After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

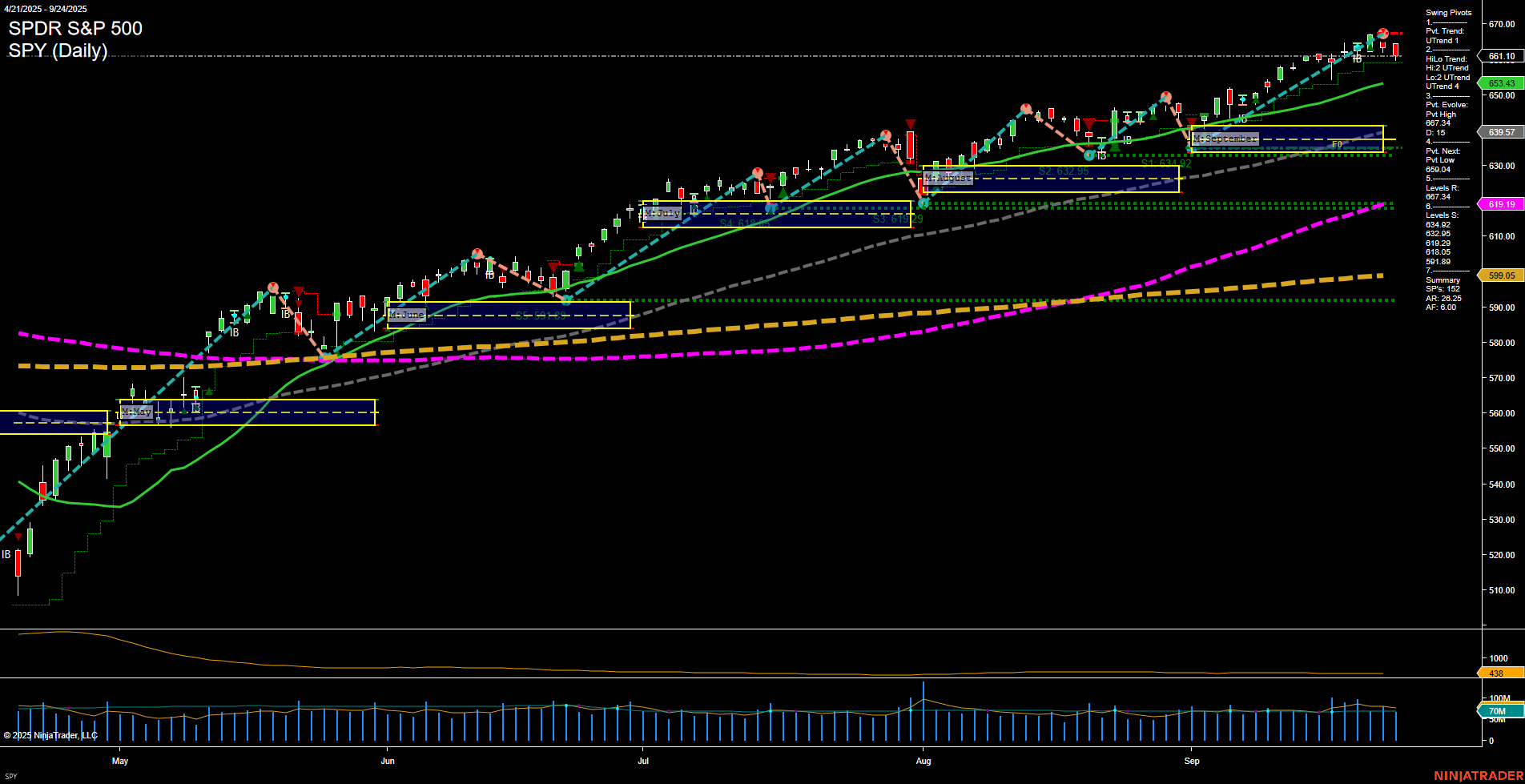

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Oil Markets: Oil prices are under pressure amid oversupply concerns and weaker macro data, with forecasts lowered and inventory builds expected into 2026. Despite this, oil experienced a bullish technical breakout toward $67–$68, even as WTI briefly tested $65. Shale oil producers signal investment delays due to policy uncertainty and low price outlooks.

- Gold and Precious Metals: Gold prices softened after robust U.S. economic data dampened hopes for imminent Fed rate cuts. The metal remains near historic overbought levels, signaling potential for further corrections or pullbacks after recent rallies. Silver continues to outperform, testing multi-year highs, largely on U.S. GDP strength.

- U.S. Economy: The economy grew faster than expected in Q2 2025, with GDP revised up to 3.8% on strong consumer spending. This has fueled debate over the number and pace of future rate cuts, as Fed officials voice caution given persistent economic resilience and inflation control.

- Equity Markets: Despite overall economic strength, U.S. stock indices fell for a third straight day ahead of key inflation data, weighed down by mixed signals and valuation concerns. Mega-cap tech and AI stocks continue to show divergence, with some warning signs of a correction as their momentum lags compared to the rest of the market.

- ETF and Sector Trends: Active ETF launches remain elevated, while dividend ETFs gain attention for income strategies. The TSX index outperformed globally, fueled by gold mining shares, and market participants debate if high equity valuations represent a warning or a new market norm.

- Global Policy Moves: Mexico’s central bank cut rates to a three-year low with possible further reductions, while U.S. tariff revenues hit records amidst legal challenges. Political and policy uncertainty continues to influence market sentiment, especially in oil and energy sectors.

News Conclusion

- Upgraded U.S. economic growth has complicated the outlook for interest rates, leading to divided expectations on Fed policy and weighing on market sentiment.

- Oil markets face downward pressure from oversupply and investment headwinds, though technical factors suggest possible rebound attempts.

- Gold and silver are responding to shifting macro conditions, with gold facing overbought signals and rate cut uncertainty, while silver tests highs on growth data.

- Equities navigate a crosscurrent of robust economic performance, high valuations, and sector divergences as technology momentum fades and defensive strategies gain traction.

- Active risk management and sector rotation remain topics as global policy and political developments continue to impact capital flows and market volatility.

Market News Sentiment:

Market News Articles: 45

- Neutral: 42.22%

- Positive: 40.00%

- Negative: 17.78%

GLD,Gold Articles: 12

- Neutral: 50.00%

- Positive: 33.33%

- Negative: 16.67%

USO,Oil Articles: 9

- Neutral: 44.44%

- Positive: 33.33%

- Negative: 22.22%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 25, 2025 05:00

- AAPL 256.87 Bullish 1.81%

- USO 76.99 Bullish 0.79%

- GLD 344.75 Bullish 0.42%

- NVDA 177.69 Bullish 0.41%

- TLT 88.98 Bearish 0.00%

- DIA 459.43 Bearish -0.34%

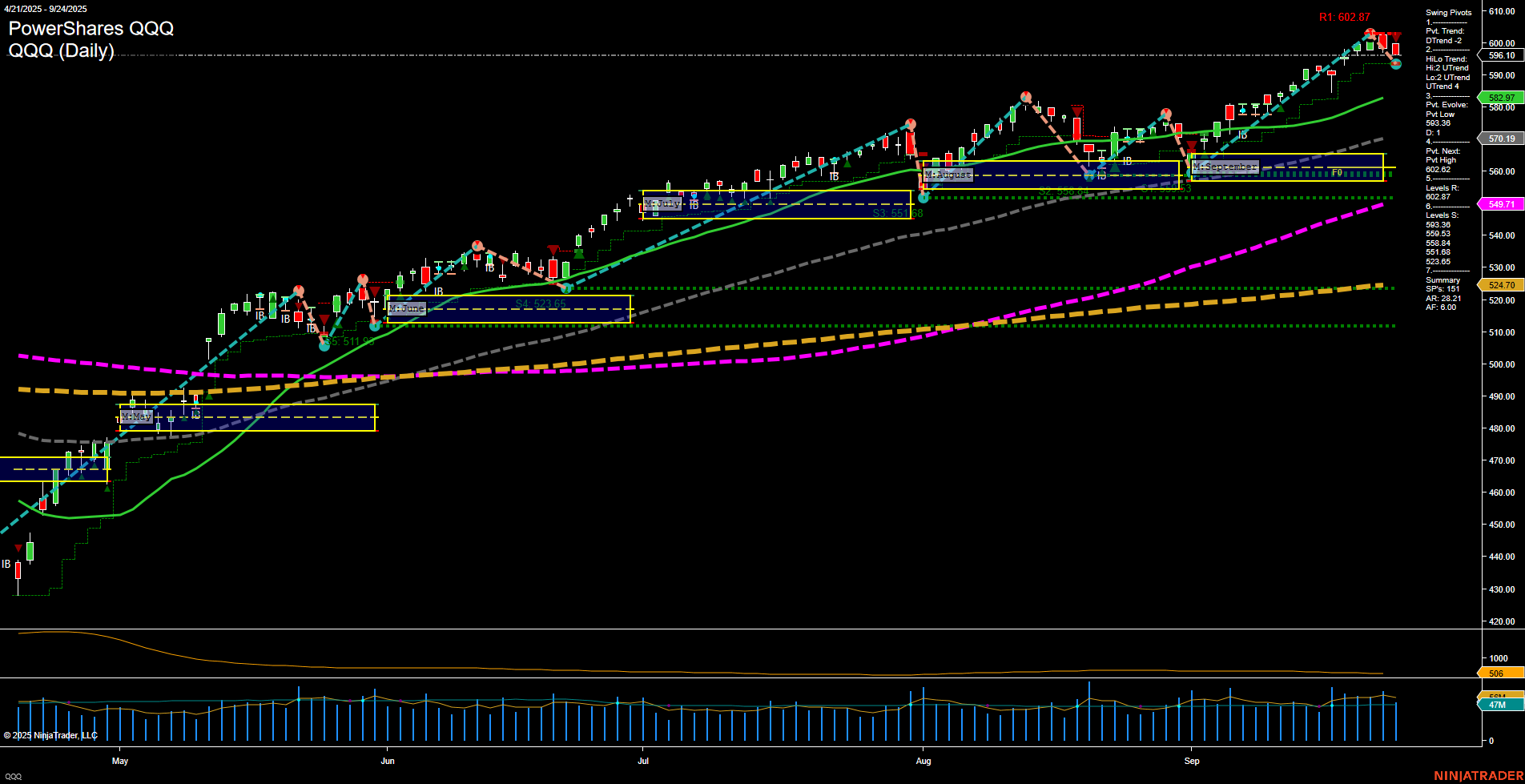

- QQQ 593.53 Bearish -0.43%

- SPY 658.05 Bearish -0.46%

- GOOG 246.57 Bearish -0.51%

- IJH 64.68 Bearish -0.55%

- MSFT 507.03 Bearish -0.61%

- AMZN 218.15 Bearish -0.94%

- IWM 239.29 Bearish -0.96%

- META 748.91 Bearish -1.54%

- IBIT 62.10 Bearish -3.60%

- TSLA 423.39 Bearish -4.38%

Market Summary: ETF Stocks, Mag7, and Key ETFs (as of 09/25/2025)

ETF Stocks Overview

- SPY: 658.05 (Bearish, -0.46%) – Broad market ETF under pressure, leading in large-cap declines.

- QQQ: 593.53 (Bearish, -0.43%) – Tech-heavy Nasdaq ETF weakens joins broad market pullback.

- IWM: 239.29 (Bearish, -0.96%) – Small caps face notable downside pressure.

- IJH: 64.68 (Bearish, -0.55%) – Midcap ETF slides modestly, in line with broader trend.

- DIA: 459.43 (Bearish, -0.34%) – Dow Jones tracking ETF softer but holds relative support vs peers.

State of Play: ETF stocks show a broad-based bearish/mixed posture as all majors are in negative territory, with relatively sharper declines in small and midcaps.

Magnificent 7 Snapshot

- AAPL: 256.87 (Bullish, +1.81%) – Stands out as the strongest major, with significant positive momentum.

- NVDA: 177.69 (Bullish, +0.41%) – Modest upside trails Apple, with some rotation into semiconductors.

- GOOG: 246.57 (Bearish, -0.51%) – Weakens alongside broader tech stack.

- MSFT: 507.03 (Bearish, -0.61%) – Continues to slide despite its defensive qualities in tech.

- AMZN: 218.15 (Bearish, -0.94%) – Retreats further; e-commerce and cloud exposure underperforming.

- META: 748.91 (Bearish, -1.54%) – Heaviest tech decliner today, faces elevated selling pressure.

- TSLA: 423.39 (Bearish, -4.38%) – Severe downside move, weakest Mag7 performer as volatility amplifies.

State of Play: Majority of Mag7 are under negative pressure, except AAPL and NVDA. TSLA and META stand out with outsized declines.

Other Notable ETFs

- TLT: 88.98 (Bearish, 0.00%) – No movement on the day; yields vigilantly watched.

- GLD: 344.75 (Bullish, +0.42%) – Gold ETF edges higher, signaling ongoing defensive positioning.

- USO: 76.99 (Bullish, +0.79%) – Oil prices trend up, energy sector outperforms risk assets.

- IBIT: 62.10 (Bearish, -3.60%) – Spot Bitcoin ETF faces steep losses amid crypto volatility.

State of Play: Commodity-linked ETFs (GLD, USO) are modestly positive, diverging from broad equity and bond weakness. Digital asset ETFs (IBIT) see pronounced volatility and declines.

Summary Table: Bullish vs. Bearish vs. Mixed

- Bullish: AAPL, NVDA, GLD, USO

- Bearish: SPY, QQQ, IWM, IJH, DIA, GOOG, MSFT, AMZN, META, TSLA, TLT, IBIT

- Mixed/Neutral: None in today’s snapshot

The prevailing tone is negative across most equity and cryptocurrency-related ETFs, with notable isolated strength in select commodities and specific tech stocks (primarily AAPL, NVDA).

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts