After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

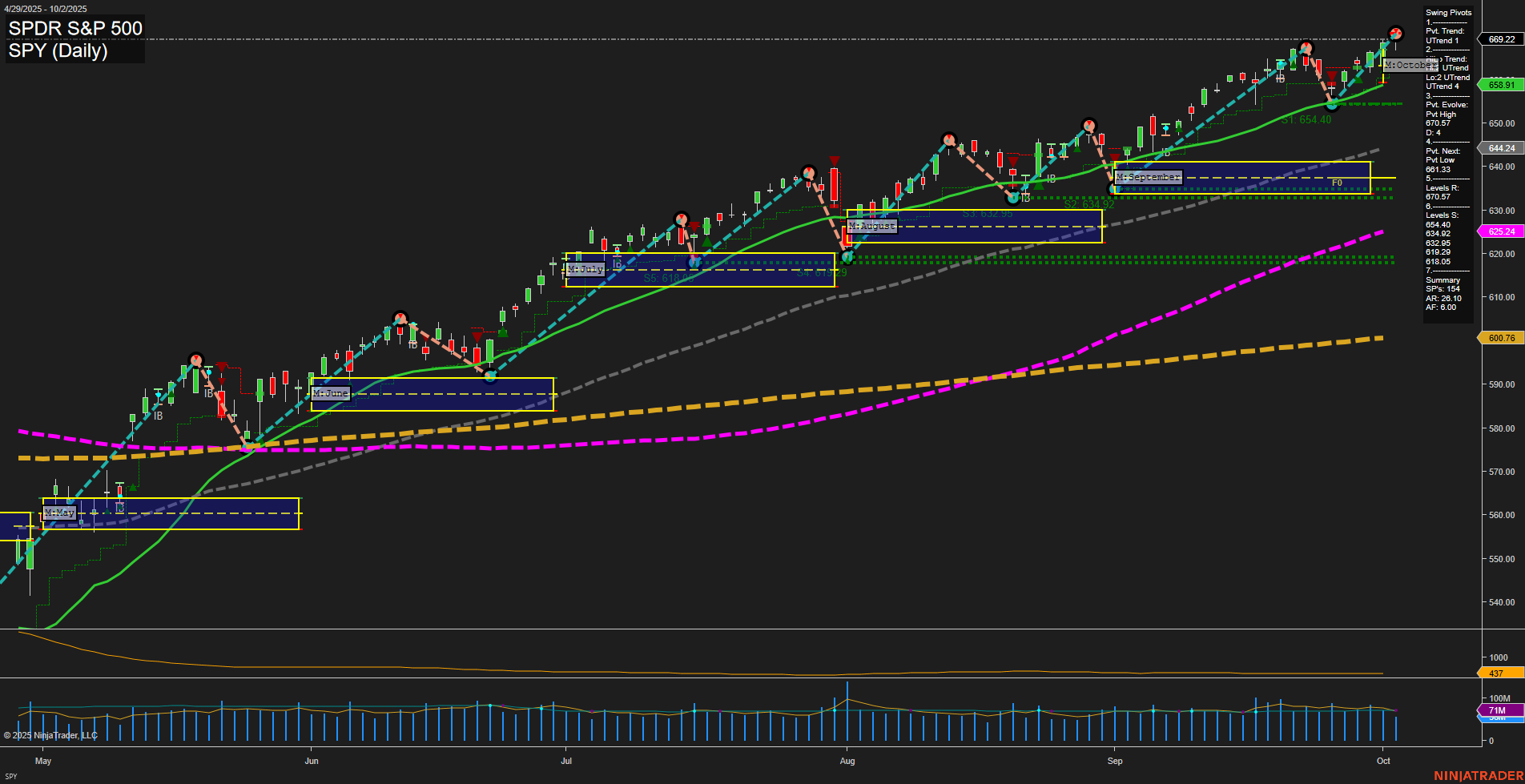

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Indices and Stocks: U.S. equities closed the week with strong momentum, with the S&P 500, Dow Jones, Nasdaq 100, and Russell 2000 all reaching record highs. The S&P 500 extended its winning streak to six days, gaining 1.1% for the week. However, there are underlying market concerns as some investors grow wary of stretched valuations and the heavy concentration of gains in large AI-driven tech stocks.

- AI Sector: AI remains a dominant theme, driving much of the recent economic and market growth, with significant investments by leading tech firms. Startups and smaller AI companies are not yet seeing the same attention, and there’s increased focus on distinguishing quality within the sector.

- Dividend and Defensive Plays: High-quality dividend growth stocks have outperformed, with a notable subset offering attractive return estimates and undervaluation. Monthly dividend ETFs have delivered superior returns and more frequent payouts than traditional vehicles. Defensive stock interest is rising amid growing economic uncertainties.

- Small Caps: Bank of America highlights potential in small cap stocks, indicating possible rally opportunities within select segments.

- Gold and Precious Metals: Gold prices maintained a strong bid, with continued momentum toward $4,000/oz, even as risks of a short-term pullback appeared. Silver and platinum prices are also surging, reflecting a broader move into precious metals amid monetary policy and economic uncertainty.

- Oil Market: Oil futures suffered their steepest weekly decline in over three months due to oversupply concerns. Despite this, OPEC+ is expected to vote for another production hike, with internal debate regarding the magnitude of the increase.

- Macro & Policy Themes: The U.S. government shutdown continued throughout the week, which limited the release of key economic data like nonfarm payrolls. The focus has shifted toward upcoming Federal Reserve meeting minutes and broader policy signals. The job market shows possible early signs of stress, with an uptick in unemployment claims and the risk of further labor market weakness if policy support wanes.

News Conclusion

- Market sentiment was bullish, with record-setting gains in major indices, despite a backdrop of caution surrounding valuations and economic fundamentals.

- AI continues to be a critical driver for both equity performance and underlying economic growth, but selectivity within the sector is becoming more crucial.

- Defensive positioning is gaining attention in light of macro risks, with both dividend growth and precious metals acting as magnets for capital flows.

- Oil and energy markets remain volatile, with supply concerns and upcoming OPEC+ decisions adding to uncertainty.

- The market is largely disregarding immediate negative developments such as the government shutdown and mixed signals from the labor market, focusing instead on Fed policy and broader liquidity conditions.

Market News Sentiment:

Market News Articles: 43

- Positive: 46.51%

- Neutral: 39.53%

- Negative: 13.95%

GLD,Gold Articles: 16

- Positive: 62.50%

- Neutral: 18.75%

- Negative: 18.75%

USO,Oil Articles: 7

- Neutral: 42.86%

- Positive: 28.57%

- Negative: 28.57%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 3, 2025 05:00

- IBIT 69.81 Bullish 1.51%

- GLD 357.64 Bullish 0.80%

- IWM 245.83 Bullish 0.74%

- DIA 467.51 Bullish 0.52%

- AAPL 258.02 Bullish 0.35%

- MSFT 517.35 Bullish 0.31%

- IJH 65.77 Bullish 0.30%

- USO 71.71 Bullish 0.24%

- GOOG 246.45 Bullish 0.01%

- SPY 669.21 Bearish -0.00%

- TLT 89.38 Bearish -0.19%

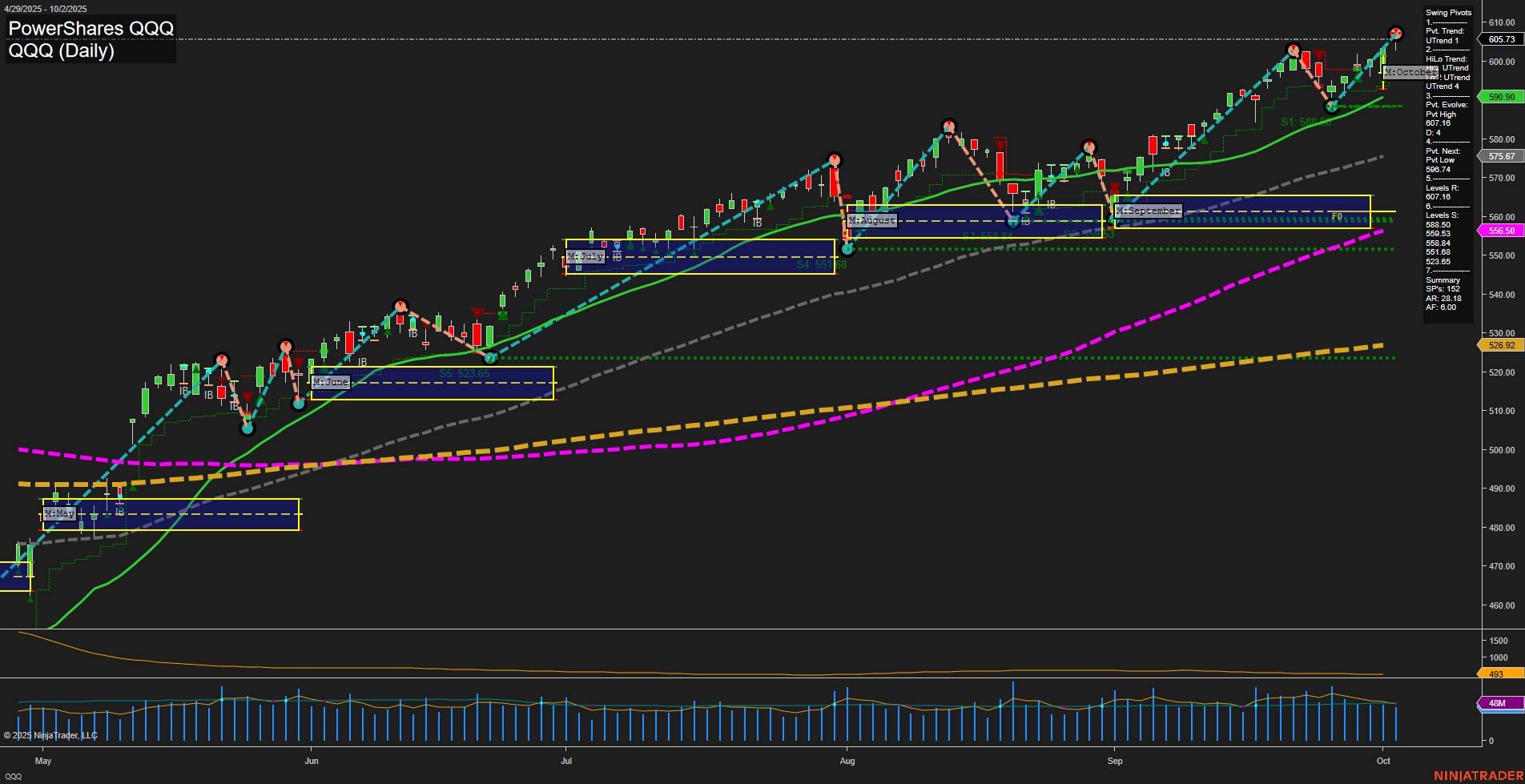

- QQQ 603.18 Bearish -0.42%

- NVDA 187.62 Bearish -0.67%

- AMZN 219.51 Bearish -1.30%

- TSLA 429.83 Bearish -1.42%

- META 710.56 Bearish -2.27%

Market Summary: State of Play (As of 2025-10-03 17:00)

ETFs & Major Indices

- Bullish Momentum:

- IBIT 69.81 (+1.51%) – Strong crypto-related ETF performance leading gains.

- GLD 357.64 (+0.80%) – Gold continues to show haven demand.

- IWM 245.83 (+0.74%) – Small caps trending higher.

- DIA 467.51 (+0.52%) – Dow stocks maintain positive bias.

- IJH 65.77 (+0.30%) – Mid-cap segment holds firm.

- USO 71.71 (+0.24%) – Oil ETF modestly bid.

- Bearish Pressure:

- SPY 669.21 (-0.00%) – S&P 500 at standstill but slightly leaning downward.

- QQQ 603.18 (-0.42%) – Tech-heavy Nasdaq ETF faces downside.

- TLT 89.38 (-0.19%) – Long-term Treasurys continue to slip.

MAG7 Stock Snapshot

- Bullish:

- AAPL 258.02 (+0.35%) – Mild gains in Apple.

- MSFT 517.35 (+0.31%) – Microsoft advances.

- GOOG 246.45 (+0.01%) – Alphabet barely higher.

- Bearish:

- NVDA 187.62 (-0.67%) – NVIDIA facing some profit-taking.

- AMZN 219.51 (-1.30%) – Amazon trades lower.

- TSLA 429.83 (-1.42%) – Tesla under pressure.

- META 710.56 (-2.27%) – Meta notable laggard among MAG7.

Mixed Market Themes

Today’s session exhibits mixed signals. Alternative assets (IBIT, GLD) and small-to-mid cap equities (IWM, IJH) are leading the advance. Traditional large-cap indices and tech giants present a split picture: some, like AAPL and MSFT, garner mild gains, while others, such as META and TSLA, are seeing sharper declines. Treasuries and tech-focused ETFs (QQQ, TLT) remain under bearish bias.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts