After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Commodities: Crude oil rallied early, remaining rangebound, but later gained nearly 2% as supply disruptions in Iraq triggered a rebound after recent declines. Gold continued its surge, breaking above $3,800 and setting fresh highs, with analysts projecting possible further gains above $4,000 by year-end. Silver and platinum also benefited as demand for precious metals increased amid geopolitical tensions.

- Equities: U.S. equity indices had extended gains over the prior sessions, with both large- and small-cap stocks reaching new highs fueled by Fed rate cuts, strong demand for tech and AI-related stocks, and optimism around U.S. growth. Recently, major indices paused as tech stocks pulled back, breaking their winning streak. Midcap stocks and active ETFs received attention for their resilience and outperformance during this cycle. Equity valuations remain elevated, prompting debate over complacency and risk.

- Federal Reserve & Macroeconomics: Fed Chair Powell indicated the central bank cut rates in response to a softening labor market, and signaled further moves would be cautious, noting divisions among Fed officials. Asset prices, including equities, are considered “fairly highly valued.” Despite economic resilience, Powell cited the dual risks of persistent inflation and weakening jobs data as a “challenging situation.” The debate on timing and magnitude of future rate cuts fuels ongoing market volatility.

- Investor Sentiment & Outlook: There is considerable optimism, with several analysts labeling the current equity environment as “euphoric” and expecting further gains, particularly in risk and AI-driven assets. Meanwhile, some caution that high P/E ratios and low volatility levels might mask underlying risks. Gold and equities both setting record highs is highlighted as a rare phenomenon, possibly signaling mixed investor signals.

- Global Markets: China is seeking to expand its role in the global gold trade, which could influence international precious metals flows going forward.

News Conclusion

- The U.S. stock market remains in a strong uptrend with robust appetite for equities, especially in technology and AI sectors, despite a pullback in key tech stocks at session end.

- The Federal Reserve’s recent rate cut and Powell’s cautious tone have contributed both support and uncertainty, as officials are divided over the future rate trajectory amid mixed economic signals.

- Commodities, especially gold, have gained significant momentum, with gold approaching record highs and projected to be a standout asset class for the year.

- Valuation concerns and muted volatility could present latent risks, even as overall sentiment remains largely positive.

Market News Sentiment:

Market News Articles: 43

- Positive: 44.19%

- Neutral: 39.53%

- Negative: 16.28%

GLD,Gold Articles: 14

- Positive: 42.86%

- Neutral: 35.71%

- Negative: 21.43%

USO,Oil Articles: 5

- Positive: 60.00%

- Neutral: 40.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 23, 2025 05:00

- USO 75.05 Bullish 2.18%

- TLT 89.32 Bullish 0.70%

- GLD 346.46 Bullish 0.41%

- IJH 65.53 Bearish -0.09%

- DIA 462.87 Bearish -0.17%

- GOOG 252.34 Bearish -0.21%

- IWM 243.84 Bearish -0.23%

- IBIT 63.41 Bearish -0.38%

- SPY 663.21 Bearish -0.54%

- AAPL 254.43 Bearish -0.64%

- QQQ 598.20 Bearish -0.66%

- MSFT 509.23 Bearish -1.01%

- META 755.40 Bearish -1.28%

- TSLA 425.85 Bearish -1.93%

- NVDA 178.43 Bearish -2.82%

- AMZN 220.71 Bearish -3.04%

Market Overview (Snapshot as of 09/23/2025 17:00:00)

The latest snapshot reveals a mostly bearish tone across major equity ETFs, the “Magnificent 7” tech stocks, and some leading sector ETFs, with a few exceptions driven by commodities and bonds. Traders are observing a risk-off sentiment in equities while traditional defensive havens show strength.

ETF Stocks

- SPY (S&P 500): 663.21, Bearing pressure with a drop of -0.54% indicates broad market softness.

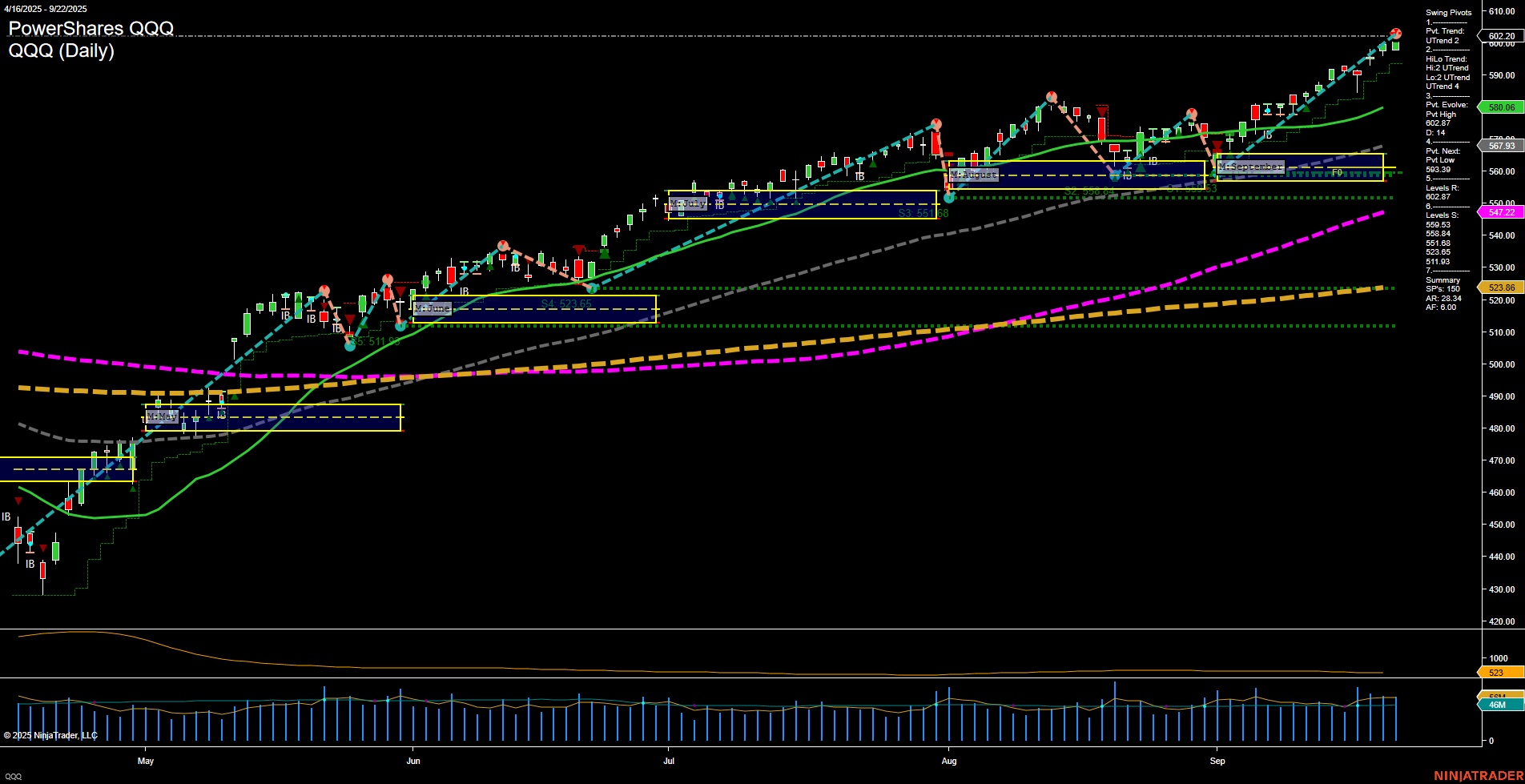

- QQQ (Nasdaq 100): 598.20, Bearish at -0.66%, tech-heavy names are underperforming.

- IWM (Russell 2000): 243.84, Bearish by -0.23%, small-cap weakness persists.

- IJH (S&P MidCap 400): 65.53, Bearish at -0.09%, showing minor downside.

- DIA (Dow Industrials): 462.87, Bearish -0.17%, large caps remain under pressure.

Magnificent 7 Technology Leaders

- AAPL (Apple): 254.43, Bearish -0.64%.

- MSFT (Microsoft): 509.23, Bearish -1.01%.

- GOOG (Alphabet): 252.34, Bearish -0.21%.

- AMZN (Amazon): 220.71, Bearish -3.04% (largest Magnificent 7 decline).

- META (Meta): 755.40, Bearish -1.28%.

- NVDA (Nvidia): 178.43, Bearish -2.82%.

- TSLA (Tesla): 425.85, Bearish -1.93%.

All Magnificent 7 constituents are down, with largest downside momentum in AMZN, NVDA, and TSLA. Growth and tech are under pronounced pressure.

Other Notable ETFs

- USO (Oil): 75.05, Bullish +2.18%. Energy bucks the trend, oil surges.

- TLT (Long-term Treasuries): 89.32, Bullish +0.70%. Bonds attract safe-haven flows.

- GLD (Gold): 346.46, Bullish +0.41%. Gold shows modest strength.

- IBIT (Bitcoin ETF): 63.41, Bearish -0.38%. Crypto-related assets join broader weakness.

Summary

At this market snapshot, equity indices and leading technology stocks exhibit a clear bearish bias. Commodities—particularly oil—and bonds demonstrate resilience, highlighting rotation toward defensive sectors. The overarching sentiment is risk-averse, with mixed pockets of strength in traditional hedges.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts