Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

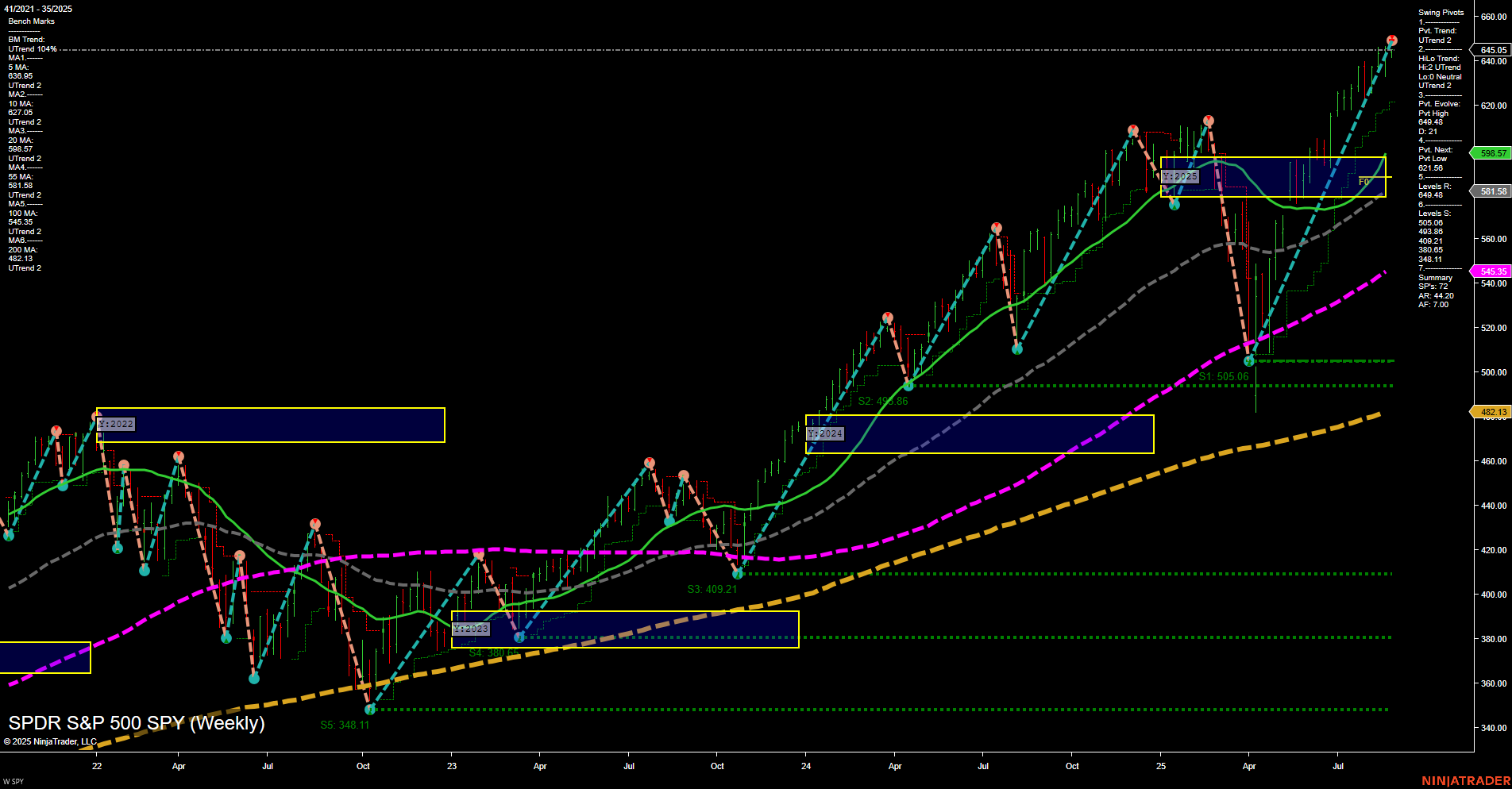

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2025-09-01 Labor Day

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- AVGO Release: 2025-09-04 T:AMC

- CRM Release: 2025-09-03 T:AMC

Looking ahead to the upcoming earnings releases for Salesforce (CRM) on September 3rd and Broadcom (AVGO) on September 4th, indices futures traders should anticipate a period of lower market momentum and lighter trading volume in the days leading up to these reports. This is due to a wait-and-see stance among participants, especially as these names are deeply connected to AI sector sentiment, alongside heightened anticipation for imminent results from NVDA and other MAG7 tech leaders. The market is likely to remain range-bound until these key earnings releases provide clarity, setting the tone for sector rotation and broader market direction in the tech-heavy indices. Traders can expect volatility to pick up around these events as the market digests fresh data from critical AI and software players.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 10:00 — ISM Manufacturing PMI (High Impact): Closely tracked as a leading indicator of US growth. High volatility often seen in indices futures, especially if results significantly diverge from consensus. Market participants may quickly reprice expectations for economic strength or weakness.

- Wednesday 10:00 — JOLTS Job Openings (High Impact): While not as immediate as payrolls data, large surprises can signal shifts in labor demand, affecting market sentiment regarding future Fed policy paths.

- Thursday 08:15 — ADP Non-Farm Employment Change (High Impact): Viewed as a prelude to Friday’s official NFP release. Strong beats or misses can set the tone for the session, accelerating positioning in index futures.

- Thursday 08:30 — Unemployment Claims (High Impact): Ongoing gauge of labor market strength. Surges or drops in claims can trigger sharp market moves as traders recalibrate growth and Fed expectations.

- Thursday 10:00 — ISM Services PMI (High Impact): Monitored for signs of resilience or slowdown in the broader economy. Indices may experience increased volatility at this time point, frequently coinciding with intraday reversals or momentum surges.

- Friday 08:30 — Non-Farm Payrolls, Unemployment Rate, and Average Hourly Earnings (High Impact): The core jobs data set. Considered a primary catalyst for market-wide risk repricing. Major surprises can induce outsized volatility, especially at the open, and set session direction.

EcoNews Conclusion

- Multiple high-impact events including ISM (both manufacturing and services), JOLTS, ADP, and especially Friday’s NFP will likely keep indices futures highly reactive throughout the week.

- Greater than usual volatility is expected, particularly during the 08:30 and 10:00 news windows.

- News events around the 10 AM time cycle often act as catalysts for intraday reversals or continuations in the indices futures markets.

- Momentum and volume may slow during the lead-up to Friday’s NFP, with sharp surges on its release.

For full details visit: Forex Factory EcoNews

Market News Summary

- Federal Reserve Policy: An effort by President Trump to influence Fed leadership is causing uncertainty in the Fed’s policy path. Market consensus is for a September rate cut, but support and future direction remain uncertain, especially as upcoming labor data appears unreliable and volatile.

- Labor Market & Fed Outlook: August’s jobs report is in sharp focus. Weakness in key cyclical sectors and conflicting labor data intensifies uncertainty about the Fed’s rate cut trajectory. Market volatility is expected around the release due to extreme market sensitivity to this data.

- Stock Market & Indices: The S&P 500 set new records last week but slipped amid inflation concerns, ending a three-week winning streak. Despite persistent inflation worries, equity markets in August maintained upward momentum, with the Dow outperforming on a monthly basis.

- ETF & Index Fund Sentiment: Significant investor interest in broad-based ETFs and index funds persists, as market participants consider these vehicles reliable for both passive income and exposure to the ongoing rally. AI-focused ETFs are highlighted amid continued optimism for the sector.

- Commodities – Oil: Crude oil’s upward movement is capped at technical resistance (50-day average), while it retains support at the 52-week average. Markets are awaiting OPEC+ production decisions, watching for signals from Russia, U.S. inventories, and global demand trends.

- Commodities – Gold and Silver: Gold saw a notable breakout driven by dovish signals from the Fed, a weaker dollar, and increased ETF demand. Both gold and silver benefit from loose financial conditions and inflation; silver’s breakout potential is noted amid rising industrial use.

- Other Markets: Matcha prices reached record highs due to supply concerns stemming from Japan’s heatwave and ongoing strong demand. Tariff revenue has hit historic levels as trade policy remains politically prominent following recent court decisions.

- Market Theory: Discussions continue on the limitations of market efficiency, with some asserting that perfect information in markets is unattainable due to knowledge constraints.

News Conclusion

- Markets are exhibiting heightened sensitivity to labor data and Federal Reserve policy signals, with upcoming jobs numbers considered highly influential for near-term moves in both equities and futures.

- While inflation concerns led to a technical pullback in the S&P 500, the prevailing bullish sentiment in equities persists, supported by expectations of Fed easing and concentrated flows into index funds and passive vehicles.

- Commodity markets remain mixed, with crude oil trading within technical boundaries ahead of critical OPEC+ decisions and metals—especially gold and silver—benefiting from macroeconomic uncertainty and increased demand.

- Broader market narratives are shaped by ongoing debates over trade policy impacts and the effectiveness of markets to process information fully and accurately.

Market News Sentiment:

Market News Articles: 14

- Positive: 42.86%

- Neutral: 42.86%

- Negative: 14.29%

GLD,Gold Articles: 3

- Positive: 100.00%

USO,Oil Articles: 2

- Neutral: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: August 31, 2025 06:15

- GLD 318.07 Bullish 0.96%

- GOOG 213.53 Bullish 0.55%

- DIA 456.09 Bearish -0.15%

- AAPL 232.14 Bearish -0.18%

- IWM 235.17 Bearish -0.44%

- USO 74.84 Bearish -0.53%

- IJH 65.16 Bearish -0.53%

- MSFT 506.69 Bearish -0.58%

- SPY 645.05 Bearish -0.60%

- TLT 86.60 Bearish -0.71%

- AMZN 229.00 Bearish -1.12%

- QQQ 570.40 Bearish -1.16%

- META 738.70 Bearish -1.65%

- NVDA 174.18 Bearish -3.32%

- IBIT 61.44 Bearish -3.37%

- TSLA 333.87 Bearish -3.50%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-08-31: 18:15 CT.

US Indices Futures

- ES Strong YSFG/MSFG/WSFG uptrend, price above all MA benchmarks, recent pivot high with support at 6107.05, possible short-term pullback after large move, structure remains bullish long-term.

- NQ YSFG/MSFG/WSFG all up, benchmarks in uptrend, new swing high at 24,089 with support at 22,108.31, minor short-term consolidation near resistance, long and intermediate-term bullish structure intact.

- YM YSFG/MSFG/WSFG up, above all MAs, strong momentum with higher highs/lows, resistance near all-time highs, support well below, trend continuation phase, no major reversal signals present.

- EMD YSFG/MSFG up, WSFG short-term bearish below NTZ, all major MAs trending up, recent correction from resistance at 3297.3, consolidation/pullback underway, medium/long-term structure remains bullish.

- RTY YSFG/MSFG/WSFG up, above all benchmarks, ongoing uptrend with recent pivot high at 2398.6, key support at 2022.7, trend continuation phase with higher highs/lows dominating.

- FDAX YSFG bullish, MSFG/WSFG bearish, price below weekly/monthly NTZ, MAs long-term up, recent pivot high at 24,748, support at 22,257, corrective phase within broader uptrend, short-term consolidation.

Overall State

- Short-Term: Neutral

- Intermediate-Term: Bullish

- Long-Term: Bullish

Conclusion

US Indices Futures remain structurally bullish across intermediate and long-term timeframes, supported by uptrending yearly and monthly session fib grids, upward MA benchmarks, and dominant higher-high/higher-low swing pivots. Short-term signals indicate possible consolidation or pullback phases, particularly in ES, NQ, EMD, and FDAX, where minor retracements or corrections are developing within prevailing uptrends. No major signs of trend exhaustion or reversal are present on HTF context. Price action remains above major support levels and fib grid NTZs for most indices, with FDAX showing lagging short-term/medium-term weakness but long-term strength. Directional correlations support continued trend structures, with rotation between indices but no breakdown in broader bullish framework.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts