Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

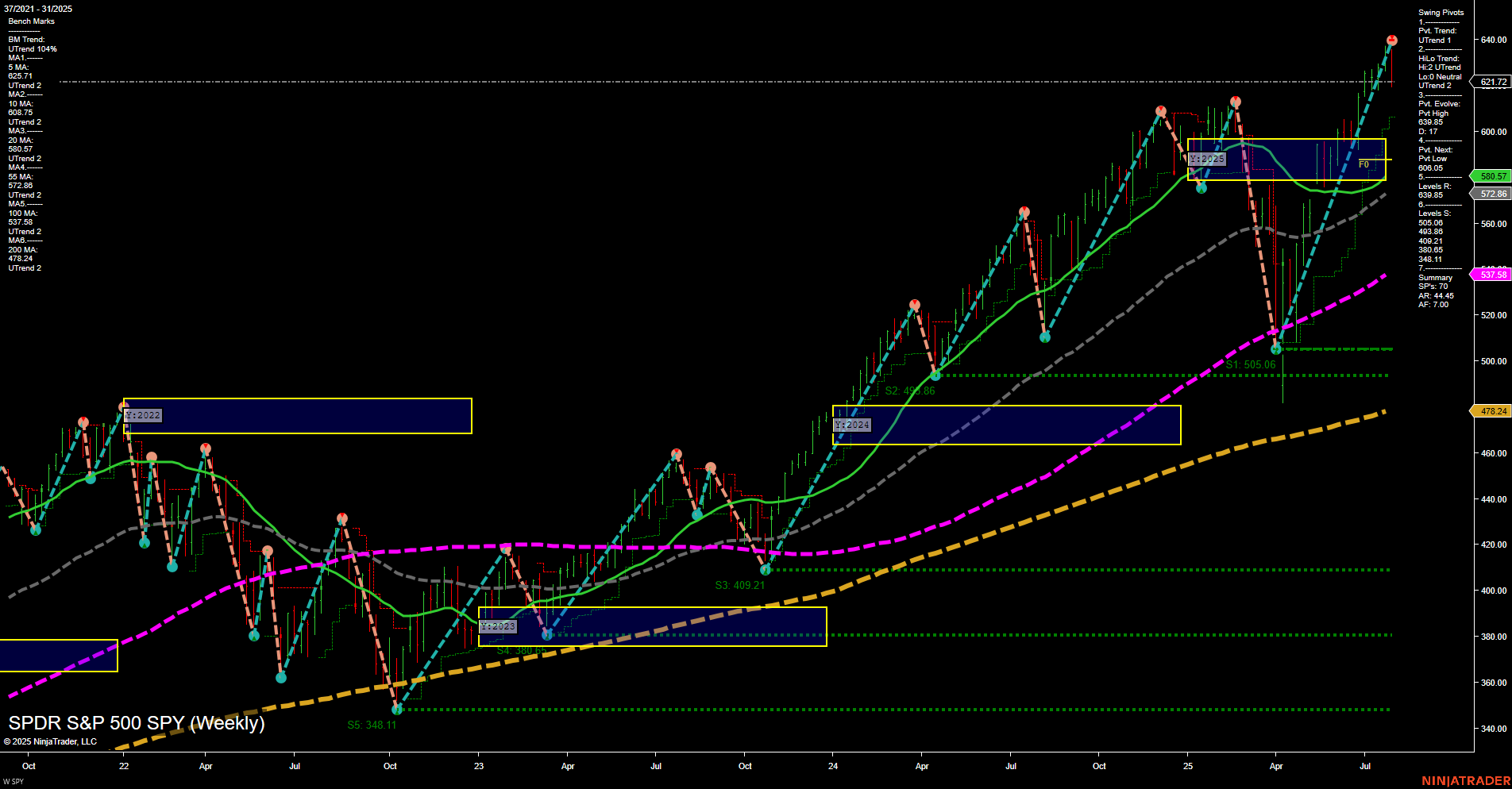

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MCHP Release: 2025-08-07 T:AMC

- AMD Release: 2025-08-05 T:AMC

- SMCI Release: 2025-08-05 T:AMC

As we approach a key week for tech sector earnings, indices futures traders should note that major releases from AMD and Super Micro Computer (SMCI) are scheduled for August 5th after market close, followed by Microchip Technology (MCHP) on August 7th. These companies are closely watched as bellwethers for the semiconductor and AI hardware space, sectors that have driven much of the recent market leadership. In the days leading up to these earnings, market momentum and trading volumes may moderate as participants await clarity on results and guidance, especially with anticipation building for subsequent reports from NVDA and the broader “MAG7” AI cohort. The outcome of these releases could set the tone for sector rotation and volatility in index futures, particularly given the heavy weighting of tech and AI-related stocks in major indices.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 10:00 – USD ISM Services PMI (High Impact): This key services sector gauge is closely watched for signs of economic strength or weakness. A significant deviation from expectations can trigger sharp moves in indices futures, especially around the 10 AM time cycle, which is known for increased volatility and potential market reversals or continuations.

- Wednesday 10:30 – USD Crude Oil Inventories (Low Impact): While typically a medium impact event, oil inventory data can influence market sentiment if there are unexpected changes, particularly if oil prices are already elevated. Watch for indirect effects on indices via energy and inflation-sensitive sectors.

- Thursday 08:30 – USD Unemployment Claims (High Impact): Weekly jobless claims provide a timely read on labor market conditions. Surprises here can affect indices futures by shifting expectations for economic resilience and Fed policy.

EcoNews Conclusion

- Indices futures traders should anticipate heightened volatility during the ISM Services PMI and Unemployment Claims releases, with the 10 AM window on Tuesday being a particularly sensitive period for market direction.

- Crude Oil Inventories on Wednesday may have a greater-than-usual impact if oil prices remain high, as this could stoke inflation concerns and influence broader market sentiment.

- News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

- Any high oil prices can have a direct impact on the market due to inflation and geopolitical concerns.

For full details visit: Forex Factory EcoNews

Market News Summary

- US Jobs Data Weakness: Multiple headlines highlight sharply weaker US jobs data for July, with significant downward revisions to previous months. This has triggered concerns about the reliability of labor market data and speculation that the Federal Reserve may be “behind the curve” on policy. The S&P 500 and other indices saw notable declines, with Friday’s session particularly volatile.

- Fed Policy and Rate Cut Bets: Despite weak jobs data, the Fed has not signaled an imminent rate cut. However, rate cut bets are influencing global markets, with futures and some international indices (Hang Seng, DAX) reacting positively to the possibility of looser policy.

- S&P 500 and Earnings: The S&P 500 recently reached an all-time high but has since reversed momentum amid macroeconomic concerns. Notably, Q2 and Q3 earnings growth estimates for the S&P 500 have been revised higher, which is an atypically positive development during earnings season.

- Commodities—Gold, Silver, Oil: Gold surged on safe-haven demand following weak jobs data but slipped as traders booked profits and yields rebounded. Silver underperformed due to China demand fears and US tariffs. Oil prices fell as OPEC+ agreed to a significant output hike, while Russia-related sanctions and US tariffs contributed to a bearish outlook.

- Tariffs and Geopolitics: The US is imposing new tariffs on Syria and is considering secondary sanctions on India for Russian oil purchases. Tariff deadlines appear firm, with no renegotiation expected.

- Consumer Sentiment: US consumers are showing anxiety over inflation and personal finances, shifting spending to essentials and away from discretionary purchases.

- ETF and Sector Flows: July saw strong inflows into ETFs, especially Ethereum-focused funds, and continued investor interest in AI and natural gas-related stocks.

- Earnings Season: This week is one of the busiest for earnings reports, adding to market volatility expectations.

News Conclusion

- The market landscape is currently shaped by disappointing US jobs data, persistent inflation, and heightened geopolitical tensions, all contributing to volatility across stocks, futures, and commodities.

- While the S&P 500 recently hit record highs and earnings growth revisions remain positive, recent price action has turned cautious, with traders responding to macroeconomic uncertainties and shifting Fed expectations.

- Commodities markets are being driven by both supply-side developments (OPEC+ output hikes, sanctions) and safe-haven demand, with gold and silver reacting to economic data and policy speculation.

- ETF inflows and sector rotation—particularly into technology, AI, and energy—remain notable, even as overall sentiment is mixed due to conflicting economic signals.

- The upcoming week is expected to be volatile due to a heavy earnings calendar and ongoing macroeconomic and geopolitical developments.

Market News Sentiment:

Market News Articles: 19

- Positive: 36.84%

- Neutral: 36.84%

- Negative: 26.32%

GLD,Gold Articles: 6

- Neutral: 50.00%

- Negative: 33.33%

- Positive: 16.67%

USO,Oil Articles: 5

- Negative: 80.00%

- Neutral: 20.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 4, 2025 07:11

- GLD 309.11 Bullish 2.03%

- TLT 87.82 Bullish 1.04%

- DIA 435.72 Bearish -1.27%

- IJH 62.09 Bearish -1.49%

- GOOG 189.95 Bearish -1.51%

- SPY 621.72 Bearish -1.64%

- MSFT 524.11 Bearish -1.76%

- TSLA 302.63 Bearish -1.83%

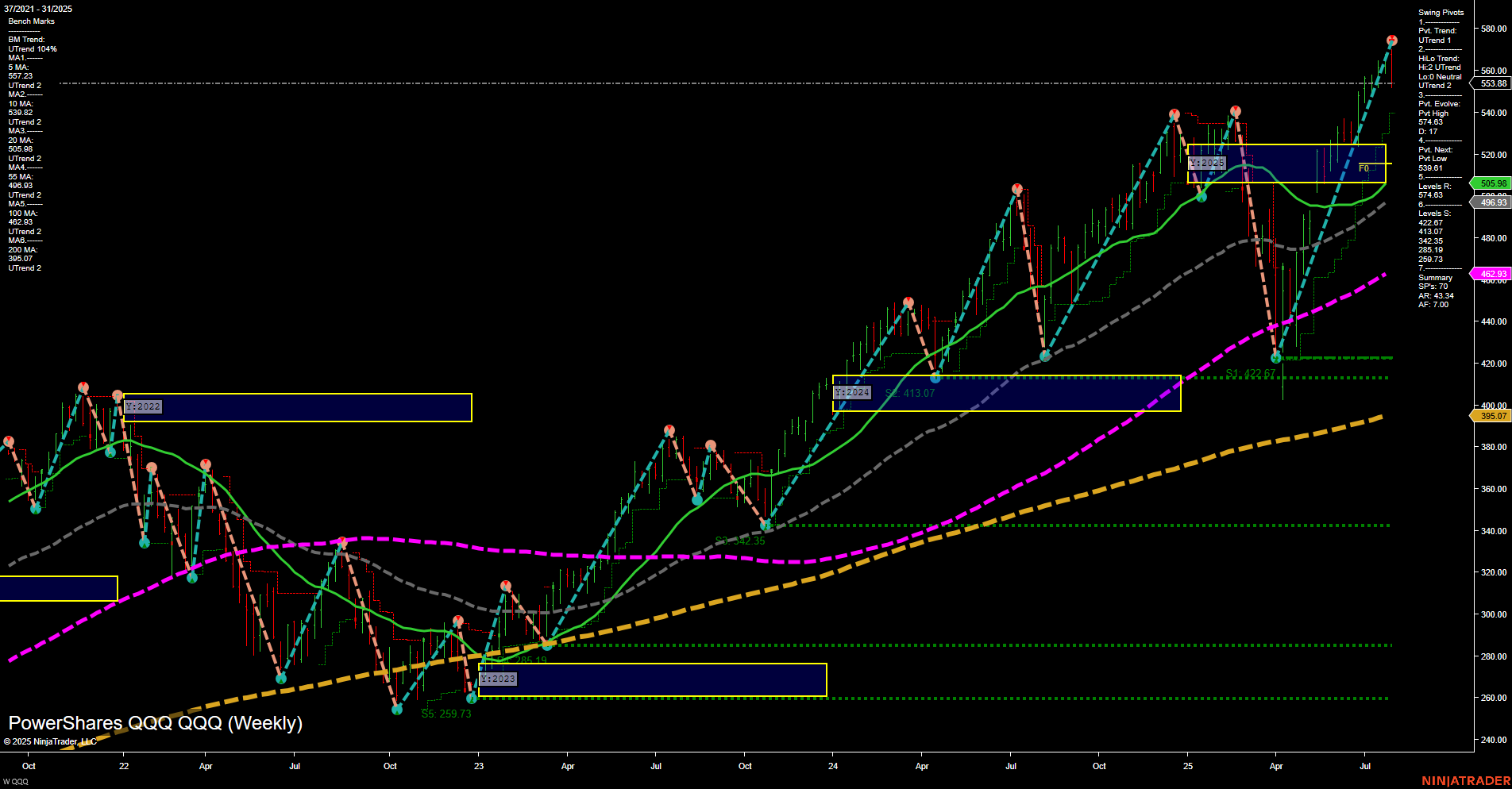

- QQQ 553.88 Bearish -1.97%

- IWM 214.92 Bearish -2.04%

- NVDA 173.72 Bearish -2.33%

- AAPL 202.38 Bearish -2.50%

- USO 77.46 Bearish -2.68%

- META 750.01 Bearish -3.03%

- IBIT 64.22 Bearish -3.17%

- AMZN 214.75 Bearish -8.27%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-04: 07:11 CT.

US Indices Futures

- ES Short-term bullish above WSFG NTZ, intermediate-term MSFG bearish below NTZ, long-term YSFG uptrend, swing pivots high at 6468.5, support at 6129.5, resistance at 6341/6457.

- NQ Short-term neutral, MSFG intermediate-term bearish, YSFG bullish, price above long-term supports, swing pivot trend up, recent short signals, resistance 23,491.5, supports layered below.

- YM Short-term neutral below resistance, MSFG intermediate-term bearish below NTZ, long-term YSFG neutral, choppy pivots, support at 43362, resistance 44268/44512, volatility elevated.

- EMD Short-term neutral above WSFG NTZ, MSFG and YSFG both bearish below NTZ, long-term MAs up, swing pivots 3268.9 (high), support at 2841.4, resistance at 3268.9/3501.9.

- RTY Bearish across all timeframes, WSFG trend up but price below MSFG/YSFG NTZ, swing pivots downtrend, support at 2100.5, resistance overhead, MAs mostly down, corrective price structure.

- FDAX WSFG/YSFG bullish, MSFG intermediate-term bearish below NTZ, short-term pivots up, MAs rolling over on short/intermediate-term, support at 23,606, resistance above 24,000, daily correction in uptrend.

Overall State

- Short-Term: Bearish

- Intermediate-Term: Bearish

- Long-Term: Bullish (except RTY, YM bearish/neutral)

Conclusion

US Indices Futures are exhibiting long-term bullish structure in most contracts as confirmed by the YSFG and major moving averages, except RTY and YM which remain bearish or neutral. Intermediate-term trends have shifted to bearish, with price below MSFG NTZ in nearly all indices and recent swing pivots/trade signals reinforcing this structure. Short-term trends are predominantly bearish or neutral, driven by accelerated downside momentum and price breaking below short-term moving averages and weekly support grids. Multiple indices (ES, NQ, EMD, FDAX) show markets in corrective or retracement phases, with potential further testing of key swing supports amid high volatility and elevated ATR readings. Overall, higher time frame bullishness remains, but intermediate and short-term trends signal corrective price action and possible further downside toward critical support benchmarks before potential resumption of the primary trend.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts