Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

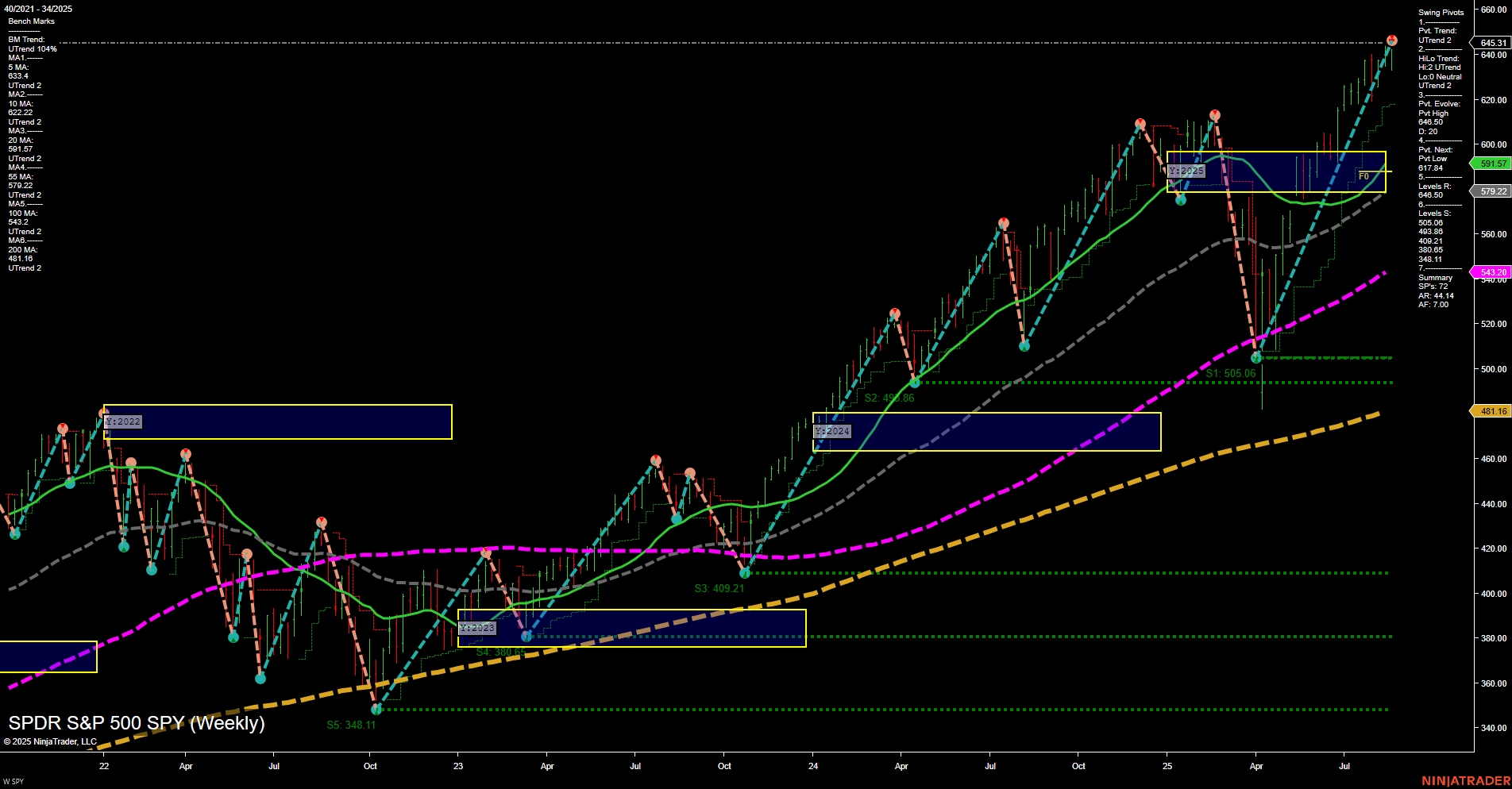

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2025-09-01 Labor Day

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Thursday 08:30 – USD Prelim GDP q/q (High Impact): The advance estimate of quarterly U.S. GDP is a key market-moving event. Stronger growth than expected may support bullish sentiment in equity indices, while a weak reading can trigger selling pressure.

- Thursday 08:30 – USD Unemployment Claims (High Impact): This weekly labor market metric influences expectations for economic resilience and Fed policy. Significant surprises can generate swift futures market moves.

- Friday 08:30 – USD Core PCE Price Index m/m (High Impact): This is the Federal Reserve’s preferred inflation gauge. Higher-than-expected inflation readings can spark volatility in index futures due to shifting rate hike expectations.

- Wednesday 10:30 – USD Crude Oil Inventories (Low Impact, Oil): Fluctuations in oil inventories and prices can impact index sentiment, particularly in energy-related and inflation-sensitive sectors.

EcoNews Conclusion

- This week’s primary catalysts for index futures are high-impact releases on Thursday (Prelim GDP and Unemployment Claims) and Friday (Core PCE Price Index).

- Crude oil inventories remain a side factor; sustained high oil prices, if present, could fuel inflation concerns and influence market risk sentiment.

- Market momentum and volume may slow in the days leading up to the Core PCE and GDP releases, with increased likelihood of significant moves during and immediately after these data events.

- Expect heightened volatility around the 08:30 AM (ET) release times, with potential 10:00 AM catalyst activity on Thursday and Friday.

For full details visit: Forex Factory EcoNews

Market News Summary

- Political risk at the Federal Reserve intensified after statements from Trump and growing concerns among global central bankers about U.S. policy instability. The political environment may be adding uncertainty to monetary policy expectations.

- The S&P 500’s rally lost momentum following a Fed-fueled surge on Friday. Futures opened flat to slightly lower as traders weighed Powell’s dovish Jackson Hole speech, the likelihood of a September rate cut, and ambiguous financial guidance regarding the timing and magnitude of possible policy changes.

- Nvidia’s upcoming earnings and U.S. PCE inflation data drew market focus, signaling potential for volatility in technology stocks and the broader index. AI leaders, including NVDA, showed technical weakness, adding to the cautious sentiment.

- Retail trading and margin debt reached record highs, reflecting elevated speculative activity. Analysts highlight that only a handful of stocks are driving index gains, suggesting risks associated with a concentrated market.

- Inflation remains front and center. U.S. and global consumer prices are pressured by tariffs, elevated costs, and the impact of a twin deficit in the U.S. While Singapore reported unexpectedly low inflation, U.S. inflation data will be closely watched for Fed policy implications.

- Commodities showed a mixed reaction: Oil prices edged up amid Ukraine-Russia hostilities and supply concerns, while gold and silver rallied on Fed rate cut hopes and U.S. dollar weakness. Natural gas continued to struggle; crude oil held above its 200-day average as traders monitored geopolitical and supply developments.

- The U.S. stock market achieved record-high valuations, recovering from tariff-induced volatility. However, volatility is expected to persist amid uncertainty over rate decisions, inflation, and key earnings reports.

- Labor markets continue to shift, with a “no-hire, no-fire” environment reported. Investor sentiment has improved, entering the “Greed” zone, but caution remains for follow-through after Friday’s rally.

- Long-term, some market participants anticipate that higher inflation and tariffs could provide cyclical opportunities, while others emphasize the risk of persistent inflation, debt, and shifting economic dynamics.

News Conclusion

- Uncertainty persists around Fed policy and rate cuts, with the September meeting and PCE data in sharp focus. Political developments and central bank commentary continue to influence risk sentiment and volatility expectations.

- The current market reflects high valuations, concentrated sector leadership, and elevated speculative trading. Technical signals in both stocks and commodities highlight the importance of key support and resistance levels this week.

- Market volatility is anticipated to remain elevated amid ambiguous monetary guidance, shifting labor conditions, and ongoing geopolitical tensions impacting both energy and precious metals markets.

- As the end of August approaches, traders are balancing short-term reactions to central bank dovishness against structural concerns about inflation, deficits, and equity concentration.

Market News Sentiment:

Market News Articles: 25

- Positive: 36.00%

- Negative: 32.00%

- Neutral: 32.00%

Sentiment Summary:

Out of 25 market news articles, sentiment is relatively balanced with 36% positive, 32% negative, and 32% neutral coverage.

This indicates mixed market sentiment, reflecting a blend of optimism, caution, and neutrality in current news.

GLD,Gold Articles: 4

- Positive: 50.00%

- Negative: 25.00%

- Neutral: 25.00%

Sentiment Summary: Of the recent news articles covering GLD and gold, 50% are positive, 25% negative, and 25% neutral.

This indicates that recent coverage is leaning more positive than negative or neutral, reflecting generally favorable sentiment in the market news.

USO,Oil Articles: 3

- Positive: 33.33%

- Neutral: 33.33%

- Negative: 33.33%

Sentiment Summary: Market news sentiment for USO and Oil is evenly split, with equal proportions of positive, neutral, and negative coverage.

This balanced distribution suggests mixed perspectives among recent articles, reflecting no clear consensus in sentiment.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 25, 2025 07:16

- TSLA 340.01 Bullish 6.22%

- IBIT 66.25 Bullish 4.02%

- IWM 234.83 Bullish 3.92%

- AMZN 228.84 Bullish 3.10%

- GOOG 206.72 Bullish 3.04%

- IJH 65.21 Bullish 2.77%

- META 754.79 Bullish 2.12%

- DIA 456.64 Bullish 1.94%

- NVDA 177.99 Bullish 1.72%

- QQQ 571.97 Bullish 1.54%

- SPY 645.31 Bullish 1.54%

- AAPL 227.76 Bullish 1.27%

- GLD 310.58 Bullish 1.07%

- TLT 87.05 Bullish 0.74%

- USO 74.64 Bullish 0.69%

- MSFT 507.23 Bullish 0.59%

Market Summary: ETFs, MegaCap Tech (Mag7), and Key Assets (08/25/2025)

As of this morning’s snapshot, broad market sentiment across leading ETFs, MegaCap tech stocks (the “Mag7”), and other major asset-tracking ETFs is decisively bullish. All primary instruments are registering positive movements for the session, with a mix of notable outperformance among risk-on names and steady strength in established ETFs and safe haven assets.

ETF Stocks Overview

- SPY (S&P 500): Bullish +1.54%

Flagship large-cap ETF is in positive territory, echoing confidence across the broader market. - QQQ (NASDAQ 100): Bullish +1.54%

Tech-heavy indices remain robust, tracking alongside the overall rally. - IWM (Russell 2000): Bullish +3.92%

Small caps are outperforming, suggesting strong risk appetite. - IJH (Midcaps): Bullish +2.77%

Broad participation with midcap traction higher. - DIA (Dow Industrials): Bullish +1.94%

Even blue chips join the rally, contributing to a market-wide advance.

Mag7 (MegaCap Tech) Performance

- TSLA: Bullish +6.22%

Tesla is the session’s standout, posting outsized gains as speculative momentum builds. - AMZN: Bullish +3.10%

- GOOG: Bullish +3.04%

- META: Bullish +2.12%

- NVDA: Bullish +1.72%

- AAPL: Bullish +1.27%

- MSFT: Bullish +0.59%

All Mag7 names are in the green, with Tesla, Amazon, and Google leading.

Other ETFs & Thematic Movers

- IBIT (Bitcoin ETF): Bullish +4.02%

Crypto-related equity surges, signaling continued risk-on behavior. - GLD (Gold): Bullish +1.07%

Gold’s move higher points to a simultaneous bid for safe haven exposure. - TLT (Long-term Treasuries): Bullish +0.74%

- USO (Oil): Bullish +0.69%

Alternative asset and commodity ETFs are positive, trailing core equity benchmarks but underscoring breadth in buying interest. Risk assets, safe havens, and bond proxies all moving higher illustrate widespread market participation.

State of Play

- Long Bias: Market is universally bullish across ETFs, MegaCap tech, and thematics.

- Leadership: Tesla, Bitcoin ETF (IBIT), and small/midcap ETFs are notable outperformers.

- Participation: All sectors represented are positive, with both risk and defensive trades working.

This snapshot is informational only. No trading advice or recommendations are provided.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-25: 07:16 CT.

US Indices Futures

- ES Uptrend holds on YSFG/MSFG, WSFG short-term pullback, price consolidates below all-time high 6508.75, key support 6005.75, benchmarks all rising, swing pivots confirm higher-highs.

- NQ Intermediate/long-term up on YSFG/MSFG, short-term WSFG trending down, consolidating near highs, resistance 24003/24068.50, support 21886/21354/22775, swing pivots up, benchmarks rising.

- YM YSFG/MSFG bullish, WSFG shows short-term pause, strong weekly momentum, intermediate/long-term up, price near resistance 46300/44647, above MAs, swing highs and higher lows persist.

- EMD YSFG/MSFG bullish, swing pivot/trade signals flipped long, WSFG minor pullback, transitioning market, resistance 3277.2/3501.9, support 3127.5/3044.8, benchmarks trending up.

- RTY Strong YSFG/MSFG uptrend, WSFG short-term pullback, swing pivots up, recent long signal, resistance 2374.9/2361.1/2537.1, support 1725.3, above most MAs, intermediate-term signals mixed.

- FDAX YSFG/MSFG uptrend, WSFG short-term downtrend, consolidating below 24360, support at 22118/23446/23414, benchmarks up, swing pivots up, possible deeper retracement if short-term weakness continues.

Overall State

- Short-Term: Neutral

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures remain structurally bullish intermediate and long-term per YSFG and MSFG, with all benchmarks and swing pivots showing uptrends. Short-term context across ES, NQ, YM, EMD, RTY, FDAX reflects some pullback or consolidation, as WSFGs indicate short-term resistance and price testing NTZs. All major support and resistance levels are well defined, with price generally above long-term moving averages and NTZs. Recent signals highlight strong longer-term momentum but possible near-term digestion phase as markets approach or consolidate below all-time highs. Directional correlations reinforce overall uptrends, with current action representing consolidation or retracement within primary bullish structures.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

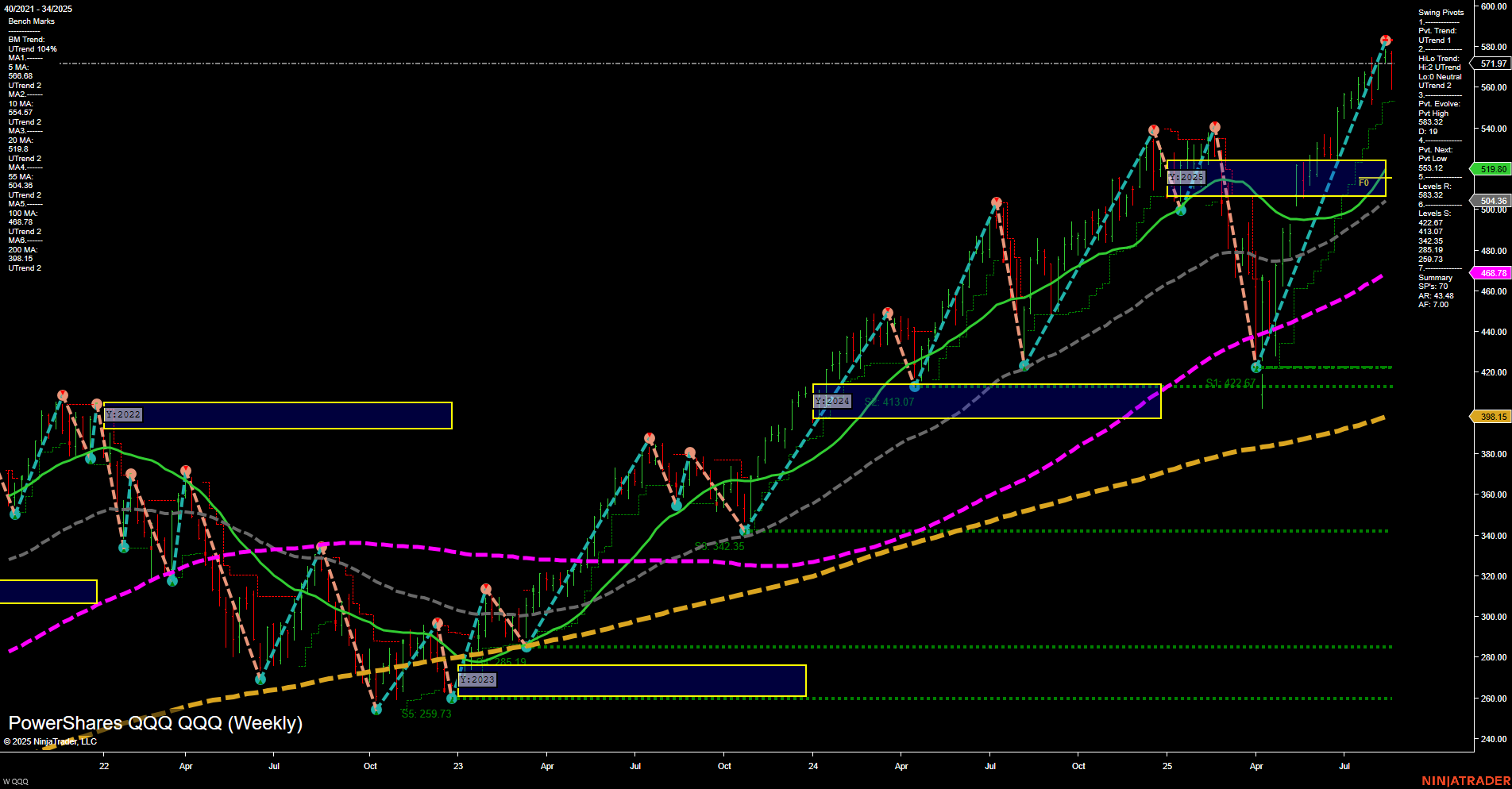

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts