After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

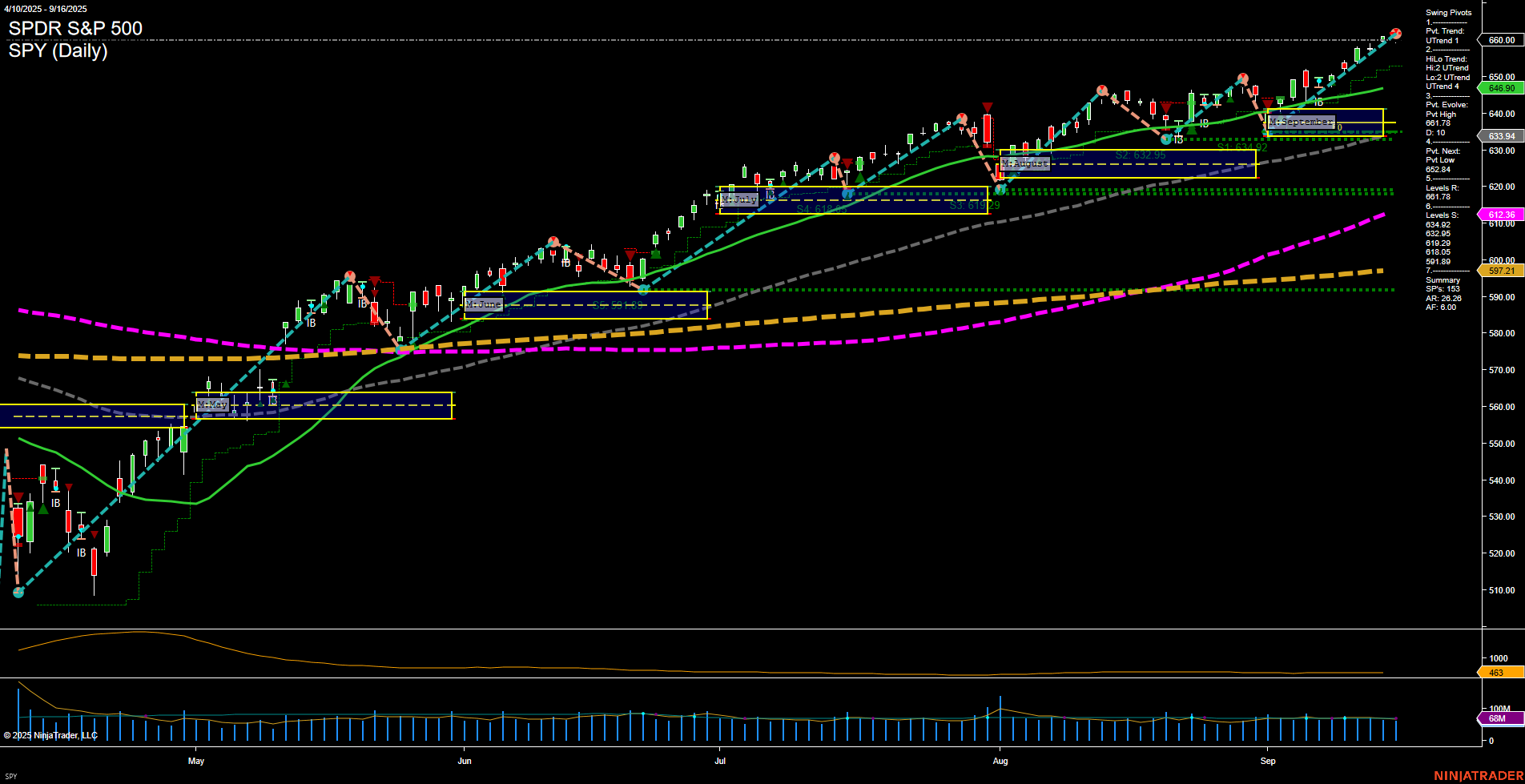

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Fed Policy & Market Reaction: The Federal Reserve cut interest rates by 25 basis points as expected. The move generated mixed reactions in US markets. While the Dow advanced and expectations for lower rates drove some stocks higher, the S&P 500 slipped. Volatility increased post-FOMC, with investors digesting Powell’s cautious tone and conflicting signals on future easing.

- Volatility and Sector Movers: A spike in VIX options ahead of the Fed announcement signaled preparations for heightened volatility. Gold experienced a two-sided trade, rallying on rate cut news but seeing intraday reversals and profit-taking. Deutsche Bank raised gold forecasts, while other metals like silver and platinum saw similar swings.

- Inflation and Bond Market Sentiment: Concerns over persistent inflation pushed inflation fears to their highest levels since “liberation day.” Bond market sentiment diverged from Powell’s optimism, with prominent voices suggesting caution on the inflation outlook and the perceived effectiveness of Fed policy.

- Tech Stocks, IPOs & Equity Trends: Technology stocks continued to transform market structure with rapid gains, drawing comparisons to the late-1990s. After lagging most of the year, IPO returns strengthened since August and outperformed broader indices recently.

- Diverging Views: Comments from market strategists and central bank observers highlighted uncertainty surrounding Fed decisions and future economic conditions. There was emphasis on the lack of consensus within the Fed and the broader market’s challenge in interpreting Fed messaging.

- Other Market Movers: Oil prices pulled back despite falling inventories, as attention turned to the EIA report. The U.S. dollar saw forecasts for renewed strength post-FOMC. Real estate activity could see potential movement with mortgage rates reaching their lowest since 2024, although analysts remain cautious about meaningful declines.

News Conclusion

- The Fed’s quarter-point rate cut and Powell’s measured comments led to increased short-term volatility and a mixed market response. There is no clear consensus on the economic outlook or the likely path of interest rate policy, contributing to wide divergence in opinions across Wall Street.

- While certain sectors, like technology and IPOs, showed relative strength, others, such as gold and oil, experienced rapid intra-day shifts as traders reacted to evolving Fed and inflation narratives.

- Underlying concerns remain about elevated equity valuations and persistent inflation despite central bank intervention, with cautious optimism tempered by significant macroeconomic uncertainty and diverging views within the Fed itself.

Market News Sentiment:

Market News Articles: 52

- Neutral: 50.00%

- Positive: 36.54%

- Negative: 13.46%

GLD,Gold Articles: 17

- Positive: 52.94%

- Neutral: 35.29%

- Negative: 11.76%

USO,Oil Articles: 2

- Negative: 50.00%

- Neutral: 50.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 17, 2025 05:00

- TSLA 425.86 Bullish 1.01%

- DIA 461.26 Bullish 0.54%

- AAPL 238.99 Bullish 0.35%

- IWM 238.89 Bullish 0.26%

- MSFT 510.02 Bullish 0.19%

- IJH 65.31 Bearish -0.12%

- SPY 659.18 Bearish -0.12%

- QQQ 590.00 Bearish -0.20%

- TLT 90.12 Bearish -0.25%

- META 775.72 Bearish -0.42%

- GOOG 249.85 Bearish -0.62%

- GLD 336.97 Bearish -0.77%

- USO 74.97 Bearish -0.93%

- AMZN 231.62 Bearish -1.04%

- IBIT 65.67 Bearish -1.05%

- NVDA 170.29 Bearish -2.62%

ETF Stocks Summary

- SPY 659.18 — Bullish → Bearish reversal. Down -0.12%. Recent downward pressure signals a mixed to negative sentiment after previous strength.

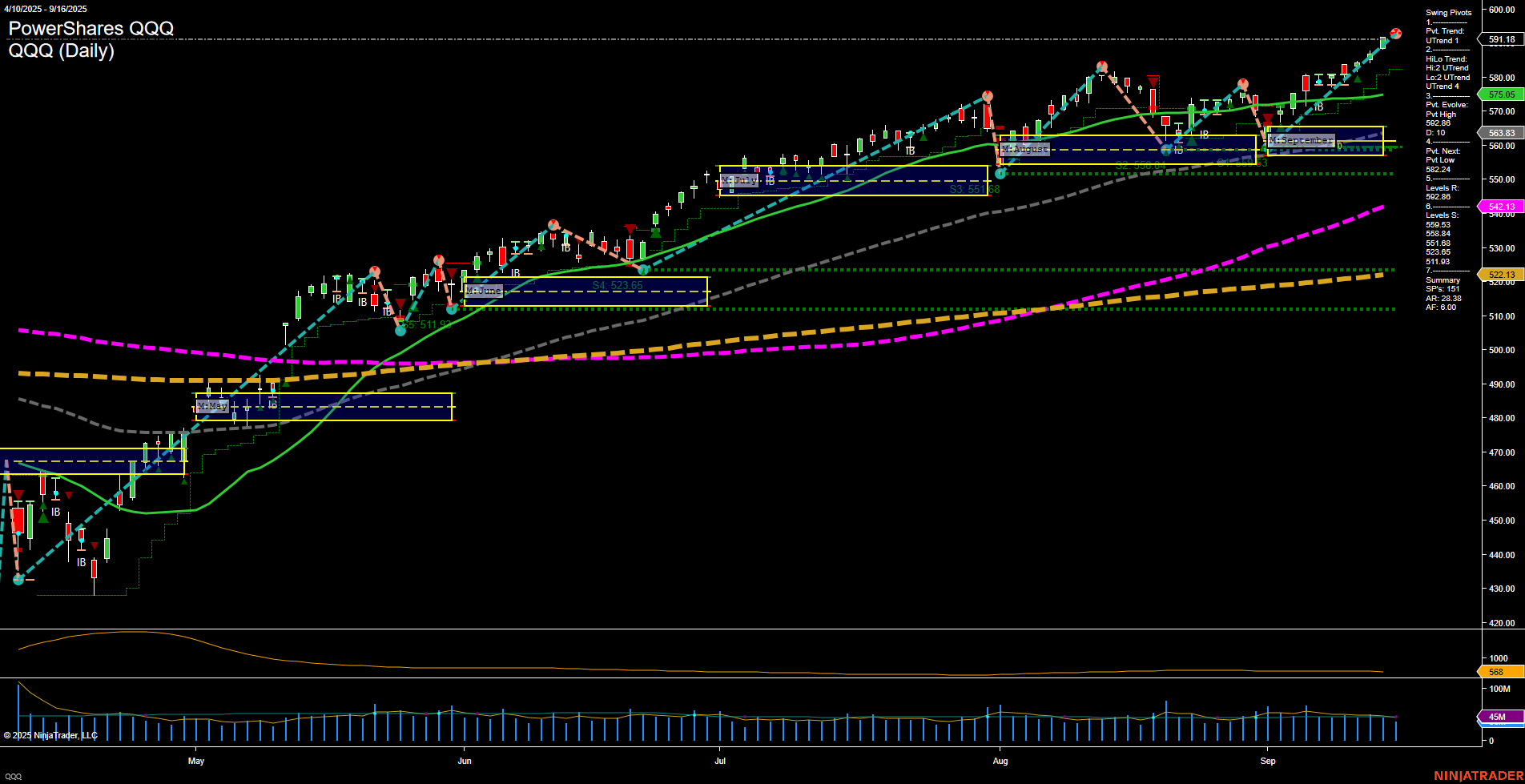

- QQQ 590.00 — Bearish. Off -0.20%. Mega-cap tech ETF experiencing mild selling.

- IWM 238.89 — Bullish. Up 0.26%. Small cap ETF outperforming broader market, showing relative strength.

- IJH 65.31 — Bearish. Down -0.12%. Midcap exposure under pressure, mirroring large cap indices.

- DIA 461.26 — Bullish. Up 0.54%. Blue chip stocks advancing, bucking some of the broader softness.

Magnificent 7 (Mag7) Snapshot

- TSLA 425.86 — Bullish. +1.01%. Notable outperformance and strong upward move.

- AAPL 238.99 — Bullish. +0.35%. Continuing its leadership posture with modest gains.

- MSFT 510.02 — Bullish. +0.19%. Steady and in green, offering stability.

- META 775.72 — Bearish. –0.42%. Encountering some profit-taking.

- GOOG 249.85 — Bearish. –0.62%. Facing moderate selling.

- NVDA 170.29 — Bearish. –2.62%. Experiencing significant downside volatility.

- AMZN 231.62 — Bearish. –1.04%. Under pressure, as sellers dominate.

Other Key ETFs

- TLT 90.12 — Bearish. –0.25%. Long-duration Treasuries continue to slip amid rate uncertainties.

- GLD 336.97 — Bearish. –0.77%. Gold ETF softer as risk sentiment cools.

- USO 74.97 — Bearish. –0.93%. Oil ETF declining on commodity weakness.

- IBIT 65.67 — Bearish. –1.05%. Bitcoin-related ETF experiencing sharp pullback.

Market State of Play

Bulls are concentrated in select large caps (DIA), small-caps (IWM), and some mega-cap tech (TSLA, AAPL, MSFT). However, the broad-based ETFs (SPY, QQQ, IJH) and much of the Mag7 are showing mixed-to-bearish tones, with notable weakness in high-flyers like NVDA and AMZN. Defensive assets (TLT, GLD) and commodity ETFs (USO, IBIT) are also under selling pressure.

The session reflects a selective risk-on sentiment amidst broader volatility and profit-taking, especially among names and sectors that had previously led the rally.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts