Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

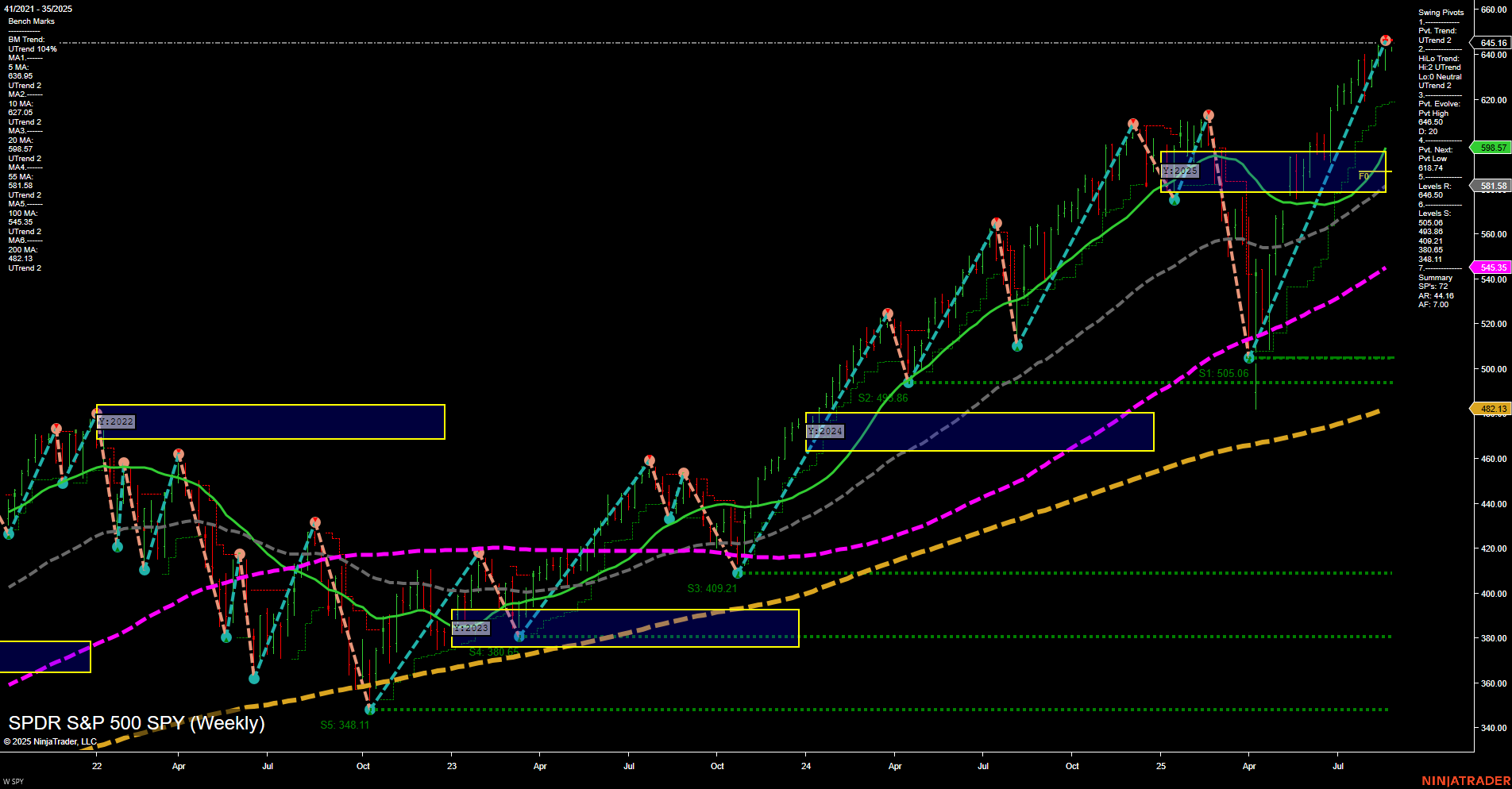

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2025-09-01 Labor Day

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary: High Impact Market-Moving Events

Thursday 08:30 – USD Prelim GDP q/q (High Impact)

The Preliminary GDP release provides a key measure of US economic growth. Stronger-than-expected GDP can boost market sentiment and support indices, while a weaker reading may raise recession concerns and pressure equities.

Thursday 08:30 – USD Unemployment Claims (High Impact)

Weekly jobless claims are a timely gauge of labor market conditions. A lower figure generally signals economic strength, potentially lifting indices, while higher-than-anticipated claims may spur risk-off moves.

Friday 08:30 – USD Core PCE Price Index m/m (High Impact)

As the Fed’s preferred inflation gauge, the Core PCE Price Index significantly influences rate expectations. A surprise to the upside can fuel rate hike fears and rattle markets; softer inflation data would likely be welcomed by equity benchmarks.

Wednesday 10:30 – USD Crude Oil Inventories (Low Impact – Mentioned for Oil Relevance)

Though generally lower impact, crude oil inventories can trigger volatility in energy-sensitive sectors. Low inventories may drive oil prices higher, amplifying inflation and elevating market sensitivity, especially amid geopolitical tensions.

EcoNews Conclusion

- Thursday and Friday feature multiple high-impact reports clustered around the 08:30 ET release, likely driving initial volatility in futures indices.

- Markets may experience reduced momentum and liquidity ahead of Friday’s Core PCE print, as traders position for a key inflation indicator.

- Crude oil inventory data, if leading to higher oil prices, can directly impact broader markets via the inflation channel.

- Watch the 10 AM news cycle on Friday (UoM Sentiment) for potential market reversal or continuation, as these events often act as short-term catalysts.

For full details visit: Forex Factory EcoNews

Market News Summary

- Stock Market & Futures: US stock futures are edging higher, driven by optimism ahead of Nvidia’s earnings and increased expectations for Federal Reserve interest rate cuts. Small-cap stocks are outperforming, which is seen as a healthy market signal. Broader US market fundamentals remain solid, with most NYSE-listed companies trading above their 200-day moving averages and senior loan officers reporting loose credit conditions.

- Federal Reserve & Policy: Fed Chair Powell has signaled a slowing economy and suggests that policy rate reductions may be coming soon. There is elevated political attention on the Fed, with President Trump attempting to exert influence and remove Fed Governor Cook, though her removal is contested. Yields on US Treasuries have risen as this confrontation escalates, raising concerns over central bank independence and policy stability.

- Macro Risks: Stagflation concerns are rising as mixed data and political uncertainty weigh on market sentiment. Rising long-term yields, discussions of tariffs, and national security comments surrounding large US corporate stakes are contributing to risk-off behavior in some sectors.

- Commodities: Oil prices have slipped below their 200-day moving average on technical selling and increased Russian exports. Goldman Sachs has forecasted Brent crude prices to fall into the low $50s by late 2026, anticipating increased supply. Gold and silver have rallied on safe-haven demand and political uncertainty, but gains are capped by a firm US dollar and rising yields.

- International Developments: China’s stock rally is driving notable gains but generating concerns over the sustainability of the move. The EU is reportedly set to remove tariffs on US industrial goods in exchange for lower US auto tariffs. Vietnam plans to fully switch to ethanol-blended gasoline, likely increasing US exports.

- Other Key Points: Legal and political debates continue around the authority to remove members of the Federal Reserve Board. Oil and gold market participants are monitoring tariff impacts, central bank risks, and key upcoming data releases.

News Conclusion

- US equity markets remain underpinned by resilient internals and rate-cut expectations, with small-cap strength supporting broader risk appetite. However, rising political risks around the Federal Reserve’s independence and ongoing tariff disputes are generating volatility and uncertainty, particularly in the treasury and commodity markets.

- Energy markets feel pressure from both technical selling and longer-term oversupply forecasts, while gold and silver see fluctuating demand tied to safe-haven flows amid policy and geopolitical uncertainty.

- Global headlines reflect shifting trade dynamics, political influence in central banking, and nascent risks related to both economic slack and potential inflation, creating an evolving backdrop for index futures and commodity trading.

Market News Sentiment:

Market News Articles: 47

- Neutral: 44.68%

- Positive: 31.91%

- Negative: 23.40%

Sentiment Summary:

Out of 47 market news articles, 44.68% are neutral, 31.91% are positive, and 23.40% are negative.

Conclusion:

The majority of recent market news maintains a neutral tone, with positive sentiment outweighing negative sentiment among the remaining articles. This distribution reflects a balanced outlook in current market coverage.

GLD,Gold Articles: 16

- Positive: 37.50%

- Neutral: 37.50%

- Negative: 25.00%

Sentiment Summary: Out of 16 recent articles on GLD and gold, 37.50% are positive, 37.50% are neutral, and 25.00% are negative.

Conclusion: News coverage is currently balanced between positive and neutral sentiment, with a smaller portion reflecting negative sentiment toward GLD and gold.

USO,Oil Articles: 8

- Negative: 87.50%

- Neutral: 12.50%

Sentiment Summary: The majority of recent USO and oil-related news articles (87.5%) carry a negative tone, with a smaller portion (12.5%) categorized as neutral.

This indicates that, based on current news coverage, sentiment around USO and oil is predominantly negative.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 27, 2025 07:16

- TSLA 351.67 Bullish 1.46%

- NVDA 181.77 Bullish 1.09%

- AAPL 229.31 Bullish 0.95%

- IWM 234.28 Bullish 0.83%

- GLD 312.08 Bullish 0.73%

- SPY 645.16 Bullish 0.42%

- IJH 64.98 Bullish 0.42%

- QQQ 572.61 Bullish 0.40%

- IBIT 63.10 Bullish 0.35%

- AMZN 228.71 Bullish 0.34%

- DIA 454.49 Bullish 0.31%

- META 754.10 Bullish 0.11%

- TLT 86.75 Bearish -0.06%

- MSFT 502.04 Bearish -0.44%

- GOOG 207.95 Bearish -0.58%

- USO 74.05 Bearish -2.24%

Market Summary: ETF Stocks & MAG7 Overview (as of 08/27/2025)

ETF Stocks

- SPY: 645.16 Bullish (0.42%)

- QQQ: 572.61 Bullish (0.40%)

- IWM: 234.28 Bullish (0.83%)

- IJH: 64.98 Bullish (0.42%)

- DIA: 454.49 Bullish (0.31%)

Summary: The major ETF indices are broadly positive, with all key indexes (SPY, QQQ, IWM, IJH, DIA) trending higher. Small and mid-caps (IWM, IJH) are notably stronger today. The broad bullish tone signals positive sentiment in equity markets.

MAG7 Stocks

- TSLA: 351.67 Bullish (1.46%)

- NVDA: 181.77 Bullish (1.09%)

- AAPL: 229.31 Bullish (0.95%)

- AMZN: 228.71 Bullish (0.34%)

- META: 754.10 Bullish (0.11%)

- MSFT: 502.04 Bearish (-0.44%)

- GOOG: 207.95 Bearish (-0.58%)

Summary: The MAG7 lineup shows a mixed picture: TSLA, NVDA, and AAPL are leading gains with strong upward moves, while MSFT and GOOG are trading lower. The overall tone is bullish but not uniform across all mega-caps.

Other ETFs

- GLD: 312.08 Bullish (0.73%)

- IBIT: 63.10 Bullish (0.35%)

- TLT: 86.75 Bearish (-0.06%)

- USO: 74.05 Bearish (-2.24%)

Summary: Gold (GLD) and Bitcoin (IBIT) ETFs are staging advances, while long-duration Treasuries (TLT) and oil (USO) are seeing weakness. Notably, energy is under pressure in contrast to other asset classes.

State of Play: Long / Short / Mixed

- Long Bias: Equity ETFs (SPY, QQQ, IWM, IJH, DIA), several MAG7 leaders (TSLA, NVDA, AAPL, AMZN, META), plus GLD and IBIT are showing sustained upward movement.

- Short Bias: MSFT and GOOG in MAG7, and ETFs TLT (bonds) and USO (oil) are under downward or bearish pressure.

- Mixed Outlook: While the general market advance is pronounced, internal leadership is selective, especially within the tech-heavy MAG7 group and cross-asset names such as gold and bitcoin advancing as energy and bonds recede.

Data Snapshot: Pricing and percentage changes reflect market activity as of 08/27/2025 07:16:00. This summary is for informational purposes only and contains no trading advice or recommendations.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-27: 07:16 CT.

US Indices Futures

- ES Short-term WSFG bearish, MSFG/YSFG bullish, price consolidating below ATH resistance (6508.75), support at 6404.25/6293.87, pullback within broad uptrend, swing low at 6055.55.

- NQ YSFG/MSFG/WSFG bullish, price above all benchmarks, swing pivot uptrend, resistance at 24,000, support at 21,000/23,010, strong sequence of higher highs and lows.

- YM WSFG short-term bearish, MSFG/YSFG bullish, benchmarks trending up, price near highs, intermediate/long-term swing pivots up, support at 43,467/43,574, resistance at 45,878/45,469.

- EMD Short-term neutral WSFG, MSFG/YSFG bullish, benchmarks up, swing pivots higher, resistance 3277.2/3248.0, support 3019.4, consolidating after rally, volatility moderate/high.

- RTY Short-term mixed (neutral/bullish), MSFG/YSFG bullish, all benchmarks rising, swing pivots up, resistance 2374.9/2365.0, support 2181.5/2250.0, continuation phase after breakout.

- FDAX Short-term bearish WSFG, MSFG neutral/up, YSFG bullish, price above long-term benchmarks, support 24100/23446, resistance 24400–24800, consolidating, corrective move within uptrend.

Overall State

- Short-Term: Neutral to Bearish (pullbacks/choppy consolidation across ES, YM, EMD, FDAX; bullish in NQ/RTY)

- Intermediate-Term: Bullish (all indices supported by MSFG/benchmarks)

- Long-Term: Bullish (all indices above YSFG and major long-term benchmarks)

Conclusion

US Indices Futures remain in structurally bullish uptrends on intermediate and long-term timeframes; YSFG and MSFG context is supportive across ES, NQ, YM, EMD, RTY, and FDAX. Current price action reflects a phase of short-term retracement or consolidation, as shown by WSFG trends and short-term resistance tests. Benchmarks (moving averages and Fib grid centers) are rising on intermediate and long term, with higher swing pivots and defined support zones, indicating intact trend structure. Short-term technicals reveal localized weakness or indecision, particularly within ES, YM, EMD, and FDAX, while NQ and RTY continue to exhibit more consistent bullish momentum. Overall, the HTF structure is bullish, with corrective price action and volatility concentrated in the near term, consistent with market digestion after extended rallies. Directional correlation across indices remains intact, with pullbacks occurring in the context of a larger uptrend.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

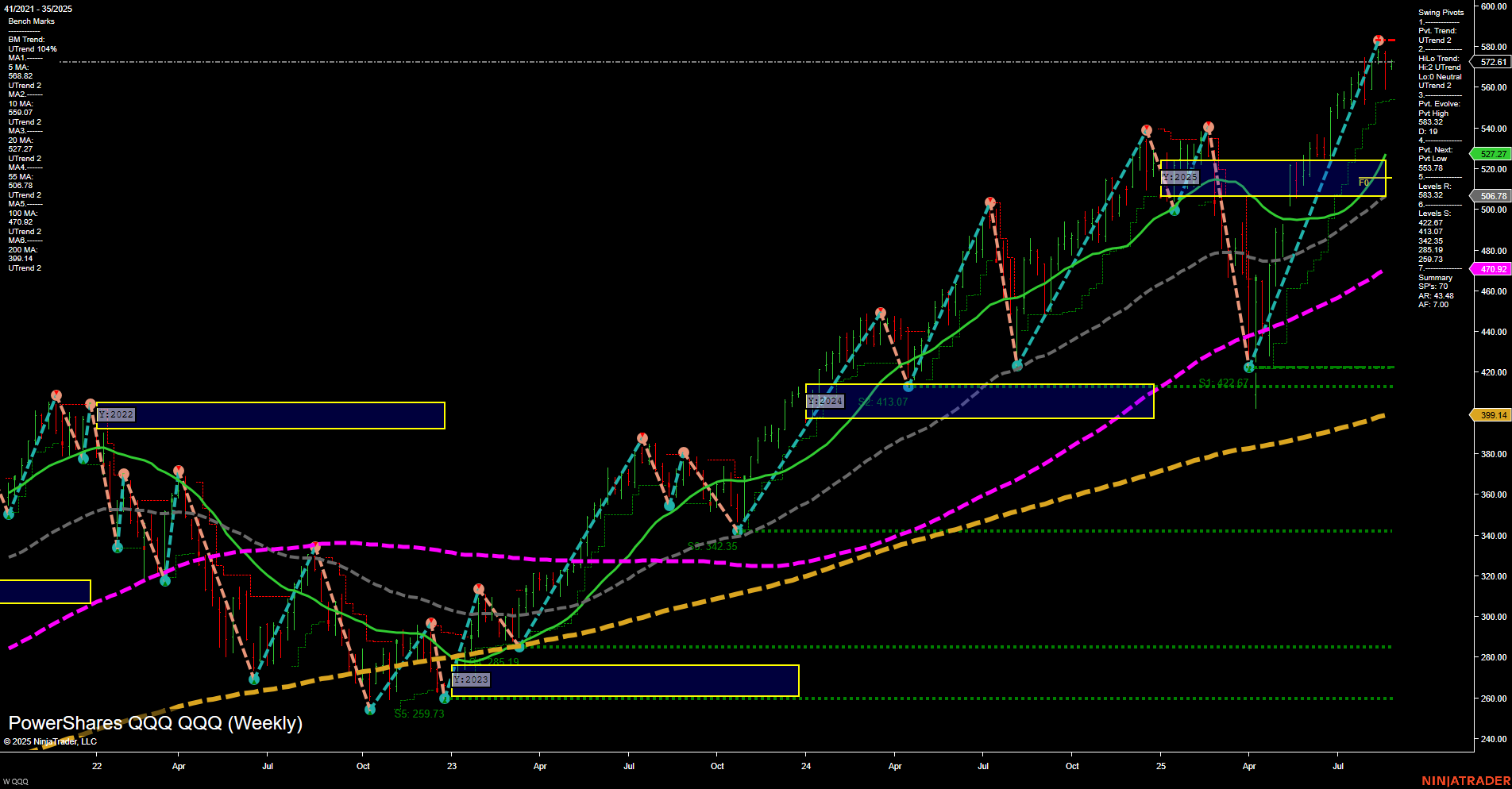

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts