After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Federal Reserve Actions: The FOMC implemented a 25 basis point interest rate cut. Market sentiment was broadly positive in response, with major indices (S&P 500, Nasdaq, Dow Jones) rising and equity momentum continuing. However, some media and analysts characterized the cut as smaller than expected, and caution remains regarding further rate moves and inflation risk.

- Indices & Stocks: The S&P 500, Nasdaq, Dow, and Russell 2000 all showed bullish trends. Notably, the Russell 2000 reached a fresh high on small-cap outperformance, and tech stocks led gains following a major corporate investment in Intel. U.S. corporate bond issuance also increased post-Fed cut, indicating renewed risk appetite.

- Gold & Precious Metals: Gold consolidated above $3,650 and continues to attract buyers on dips, though volatility and profit-taking were observed after the FOMC decision. Momentum in gold faded near highs as the dollar rebounded, leading to a moderate pullback, but long-term support for gold persists given rate cuts and geopolitical risk. Silver and platinum followed similar corrective trends.

- Commodities & Energy: Crude oil attempted to confirm a bullish technical setup but faced challenges, while oil prices pulled back despite the Fed’s easing, as rate cuts failed to lift crude sentiment. Policymakers attempt to address fuel-supply issues amid looming refinery closures.

- Economic Data: Weekly initial unemployment claims dropped significantly, reversing the previous week’s spike and supporting a positive macro backdrop. International stocks outperformed U.S. counterparts for the year.

- Macro Risks: Caution persists regarding growing fiscal debt, weakening consumer sentiment, rising margin debt, and the risk of a U.S. government shutdown. Ongoing disputes about Fed independence and leadership have added to uncertainty.

- Thematic & Sector Trends: AI-themed ETFs and rule-breaker strategies are highlighted as leaders amid the tech-driven rally. Increased demand for gold ETFs reflects broader asset rotation.

News Conclusion

- Markets rallied after the Fed’s rate cut, with indices recording strong gains and small-caps breaking out to new highs. Optimism is tempered by concerns about inflation, margin risk, and mixed signals from commodity markets.

- Gold and precious metals experienced volatility but maintain a supportive backdrop given dovish central banks and risk factors, though momentum has slowed in the near term.

- The rally in equities has been broad-based, featuring notable strength in technology and renewed corporate bond issuance, but pockets of caution remain related to macroeconomic risks and potential policy disruptions.

Market News Sentiment:

Market News Articles: 44

- Positive: 50.00%

- Neutral: 31.82%

- Negative: 18.18%

GLD,Gold Articles: 14

- Positive: 50.00%

- Neutral: 35.71%

- Negative: 14.29%

USO,Oil Articles: 7

- Negative: 42.86%

- Positive: 28.57%

- Neutral: 28.57%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 18, 2025 05:00

- NVDA 176.24 Bullish 3.49%

- IWM 244.84 Bullish 2.49%

- IBIT 66.75 Bullish 1.64%

- IJH 66.14 Bullish 1.27%

- GOOG 252.33 Bullish 0.99%

- QQQ 595.32 Bullish 0.90%

- META 780.25 Bullish 0.58%

- SPY 662.26 Bullish 0.47%

- DIA 462.63 Bullish 0.30%

- AMZN 231.23 Bearish -0.17%

- MSFT 508.45 Bearish -0.31%

- USO 74.69 Bearish -0.37%

- GLD 335.62 Bearish -0.40%

- AAPL 237.88 Bearish -0.46%

- TLT 89.19 Bearish -1.03%

- TSLA 416.85 Bearish -2.12%

ETF Stocks: State of Play

- SPY: Bullish (+0.47%) – The S&P 500 ETF continues to climb, reflecting broad market optimism.

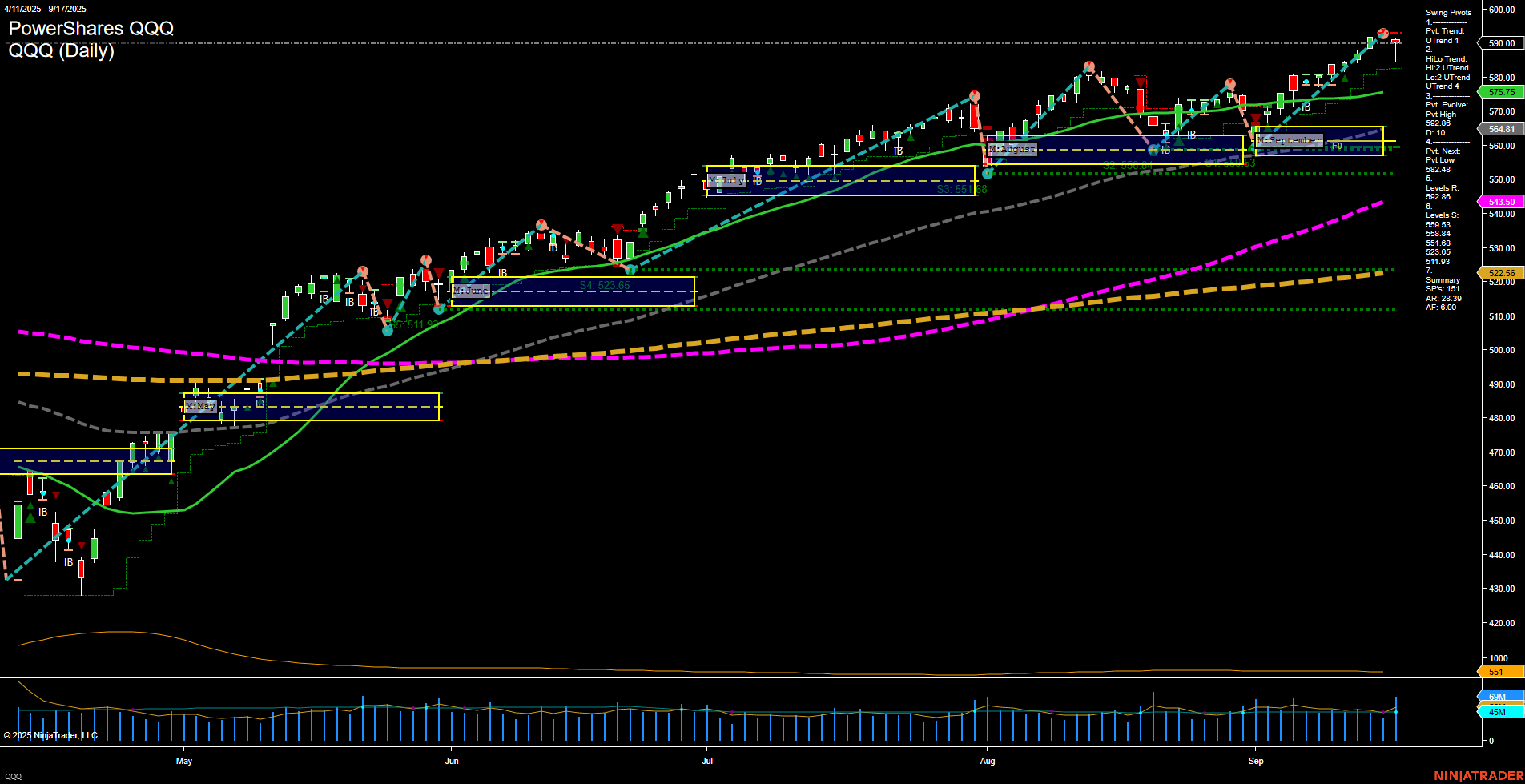

- QQQ: Bullish (+0.90%) – The Nasdaq 100 ETF maintains strength, benefiting from gains in tech stocks.

- IWM: Bullish (+2.49%) – Small caps surge with notable outperformance, signaling risk-on sentiment.

- IJH: Bullish (+1.27%) – Mid-cap equities also rise, participating in the broader uptick.

- DIA: Bullish (+0.30%) – Blue chips are positive but lagging high-growth segments.

Mag7 Stocks: Mixed Momentum

- NVDA: Bullish (+3.49%) – Nvidia leads with outsized gains, indicating persistent demand for AI-related names.

- GOOG: Bullish (+0.99%) – Alphabet posts steady advances, contributing to tech’s resilience.

- META: Bullish (+0.58%) – Meta Platforms remains in positive territory amid stable tech flows.

- AMZN: Bearish (-0.17%) – Amazon slides modestly, highlighting some divergence among big tech peers.

- MSFT: Bearish (-0.31%) – Microsoft retraces slightly after recent gains.

- AAPL: Bearish (-0.46%) – Apple underperforms as traders rotate within tech.

- TSLA: Bearish (-2.12%) – Tesla is the weakest in the Mag7 group, reflecting ongoing volatility.

Other Key ETFs: Divergence

- IBIT: Bullish (+1.64%) – Bitcoin ETF rallies, riding digital asset strength.

- USO: Bearish (-0.37%) – Crude oil ETF ticks lower, indicating consolidation in energy.

- GLD: Bearish (-0.40%) – Gold ETF dips as risk appetite curbs safe-haven demand.

- TLT: Bearish (-1.03%) – Long-term treasuries weaken, with rates pressuring bond prices.

Market Summary

The market snapshot shows a broadly bullish tilt among equity ETFs, with small and mid-cap segments leading gains. The Mag7 stocks display mixed momentum—Nvidia outpaces the group, while Tesla, Apple, and Microsoft lag. Notably, the Bitcoin ETF is firmly higher, but commodity-related (USO, GLD) and bond (TLT) ETFs trend lower, outlining a continued preference for growth and risk assets over defensive exposures.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts