Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

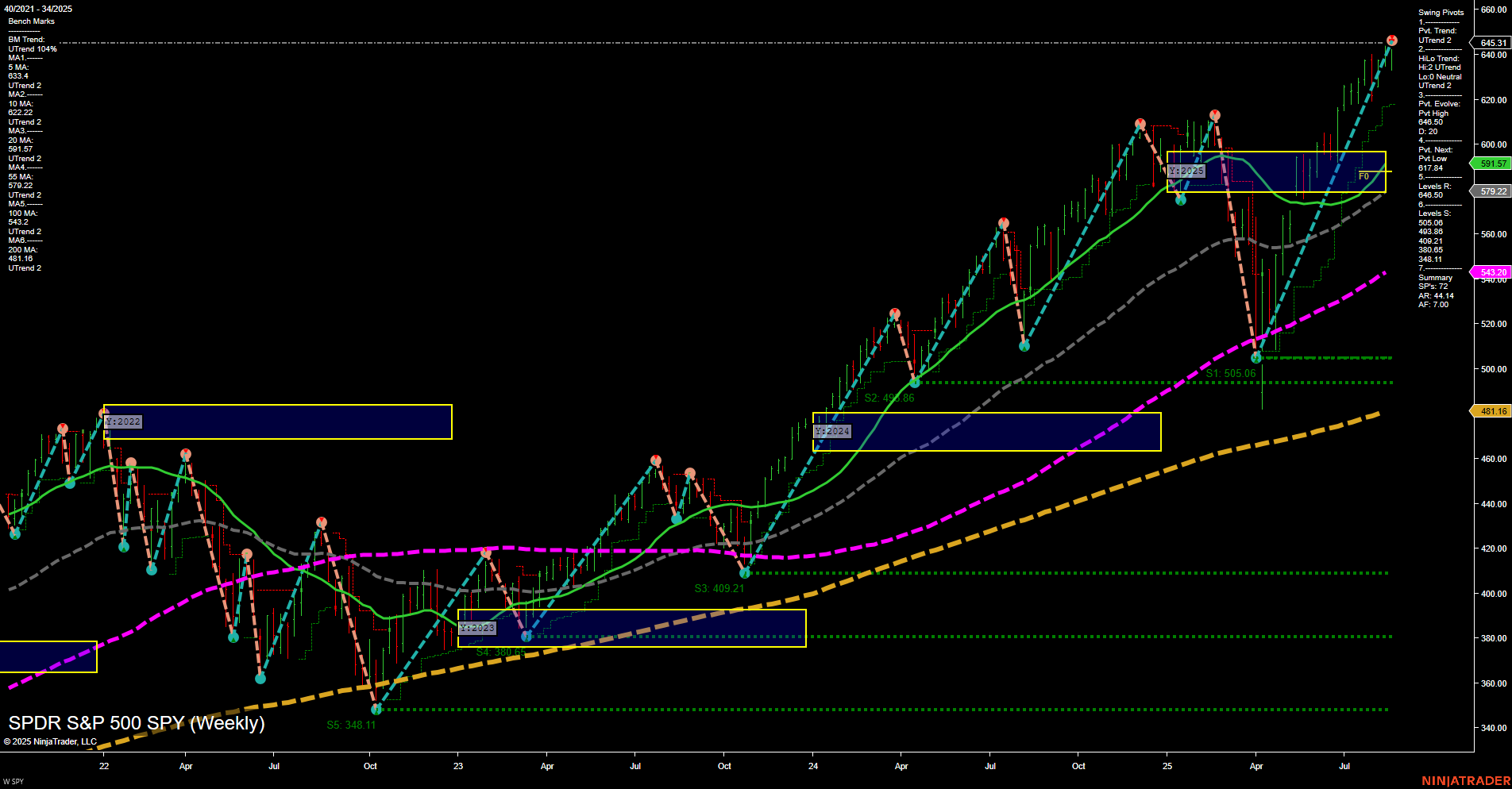

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Thursday 08:30 – USD Prelim GDP q/q (High Impact): The advance GDP estimate is a key measure of overall economic health. Stronger GDP growth typically boosts equity sentiment, while disappointments may weigh on indices futures.

- Thursday 08:30 – USD Unemployment Claims (High Impact): Weekly claims give a timely read on the labor market. Unexpected spikes raise recession concerns, while declines support risk appetite.

- Friday 08:30 – USD Core PCE Price Index m/m (High Impact): As the Fed’s preferred inflation metric, a higher PCE reading may prompt concerns about tighter monetary policy, increasing volatility across indices futures.

- Wednesday 10:30 – USD Crude Oil Inventories (Low Impact): Weekly inventory fluctuations can influence oil prices. Elevated prices from supply disruptions or tightening inventories may directly affect indices through inflationary and geopolitical channels.

EcoNews Conclusion

- This week’s futures markets will be highly sensitive to Thursday’s GDP and Unemployment Claims, along with Friday’s Core PCE inflation data.

- Momentum and volume may slow in the days leading up to these major events as participants await clarity.

- Any significant oil price movements following Wednesday’s inventory data could impact indices due to inflation and geopolitical risks.

- Traders should monitor the 10 AM time cycle, as scheduled events near this hour can act as catalysts for sharp reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- Silver: Silver prices maintained gains after breaking above their 50-day moving average, driven by a weaker dollar and dovish Federal Reserve stance, with upward momentum aiming toward resistance near 14-year highs.

- Oil: Crude futures reclaimed their 200-day moving average amid escalating Ukraine-related tensions and supply risks, contributing to a bullish outlook. Additional supply disruptions and EIA inventory draws further support positive price momentum.

- Gold: Gold prices saw subdued trading ahead of key economic releases, such as PCE and jobless claims, as traders assess the Federal Reserve’s changing policy focus.

- Equities & Indices: U.S. equity markets closed at record highs following Federal Reserve Chair Powell’s dovish pivot at Jackson Hole, with speculation mounting around imminent interest rate cuts. The market’s positive reaction has shifted forecasts for indexes like the S&P 500, with some analysis suggesting potential for further upside, while others highlight concentration risks in the index’s performance.

- Credit Markets: Credit spreads remain at historical lows. Notable divergence between TLT (Treasury ETF) and VCLT (corporate bond ETF) suggests temporary market dislocation.

- Retail Sentiment: Speculative activity among retail investors has spiked, marked by record-high trading in short-term derivatives.

- Macro Factors: The extended pause in Federal Reserve rate policy has provided a potential tailwind for equities. Persistent inflation and tariffs are creating pressures for consumers, according to major retailers.

- Technical Outlook: While major indices experienced a robust rally to close the week, technical analysts underscore the need for continued follow-through and higher closes to confirm a shift into a sustained bullish trend.

News Conclusion

- Major asset classes reacted positively to Federal Reserve signals favoring a shift toward lower rates, supporting new highs in equities and precious metals while driving continued bullish momentum in oil.

- Despite the broad-based rally, technical and market structure concerns are noted, including index concentration and elevated retail speculation.

- Macroeconomic releases in the upcoming week remain key for market direction, particularly for gold and broader risk sentiment.

- Underlying inflation and tariff issues continue to weigh on consumer-facing sectors, tempering optimism from the wider market rally.

Market News Sentiment:

Market News Articles: 8

- Positive: 50.00%

- Negative: 37.50%

- Neutral: 12.50%

GLD,Gold Articles: 2

- Positive: 50.00%

- Neutral: 50.00%

USO,Oil Articles: 2

- Positive: 50.00%

- Negative: 50.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 24, 2025 06:15

- TSLA 340.01 Bullish 6.22%

- IBIT 66.25 Bullish 4.02%

- IWM 234.83 Bullish 3.92%

- AMZN 228.84 Bullish 3.10%

- GOOG 206.72 Bullish 3.04%

- IJH 65.21 Bullish 2.77%

- META 754.79 Bullish 2.12%

- DIA 456.64 Bullish 1.94%

- NVDA 177.99 Bullish 1.72%

- QQQ 571.97 Bullish 1.54%

- SPY 645.31 Bullish 1.54%

- AAPL 227.76 Bullish 1.27%

- GLD 310.58 Bullish 1.07%

- TLT 87.05 Bullish 0.74%

- USO 74.64 Bullish 0.69%

- MSFT 507.23 Bullish 0.59%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-24: 18:15 CT.

US Indices Futures

- ES Uptrend in YSFG/MSFG, minor pullback in WSFG, above all MA benchmarks, recent swing high at 6508.75, near-term resistance, support at 6055.65, trend continuation on pullbacks.

- NQ YSFG/MSFG bullish, WSFG down/consolidating, price above long-term NTZs, swing pivot trend up, testing resistance at 23,658, support at 20,604, consolidation phase above support.

- YM Strong YSFG/MSFG uptrend, WSFG short-term down, price above all MA/NTZs, pivot high at 46,300, support much lower, recent breakout, consolidation expected after fast rally.

- EMD All session grids bullish, WSFG minor pullback, price above MA/NTZs, V-shaped recovery, uptrend in all pivot timeframes, support at 3172.2, resistance at 3501.9, continued upside structure.

- RTY MSFG/YSFG bullish, WSFG down/consolidating, price above major MA/NTZs, swing high at 2374.9, resistance 2537.1, support 2180.5, recent rally pausing near highs, digesting gains.

- FDAX YSFG/MSFG bullish, WSFG down/consolidation, near all-time highs, price above all MA/NTZs, short-term neutral, pivots at resistance (24748), support (23408), consolidation after strong rally.

Overall State

- Short-Term: Neutral

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

Across US Indices Futures, the higher-timeframe context remains bullish with intermediate and long-term uptrends confirmed by YSFG/MSFG grid alignment, higher swing pivots, and price above all major moving average benchmarks. The short-term trend is neutral overall, as WSFGs for ES, NQ, YM, RTY, and FDAX register minor pullbacks or consolidations near resistance and NTZ centers following recent advances. Price structures feature higher highs and higher lows, ongoing support at key session grid levels, and elevated but controlled volatility. Major indices are consolidating after sharp rallies, with technicals favoring continuation higher as long as benchmarks and support levels hold. Directional context remains constructive, but short-term sideways or minor retracement action is apparent as markets digest gains and test swing resistance pivots.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

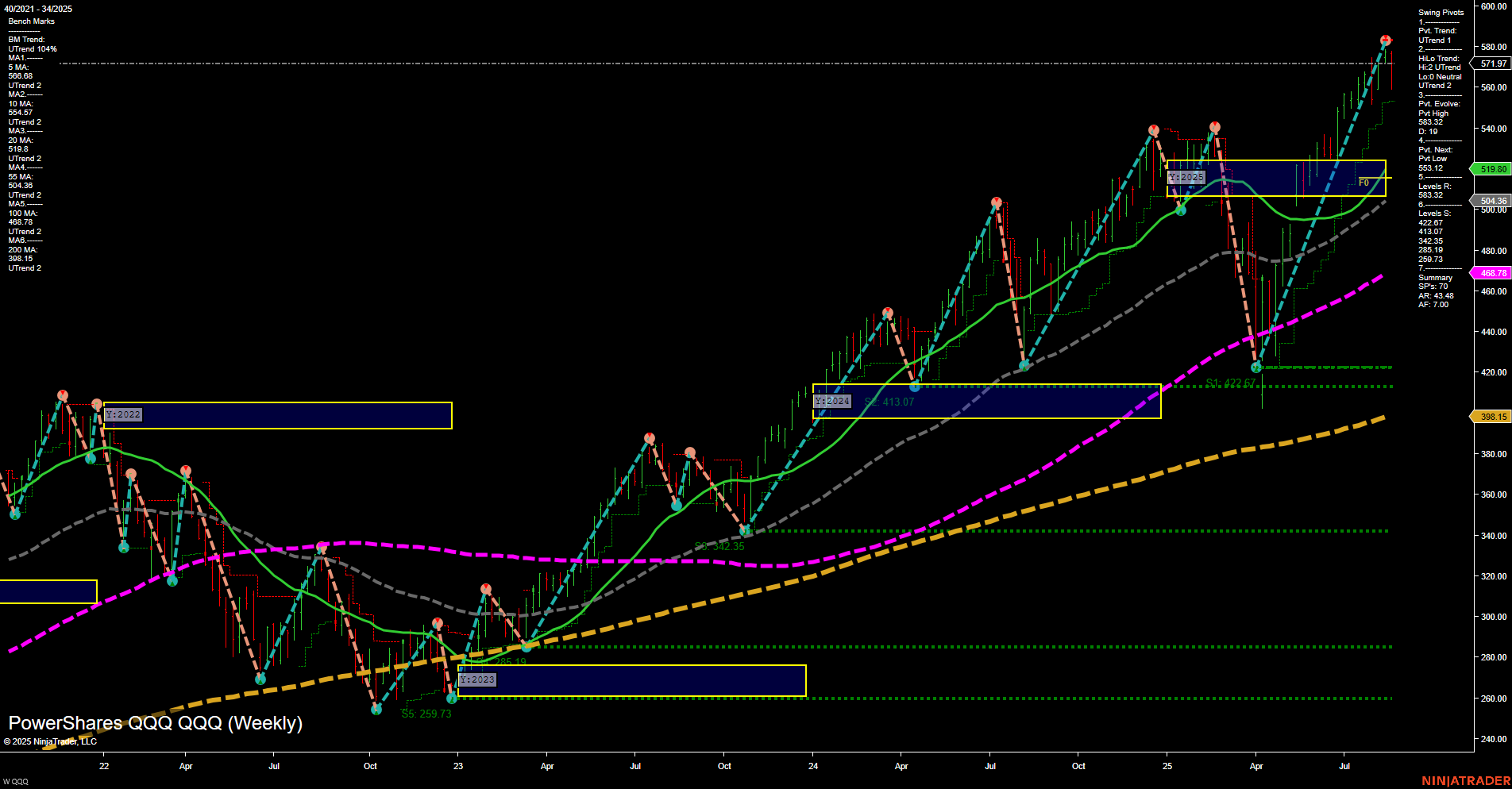

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts