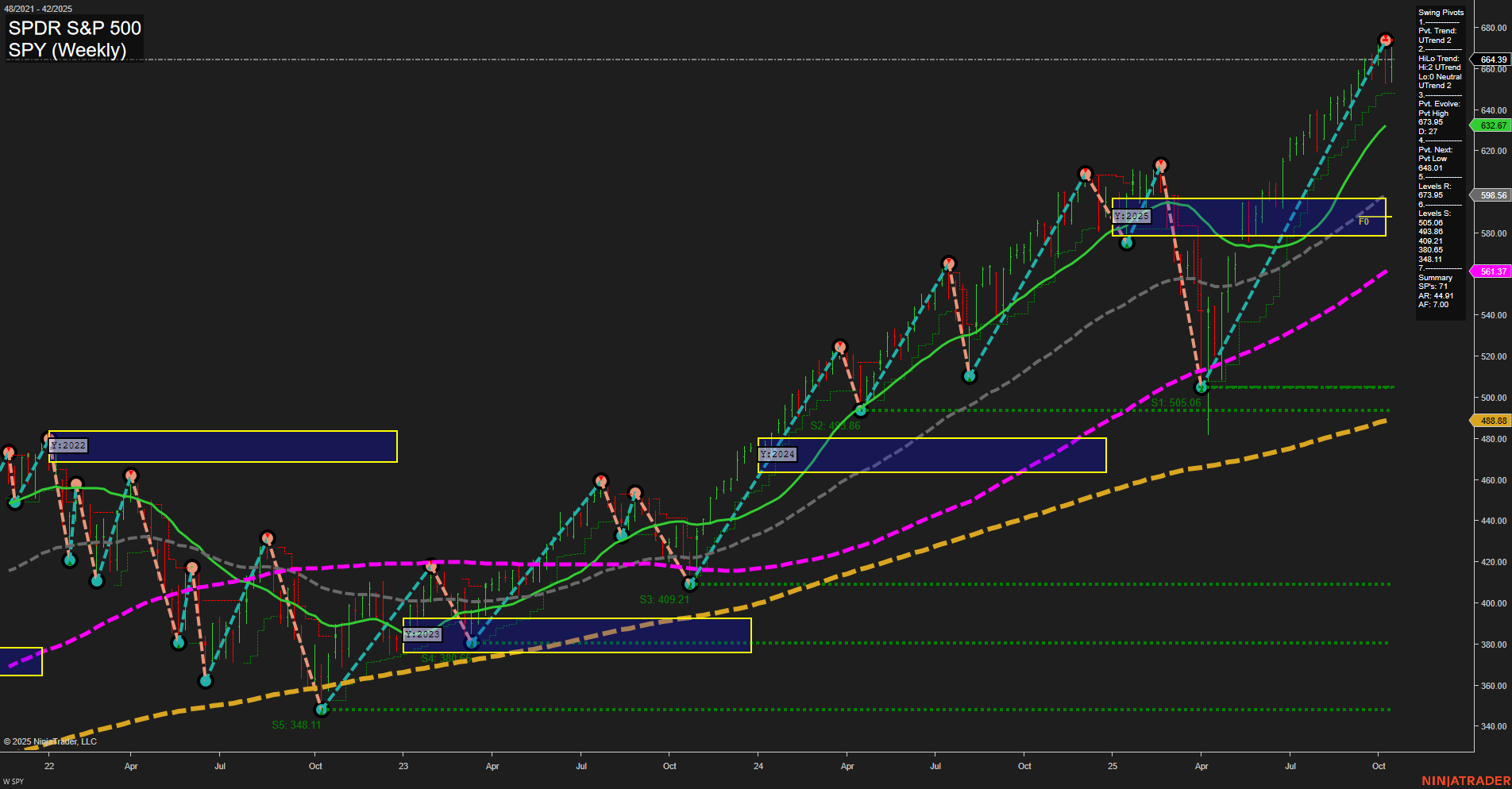

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- INTC Release: 2025-10-23 T:AMC

- TSLA Release: 2025-10-22 T:AMC

- IBM Release: 2025-10-22 T:AMC

Over the coming week, key earnings releases from Tesla (TSLA), IBM, and Intel (INTC) are scheduled after market close on October 22nd and 23rd. With these tech giants set to report, indices futures traders can expect potential sector-driven volatility, particularly in the NASDAQ and S&P 500. However, market momentum and trading volumes may slow ahead of these announcements, as participants often adopt a wait-and-see approach. This effect is amplified by anticipation for subsequent major earnings—including from NVDA and other MAG7 and AI-linked stocks—which can keep broader indices in a narrow range as traders await more market-moving data. The chain of tech earnings could set the tone for broader indices direction, but in the lead-up, caution and reduced activity are historically common.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Friday 08:30 – High Impact: USD Core CPI m/m, CPI m/m, CPI y/y

Markets will be highly sensitive to Friday morning’s inflation reports. Significant CPI data releases often trigger sharp movements in index futures as traders position for potential policy shifts by the Federal Reserve. Deviations from expectations in core or headline CPI could increase volatility across equity indices, with heightened activity and volume likely at the opening and immediately after the numbers release. - Friday 09:45 – High Impact: USD Flash Manufacturing PMI, Flash Services PMI

The preliminary PMIs will provide an early read on US economic activity for June. Surprises in these data points, especially if paired with unexpected inflation data, can amplify directional moves in S&P, Nasdaq, and Dow futures. Market reaction is usually swift, especially if PMI prints bolster or contradict the inflation narrative established earlier in the session. - Wednesday 10:30 – Medium Impact: USD Crude Oil Inventories

For oil-linked index components, inventories data may influence sector rotation and broader risk sentiment. Lower oil inventories can lead to upward oil price pressure, which in turn impacts inflation expectations and may cause volatility in index futures, especially if inventory trends align with ongoing inflation concerns.

EcoNews Conclusion

- Friday morning is front-loaded with high-impact data releases—CPI and PMI—which are key drivers of index futures volatility and trend direction.

- News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

- Any high oil prices can have a direct impact on the market due to inflation and geopolitical concerns.

For full details visit: Forex Factory EcoNews

Market News Summary

- Stocks & Indices: The S&P 500 experienced notable volatility, achieving its largest daily gain in months early in the week before ending up 1.7% from the prior Friday. Despite repeated choppiness and sources of market concern—including deteriorating liquidity, widened spreads, and loss of stabilizing flows after options expiration—stocks managed gains, especially in technology, industrials, and utilities.

- Futures & Technical Outlook: The S&P 500 remains range-bound with technical observers expecting a decisive move in the upcoming week. Market participants are watching the third-quarter earnings season and upcoming inflation data due to a lack of recent economic reports.

- Sector Highlights: Semiconductors and technology continue to underpin market strength, with ETFs in these areas receiving renewed attention. AI and crypto-linked equities, as well as uranium-focused funds, are seeing outperformance as investors chase emerging and resilient themes.

- Commodities: Gold soared to record highs, driven by strong demand, macro reforms, and declining trust in fiat, but encountered a sharp reversal following developments in U.S.–China trade. Analysts are pointing to crucial technical support levels, with overbought conditions and a strengthening dollar acting as near-term headwinds.

- Silver: Silver also reached historic highs before showing signs of exhaustion, with traders monitoring key support and expecting influence from likely Fed rate decisions.

- Oil: WTI crude futures weakened on persistent oversupply and weak demand. Analysts warn of a deepening decline should support levels break.

- Other Developments: A major bank faces legal penalties, contributing to negative sentiment in the financial sector. Additionally, Bitcoin’s resilience is being highlighted as a potential stabilizer preventing broader U.S. equity market stress.

News Conclusion

- Last week was marked by sharp intraday swings and an overall drift higher for U.S. equities, fueled by continued leadership within technology and resource-linked sectors. Despite positive weekly closes, multiple risk factors are emerging—including reduced liquidity and changing volatility profiles—that could drive increased price movement in the near term.

- The commodities complex saw a turning point as gold and silver pull back from new highs, putting focus on key support levels and upcoming policy signals for direction. Energy markets continue to confront supply-driven headwinds.

- Looking ahead, scheduled earnings releases and inflation data may serve as key volatility catalysts for index futures, particularly within an environment short on economic data. Technical conditions suggest the potential for a decisive move in the S&P 500 is near.

- Market discourse is also examining the roles of non-equity assets such as Bitcoin and gold as potential stabilizing factors or alternative investments during periods of elevated volatility.

Market News Sentiment:

Market News Articles: 10

- Neutral: 40.00%

- Positive: 30.00%

- Negative: 30.00%

GLD,Gold Articles: 5

- Neutral: 40.00%

- Positive: 40.00%

- Negative: 20.00%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 19, 2025 06:15

- TSLA 439.31 Bullish 2.46%

- AAPL 252.29 Bullish 1.96%

- NVDA 183.22 Bullish 0.78%

- GOOG 253.79 Bullish 0.76%

- META 716.91 Bullish 0.68%

- QQQ 603.93 Bullish 0.66%

- SPY 664.39 Bullish 0.57%

- DIA 461.78 Bullish 0.48%

- MSFT 513.58 Bullish 0.39%

- USO 67.98 Bullish 0.25%

- IJH 64.47 Bullish 0.20%

- TLT 91.20 Bearish -0.15%

- AMZN 213.04 Bearish -0.67%

- IWM 243.41 Bearish -0.67%

- IBIT 60.47 Bearish -1.56%

- GLD 388.99 Bearish -1.88%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-19: 18:15 CT.

US Indices Futures

- ES Uptrend intact: YSFG/MSFG/WSFG bullish, price above all MA benchmarks, swing pivots rising, resistance 6812.25, support 6461.96, recent signals long and trend-aligned, short-term/daily corrective phase.

- NQ Weekly YSFG/MSFG/WSFG all bullish, all-time high pivots, above all session fib grids, strong MA support, support far below, daily short-term consolidation but HTF structure bullish, resistance 25394, support 24158.

- YM Data unavailable for technical summary.

- EMD Short/intermediate-term bearish, below WSFG/MSFG NTZs, weekly consolidation above rising 20w/55w/100w/200w MA, resistance 3350–3520, support 3149/2978, long-term trend up, short/medium-term downward bias dominates.

- RTY Weekly bullish across YSFG/MSFG/WSFG, all MA benchmarks rising, current price above NTZs, swing highs at 2559.9, support 2055.5, daily shows short-term pullback with uptrend structure intact on higher frames.

- FDAX Intermediate/long-term bullish, short-term neutral/weak below WSFG NTZ, consolidation after rally, support 23419/22720, resistance 24391/24500, daily shows short-term left shift bearish but HTF uptrend persists.

Overall State

- Short-Term: Mixed/Choppy (Pullbacks in ES, NQ, RTY, FDAX; EMD bears dominate)

- Intermediate-Term: Bullish (Except EMD, which is bearish, and FDAX showing some neutral zones)

- Long-Term: Bullish (All instruments where data is available)

Conclusion

HTF context across US indices futures (ES, NQ, RTY, EMD) and FDAX remains upward, as supported by session fib grid structures (YSFG/MSFG mostly up), benchmarks well below price, and persistent trend pivots. Recent lower time frame pivots, session grid pullbacks, and volatility produce short-term chop or corrections, mainly contained within broader uptrends. EMD exhibits both short/intermediate-term downside with long-term support, FDAX reveals short-term right shift bearish while holding broader structure. Absence of exhaustion or broad directional reversal signals. Price action reflects active phases with elevated volatility, but key swing support zones and HTF grids remain structural pivots for major directional change.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

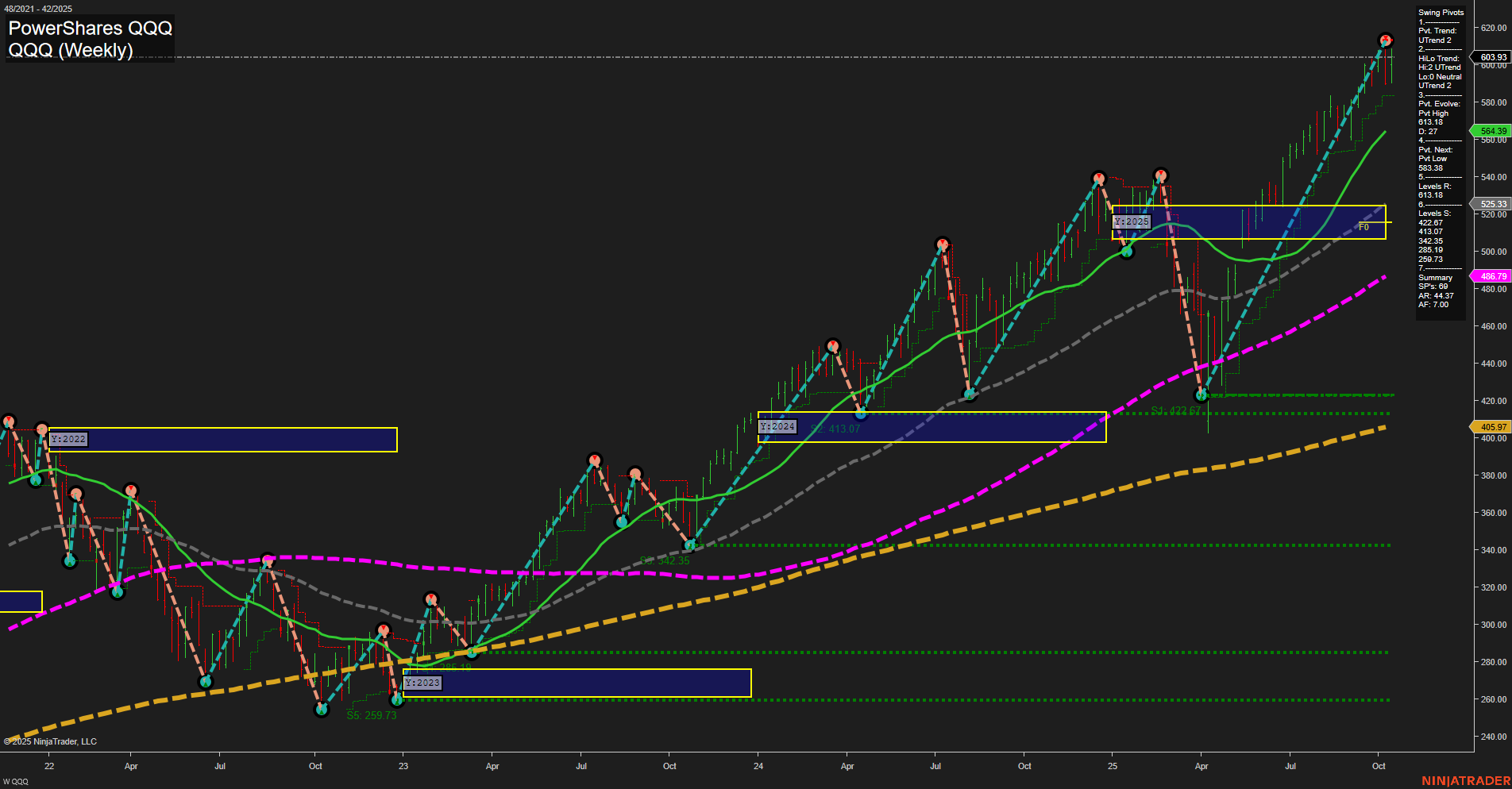

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts