Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

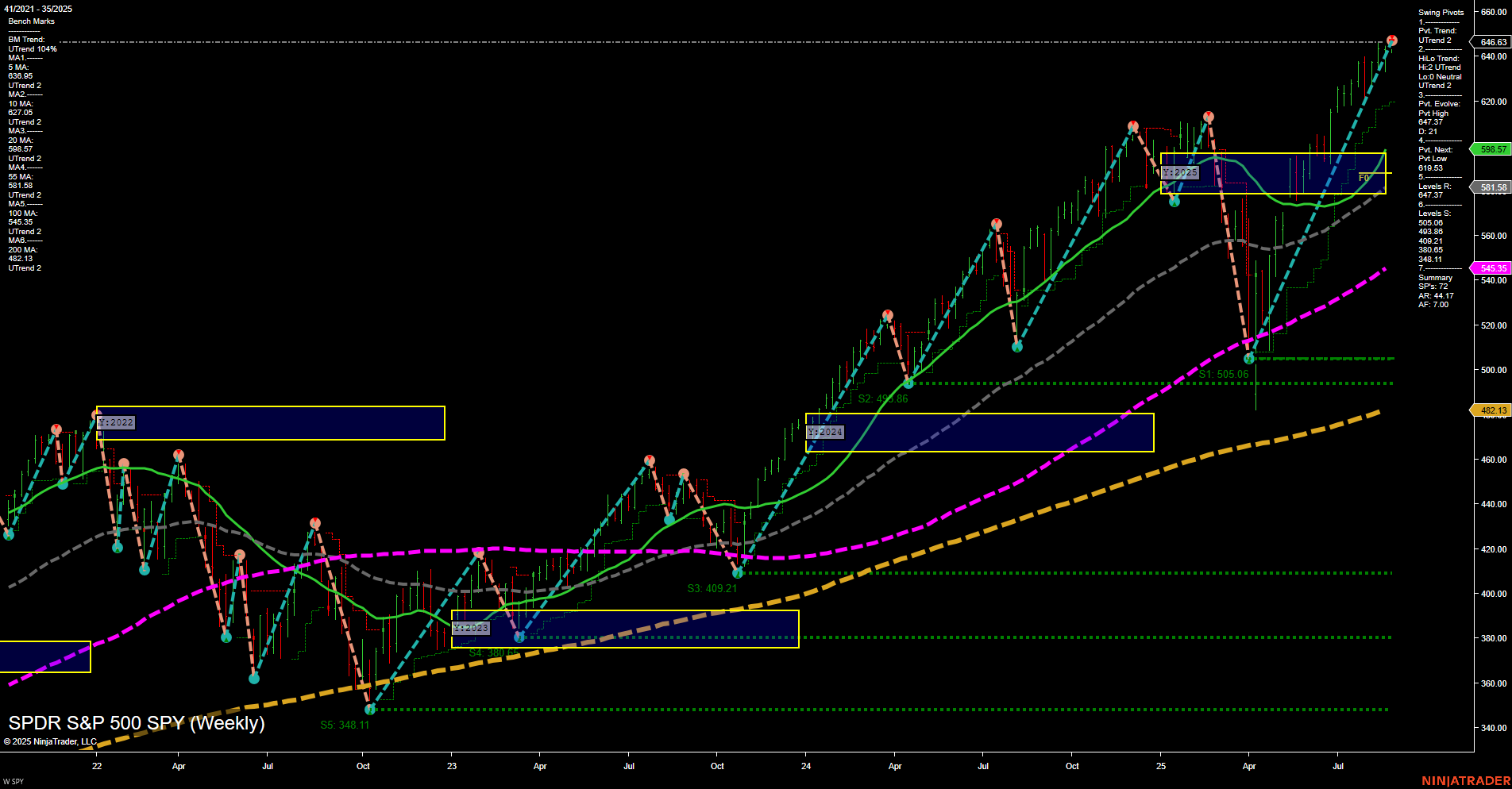

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2025-09-01 Labor Day

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Thursday 08:30 – USD Prelim GDP q/q (High Impact):

This early GDP release is closely monitored for its insights into broad US economic health. A stronger or weaker print can quickly shift indices futures as traders reassess growth expectations and rate path speculation. - Thursday 08:30 – USD Unemployment Claims (High Impact):

Weekly claims data is a key gauge of labor market resilience. Unexpected changes can influence sentiment regarding consumer strength and Fed policy outlook, fueling short-term volatility. - Friday 08:30 – USD Core PCE Price Index m/m (High Impact):

This is the Federal Reserve’s preferred inflation measure. A surprise here – on either side – often creates swift, sharp market reactions as expectations for rate moves are recalibrated.

EcoNews Conclusion

- Multiple high-impact releases early Thursday and Friday heighten the potential for significant price swings in Indices Futures at the 08:30 cycle.

- Anticipation of PCE and GDP may contribute to shifting market momentum, with volume potentially slowing in the hours leading up to these numbers.

- Trading dynamics may see additional volatility or reversal potential around the 10 AM cycle, as markets digest outcomes and reassess direction following the initial releases.

For full details visit: Forex Factory EcoNews

Market News Summary

- Tariff Tensions: President Trump has imposed significant new tariffs (200%) on rare earth magnets, and a 50% tariff on India’s Russian oil imports. These moves, along with the US sanctioning a major Chinese oil port, are stirring up global trade concerns, impacting oil flows and raising questions about supply chain stability.

- Nvidia in Focus: Nvidia beat earnings expectations, contributing to a new record close for the S&P 500. However, data center revenue missed Wall Street’s forecasts, leading to a post-earnings dip in Nvidia shares and mixed movement in US stock futures.

- AI & Market Momentum: Strong interest in artificial intelligence is fueling capital expenditures and ETF inflows. AI-exposed funds like SMH and SPRX continue to draw attention. Some analysts see further upside for the S&P 500, predicting ambitious targets over five to six years.

- Fed Independence Drama: Fallout continues from attempts to fire multiple federal officials, including Fed Governor Lisa Cook. Debates over central bank independence remain active, and some legal battles could reach the Supreme Court.

- Energy Markets Volatile: Oil prices slipped on waning US demand after the summer driving season, increased Russian crude supply, and ongoing trade headlines. Oil futures volatility surged following US moves against China’s Yangshan port. Natural gas is showing bullish technical momentum while oil faces downside risk.

- Macro & Sentiment Trends: The S&P 500 set another record high, with investor sentiment firmly in the “Greed” zone. Despite concerns of an “everything” bubble, some see only slight year-end oil price softening as the main macro risk. The PCE inflation report and auto sales data are upcoming catalysts for September’s market tone.

- Consumer Shifts & ETF Activity: Companies are pivoting focus to affluent customers as lower-income spending stalls. Index ETFs, especially tech-focused funds like QQQ, command large inflows and attention.

- Precious Metals: Gold retreated from highs due to dollar strength, with silver showing gains on safe-haven demand, as traders assess Fed policy direction.

News Conclusion

- US equity markets remain historically strong, highlighted by record index closes and optimism around AI progress, though select heavyweight stocks are under post-earnings pressure.

- Geopolitical developments and elevated tariffs are driving volatility across commodities, especially oil, where both demand outlook and supply chains face renewed uncertainty.

- Uncertainty around Federal Reserve independence and future interest rate policy continues, with upcoming inflation and sales data in sharp focus.

- Sector rotation is apparent as consumer-facing companies pivot toward higher earners, and ETF flows underscore ongoing risk appetite.

- Technical signals and macroeconomic cross-currents, especially in energy and metals, suggest a complex, volatile backdrop for day traders monitoring both futures and spot indices.

Market News Sentiment:

Market News Articles: 45

- Neutral: 42.22%

- Positive: 37.78%

- Negative: 20.00%

Sentiment Summary:

Out of 45 market news articles, 42.22% report a neutral sentiment, 37.78% reflect a positive tone, and 20.00% convey negative sentiment.

Conclusion:

The majority of recent news maintains a neutral perspective, while positive articles outnumber negative ones. This distribution suggests a balanced news environment with a slight lean toward positive coverage.

GLD,Gold Articles: 9

- Positive: 66.67%

- Neutral: 33.33%

Sentiment Summary: Out of 9 recent articles covering GLD and gold, 66.67% reflect a positive sentiment, while 33.33% are neutral.

This indicates that the majority of current news coverage leans positive, with no negative sentiment reported.

USO,Oil Articles: 11

- Negative: 45.45%

- Neutral: 36.36%

- Positive: 18.18%

Sentiment Summary: Recent news coverage on USO and oil is predominantly negative (45.45%), with a significant portion being neutral (36.36%), and a smaller share of positive sentiment (18.18%).

This suggests that the overall media sentiment regarding USO and oil is currently skewed toward negativity, with relatively limited positive outlooks.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 28, 2025 07:16

- MSFT 506.74 Bullish 0.94%

- IBIT 63.65 Bullish 0.87%

- USO 74.68 Bullish 0.85%

- IWM 235.94 Bullish 0.71%

- IJH 65.43 Bullish 0.69%

- AAPL 230.49 Bullish 0.51%

- DIA 456.03 Bullish 0.34%

- SPY 646.63 Bullish 0.23%

- GLD 312.71 Bullish 0.20%

- AMZN 229.12 Bullish 0.18%

- QQQ 573.49 Bullish 0.15%

- GOOG 208.21 Bullish 0.12%

- NVDA 181.60 Bearish -0.09%

- TLT 86.65 Bearish -0.12%

- TSLA 349.60 Bearish -0.59%

- META 747.38 Bearish -0.89%

Market Summary: ETF Stocks, Mag7 & Related ETFs (as of 08/28/2025 07:16:00)

This snapshot provides a look at the market sentiment and performance across major ETF stocks, Mag7 tech leaders, and key sector ETFs. The session shows a broadly bullish landscape, with select weakness among high-growth and tech names.

ETF Stocks: SPY, QQQ, IWM, IJH, DIA

- SPY (S&P 500): 646.63 (+0.23%) – Bullish tone, continuing recent strength in the broad large-cap index.

- QQQ (Nasdaq 100): 573.49 (+0.15%) – Moderately bullish, echoing steady tech sector performance.

- IWM (Russell 2000): 235.94 (+0.71%) – Outperforming, with notable gains in small caps.

- IJH (S&P MidCap 400): 65.43 (+0.69%) – Medium caps also showing broad participation in the rally.

- DIA (Dow Jones): 456.03 (+0.34%) – Steady gains among blue chips round out strong ETF action.

Mag7 Stocks: AAPL, MSFT, GOOG, AMZN, META, NVDA, TSLA

- MSFT: 506.74 (+0.94%) – Leading the group with strong bullish momentum.

- AAPL: 230.49 (+0.51%) – Continuing higher, contributing to broad tech sector gains.

- GOOG: 208.21 (+0.12%) – Modest gains, maintaining bullish bias.

- AMZN: 229.12 (+0.18%) – Slightly higher, mirroring the index.

- META: 747.38 (−0.89%) – Underperforming, notable for its bearish move in contrast to peers.

- NVDA: 181.60 (−0.09%) – Mild pullback, a pause after significant outperformance in prior sessions.

- TSLA: 349.60 (−0.59%) – Bearish, under pressure relative to the group.

Other Notable ETFs

- IBIT (Bitcoin ETF): 63.65 (+0.87%) – Sharp move upward as digital asset interest remains elevated.

- USO (Oil Fund): 74.68 (+0.85%) – Leading commodity ETFs, hinting at energy sector strength.

- GLD (Gold): 312.71 (+0.20%) – Mildly bullish, reflecting continued interest in defensive assets.

- TLT (Long-Term Treasuries): 86.65 (−0.12%) – Weakness in bond prices as rates are pressured higher.

Sentiment Overview

- Bullish: Broad participation across major index ETFs, small/mid caps, leading tech, Bitcoin, energy, and gold.

- Bearish: Select pressure in momentum tech stocks (META, TSLA, NVDA), and longer-dated Treasuries.

- Mixed: While the overall market remains constructive, individual names and asset classes show emerging divergences worthy of attention by traders.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-28: 07:16 CT.

US Indices Futures

- ES Uptrend across YSFG, MSFG, WSFG; price at new highs, above all MA benchmarks, higher highs/lows, pivots confirm uptrend, key support at 6039.75, thin resistance above, trend continuation favored.

- NQ Strong uptrend YSFG/MSFG/WSFG; price above all MAs, higher highs/lows, current pivot high 24003.50, next support 22053.50, volatility moderate, no major resistance, persistent bullish structure.

- YM Neutral short-term, bullish intermediate/long; price above MSFG/YSFG NTZ, WSFG trend down, uptrend swing pivots, latest high 45878, support at 43067, consolidation near highs, benchmarks upward.

- EMD All session fib grids up, above NTZ, strong bullish momentum, recent pivot high at 3297.9, support at 3071.4, above all MA benchmarks, higher highs/lows, volatility elevated, resistance tested near highs.

- RTY YSFG, MSFG, WSFG all up, price above key NTZ/F0%, recent pivot high at 2389.6, support at 2202.6, benchmarks rising, testing upper resistance, higher highs/lows, trend continuation environment.

- FDAX Short-term bearish/neutral, intermediate/long-term bullish; price below WSFG NTZ, short-term MAs down, monthly/yearly grids up, swing low 24001, resistance above at 24402/24411, long-term uptrend structure.

Overall State

- Short-Term: Bullish (ES, NQ, EMD, RTY, YM), Neutral (FDAX, YM wkly), Bearish (FDAX daily)

- Intermediate-Term: Bullish (ES, NQ, YM, EMD, RTY, FDAX wkly), Neutral (FDAX daily)

- Long-Term: Bullish (ES, NQ, YM, EMD, RTY, FDAX)

Conclusion

US Indices Futures continue to show strong higher time-frame uptrends, confirmed by persistent bullish YSFG, MSFG, WSFG alignment and price action above NTZ/F0% on all grids except short-term FDAX. ES, NQ, EMD, and RTY remain in accelerated uptrends with all benchmarks trending upward, swing pivots and support levels well below current price, and thin resistance above new highs. YM shows bullish intermediate and long-term conditions, with some short-term consolidation, while FDAX is pausing in the short term but retains long-term uptrend characteristics. Overall, trend continuation dominates across the complex, with rising benchmarks, confirmed swing pivots, and elevated volatility, while short-term countertrend pullbacks appear as consolidative action within broader bullish structures.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts