Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

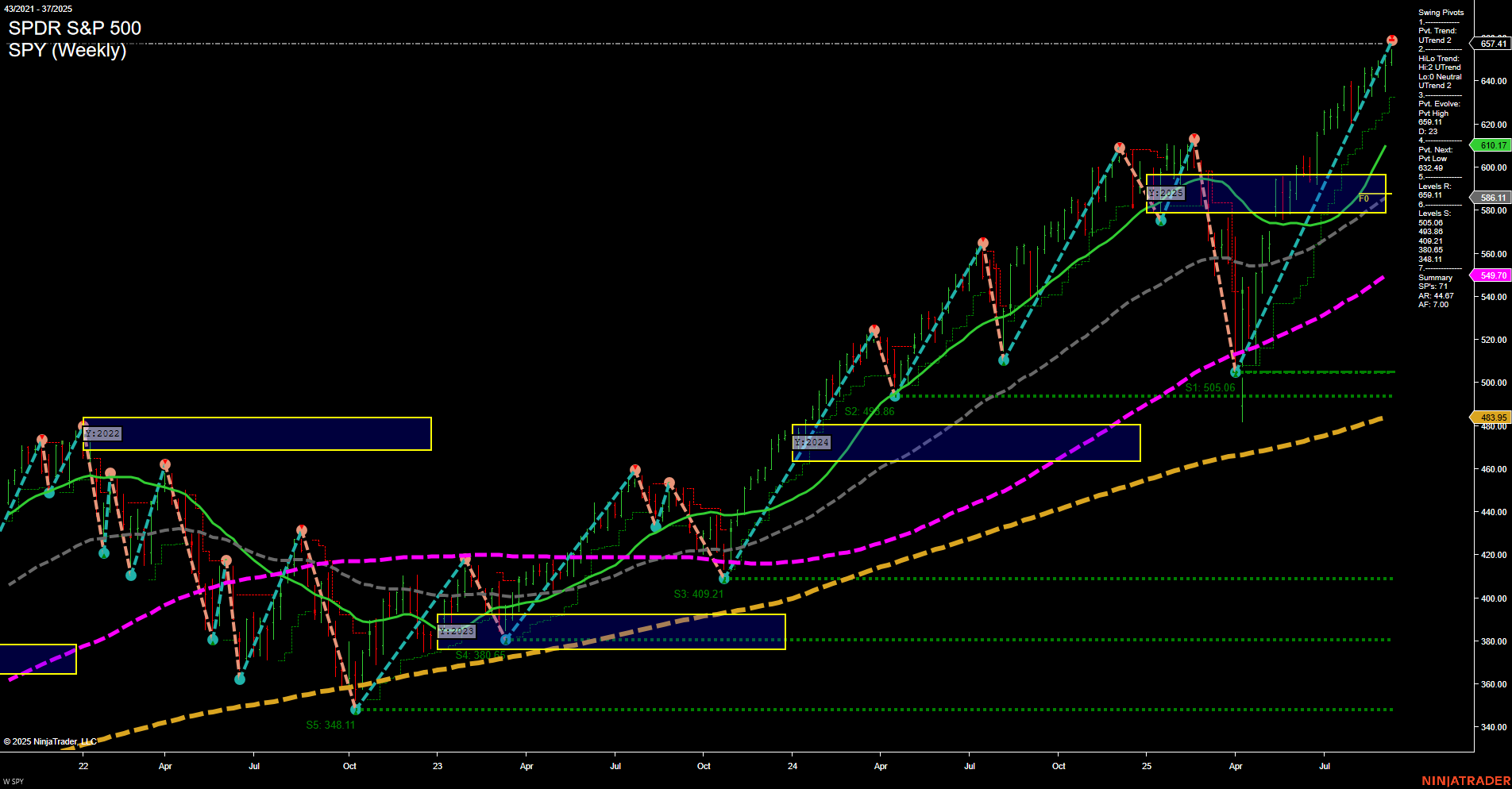

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:30 – USD Core Retail Sales m/m & Retail Sales m/m (High Impact):

Both reports could create significant early market volatility. Stronger-than-expected numbers may spark bullish sentiment on expectations of consumer strength and possible Fed hawkishness, while weaker readings may trigger concerns about economic slowdown. - Wednesday 14:00 & 14:30 – USD Federal Funds Rate, FOMC Economic Projections, FOMC Statement, FOMC Press Conference (High Impact):

This dense FOMC event cluster is the most pivotal of the week. Any surprise in the policy rate or a shift in projections regarding inflation or rate cuts could sharply move indices futures. The FOMC statement and press conference may fuel outsized intraday volume and volatility, especially if Fed language suggests patience or urgency on future policy paths. - Thursday 08:30 – USD Unemployment Claims (High Impact):

Weekly claims can influence market tone at the open; a spike can raise recession fears, while unexpectedly low claims reinforce resilience. As this follows FOMC, the reaction may be more muted unless the result is a major surprise.

EcoNews Conclusion

- Indices futures traders should expect pronounced market swings around Tuesday’s retail data and Wednesday’s FOMC events, with significant momentum and volume surges likely at those time slots.

- Market momentum and volume may slow in the days leading up to the FOMC cluster as market participants await clear policy direction.

- Moves during the 10 AM time window, particularly on Wednesday post-FOMC, may act as inflection points, serving as catalysts for reversals or continuation moves.

For full details visit: Forex Factory EcoNews

Market News Summary

- Crude oil futures remain under pressure, trading below their 52-week average due to oversupply, weak demand, and growing inventories.

- Gold prices are climbing, buoyed by anticipation of Fed rate cuts, central bank buying, and strong ETF inflows, eyeing the $3,879–$4,000 range as inflation and economic uncertainty lift safe-haven demand.

- US stock market momentum is driving a surge in capital gains revenue and lifting long-term portfolio prospects, as regular investing in leading ETFs is highlighted as a path to significant wealth accumulation.

- IPO market activity has rebounded sharply, with $4 billion in new offerings signaling returning appetite for newly listed companies amid pent-up demand.

- S&P 500 continues its rally, reaching 6,600, with technicals pointing toward further gains toward 7,000 and no apparent threats to the larger trend.

- Falling mortgage rates could revitalize the housing sector, potentially benefiting shares of homebuilders, mortgage servicers, and home improvement retailers as the broader market environment evolves.

- Central bank policy dynamics remain at the center of market attention: the Federal Reserve is expected to cut rates, but mixed internal views and cut-driven volatility may impact equities, while the Bank of Japan faces pressure to raise rates, complicating currency trades like the yen carry trade.

- Traders face uncertainty over whether the Fed’s policy shift will sustain the equity rally or prompt a pullback, as inflation fears and economic projections shape sentiment.

- International trade relations are in focus, with pressure building to address US tariffs ahead of political developments.

- Taking a long-term approach is underscored, even as markets trend near all-time highs, highlighting the potential risks of waiting for a pullback.

News Conclusion

- Major asset classes are experiencing pivotal moves: oil is weighed down by supply-demand imbalances, while gold is finding renewed support amid inflation concerns and central bank activity.

- The equities market is robust, evidenced by growing capital gains, a bullish S&P 500 outlook, and renewed IPO funding, despite monetary policy crosscurrents.

- Central bank decisions are key drivers, shaping trends in both currency and equity markets as traders monitor potential impacts from impending Fed and Bank of Japan moves.

- Sectors tied to housing and homeownership may benefit from rapidly declining mortgage rates, providing new trading considerations amid market shifts.

- The interplay between monetary easing, inflation expectations, and global trade developments continues to drive volatility and opportunity across futures and equity markets.

Market News Sentiment:

Market News Articles: 9

- Positive: 66.67%

- Neutral: 22.22%

- Negative: 11.11%

GLD,Gold Articles: 2

- Positive: 50.00%

- Neutral: 50.00%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 14, 2025 06:15

- TSLA 395.94 Bullish 7.36%

- IBIT 66.38 Bullish 2.08%

- MSFT 509.90 Bullish 1.77%

- AAPL 234.07 Bullish 1.76%

- META 755.59 Bullish 0.62%

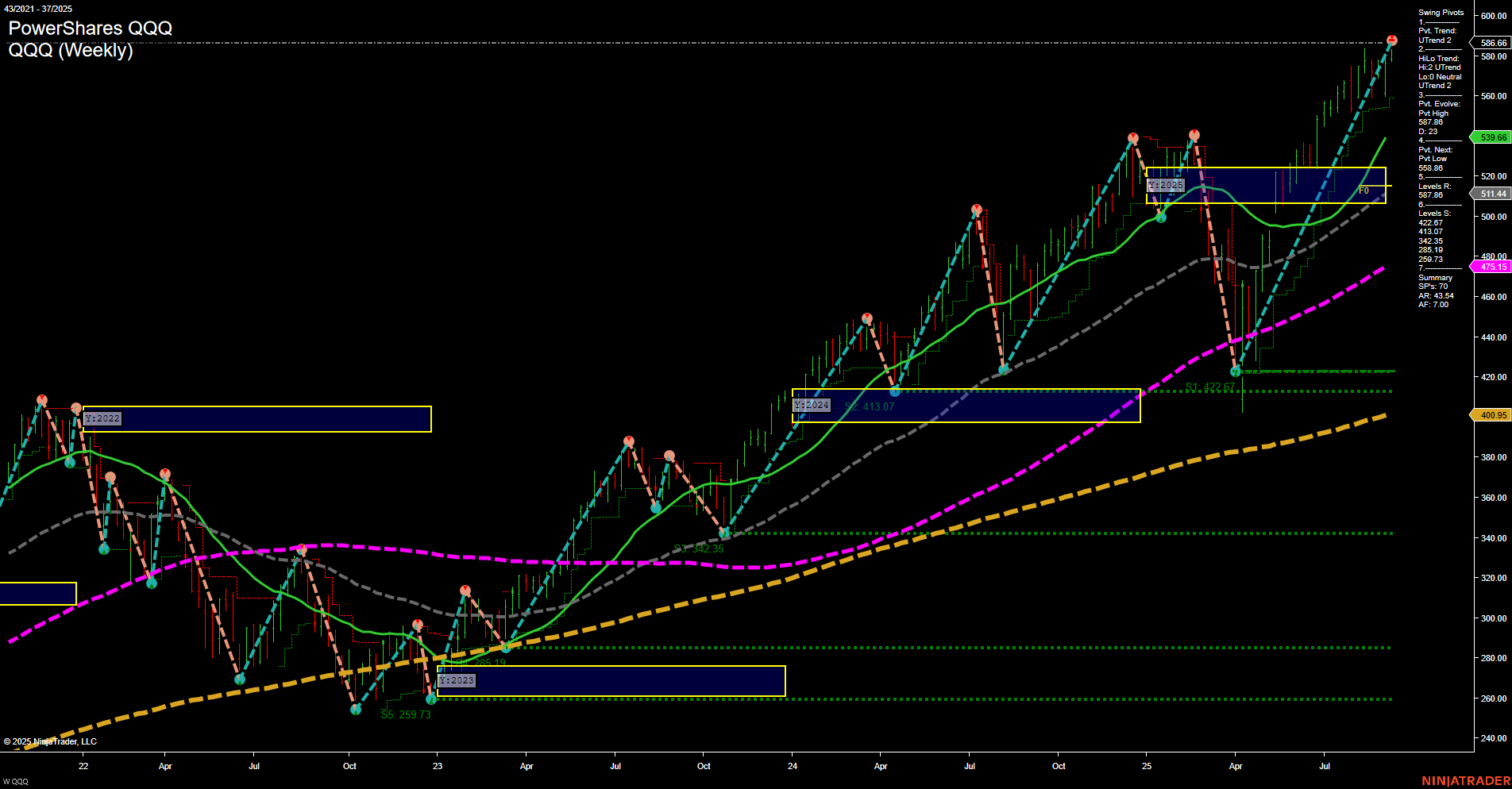

- QQQ 586.66 Bullish 0.44%

- USO 73.31 Bullish 0.42%

- NVDA 177.82 Bullish 0.37%

- GOOG 241.38 Bullish 0.25%

- GLD 335.42 Bullish 0.20%

- SPY 657.41 Bearish -0.03%

- TLT 89.95 Bearish -0.43%

- DIA 459.32 Bearish -0.56%

- AMZN 228.15 Bearish -0.78%

- IWM 238.34 Bearish -1.02%

- IJH 65.78 Bearish -1.10%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-09-14: 18:15 CT.

US Indices Futures

- ES Bullish on YSFG, MSFG, WSFG; benchmarks trending up, swing pivots at new highs 6606.00, key support 6230.50, price above NTZ/F0%, trend continuation, strong S/R alignment.

- NQ Bullish across YSFG, MSFG, WSFG; benchmarks rising, new pivot high 24122.5, support at 22445.5, price above all NTZ, higher highs/lows, no reversal signals.

- YM Bullish on all sessions; YSFG, MSFG, WSFG up, benchmarks strong, recent pivot high 46300, support 42000, price above NTZ/F0%, trend continuation, no near-term reversal.

- EMD Neutral short-term (WSFG down), bullish on MSFG/YSFG, benchmarks up, latest pivot high 3328.5, support 3163.5, resistance 3501.9, consolidation with HTF trend up.

- RTY Bullish YSFG, MSFG, WSFG, benchmarks up, recent swing high 2424.7, key support 2284.8, price above all NTZ, higher highs/lows, resistance at 2537.1.

- FDAX Bearish short- and intermediate-term (MSFG, DTrend down), bullish long-term (YSFG up), 200MA up, swing resistance 24748, support 22355, price consolidating under MSFG NTZ.

Overall State

- Short-Term: Mostly Bullish (EMD Neutral, FDAX Bearish)

- Intermediate-Term: Bullish (FDAX Neutral, FDAX MSFG down)

- Long-Term: Bullish (all major indices, FDAX also bullish)

Conclusion

Higher-timeframe technicals for US indices futures are in broad uptrends with bullish alignment across Yearly, Monthly, and Weekly Session Fib Grids. ES, NQ, YM, and RTY maintain price action above key NTZ levels with sustained higher highs, higher lows, and bullish moving average structures, indicating trend continuation. EMD presents near-term (weekly) consolidation against intermediate and long-term uptrends above MSFG/YSFG NTZ support. FDAX exhibits short- and intermediate-term retracement with bearish signals below the MSFG NTZ and falling short-term MAs; however, long-term structure remains bullish and consolidation persists above yearly support. Leading indices remain aligned for continuation provided momentum sustains and support levels are held.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts