Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

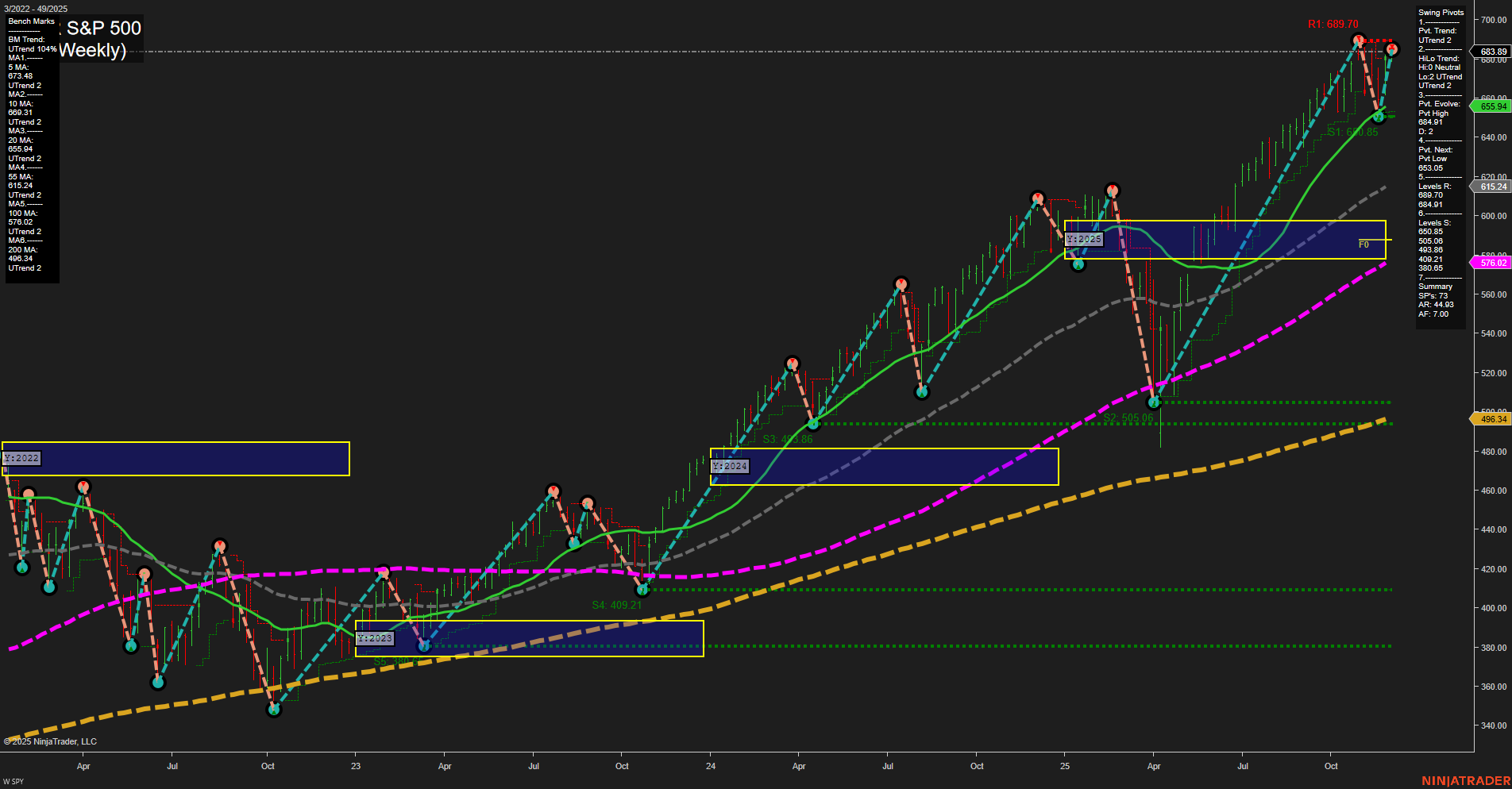

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- Commodities: Gold and silver saw continued bullish momentum, underpinned by weak U.S. jobs data and increasing expectation of near-term Fed rate cuts. Safe-haven demand and high Fed cut probability (85%) kept metals steady, though spot gold briefly pulled back as traders focused on the coming rate decision and inflation data. Oil prices edged up on the week, buoyed by Fed cut hopes, U.S.-Venezuela tensions, and OPEC output discussions; futures approach key technical levels (50-day MA). Natural gas and oil remain sensitive to geopolitical risks and supply concerns as price channels develop.

- Equities & Indices: U.S. stock markets maintained a positive streak, extending to a seventh month of gains, despite cracks in large-cap tech and AI. A broad-based rotation was observed: investors favored companies with tangible earnings and cash flow, while skepticism grew around Magnificent 7 and AI-driven names amid signs of cooling free cash flows and widening credit spreads. Seasonality suggests a potential year-end rally, with the Nasdaq set for a stronger open and S&P 500 and Dow futures also pointing higher.

- Central Banks: Fed leadership appears set for a dovish shift, with expectations skewed toward lower rates and pro-growth stances. In India, the central bank delivered a widely expected rate cut, highlighting weakness in PMI, exports, and industrial output.

- Sector Focus & Fund Flows: Market signals point toward renewed interest in cyclical and value stocks in sectors like transportation, housing, and energy ahead of 2026, with fund strategies prioritizing disciplined stock selection over speculation. Meanwhile, institutional holders like Pimco maintained a positive stance in U.S. Treasuries despite global trade tensions.

- Macro Risks: Job cuts and labor market uncertainty persist, and skepticism toward tech capex is increasing. Tariffs continue to drive business adjustments, as seen with IKEA moving production stateside.

- Europe: Calls continue for a consolidated European exchange, as regional markets seek to strengthen competitiveness.

- Notable Stock Action: Recent high-profile disclosures showed interest in select small-cap names and companies facing post-controversy rebounds.

News Conclusion

- The broad market remains positively biased heading into year-end, driven by expectations of Fed rate cuts, resilient corporate earnings outside of tech, and safe-haven demand supporting commodities.

- Large-cap tech faces increasing scrutiny, while rotation into value and cyclicals may gather pace as rates ease and policy support is anticipated in 2026.

- Commodity markets, particularly gold, silver, and oil, are being shaped by rate cut expectations and geopolitical factors, underpinning short-term volatility and directional moves.

- Central bank actions remain a key catalyst, as evidenced by recent dovish shifts in both the U.S. and India, prompting business and asset allocation adjustments across regions and sectors.

- Labor and trade policy uncertainty continue to pose risks, as job market challenges and tariff impacts drive strategic shifts within corporations and supply chains.

Market News Sentiment:

Market News Articles: 44

- Positive: 47.73%

- Neutral: 31.82%

- Negative: 20.45%

Sentiment Summary: Out of 44 market news articles, 47.73% were positive, 31.82% neutral, and 20.45% negative.

Conclusion: The overall market news sentiment leans positive, with nearly half of the coverage reflecting optimism, while a smaller portion of articles conveyed negative sentiment.

GLD,Gold Articles: 15

- Positive: 46.67%

- Neutral: 26.67%

- Negative: 26.67%

Sentiment Summary:

Out of 15 recent articles on GLD and Gold, 46.67% were positive, 26.67% were neutral, and 26.67% were negative.

This indicates that recent market news sentiment toward GLD and Gold has been more positive than negative or neutral.

USO,Oil Articles: 8

- Positive: 50.00%

- Negative: 25.00%

- Neutral: 25.00%

Sentiment Summary:

Among recent articles covering USO and oil, sentiment is mixed but leans positive, with 50% of articles expressing a positive outlook, 25% negative, and 25% neutral.

This indicates a cautiously optimistic tone in news coverage, though diverse perspectives remain present in the market discourse.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 5, 2025 07:16

- META 661.89 Bullish 3.49%

- NVDA 183.38 Bullish 2.11%

- TSLA 454.53 Bullish 1.74%

- USO 71.39 Bullish 1.03%

- IWM 251.82 Bullish 0.88%

- IJH 66.52 Bullish 0.50%

- MSFT 479.93 Bullish 0.46%

- SPY 684.39 Bullish 0.07%

- GLD 387.13 Bullish 0.06%

- DIA 479.07 Bearish -0.07%

- QQQ 622.94 Bearish -0.09%

- IBIT 52.51 Bearish -0.44%

- TLT 88.58 Bearish -0.54%

- GOOG 317.82 Bearish -0.87%

- AAPL 280.70 Bearish -1.21%

- AMZN 228.93 Bearish -1.48%

Market Summary: ETF Stocks

- SPY (S&P 500): 684.39, Bullish 0.07% — Marginal gains, with positive momentum.

- QQQ (NASDAQ 100): 622.94, Bearish -0.09% — Moving slightly lower, some tech pressure.

- IWM (Russell 2000): 251.82, Bullish 0.88% — Small caps showing notable strength.

- IJH (S&P MidCap 400): 66.52, Bullish 0.50% — Midcaps modestly positive.

- DIA (Dow Jones): 479.07, Bearish -0.07% — Slight downward pressure on blue chips.

Market Summary: “Mag7” Stocks

- META: 661.89, Bullish 3.49% — Strong rally, leading gains among mega caps.

- NVDA: 183.38, Bullish 2.11% — Chip sector strength, robust buying.

- TSLA: 454.53, Bullish 1.74% — Outperforming, positive sentiment.

- MSFT: 479.93, Bullish 0.46% — Steady upward move.

- GOOG: 317.82, Bearish -0.87% — Facing downward momentum.

- AAPL: 280.70, Bearish -1.21% — Pulling back, underperforming the group.

- AMZN: 228.93, Bearish -1.48% — Also retracing, negative performance.

Market Summary: Thematic/Other ETFs

- USO (Oil Fund): 71.39, Bullish 1.03% — Energy sector seeing renewed buying.

- GLD (Gold Fund): 387.13, Bullish 0.06% — Gold eking out gains, steady haven interest.

- TLT (20+ Yr Treasury Bond): 88.58, Bearish -0.54% — Down as yields rise, rate expectations shifting.

- IBIT (Bitcoin ETF): 52.51, Bearish -0.44% — Bitcoin ETF moves lower, crypto cooling.

ETF & Mega Cap Stock Strength Breakdown

- Long (Bullish): META, NVDA, TSLA, USO, IWM, IJH, MSFT, SPY, GLD

- Short (Bearish): DIA, QQQ, IBIT, TLT, GOOG, AAPL, AMZN

- Mixed/Market Nuance: While major indices (SPY, IWM, IJH) show bull momentum, mega cap tech (GOOG, AAPL, AMZN) and QQQ/DIA reflect pressure. Energy and gold holding positive ground, while bonds and crypto ETFs trending weaker.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-12-05: 07:17 CT.

US Indices Futures

- ES Strong uptrend, YSFG/MSFG/WSFG above NTZ/F0%, recent swing high 6953.75, support 6255.00, moving averages rising, resistance near highs, trend continuation, bullish on all timeframes.

- NQ Uptrend confirmed, price above all Fib grids, swing high 26,399.00, support 25,025.25, all MAs increasing, strong rally phase, higher highs/lows, bullish structure on all timeframes.

- YM Bullish trend, price above YSFG/MSFG/WSFG NTZ, swing high 48,528, support below at 47,000, all MAs advancing, long signals active, rally continuation, bullish across all horizons.

- EMD Broad uptrend, YSFG/MSFG/WSFG above NTZ, recent swing high 3347.6, nearest support 3205.1, MAs up, weekly intermediate trend neutral, daily momentum strong, breakout phase, buffers below.

- RTY Strong bullish structure, YSFG/MSFG/WSFG up/trending, swing high 2566.5, support 2191.3, MAs in uptrend, recent recovery from lows, trend continuation, bullish across all timeframes.

- FDAX Weekly uptrend, above YSFG/MSFG/WSFG, recent swing low 23,384, resistance overhead at 24,891, MAs long/intermediate trend up, short-term bullish, daily intermediate/long-term neutral, recovery phase.

Overall State

- Short-Term: Bullish (except FDAX Neutral)

- Intermediate-Term: Bullish (FDAX and EMD Neutral)

- Long-Term: Bullish (FDAX Neutral)

Conclusion

US indices futures ES, NQ, YM, EMD, and RTY all exhibit strong bullish structure on higher timeframes, with prices above yearly, monthly, and weekly session fib grids, and all major benchmarks in uptrends. Swing pivots confirm uptrends with higher highs and support well below current levels, providing buffers for potential retracements. FDAX shows a long-term and intermediate-term uptrend but remains neutral on shorter timeframes due to recent consolidation and resistance overhead. Trend correlations align for bullish continuation across US indices, with signals confirming the technical structure and no immediate signs of reversal; short-term pullbacks remain possible within the prevailing HTF uptrend context.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

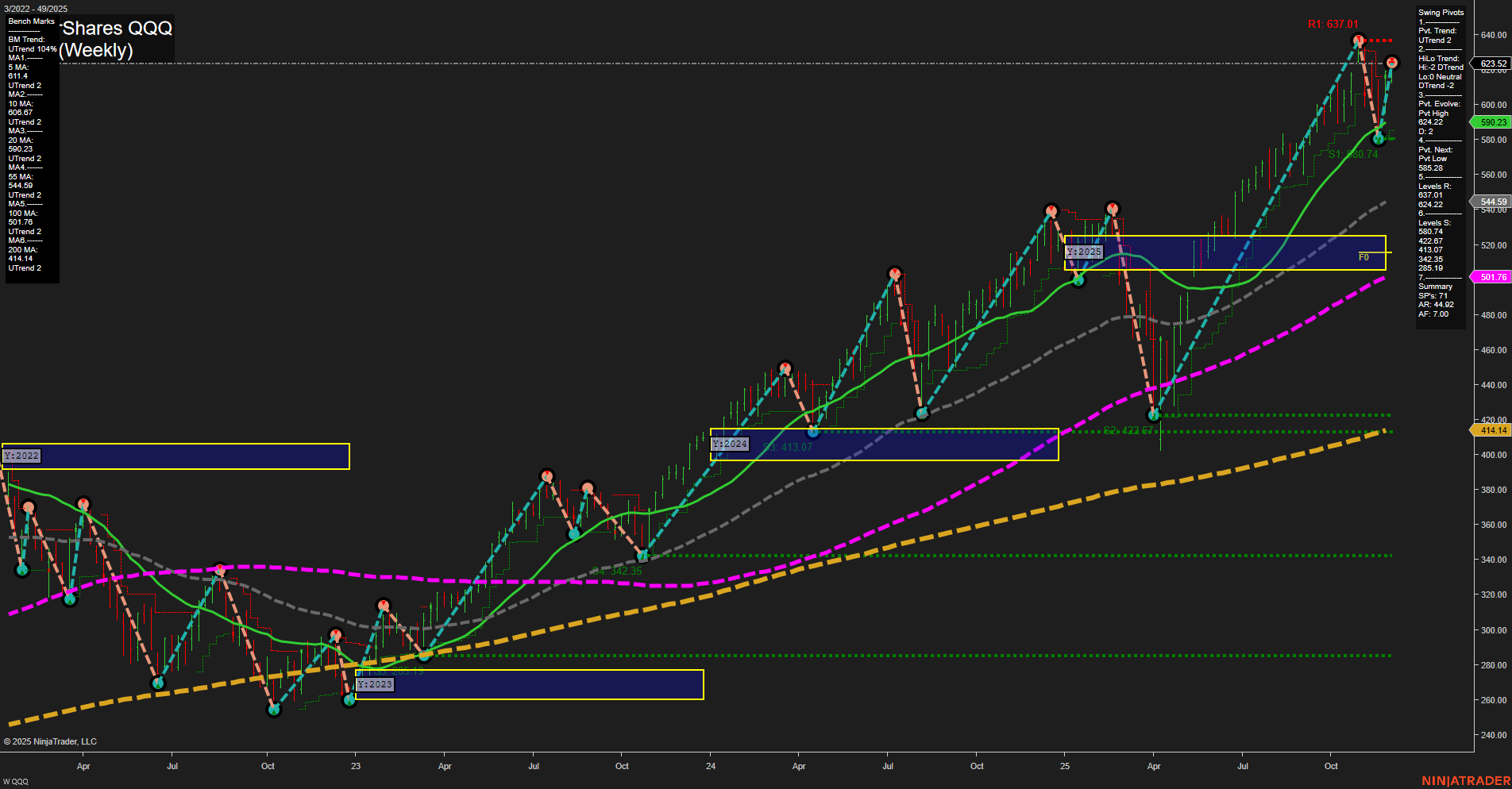

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts