Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

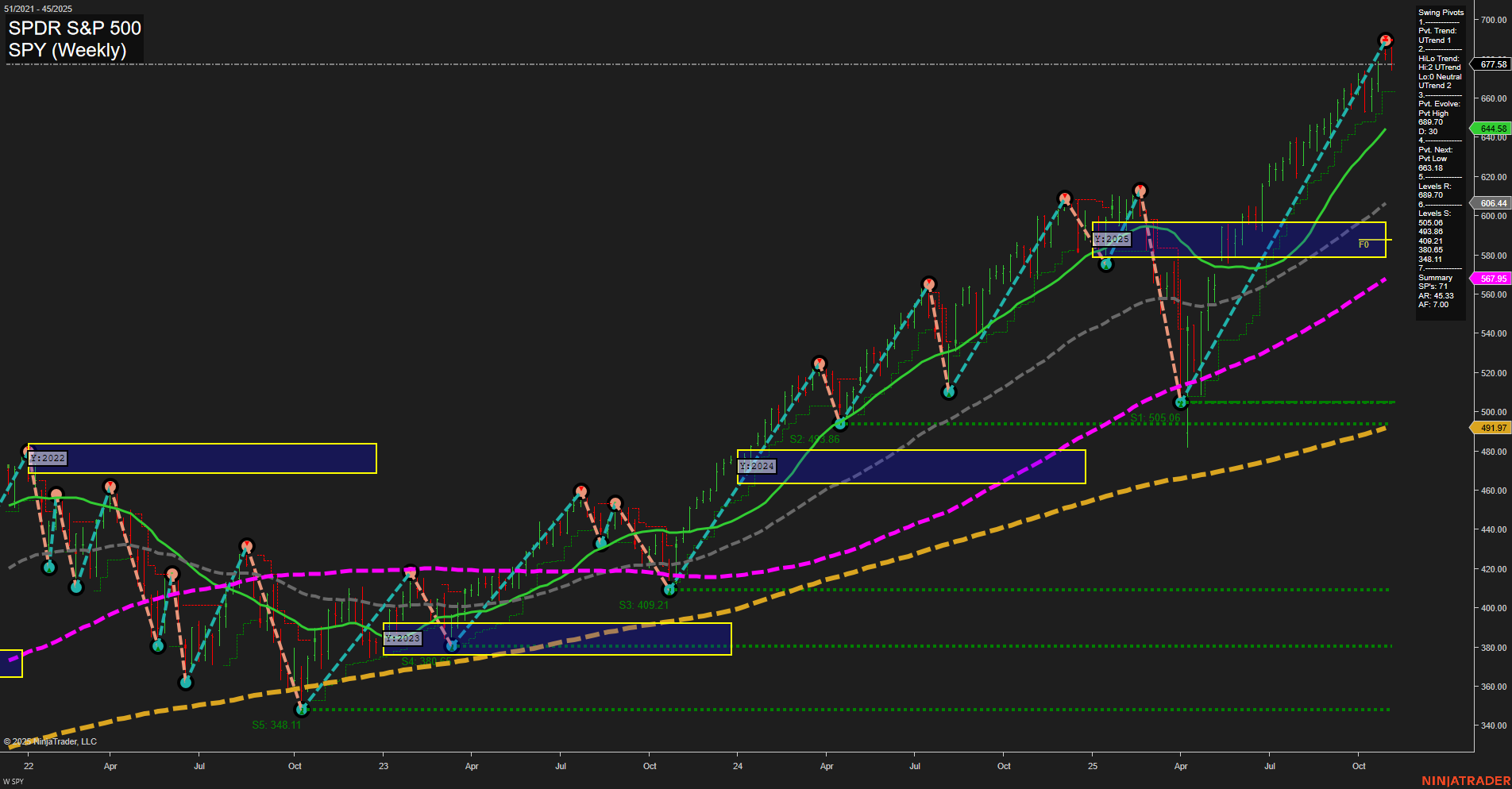

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MCHP Release: 2025-11-06 T:AMC

Earnings Summary and Market Conclusion:

Looking ahead to Microchip Technology’s (MCHP) earnings release scheduled after market close on November 6, 2025, overall index futures trading is likely to experience subdued momentum and lighter volume. This slowdown typically reflects market participants holding back significant positioning in advance of not only MCHP’s results but also pivotal upcoming reports from major tech names including NVDA and the broader “MAG7” group, whose performance forecasts are closely tied to the AI technology sector’s trajectory. The aggregation of such high-impact earnings events creates an atmosphere of uncertainty, often causing indices such as the S&P 500 and Nasdaq futures to trade within narrowing ranges as traders await fresh catalysts. Expect pre-earnings consolidation, with directional conviction and volatility likely to return once the results and forward guidance from these key technology firms are digested by the market.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- No high impact, market-moving economic events are scheduled for this period. Only medium impact U.S. events related to FOMC commentary and University of Michigan sentiment and inflation expectations are on the calendar, with no direct oil data releases.

EcoNews Conclusion

- Market momentum and volume may slow ahead of major economic releases, as there are no high impact events this session.

- Be aware that news events around the 10 AM cycle, such as the UoM releases on Friday, can act as catalysts for intraday reversals or continued moves even if overall impact is expected to be moderate.

For full details visit: Forex Factory EcoNews

Market News Summary

- US Indices: Major US indices (Nasdaq 100, S&P 500, Dow Jones) stabilized after an overnight sell-off, maintaining their uptrends. Key support levels held, and dips were met with buying interest.

- ETF Flows: Demand remains strong for growth, income, and global balance ETFs. QQQ continues to outperform more focused software ETFs with its tech mega-cap exposure and risk-adjusted returns.

- Sector Trends: Investors remain bullish on big tech and AI infrastructure. AI-related capital expenditure is a dominant market force, resulting in concentrated gains for the largest stocks.

- Commodities: Oil prices face headwinds from increased supply, particularly after Saudi Arabia’s price cuts for Asia and OPEC+ production increases. Natural gas shows relative strength on a rebound.

- Bonds & Rates: Malaysia’s central bank held rates steady amid easing global uncertainties. Gold and silver trade sideways with a supportive backdrop of dollar weakness and safe-haven demand.

- European Banks: UK bank stocks moved higher following reports they may avoid a new budget tax.

- Corporate Earnings: SES reported weaker quarterly results due to integration costs, missing expectations.

- Macro & Labor: October job cuts surged to a 22-year high. Tariff discussions continue to affect manufacturing outlooks and consumer pricing.

- Other Trends: Deleveraging in bitcoin has completed, and it now appears to have substantial upside on a risk-adjusted basis.

News Conclusion

- US indices remain technically resilient despite overnight selling and pockets of volatility.

- Large-cap tech and AI maintain concentrated market leadership, with ETF products offering potential for both growth and defensive positioning.

- Energy markets are cautious, with oil pressured by supply developments yet natural gas outperforming this session.

- Mixed macro signals persist: rising job cuts and ongoing tariff debates signal economic crosscurrents, even as banks, select commodities, and certain digital assets offer strength.

Market News Sentiment:

Market News Articles: 15

- Positive: 40.00%

- Neutral: 33.33%

- Negative: 26.67%

Sentiment Summary: Among 15 recent market news articles, 40% conveyed a positive outlook, 33.33% were neutral, and 26.67% reflected a negative sentiment.

This distribution suggests that recent coverage is leaning more positive, with a sizable portion of neutral reporting and a smaller share of negative sentiment.

GLD,Gold Articles: 4

- Positive: 50.00%

- Neutral: 25.00%

- Negative: 25.00%

Sentiment Summary: Recent news coverage on GLD and gold shows a split tone, with half of the articles carrying a positive sentiment, while the remainder are evenly divided between neutral and negative perspectives.

This suggests that current market sentiment is somewhat optimistic but mixed, indicating varying outlooks and some degree of uncertainty among news sources.

USO,Oil Articles: 5

- Neutral: 40.00%

- Positive: 40.00%

- Negative: 20.00%

Sentiment Summary: Recent news on USO and oil is evenly split between neutral (40%) and positive (40%) sentiment, with a smaller portion (20%) reflecting negative sentiment.

This mix suggests the current news landscape is balanced, with no single sentiment dominating the coverage for USO and oil.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 6, 2025 07:16

- TSLA 462.07 Bullish 4.01%

- IBIT 58.92 Bullish 3.04%

- GOOG 284.75 Bullish 2.41%

- IWM 244.68 Bullish 1.44%

- META 635.95 Bullish 1.38%

- GLD 366.51 Bullish 1.16%

- IJH 64.78 Bullish 0.68%

- QQQ 623.28 Bullish 0.65%

- DIA 473.11 Bullish 0.47%

- AMZN 250.20 Bullish 0.35%

- SPY 677.58 Bullish 0.35%

- AAPL 270.14 Bullish 0.04%

- TLT 88.96 Bearish -1.09%

- USO 71.03 Bearish -1.25%

- MSFT 507.16 Bearish -1.39%

- NVDA 195.21 Bearish -1.75%

Market Summary: ETF Stocks, Mag7 & Key ETFs (as of 11/06/2025 07:16)

ETF Stocks Overview

- SPY 677.58 — Bullish (+0.35%)

- QQQ 623.28 — Bullish (+0.65%)

- IWM 244.68 — Bullish (+1.44%)

- IJH 64.78 — Bullish (+0.68%)

- DIA 473.11 — Bullish (+0.47%)

ETF stocks are showing a strong bullish tone across large, mid, and small cap trackers. Gains range from +0.35% (SPY, DIA) to +1.44% (IWM), indicating broad-based positive moves in the equity indices.

Mag7 Overview

- TSLA 462.07 — Bullish (+4.01%)

- GOOG 284.75 — Bullish (+2.41%)

- META 635.95 — Bullish (+1.38%)

- AMZN 250.20 — Bullish (+0.35%)

- AAPL 270.14 — Bullish (+0.04%)

- MSFT 507.16 — Bearish (-1.39%)

- NVDA 195.21 — Bearish (-1.75%)

Mag7 stocks display a mixed picture: strength in TSLA, GOOG, META (notably TSLA up over 4%), but weakness is evident in MSFT and NVDA (down -1.39% and -1.75% respectively).

Other Key ETFs

- IBIT 58.92 — Bullish (+3.04%)

- GLD 366.51 — Bullish (+1.16%)

- TLT 88.96 — Bearish (-1.09%)

- USO 71.03 — Bearish (-1.25%)

Other ETFs highlight notable outperformance in Bitcoin exposure (IBIT, +3.04%) and gold (GLD, +1.16%), while bonds (TLT) and oil (USO) are down over 1%, suggesting rotation away from those assets.

Summary of State of Play

- Long/Bullish: Broad equities (SPY, QQQ, IWM, IJH, DIA), major Mag7 names (TSLA, GOOG, META, AMZN, AAPL), crypto & gold ETFs (IBIT, GLD).

- Short/Bearish: Bonds (TLT), oil (USO), and select Mag7 stocks (MSFT, NVDA).

- Mixed: The overlap is visible most clearly within Mag7 leadership, where strength and weakness are present in tandem.

The snapshot reflects a risk-on environment in equities and digital assets, with defensive segments and some heavyweight tech leaders under pressure.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-11-06: 07:16 CT.

US Indices Futures

- ES: YSFG and MSFG bullish, WSFG short-term trend down, above long-term MAs, new high pivot 6953.75, support at 6292.25, consolidating after strong rally.

- NQ: YSFG/MSFG uptrend, WSFG short-term trend down, price below weekly NTZ, new high pivot 25782.50, support well below, broad uptrend, short-term correction.

- YM: YSFG/MSFG bullish, WSFG and short-term MAs trending down, price near highs but below weekly NTZ, short-term correction, support at 47010 and layered lower.

- EMD: YSFG long-term bullish, MSFG/WSFG down, below NTZ centers, short/intermediate pivots down, support at 3140, resistance 3352/3523, corrective phase in uptrend.

- RTY: YSFG/MSFG bullish, WSFG downtrend, price below NTZ short-term, recent high pivot 2566.5, support 2410.6/2375.5, consolidating after pullback, long-term structures intact.

- FDAX: YSFG bullish, MSFG/WSFG up, short-term pivots down, MA benchmarks up long-term, resistance 24891, support 23419/22983, consolidating after rally, long-term uptrend holds.

Overall State

- Short-Term: Neutral to Bearish

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures remain in established higher-timeframe uptrends (YSFG/MSFG) with bullish long-term and intermediate-term structures across ES, NQ, YM, EMD, RTY, and FDAX. Current short-term action reflects either neutral or bearish WSFG grid directions and downward-trending short-term moving averages, signaling consolidating or corrective activity near or just below recent highs. All indices show price at or above key long-term support, with higher lows and uptrending benchmarks intact. Mixed short-term signals and recent pivot reversals suggest ongoing volatility and choppy conditions as markets digest prior gains. Support and resistance levels from swing pivots and SR levels define the consolidation zones. Directional correlations across indices confirm a shared pause or moderate retracement within ongoing broad uptrends, with no major breakdown in long-term structure.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

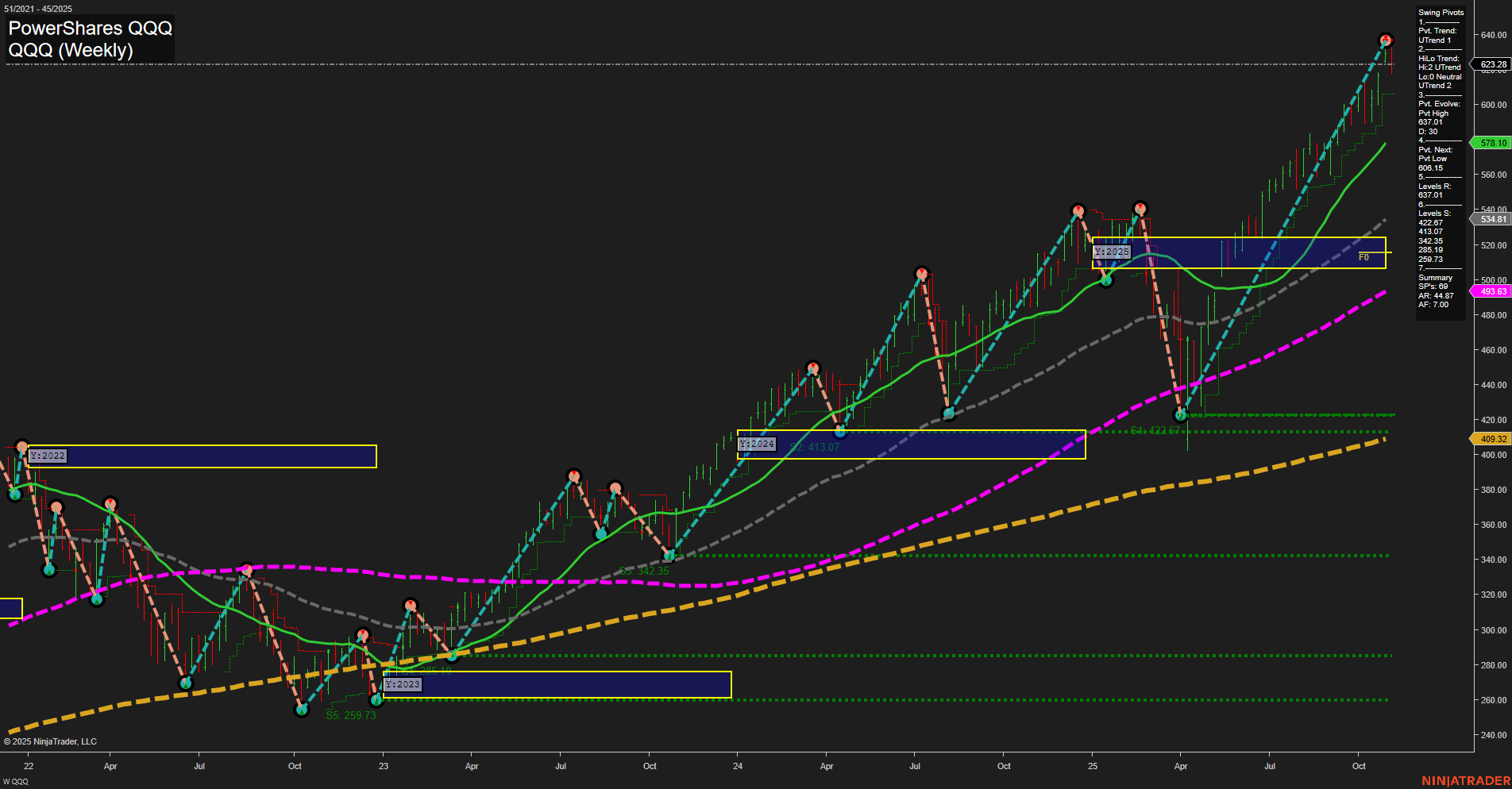

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts