After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETF moves, Magnificent 7 analysis, and QQQ daily view.

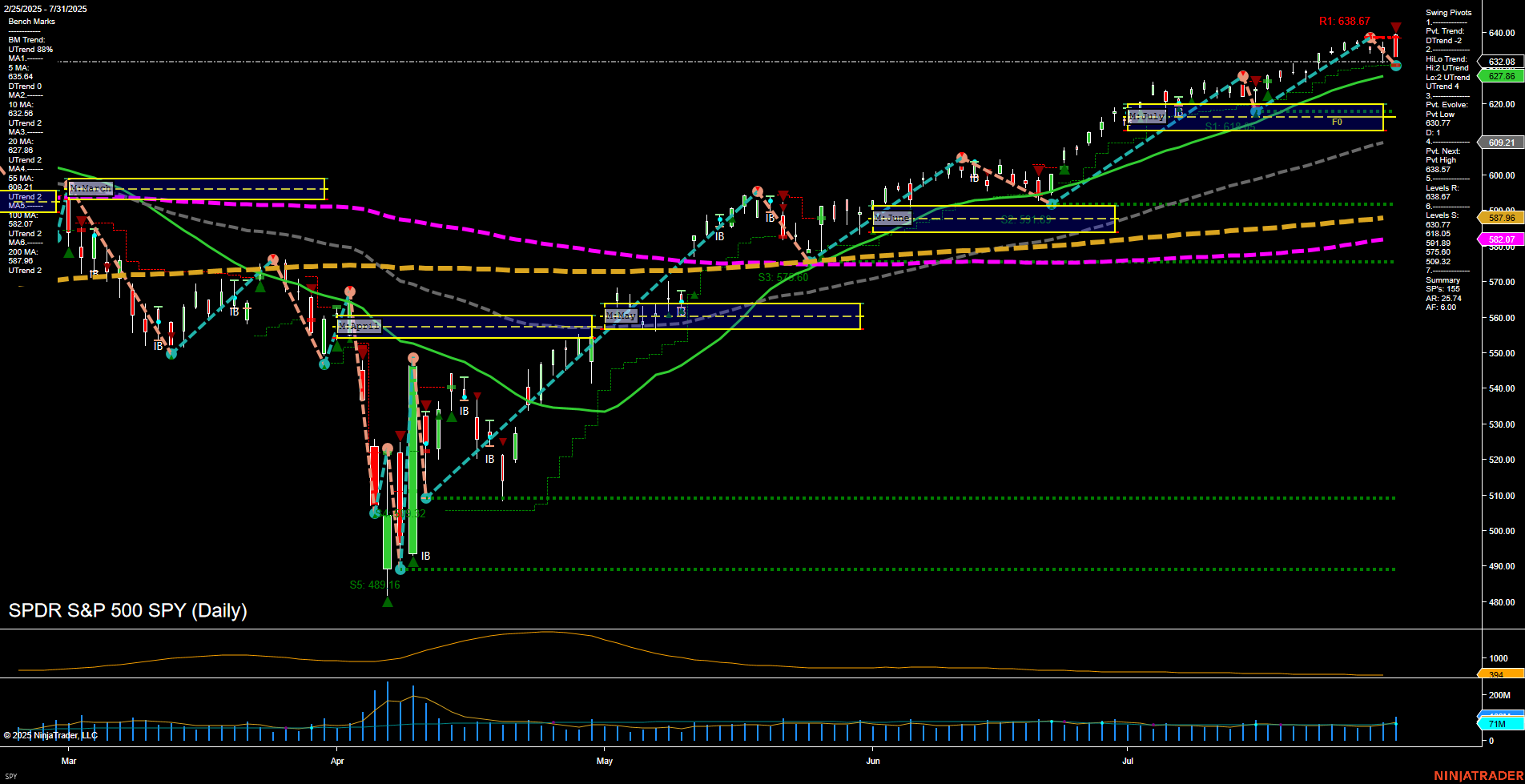

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Stock Selloff & Market Weakness: U.S. equities tumbled on Friday, with major indices posting their sharpest declines in over two months. The S&P 500 dropped 1.6% on the day and 2.4% for the week, pressured by weak July jobs data and renewed tariff concerns. The selloff marked the worst week for stocks since May, with megacap tech and chip stocks seeing their worst trading day in four months.

- Tariff Turmoil: The U.S. imposed sweeping new tariffs, including a 35% levy on some Canadian goods, escalating trade tensions. Canada’s trade delegation threatened to walk away from negotiations. Tariffs are expected to raise costs for farmers and consumers, with economists warning of potential inflationary effects.

- Economic Data: The July jobs report disappointed, signaling a slowing labor market. The weak data sparked debate about the Federal Reserve’s response, with some market participants calling for rate cuts and others warning of policy risks.

- Bond and Currency Moves: Short-dated Treasury yields fell sharply as investors sought safety, while the U.S. dollar retreated. These moves reflected growing concerns about economic growth and the Fed’s policy stance.

- Gold Rally: Gold surged, reaching trend highs and forming a bullish technical pattern. Traders cited the weak jobs report and tariff turmoil as boosting expectations for a dovish Fed, with bullish sentiment for gold intensifying. Silver and platinum also gained.

- Oil & Commodities: Oil prices fell 3% on demand concerns tied to the jobs data and global trade uncertainty.

- Earnings Season: Despite the broader market selloff, many companies reported strong earnings beats and positive outlooks, though this was not enough to offset macroeconomic headwinds.

- Market Structure & Risks: Concentration risk in megacap stocks and the limitations of traditional 60/40 portfolios were highlighted amid increased volatility and macro uncertainty.

- Fed & Policy Developments: Political pressure on the Fed intensified, with a governor’s resignation and calls for leadership changes. Debate continued over the wisdom and risks of potential rate cuts.

News Conclusion

- Friday’s trading session was dominated by risk-off sentiment as weak jobs data and escalating tariff actions drove equities lower and safe-haven assets higher.

- Tariff developments and disappointing labor market figures weighed heavily on stocks, with investors positioning for possible Fed policy shifts.

- Gold and Treasuries benefited from flight-to-safety flows, while the dollar weakened and oil prices declined on growth concerns.

- Despite strong corporate earnings in select sectors, broad market sentiment reflected heightened caution around macroeconomic and policy risks.

- Market participants remain focused on evolving trade policy, inflation risks, and the Federal Reserve’s potential response to economic data and political pressure.

Market News Sentiment:

Market News Articles: 48

- Negative: 62.50%

- Neutral: 25.00%

- Positive: 12.50%

GLD,Gold Articles: 12

- Positive: 50.00%

- Negative: 25.00%

- Neutral: 25.00%

USO,Oil Articles: 7

- Negative: 57.14%

- Positive: 28.57%

- Neutral: 14.29%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 1, 2025 10:22

- GLD 309.11 Bullish 2.03%

- TLT 87.82 Bullish 1.04%

- DIA 435.72 Bearish -1.27%

- IJH 62.09 Bearish -1.49%

- GOOG 189.95 Bearish -1.51%

- SPY 621.72 Bearish -1.64%

- MSFT 524.11 Bearish -1.76%

- TSLA 302.63 Bearish -1.83%

- QQQ 553.88 Bearish -1.97%

- IWM 214.92 Bearish -2.04%

- NVDA 173.72 Bearish -2.33%

- AAPL 202.38 Bearish -2.50%

- USO 77.46 Bearish -2.68%

- META 750.01 Bearish -3.03%

- IBIT 64.22 Bearish -3.17%

- AMZN 214.75 Bearish -8.27%

Market Summary: ETFs, Mag7, and Key Asset ETFs (as of 08/01/2025)

This snapshot provides a concise overview of major ETFs, the Mag7 stocks, and notable asset-based ETFs, highlighting their current directional trends and daily percentage changes.

ETF Stocks: Broad Market Indices

- SPY (S&P 500 ETF): 621.72 Bearish -1.64%

- QQQ (Nasdaq 100 ETF): 553.88 Bearish -1.97%

- IWM (Russell 2000 ETF): 214.92 Bearish -2.04%

- IJH (S&P MidCap 400 ETF): 62.09 Bearish -1.49%

- DIA (Dow Jones ETF): 435.72 Bearish -1.27%

Summary: All major equity index ETFs are showing bearish momentum, with losses ranging from -1.27% to -2.04%. This reflects broad-based selling pressure across large-, mid-, and small-cap equities.

Mag7 Stocks

- AAPL (Apple): 202.38 Bearish -2.50%

- MSFT (Microsoft): 524.11 Bearish -1.76%

- GOOG (Alphabet): 189.95 Bearish -1.51%

- AMZN (Amazon): 214.75 Bearish -8.27%

- META (Meta Platforms): 750.01 Bearish -3.03%

- NVDA (Nvidia): 173.72 Bearish -2.33%

- TSLA (Tesla): 302.63 Bearish -1.83%

Summary: The Mag7 stocks are all in negative territory, with AMZN notably down -8.27%. Losses across these tech leaders are accentuating the risk-off sentiment in growth sectors.

Other Key ETFs

- GLD (Gold ETF): 309.11 Bullish +2.03%

- TLT (20+ Yr Treasury Bond ETF): 87.82 Bullish +1.04%

- USO (Oil ETF): 77.46 Bearish -2.68%

- IBIT (Bitcoin ETF): 64.22 Bearish -3.17%

Summary: GLD and TLT stand out as bullish, suggesting a rotation into perceived safe havens. Commodities and crypto proxies (USO, IBIT) are under pressure, tracking broader risk-off flows.

Overall Market State

- Long/Bullish: GLD, TLT

- Short/Bearish: All major equity ETFs, Mag7 stocks, USO, IBIT

- Mixed: No major assets in a mixed state; the session is dominated by risk-off sentiment except for gold and treasuries.

Summary: The market snapshot is characterized by broad-based equity and risk-asset weakness, with notable strength in traditional safe havens. Traders may note the defensive rotation underway, as risk aversion dominates the current session.

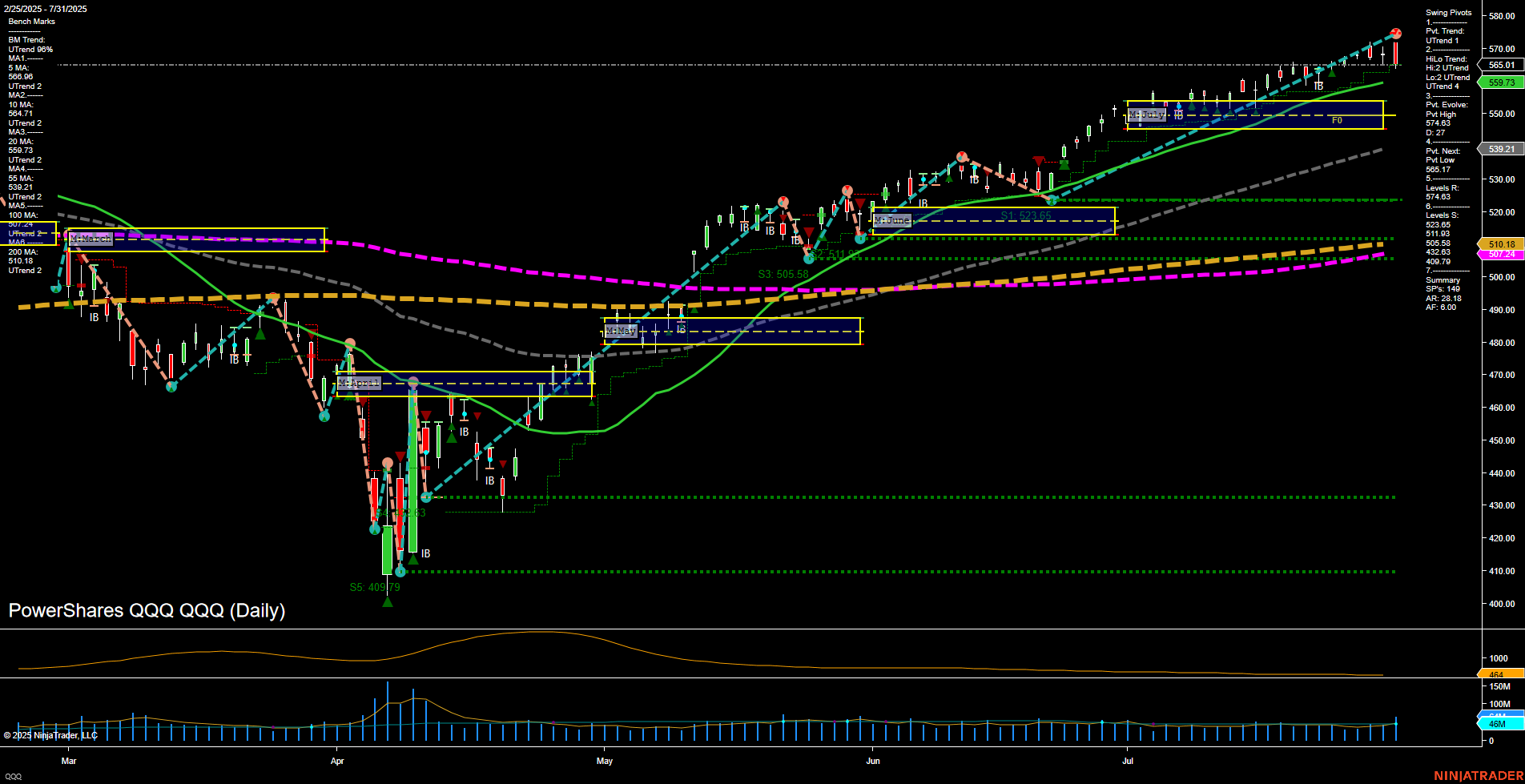

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts