Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

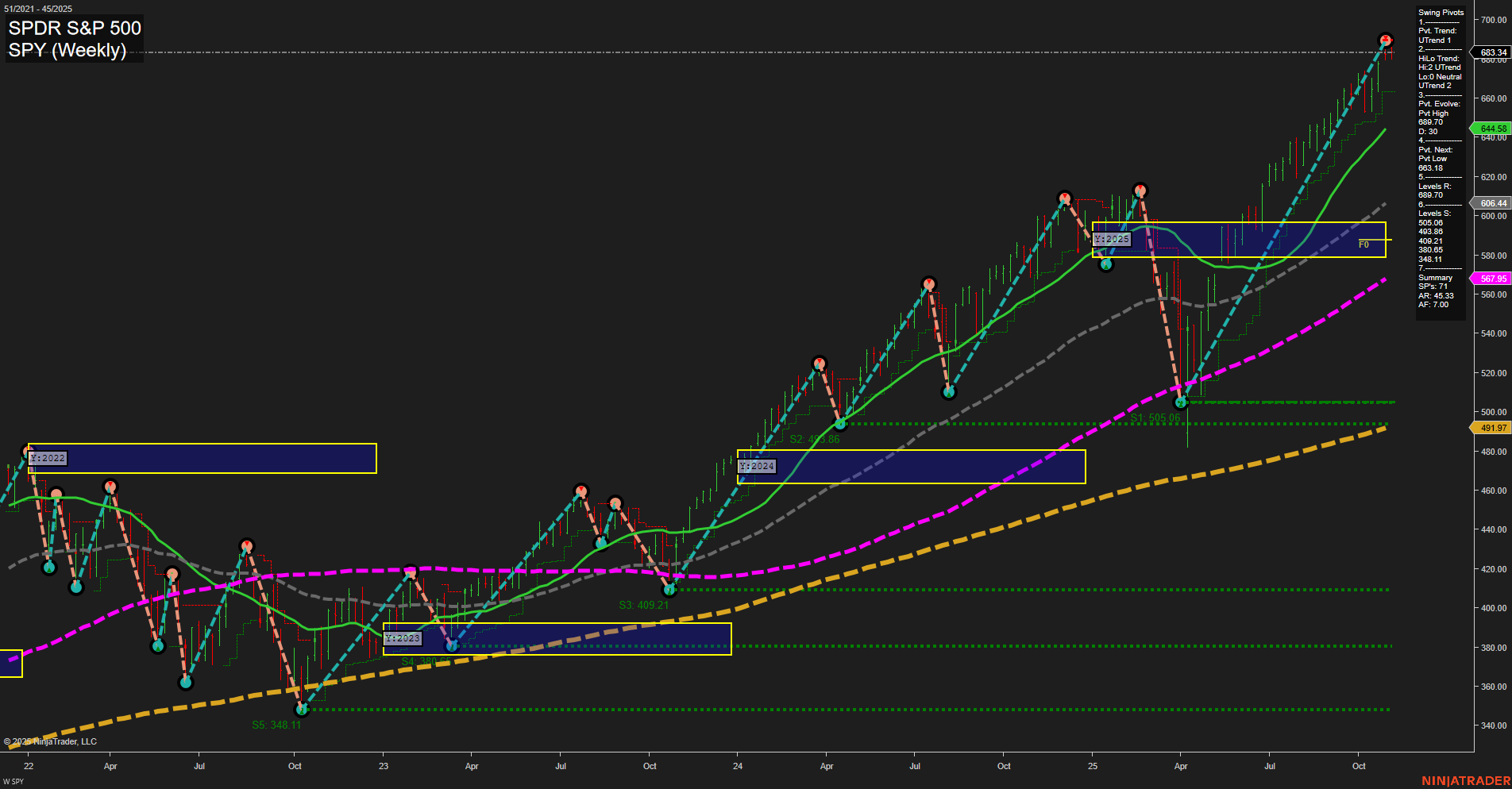

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- AAPL Release: 2025-10-30 T:AMC

- AMZN Release: 2025-10-30 T:AMC

- MSFT Release: 2025-10-29 T:AMC

- GOOGL Release: 2025-10-29 T:AMC

- META Release: 2025-10-29 T:AMC

The recent earnings releases from key tech giants—Microsoft (MSFT), Alphabet (GOOGL), and Meta (META) on October 29, followed by Apple (AAPL) and Amazon (AMZN) on October 30—have been the central focus for equity index futures traders. These reports delivered outsized influence on price action and intraday volatility across the S&P 500 and Nasdaq futures, reflecting market sensitivity to both top-line growth and AI-related guidance from the MAG7 cohort. With these events now digested, broad index momentum and volume typically begin to retrace, as market participants reposition and risk appetite becomes more neutral. Liquidity and price movement may decelerate in the immediate aftermath, especially while traders await further catalysts from Nvidia (NVDA) and other AI names, which are expected to provide the next round of directional cues. Expect the anticipation of upcoming tech earnings—including NVDA and any unresolved AI guidance—to continue to weigh on market sentiment, potentially resulting in quieter sessions and more range-bound trading until the next headline event.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary: High Impact Market-Moving Events

Wednesday

- 08:15 – ADP Non-Farm Employment Change (High Impact): Key private sector employment data often used as a leading indicator for broader labor trends. Surprises can introduce volatility in pre-market futures trading.

- 10:00 – ISM Services PMI (High Impact): Closely watched for signals on the health of the US services sector. Strong or weak readings can shift expectations for growth and Fed policy, provoking rapid index futures moves.

- 10:30 – Crude Oil Inventories (Low-Impact, Mentioned due to oil): Unexpected inventory changes, especially large draws in current macro conditions, can influence indices by impacting inflation expectations via oil price moves.

Friday

- 08:30 – Average Hourly Earnings m/m (High Impact): Wage growth is a key inflation metric. Upside surprises may increase fears of persistent inflation and tighter Fed policy, moving equity index futures sharply.

- 08:30 – Non-Farm Employment Change (High Impact): The primary US employment report. Significant deviations from expectations can rapidly alter market sentiment and futures price action.

- 08:30 – Unemployment Rate (High Impact): Monitored alongside NFP for a fuller labor market picture. Unexpected changes can amplify volatility in indices futures around release.

EcoNews Conclusion

- Key labor market reports (ADP, NFP, Unemployment Rate) and ISM data are scheduled, likely resulting in heightened futures volatility during release windows.

- Surprise moves in oil inventories can indirectly affect indices via oil price dynamics and inflation sentiment.

- Market momentum and volume may slow in the days leading up to Friday’s Non-Farm Payrolls report.

- News events around the 10 AM time cycle, such as ISM Services PMI, frequently act as catalysts for reversals or continuations in index futures price action.

- High oil prices can have a direct impact on the market due to inflation and geopolitical concerns.

For full details visit: Forex Factory EcoNews

Market News Summary

- Market Concentration & AI Impact: Commentary from leading analysts highlighted ongoing market concentration, with AI and high-tech stocks driving S&P 500 gains. Outside of these “Mag 7” leaders, broader equity performance appeared less impressive.

- Indices & Earnings: U.S. stock futures drifted lower amid profit-taking and Federal Reserve uncertainty, especially as investors eyed upcoming jobs data. Despite this, S&P 500 Q3 earnings so far have shown solid growth, led by tech and health care.

- Oil & Energy: Crude oil prices edged lower on supply concerns, stabilizing later as OPEC+ paused output hikes. Major oil firms posted mixed quarterly results: Aramco reported year-on-year profit declines due to lower crude prices, but improved quarter-over-quarter, while BP beat profit expectations despite trading headwinds.

- Commodities: Gold and silver consolidated near key technical levels as traders awaited crucial economic data and Fed policy insights, with gold price volatility muted despite broader market moves. Natural gas held firm above $4.20 amid winter demand optimism.

- Corporate & Sector Trends: ETF flows reflected investor demand for growth and innovation, with products like the Vanguard Growth ETF seeing interest. Pharma sectors saw minimal tariff impact, with some biotechs identified as potential outperformers. Speculation grew around possible large-cap gold sector M&A activity.

- Risk & Sentiment: Wall Street executives and market strategists flagged the possibility of a correction, highlighting stretched valuations, ongoing loan loss concerns, and persistent uncertainties linked to the Fed and tariffs. Futures traders were cautious amid mixed data and earnings results from high-profile companies.

News Conclusion

- Tech and AI leadership continues to drive index performance, overshadowing lagging sectors amid broad market divergence.

- Energy markets remain volatile, with oil prices stabilizing as traders weigh OPEC+ policies, company earnings, and global demand signals.

- Upcoming economic releases and Fed commentary remain central to short-term directional trades in indices, commodities, and related futures.

- Outflows from underperforming corners and inflows into select ETFs and key growth stocks highlight persistent sector rotation and risk-on/risk-off dynamics.

- Overall, sentiment is cautious; traders weigh strong earnings from select sectors against macro and policy risks, preparing for heightened volatility around pivotal data releases.

Market News Sentiment:

Market News Articles: 51

- Neutral: 41.18%

- Positive: 37.25%

- Negative: 21.57%

Sentiment Summary:

Out of 51 market news articles, 41.18% are neutral, 37.25% are positive, and 21.57% are negative.

Conclusion:

The majority of the news articles present a neutral to slightly positive sentiment, with negative sentiment making up the smallest portion of recent coverage.

GLD,Gold Articles: 15

- Neutral: 60.00%

- Negative: 20.00%

- Positive: 20.00%

Sentiment Summary:

Recent market news coverage for GLD/Gold shows a predominantly neutral sentiment at 60%, with negative and positive news both comprising 20% each.

This indicates that, based on the latest articles, market commentary remains largely balanced, with limited sway towards either bullish or bearish perspectives.

USO,Oil Articles: 14

- Negative: 42.86%

- Positive: 35.71%

- Neutral: 21.43%

Sentiment Summary: The majority of recent coverage on USO and oil is negative (42.86%), with a smaller proportion positive (35.71%), and the remainder neutral (21.43%).

This indicates a cautionary tone in the current market news, reflecting concerns and uncertainty among news sources regarding USO and oil.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 4, 2025 07:16

- AMZN 254.00 Bullish 4.00%

- TSLA 468.37 Bullish 2.59%

- NVDA 206.88 Bullish 2.17%

- GOOG 284.12 Bullish 0.82%

- QQQ 632.08 Bullish 0.48%

- USO 72.74 Bullish 0.25%

- SPY 683.34 Bullish 0.19%

- GLD 368.78 Bullish 0.18%

- IJH 64.90 Bearish -0.05%

- MSFT 517.03 Bearish -0.15%

- IWM 245.44 Bearish -0.32%

- DIA 473.47 Bearish -0.46%

- AAPL 269.05 Bearish -0.49%

- TLT 89.74 Bearish -0.61%

- META 637.71 Bearish -1.64%

- IBIT 60.53 Bearish -2.84%

Market Summary: ETF Stocks, MAG7, and Key Thematic ETFs

ETF Stocks Outlook

- SPY: 683.34 (+0.19%) — Bullish tone continues in this S&P 500 tracker, notching modest gains and signaling overall broad market resilience.

- QQQ: 632.08 (+0.48%) — The Nasdaq 100 ETF remains positively aligned, showing relative strength as tech-related flows remain constructive.

- IWM: 245.44 (-0.32%) — Small caps turn lower, reflecting a cautious stance among risk-focused traders.

- IJH: 64.90 (-0.05%) — Mid-cap ETF dips slightly, indicating a mixed sentiment across mid-sized companies.

- DIA: 473.47 (-0.46%) — Dow Jones ETF softens, as traders shift momentum away from large industrials and value names.

MAG7 (Mega Cap Tech) Pulse

- AMZN: 254.00 (+4.00%) — Amazon stands out with robust, bullish price action, suggesting a resurgence of e-commerce and cloud optimism.

- TSLA: 468.37 (+2.59%) — Tesla rallies actively, indicative of renewed speculative interest and sector rotation into EVs.

- NVDA: 206.88 (+2.17%) — Nvidia sustains upward movement, aligned with continued semis and AI enthusiasm.

- GOOG: 284.12 (+0.82%) — Alphabet maintains a steady bid, reinforcing tech’s leadership in mega caps.

- MSFT: 517.03 (-0.15%) — Microsoft trades slightly lower, suggesting selective consolidation in software leaders.

- AAPL: 269.05 (-0.49%) — Apple’s weaker tone may signal concerns around hardware cycles or profit-taking.

- META: 637.71 (-1.64%) — Meta Technologies slides, pointing to further rebalancing across social and ad-driven tech stocks.

Thematic & Alternative ETFs

- TLT: 89.74 (-0.61%) — Long-dated Treasuries ETF declines, as yields edge higher and bond sentiment remains defensive.

- GLD: 368.78 (+0.18%) — Gold ETF holds a mild gain, highlighting a steady need for perceived safety amid mixed equity performance.

- USO: 72.74 (+0.25%) — Oil ETF ticks up, in line with steady energy demand and commodity sector interest.

- IBIT: 60.53 (-2.84%) — Bitcoin ETF endures a sharper pullback, showcasing crypto market volatility and rotation away from digital assets.

Broad Market Sentiment

Traders are witnessing a mixed landscape. Mega cap tech and select growth names show pockets of strong momentum, while small and mid caps lag. Rotation is evident within tech, and alternative assets like gold maintain stability. Bond proxies are pressured, and crypto-related ETFs are under notable stress. The overall sentiment skews toward selective risk-on positioning, with a clear dispersion between leaders and laggards.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-11-04: 07:16 CT.

US Indices Futures

- ES Short-term bearish WSFG, intermediate/long-term bullish YSFG/MSFG, price below NTZ short-term, swing pivot resistance 6953.75, support 6536.44, market in corrective retracement within broader uptrend.

- NQ Short-term bearish WSFG, long-term intermediate up YSFG/MSFG, swing pivot new high 26080.00, key support 22535.16, elevated volatility, corrective move within broad bullish trend.

- YM Short-term bearish WSFG, intermediate/long-term bullish, below NTZ short-term, resistance at 48248, support at 47118, corrective consolidation phase within overall uptrend structure.

- EMD Short/intermediate-term bearish WSFG/MSFG, long-term neutral to up, price below NTZ, downtrend pivots, resistance 3352/3523, support 3140, increased volatility during corrective pullback in larger bull cycle.

- RTY Short-term bearish WSFG, intermediate/long-term bullish YSFG/MSFG, below NTZ short-term, swing resistance 2566.5, support 2375.5, recent high volatility, corrective phase after rally.

- FDAX Short/intermediate-term bearish WSFG/MSFG, long-term bullish YSFG, consolidating below NTZ, downtrend pivots, resistance 24691/24161, support at 23419/19274, controlled retracement with bullish longer-term structure.

Overall State

- Short-Term: Bearish to Neutral

- Intermediate-Term: Neutral to Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures are undergoing a short-term corrective phase, with WSFG indicating downside and prices generally below NTZs. Intermediate and long-term YSFG/MSFG grids remain up across most instruments, supported by bullish swing pivots and structural S/R. Key resistance levels from recent highs and layered supports define retracement zones. Volatility and volume metrics are elevated, emphasizing active consolidation. Directional correlations show ES, NQ, and YM aligned in short-term retracement within broader uptrends, while EMD and FDAX are deeper in correction, but keep long-term up-bias. No immediate reversal signals present; structure remains trending bullish at the highest timeframes with counter-trend pullbacks dominating the short-term landscape.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

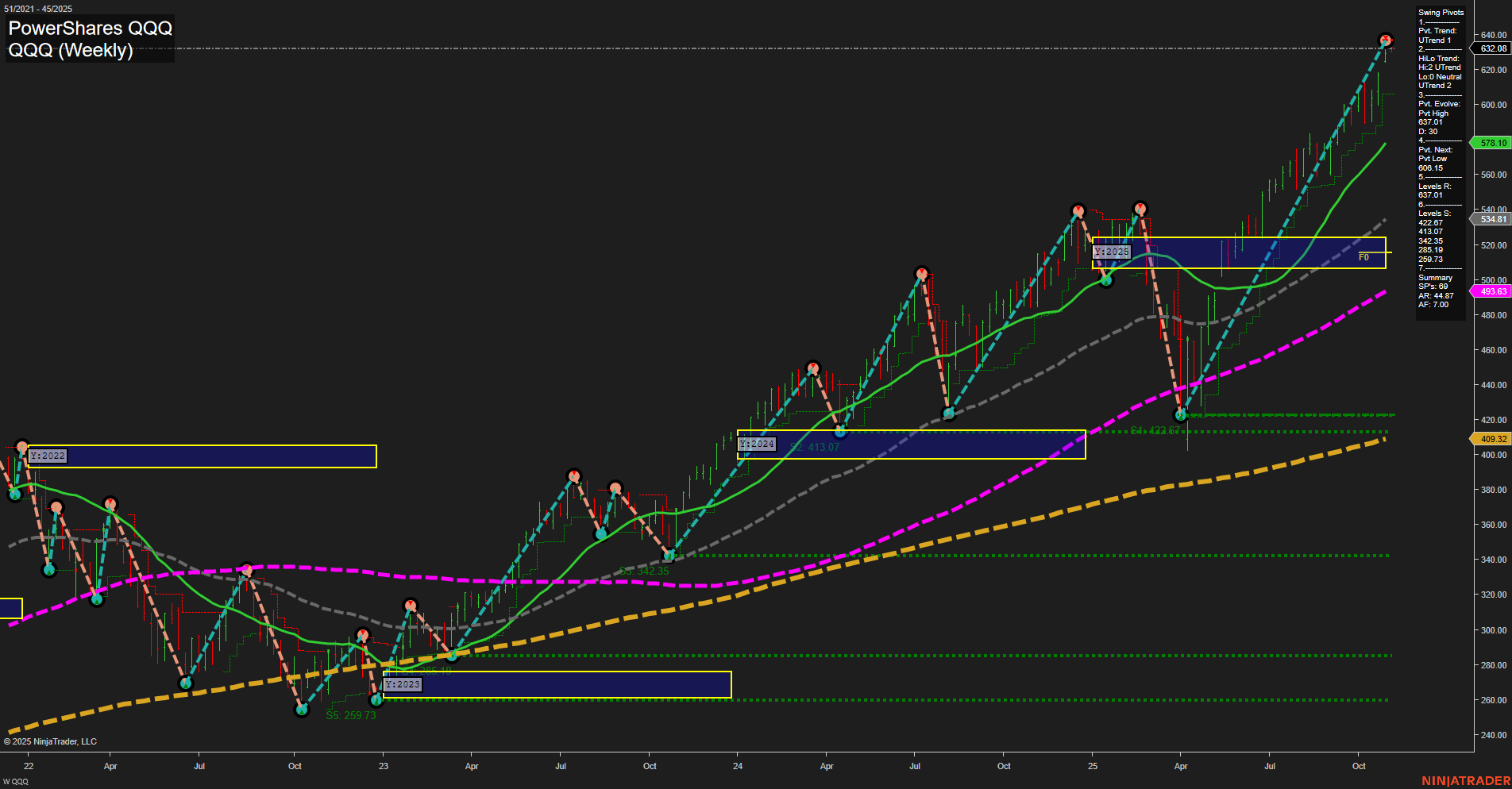

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts