Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

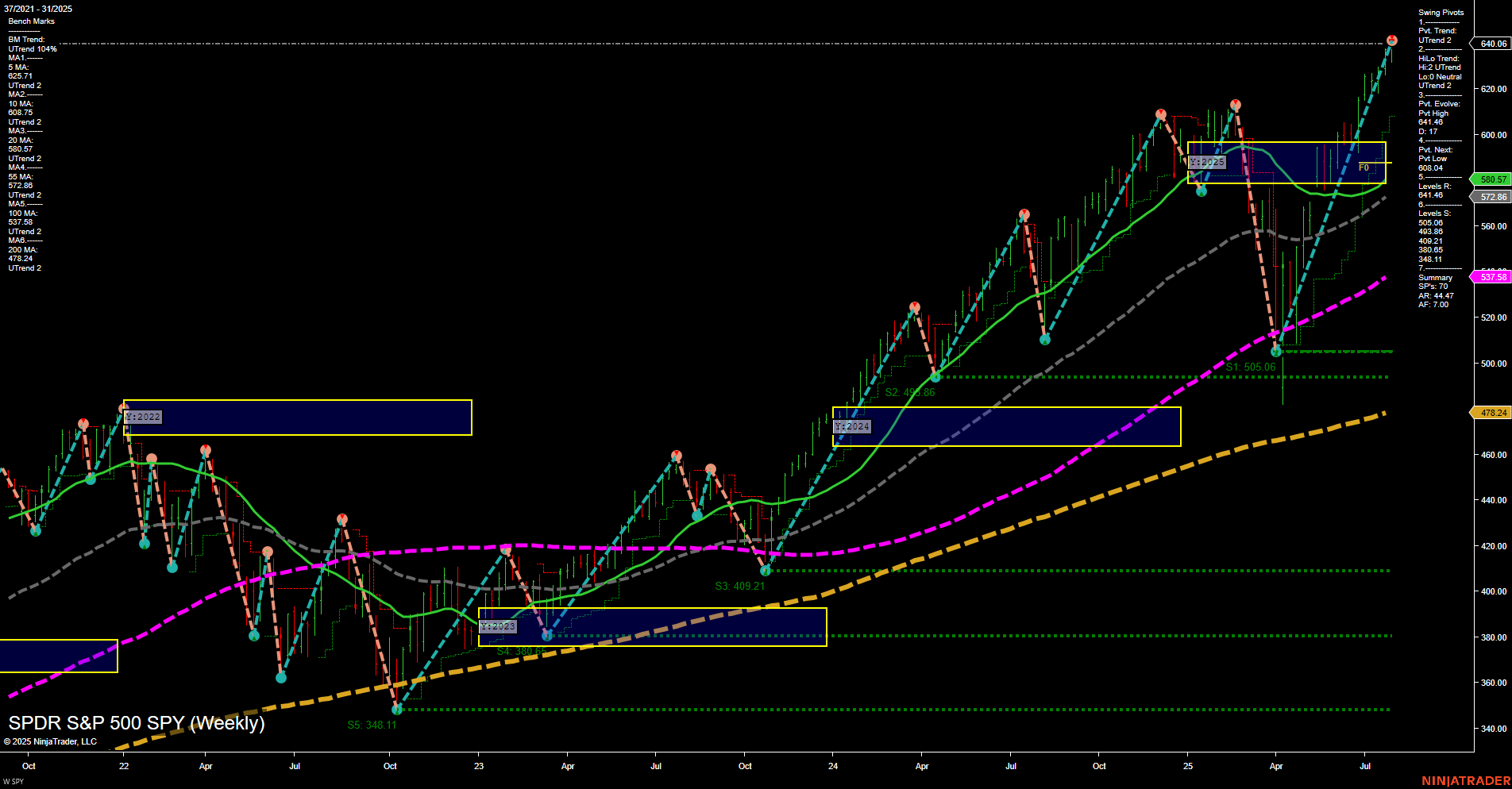

SPY Weekly View

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- AAPL Release: 2025-07-31 T:AMC

- AMZN Release: 2025-07-31 T:AMC

Earnings Summary and Market Conclusion:

With both Apple (AAPL) and Amazon (AMZN) scheduled to report earnings after the market close on July 31, 2025, indices futures traders should be aware that market activity may remain muted leading into these key events. Historically, the anticipation of major tech earnings—especially from MAG7 constituents like AAPL and AMZN—often results in reduced momentum and lighter trading volume as participants await clarity on results and guidance. This effect is further amplified by the upcoming earnings for other influential names such as NVIDIA (NVDA) and the broader AI technology sector, which together have an outsized impact on index direction. As a result, expect continued caution and range-bound price action in the lead-up, with potential for significant volatility once these high-profile releases hit the tape and set the tone for the next leg of market movement.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- 08:30 – USD Average Hourly Earnings m/m (High Impact): This wage growth metric is a key inflation indicator. A stronger-than-expected reading may increase expectations of tighter monetary policy, potentially pressuring equity indices.

- 08:30 – USD Non-Farm Employment Change (High Impact): The headline jobs figure is closely watched for signs of labor market strength or weakness. Significant beats or misses often trigger sharp index futures moves at the open.

- 08:30 – USD Unemployment Rate (High Impact): This provides a broader snapshot of labor market health. Unexpected changes can amplify market volatility, especially when combined with surprises in wage or NFP data.

- 10:00 – USD ISM Manufacturing PMI (High Impact): As a leading indicator of economic activity, this release can sway sentiment on growth prospects. A strong or weak print can drive indices directionally, especially during the late morning session.

EcoNews Conclusion

- With multiple high-impact labor market releases at 08:30, expect elevated volatility and potential directional moves in index futures at the NY open.

- The 10:00 ISM Manufacturing PMI release may act as a secondary catalyst, often leading to reversals or continuations in market momentum during the late morning cycle.

For full details visit: Forex Factory EcoNews

Market News Summary

- Oil, Gas & Commodities: WTI crude oil is rebounding from long-term support, while natural gas is consolidating in a bullish range. Oil prices are being influenced by tariff threats and supply risks, with OPEC+ output increases and U.S. tariff uncertainty weighing on forecasts. Despite these pressures, WTI remains above $70, supported by strong GDP data and a Fed pause. Shell reported better-than-expected earnings, boosting investor sentiment even as oil prices remain soft.

- Tariffs & Trade Policy: The U.S. is approaching an August 1 deadline for the suspension of “reciprocal” tariffs, with only a handful of trade deals completed. A new trade pact with South Korea introduces a 15% tariff, providing a boost to U.S. equity futures. Uncertainty persists around U.S.-China trade negotiations, with the possibility of a significant slowdown in China’s GDP if no deal is reached. Court arguments are underway regarding the potential overturning of Trump’s tariffs.

- Central Bank & Rates: Fed Chair Powell has maintained a moderately hawkish stance, signaling no rate cuts before September. Although headline GDP growth is strong, underlying domestic demand is weakening. Inflation has posted its largest rise in four months, partly attributed to tariffs, complicating the outlook for Fed policy. Market strategists are debating the timing and number of potential future rate cuts.

- Equities & Indices: The Dow and S&P 500 futures are higher on the back of multiple trade deals and solid earnings. The S&P 500 has extended its rally into a third month, up 14% over that span, despite concerns about seasonal headwinds. The Hang Seng Index is under pressure from weak China PMI data and hawkish Fed commentary. Positive sentiment is also seen in semiconductor stocks, with new AI chip strategies from major tech companies.

- Gold & Safe Havens: Gold prices are rebounding as the Fed holds rates steady and the dollar eases, with safe-haven demand rising on renewed China trade tensions and softer Treasury yields.

- Labor Market: U.S. jobless claims remain low, indicating a stable labor market, while job cuts in 2025 have already surpassed those of 2024, with tariffs, AI, and crypto cited as key factors.

News Conclusion

- Markets are currently driven by a mix of tariff uncertainty, central bank policy signals, and corporate earnings.

- Energy markets are volatile, balancing supply risks and policy developments, while equities are buoyed by trade deals and resilient earnings.

- The Fed’s cautious approach and rising inflation are creating uncertainty about the timing of future rate cuts.

- Tariff deadlines and ongoing trade negotiations, especially between the U.S. and China, remain pivotal for market direction in the near term.

- Despite macro headwinds, certain sectors such as technology and energy are showing pockets of strength.

Market News Sentiment:

Market News Articles: 55

- Neutral: 58.18%

- Negative: 21.82%

- Positive: 20.00%

SPY,IVV,VOO,QQQ Articles: 10

- Positive: 60.00%

- Neutral: 30.00%

- Negative: 10.00%

GLD,Gold Articles: 14

- Negative: 42.86%

- Neutral: 42.86%

- Positive: 14.29%

USO,Oil Articles: 10

- Positive: 40.00%

- Negative: 30.00%

- Neutral: 30.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: July 31, 2025 08:25

- NVDA 179.27 Bullish 2.14%

- USO 81.04 Bullish 1.55%

- GOOG 197.44 Bullish 0.51%

- QQQ 568.02 Bullish 0.13%

- MSFT 513.24 Bullish 0.13%

- SPY 634.46 Bearish -0.13%

- AMZN 230.19 Bearish -0.35%

- DIA 444.76 Bearish -0.39%

- IWM 221.56 Bearish -0.51%

- IBIT 66.37 Bearish -0.51%

- TLT 86.87 Bearish -0.52%

- IJH 63.75 Bearish -0.62%

- TSLA 319.04 Bearish -0.67%

- META 695.21 Bearish -0.68%

- AAPL 209.05 Bearish -1.05%

- GLD 300.96 Bearish -1.73%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-07-31: 08:26 CT.

US Indices Futures

- ES New highs, YSFG/MSFG/WSFG bullish, above all MA benchmarks, uptrend pivots, support at 6177.00, resistance above, strong HTF structure, some short-term consolidation.

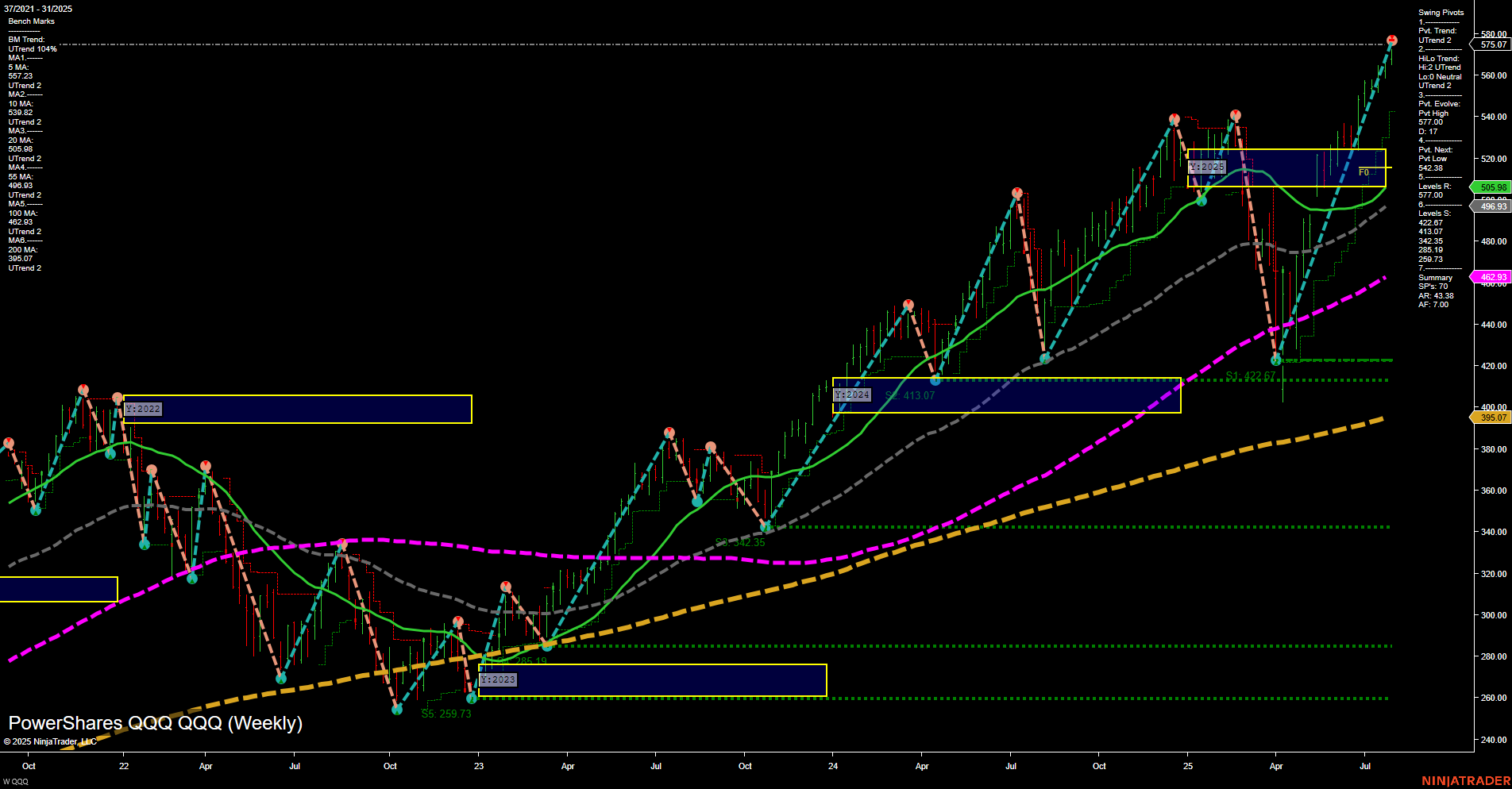

- NQ All timeframe bullish, price above YSFG/MSFG/WSFG, strong uptrend pivots, resistance layered above, MA benchmarks rising, most recent high 23,763.25, next support 21,388.00.

- YM YSFG/MSFG bullish, WSFG neutral to bearish, price near support, intermediate/long-term MA benchmarks rising, short-term consolidation, pivots show uptrend on higher TF, resistance at 44734/45878/46300.

- EMD Intermediate-term MSFG up, YSFG/WSFG mixed, short-term downtrend signals, MA benchmarks long-term up, support 3177.9/3107.6, resistance 3236.9/3501.9, corrective phase, indecisive HTF signals.

- RTY Short-term & long-term bearish, MSFG neutral/up, WSFG trend down, price below NTZ, intermediate-term support at 2095, major resistance 2257–2296, pivots mixed, volatility elevated.

- FDAX YSFG/MSFG bullish, WSFG/short-term neutral/down, strong long/intermediate uptrend, above all MA benchmarks, resistance at 24,748, support at 24,000/23,329, consolidating after strong rally.

Overall State

- Short-Term: Neutral

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

HTF context shows US indices futures generally holding intermediate- and long-term uptrends, confirmed by bullish YSFG and MSFG structures, rising MA benchmarks, and uptrending pivots in ES and NQ. YM and FDAX are consolidating after rallies, with short-term neutral to bearish signals but bullish higher timeframe structure. EMD and RTY display volatility and mixed signals, with bearish/neutral short-term readings and underlying HTF support. Resistance levels are layered above current prices, with well-established support below, permitting consolidation or pullback within broader uptrends. Overall, the technical environment reflects trending bias on longer timeframes with short-term corrections and consolidations, typical of markets digesting gains near highs.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals