Market Roundup – NYSE After Market Close Bullish as of September 30, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

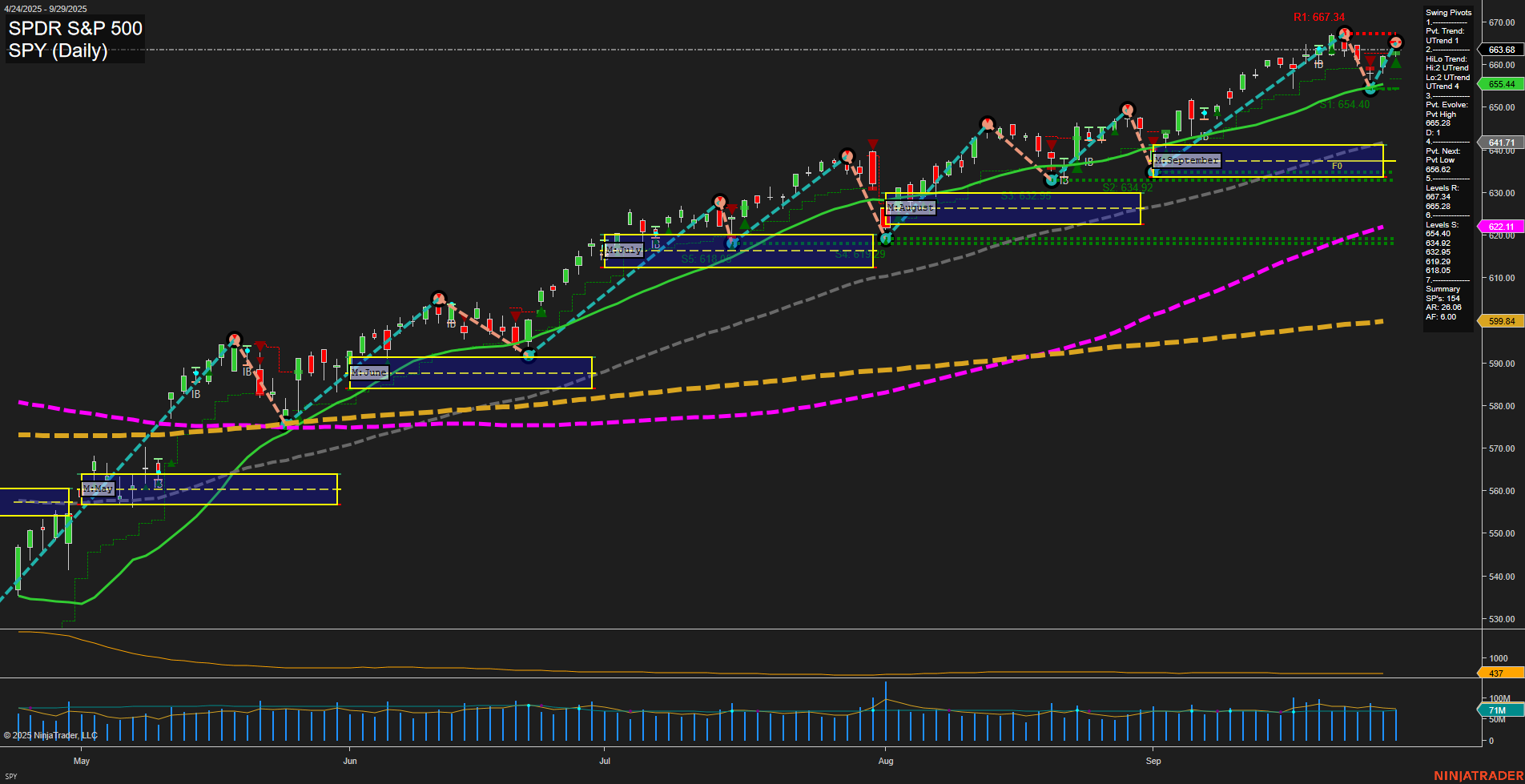

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Government Shutdown Risks: U.S. equities faced headwinds as concerns over a looming government shutdown grew. This risk delayed key economic data releases, raising anxiety about the Federal Reserve’s response. Historically, shutdowns impact trading volumes, market data flow, and select federal programs.

- Major Indices and Sector Moves: Despite shutdown worries, the S&P 500 and Dow Jones finished higher. Tech and small caps led gains, with the Dow closing at a record high. Market breadth remains narrow amid outperformance by select large cap names and ongoing debate about elevated stock valuations.

- Commodities Highlights: Gold rallied to fresh records, supported by safe-haven demand against rising government debt and policy uncertainty. Gold ETFs and physical buying, particularly from India, surged despite high prices and profit-taking in silver and platinum. Oil prices slipped over 1%, pressured by production speculation and OPEC+ headlines, but analysts remain constructive if key support holds. Natural gas and oil forecasts remain choppy amid volatility.

- Macro and Corporate Headlines: Sluggish economic data—including a drop in Chicago PMI—added to market caution. Treasuries delivered their best returns since 2020 as investors positioned defensively. Large oil companies continued cost-cutting amid persistent lower prices. The SEC cleared a new stock exchange for Texas, and Morgan Stanley got a reduced capital buffer.

- Outlook and Market Sentiment: September saw indexes defy seasonal weakness, fueled by robust tech leadership and AI enthusiasm. Market participants debated overvaluation risks, with prominent investors warning of potential pullbacks even as the rally persisted. Analyst consensus expects a possibility of two rate cuts in 2025 and ongoing volatility in Q4.

News Conclusion

- The trading session was shaped by heightened uncertainty around a U.S. government shutdown, resulting in cautious flows across equities, bonds, and commodities.

- Major indices closed with gains, supported by strength in technology and large-cap stocks, while market breadth remains concentrated and valuations stretched.

- Commodities saw divergent trends: gold surged as a preferred hedge, while profit-taking hit silver and platinum; energy markets weakened on production rumors.

- Mixed economic data and profit warnings kept investor sentiment in check, though defensive assets like Treasuries and gold outperformed.

- The broader outlook stays constructive, barring short-term volatility as investors navigate macro risk and sector rotations heading into the new quarter.

Market News Sentiment:

Market News Articles: 46

- Neutral: 43.48%

- Positive: 36.96%

- Negative: 19.57%

GLD,Gold Articles: 14

- Positive: 57.14%

- Negative: 21.43%

- Neutral: 21.43%

USO,Oil Articles: 9

- Negative: 66.67%

- Positive: 33.33%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 30, 2025 05:00

- NVDA 186.58 Bullish 2.60%

- GLD 355.47 Bullish 0.85%

- MSFT 517.95 Bullish 0.65%

- SPY 666.18 Bullish 0.38%

- TSLA 444.72 Bullish 0.34%

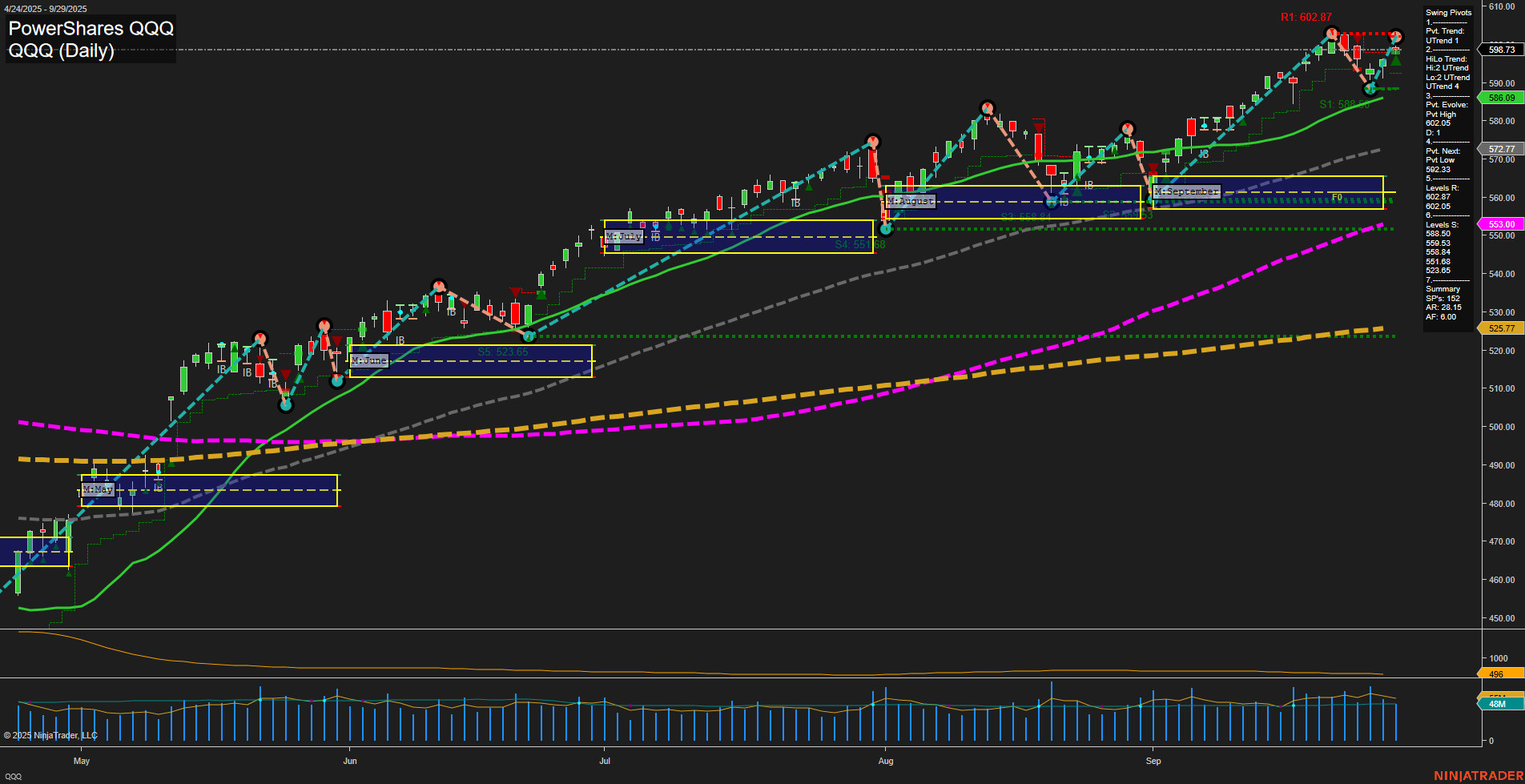

- QQQ 600.37 Bullish 0.27%

- DIA 463.74 Bullish 0.15%

- IWM 241.96 Bullish 0.14%

- IJH 65.26 Bullish 0.11%

- AAPL 254.63 Bullish 0.08%

- IBIT 65.00 Bullish 0.05%

- TLT 89.37 Bearish -0.29%

- GOOG 243.55 Bearish -0.33%

- USO 73.75 Bearish -1.13%

- AMZN 219.57 Bearish -1.17%

- META 734.38 Bearish -1.21%

Market Summary: ETF Stocks, Mag7, and Other ETFs

ETF Stocks Overview (SPY, QQQ, IWM, IJH, DIA)

- SPY: 666.18 (Bullish, +0.38%) – The S&P 500 ETF shows steady upward momentum, contributing to positive sentiment across large-cap equities.

- QQQ: 600.37 (Bullish, +0.27%) – Nasdaq-tracking QQQ is firmly bullish, mirroring strength in technology-focused names.

- DIA: 463.74 (Bullish, +0.15%) – The Dow Jones ETF moves higher, supported by modest gains in industrials and blue chips.

- IWM: 241.96 (Bullish, +0.14%) – Small caps in IWM participate with a mild bullish bias.

- IJH: 65.26 (Bullish, +0.11%) – Mid-cap exposures in IJH register incremental advances.

Mag7 Stocks (AAPL, MSFT, GOOG, AMZN, META, NVDA, TSLA)

- NVDA: 186.58 (Bullish, +2.60%) – Nvidia leads tech with outsized gains, fueling positive momentum for the sector.

- MSFT: 517.95 (Bullish, +0.65%) – Microsoft posts solid advances, contributing to tech’s general outperformance.

- AAPL: 254.63 (Bullish, +0.08%) – Apple ekes out a small gain, reflecting stable demand.

- TSLA: 444.72 (Bullish, +0.34%) – Tesla records gains, lifting sentiment in disruptive growth names.

- GOOG: 243.55 (Bearish, -0.33%) – Google trends lower, standing in contrast to other big tech performers.

- AMZN: 219.57 (Bearish, -1.17%) – Amazon moves decisively lower, reflecting sector rotation or company-specific factors.

- META: 734.38 (Bearish, -1.21%) – Meta underperforms, with technology breadth mixed.

Other Key ETFs

- GLD: 355.47 (Bullish, +0.85%) – Gold ETF advances as investors seek exposure to precious metals.

- IBIT: 65.00 (Bullish, +0.05%) – IBIT shows a neutral to mildly bullish stance, with Bitcoin-linked sentiment stable.

- TLT: 89.37 (Bearish, -0.29%) – Treasury bond ETF slips, suggesting rate pressures or shifting demand for safe havens.

- USO: 73.75 (Bearish, -1.13%) – Oil ETF sees notable declines, underscoring commodity or macro uncertainty.

State of Play

The snapshot reflects a bullish predominance across broad market ETFs and technology leaders, especially semiconductor and cloud names. Some Mag7 components are mixed, with notable weakness in GOOG, AMZN, and META. Commodity-linked (USO) and fixed income (TLT) ETFs turn negative, while gold is in favor. Bitcoin exposure remains stable to softly bullish.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts