Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

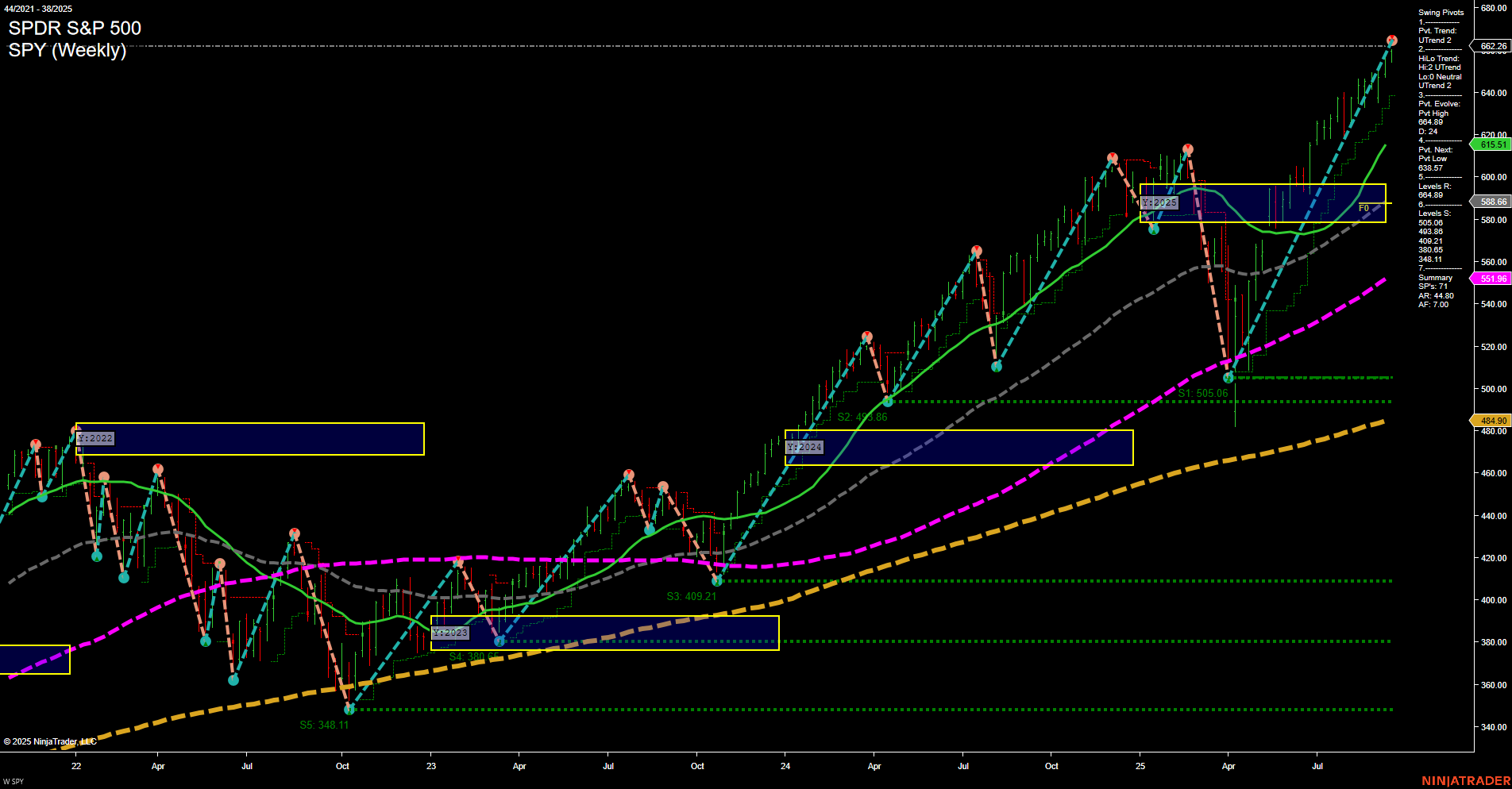

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MU Release: 2025-09-23 T:AMC

Micron Technology (MU) is scheduled to report earnings after the market close on September 23, 2025. As one of the key semiconductor names connected to the AI supply chain, this report is likely to attract broad market attention—especially with NVDA and other “Magnificent 7” and AI-focused companies also on traders’ watchlists for upcoming results. In the days leading up to MU’s release, index futures traders may notice a dampening of momentum and lighter volumes, as participants reduce risk and await fresh signals from both MU and the larger AI sector. The report’s outcomes could set the tone for sentiment and volatility not just in tech, but across the indices, as traders parse the data for indications on AI demand, memory pricing, and broader tech-sector health heading into the rest of the earnings season.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- Equities: U.S. and global stock indices set new highs as technology deals and Federal Reserve interest rate cuts fuel optimism. Intel shares posted their best day in decades following a major investment by Nvidia. The Russell 2000 small-cap index reached its first record in four years, bolstered by attractive valuations and expectations that lower rates will favor small cap and housing stocks. S&P 500 outlooks remain positive, with new all-time price targets set for 2026.

- Commodities: Gold reached new record highs and remains supported by a weaker dollar, dovish Fed signals, and ongoing geopolitical risks. Silver has also gained on similar momentum. Oil prices trade little changed to lower, pressured by demand concerns and rising U.S. inventories, despite central bank easing efforts. Natural gas demonstrates bearish trends as inventory swings and geopolitical factors weigh on the market.

- Fixed Income and Central Banks: Treasury yields rose in response to the Fed’s rate cut as investors adjusted positions. A more accommodative U.S. rate path is expected to provide space for Asian central banks to ease. China is anticipated to keep rates unchanged. The outlook for global rates stays dovish with varying degrees of response regionally.

- Fund Flows and Portfolios: Inflows to U.S. equities have hit their highest levels in over a year, with market analysts suggesting attention may shift to lagging segments. There is renewed discussion of yield-oriented portfolios to capitalize on declining rates. The Nasdaq-100 and small-cap ETFs remain in the spotlight, and positive signals in the U.S.-China relationship are noted.

- Corporate Earnings and Retail: EPS estimate upgrades are at record highs, fueling rallies in consumer and tech sectors. UK retail sales rose for a second consecutive month, and U.S. housing shares are attracting interest amid rate cuts.

- Market Themes: Market commentary highlights a rise in speculative activity, with individual stocks moving independently of broader monetary policy shifts. Prominent voices cite increasing importance for gold and non-fiat currencies as stores of value amid macroeconomic uncertainties.

News Conclusion

- Rate cuts and high-profile technology investments are propelling stocks to all-time highs, with small caps and rate-sensitive sectors like housing benefiting from easing policies.

- Precious metals, particularly gold, are experiencing strong demand and bullish technical setups, while oil prices remain under pressure due to demand uncertainties.

- Fund flows indicate robust investor appetite for equities, and analysts are watching underperforming stocks for potential catch-up moves amid record market participation.

- Speculation is playing a key role in market dynamics, while currency and commodity experts underscore gold’s relevance in portfolio diversification as global debt concerns grow.

- Across regions, monetary policy divergence is evident, with Asian central banks having flexibility amid U.S. easing and China steadying its rates. Overall, risk assets remain buoyant even as some pockets of economic and commodity market caution persist.

Market News Sentiment:

Market News Articles: 44

- Positive: 56.82%

- Neutral: 31.82%

- Negative: 11.36%

Sentiment Summary:

Out of 44 market news articles analyzed, 56.82% reflected positive sentiment, 31.82% were neutral, and 11.36% were negative.

The majority of recent market news maintains a positive tone, with a significant portion of articles remaining neutral and a smaller percentage exhibiting negative sentiment.

GLD,Gold Articles: 18

- Positive: 55.56%

- Neutral: 33.33%

- Negative: 11.11%

Sentiment Summary: Recent market news on GLD and gold is predominantly positive, with 55.56% of articles reflecting a positive sentiment. Neutral sentiment accounts for 33.33% of coverage, while negative news comprises 11.11%.

This indicates that the majority of recent articles present a favorable view of GLD and gold, with a smaller proportion expressing concerns or neutrality.

USO,Oil Articles: 5

- Negative: 60.00%

- Neutral: 20.00%

- Positive: 20.00%

Sentiment Summary: The recent coverage of USO and oil related topics shows a predominantly negative sentiment, with 60% of articles classified as negative. Neutral and positive articles are balanced at 20% each.

Conclusion: Market news sentiment around USO and oil has been mostly negative in recent articles, with limited positive and neutral perspectives.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 19, 2025 07:16

- NVDA 176.24 Bullish 3.49%

- IWM 244.84 Bullish 2.49%

- IBIT 66.75 Bullish 1.64%

- IJH 66.14 Bullish 1.27%

- GOOG 252.33 Bullish 0.99%

- QQQ 595.32 Bullish 0.90%

- META 780.25 Bullish 0.58%

- SPY 662.26 Bullish 0.47%

- DIA 462.63 Bullish 0.30%

- AMZN 231.23 Bearish -0.17%

- MSFT 508.45 Bearish -0.31%

- USO 74.69 Bearish -0.37%

- GLD 335.62 Bearish -0.40%

- AAPL 237.88 Bearish -0.46%

- TLT 89.19 Bearish -1.03%

- TSLA 416.85 Bearish -2.12%

Market Summary: ETF Stocks, Mag7, and Thematic ETFs

ETF Stocks Overview

- SPY (662.26): Bullish (+0.47%)

Continues upward, mirroring broad US large-cap strength. - QQQ (595.32): Bullish (+0.90%)

Tech-heavy, notable intraday momentum in the Nasdaq-100. - IWM (244.84): Bullish (+2.49%)

Small caps outperformed, showing significant buying interest. - IJH (66.14): Bullish (+1.27%)

Mid-caps advancing, supporting a broad market move higher. - DIA (462.63): Bullish (+0.30%)

Dow components in positive territory, moderate gains.

Mag7 State of Play

- NVDA (176.24): Bullish (+3.49%)

Displays leadership with robust outperformance. - GOOG (252.33): Bullish (+0.99%)

Sustained gains aligning with strength in tech. - META (780.25): Bullish (+0.58%)

Adds to sector-driven advances. - AAPL (237.88): Bearish (-0.46%)

Slight drawdown, facing selling interest. - MSFT (508.45): Bearish (-0.31%)

Small loss, diverging from other tech majors. - AMZN (231.23): Bearish (-0.17%)

Marginal pullback. - TSLA (416.85): Bearish (-2.12%)

Notable downside, weighing on the group.

Other Thematic and Macro ETFs

- IBIT (66.75): Bullish (+1.64%)

Strong bid for Bitcoin exposure ETF. - USO (74.69): Bearish (-0.37%)

Oil ETF edged down, softening commodities sentiment. - GLD (335.62): Bearish (-0.40%)

Gold ETF sliding, possible rotation away from safe havens. - TLT (89.19): Bearish (-1.03%)

Treasuries under pressure with further outflows noted.

Overall Market Sentiment

Mixed session characterized by robust momentum in equities, especially small- and mid-cap ETFs, as well as select large-cap tech leaders like NVDA and GOOG. Meanwhile, other Mag7 stocks (AAPL, AMZN, MSFT, TSLA) and macro-focused ETFs (GLD, TLT, USO) saw selling pressures, reflecting a split risk appetite and selective sector rotation.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-09-19: 07:16 CT.

US Indices Futures

- ES Bullish across YSFG, MSFG, WSFG, all benchmarks rising, new swing highs, swing support at 6295.40, resistance untested, wide cushion below current price, persistent trend continuation signals.

- NQ All session fib grids trending up, new swing highs at 24,743, key resistance at 25,000, supports at 22,818.43/21,840.58, all benchmarks up, confirmed by higher highs/lows and consistent long signals.

- YM YSFG, MSFG, WSFG all up, price above NTZ/F0% levels, pivot high at 46,742, support at 45,088, all moving averages up, trend intact, minor resistance, and no reversal/exhaustion indicated.

- EMD Bullish YSFG, MSFG, WSFG, price above NTZ centers, swing pivot high at 3,523.1, support at 3,231.8, benchmarks rising, trend continuation, moderate volatility supporting bullish case.

- RTY Strong YSFG, MSFG, WSFG uptrends, price well above all MAs, recent swing high at 2,498.8, key support at 2,208.8, V-shaped reversal out of prior consolidation, higher highs/lows continue.

- FDAX Weekly: Short-term bearish, MSFG/WSFG down, consolidating above 23,819, YSFG uptrend, long-term MAs rising. Daily: Short/intermediate-term bearish, below NTZs, resistance 24,147–24,891, corrective within larger uptrend.

Overall State

- Short-Term: US indices Bullish, FDAX Bearish

- Intermediate-Term: US indices Bullish, FDAX Bearish to Neutral

- Long-Term: All indices Bullish

Conclusion

All US index futures (ES, NQ, YM, EMD, RTY) are exhibiting strong bullish structure across higher timeframes, with YSFG, MSFG, and WSFG trends aligned up, price above NTZ/F0% levels, and benchmarks rising. Swing pivots confirm uptrends with higher highs and strong support layers. Benchmark MAs from short to long-term confirm prevailing momentum, with only FDAX showing a mixed profile: short-/intermediate-term bearish due to persistent downtrends on WSFG/MSFG and swing lows, but long-term structure remains bullish above yearly session grid and rising 200-day MA. Recent signals across US indices align with ongoing uptrends; leading instruments (ES, NQ) continue to confirm a rally phase. Overall, the HTF landscape reflects dominant trend continuation for US indices, while FDAX is consolidating/correcting within a longer-term upward structure.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

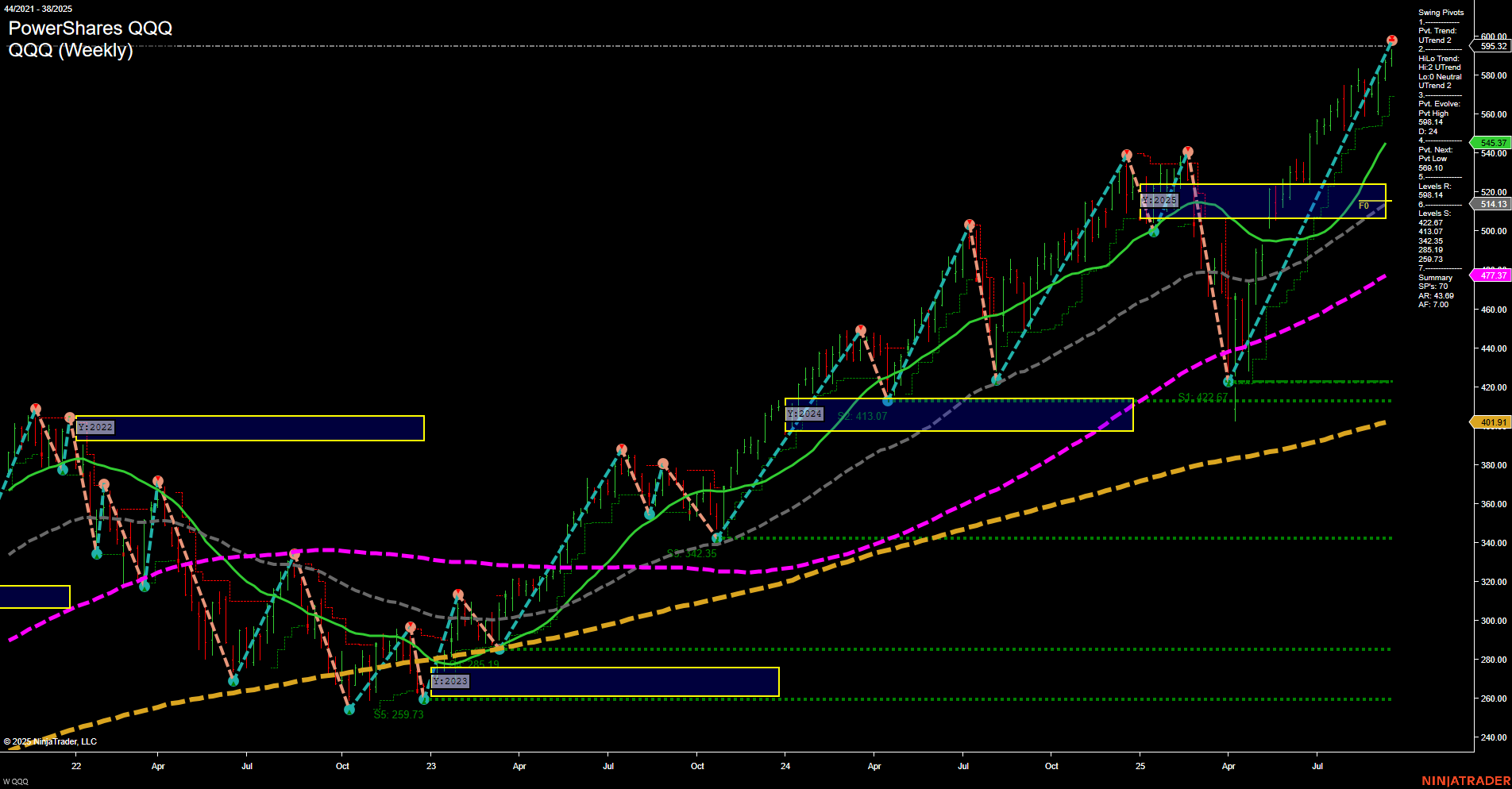

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts