After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

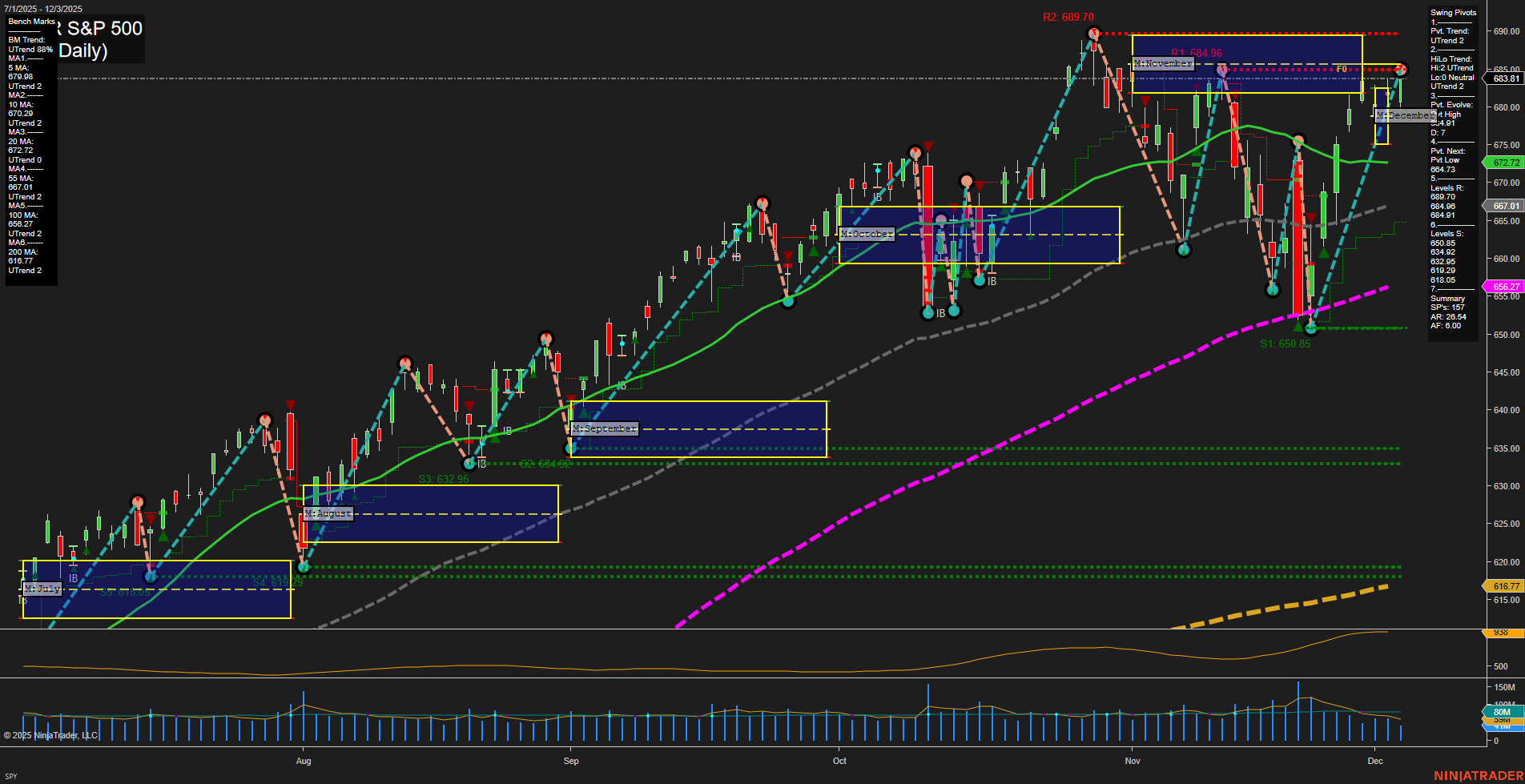

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Energy Markets & Commodities: OPEC production came in below target despite an agreement to increase output, citing member outages. Oil prices gained 1% amid heightened geopolitical risk tied to Ukraine. Crude futures broke technical resistance levels, establishing higher targets after a weekly bullish reversal. Silver pulled back sharply from historic highs on profit-taking, while gold remained steady above key support as traders awaited PCE inflation data. Bullish momentum was noted for gold and silver, driven by weak employment reports and heightened Fed rate cut expectations.

- Equity Markets & Indices: The S&P 500 edged up, holding near record territory, as mixed labor data increased bets on Fed policy easing. Major indices closed mixed, with the Dow slipping and small caps rallying amid competing economic signals and higher bond yields in the U.S. and Japan. Junk bond markets hinted at further equity gains, and positive seasonality buoyed expectations for potential all-time highs by year-end. Longer-term, optimism is underpinned by sector rotation and broad “Fourth Industrial Revolution” trends.

- Labor Market & Economy: Job market data remains patchy—layoffs for 2025 have exceeded 1.1 million, the highest since the pandemic, with signs of slowing job growth and concern over economic stagnation. These trends underpin market expectations of additional Fed rate cuts.

- Federal Reserve & Macro Policy: Odds for rate cuts at upcoming Fed meetings remain high, with commentary from former policy officials mixed on timing. Potential policy direction may shift as Kevin Hassett emerges as Fed Chair frontrunner—he is expected to favor further rate reductions. There is market debate about the main drivers of U.S. yields, including the influence of Japanese market moves.

- ETFs & Market Structure: New ETF launches allow traders to make directional bets against technology-heavy indices like QQQ with reduced reset risks. Increased interest in dividend ETFs and long-term ETF strategies reflects efforts to build resilient portfolios amid market volatility.

- Trends & Sector Insights: Growth is seen in consumer product sectors led by younger buyers, offsetting tariff impacts, and enhanced by AI-driven efficiency. Excitement around artificial intelligence continues, though job displacement concerns persist, and skepticism over AI trades is being debated.

- Additional Events: Ongoing Warner Bros. Discovery acquisition speculation, crypto’s uncertain momentum, and U.S.-Venezuela relations impacting oil sentiment featured in late-session headlines. Calls for banning lawmaker stock trading are gaining support.

News Conclusion

- Market sentiment remains broadly constructive into year-end, anchored by technical resilience in stocks, high expectations for monetary easing, and strong performance in select commodities.

- Labor market weakness and slowing economic growth have heightened expectations for rate cuts, fueling safe-haven asset demand and shaping moves in major indices.

- Sector rotation, innovation trends, and strategic ETF allocations remain focal points for the evolving bull market narrative.

- Policy shifts at the Federal Reserve, as well as global bond dynamics and ongoing geopolitical risks, will continue to frame trader attention across asset classes.

Market News Sentiment:

Market News Articles: 40

- Neutral: 45.00%

- Positive: 40.00%

- Negative: 15.00%

GLD,Gold Articles: 17

- Positive: 58.82%

- Negative: 23.53%

- Neutral: 17.65%

USO,Oil Articles: 11

- Positive: 45.45%

- Negative: 36.36%

- Neutral: 18.18%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 4, 2025 05:00

- META 661.89 Bullish 3.49%

- NVDA 183.38 Bullish 2.11%

- TSLA 454.53 Bullish 1.74%

- USO 71.39 Bullish 1.03%

- IWM 251.82 Bullish 0.88%

- IJH 66.52 Bullish 0.50%

- MSFT 479.93 Bullish 0.46%

- SPY 684.39 Bullish 0.07%

- GLD 387.13 Bullish 0.06%

- DIA 479.07 Bearish -0.07%

- QQQ 622.94 Bearish -0.09%

- IBIT 52.51 Bearish -0.44%

- TLT 88.58 Bearish -0.54%

- GOOG 317.82 Bearish -0.87%

- AAPL 280.70 Bearish -1.21%

- AMZN 228.93 Bearish -1.48%

Market Summary – State of Play (as of 12/04/2025 17:00)

ETF Stocks

- SPY: 684.39 (Bullish, +0.07%) – S&P 500 ETF edges higher, reflecting marginal gains in large-cap equities.

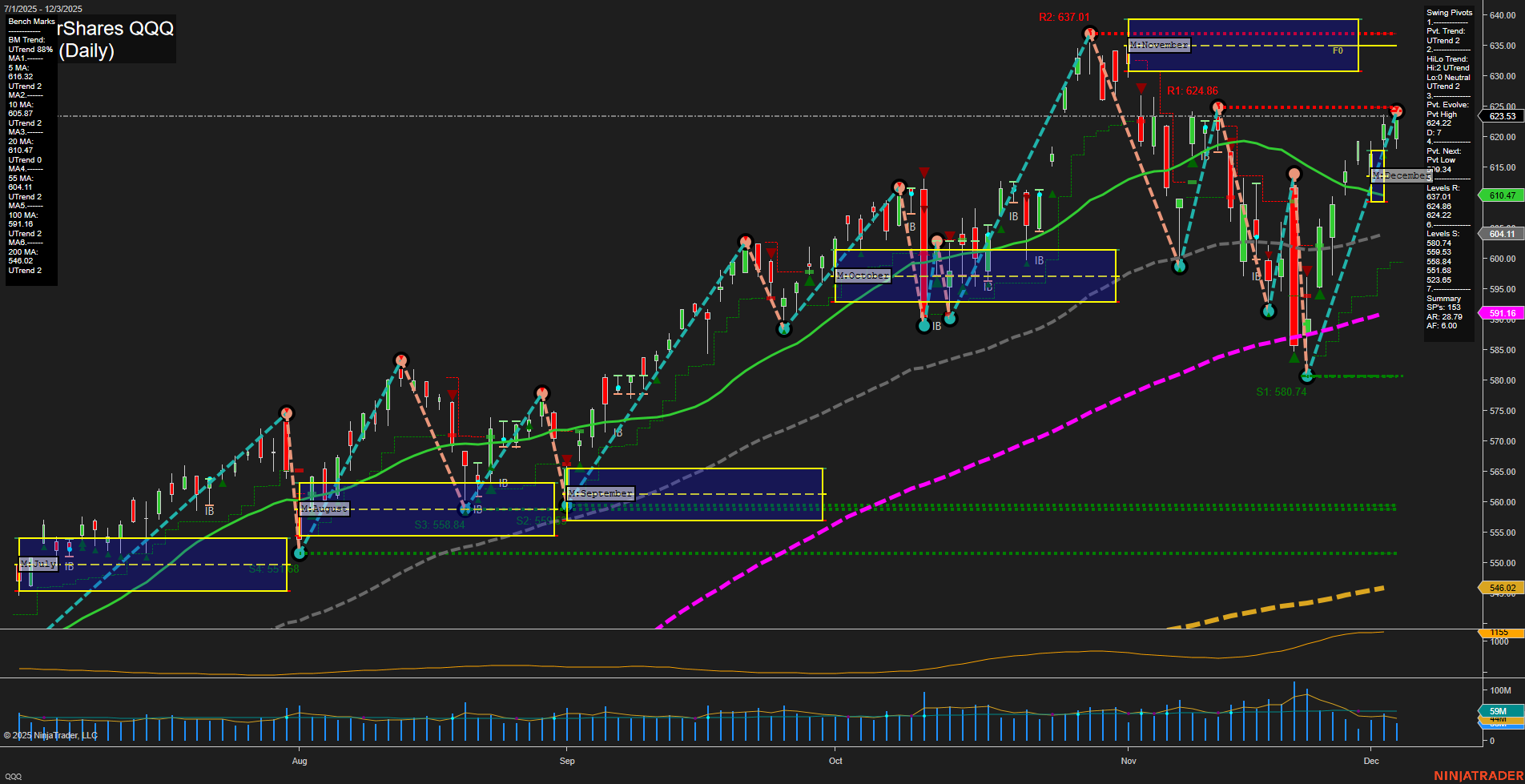

- QQQ: 622.94 (Bearish, -0.09%) – Nasdaq-100 ETF slides slightly as some mega-cap tech pulls back.

- IWM: 251.82 (Bullish, +0.88%) – Strong advance in small caps, showing broadening market participation.

- IJH: 66.52 (Bullish, +0.50%) – Mid-cap ETF continues its positive trend.

- DIA: 479.07 (Bearish, -0.07%) – Dow ETF dips on weaker blue-chip sentiment.

Magnificent 7 (MAG7)

- META: 661.89 (Bullish, +3.49%) – Leads tech higher on strong momentum.

- NVDA: 183.38 (Bullish, +2.11%) – Maintains robust uptrend, continuing outperformance in semis.

- TSLA: 454.53 (Bullish, +1.74%) – Rebounds on renewed growth sentiment.

- MSFT: 479.93 (Bullish, +0.46%) – Posts modest gains.

- GOOG: 317.82 (Bearish, -0.87%) – Slides, highlighting mixed action among big tech.

- AAPL: 280.70 (Bearish, -1.21%) – Retreats, contributing to weakness in tech-heavy indices.

- AMZN: 228.93 (Bearish, -1.48%) – Experiences notable pullback after recent strength.

Other Key ETFs

- TLT: 88.58 (Bearish, -0.54%) – Long Treasury ETF under pressure amid interest rate concerns.

- GLD: 387.13 (Bullish, +0.06%) – Gold ETF barely positive, maintains its safe-haven role.

- USO: 71.39 (Bullish, +1.03%) – Oil ETF rises on commodity market momentum.

- IBIT: 52.51 (Bearish, -0.44%) – Bitcoin ETF declines, tracking digital asset volatility.

Summary of the Day’s Tone

The ETF market snapshot shows a divided landscape. Small and mid-caps (IWM, IJH) are showing broad-based strength, while some major indices (SPY) post marginal gains. In contrast, the Dow (DIA) and QQQ are slightly lower.

Among the MAG7, META, NVDA, and TSLA stood out with robust gains, though heavyweights like AAPL, AMZN, and GOOG weighed on tech. Commodity plays like USO advanced, while TLT and crypto proxy IBIT came under pressure. Overall, traders are navigating a mixed environment with sector rotation and divergent moves among market leaders.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts