After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

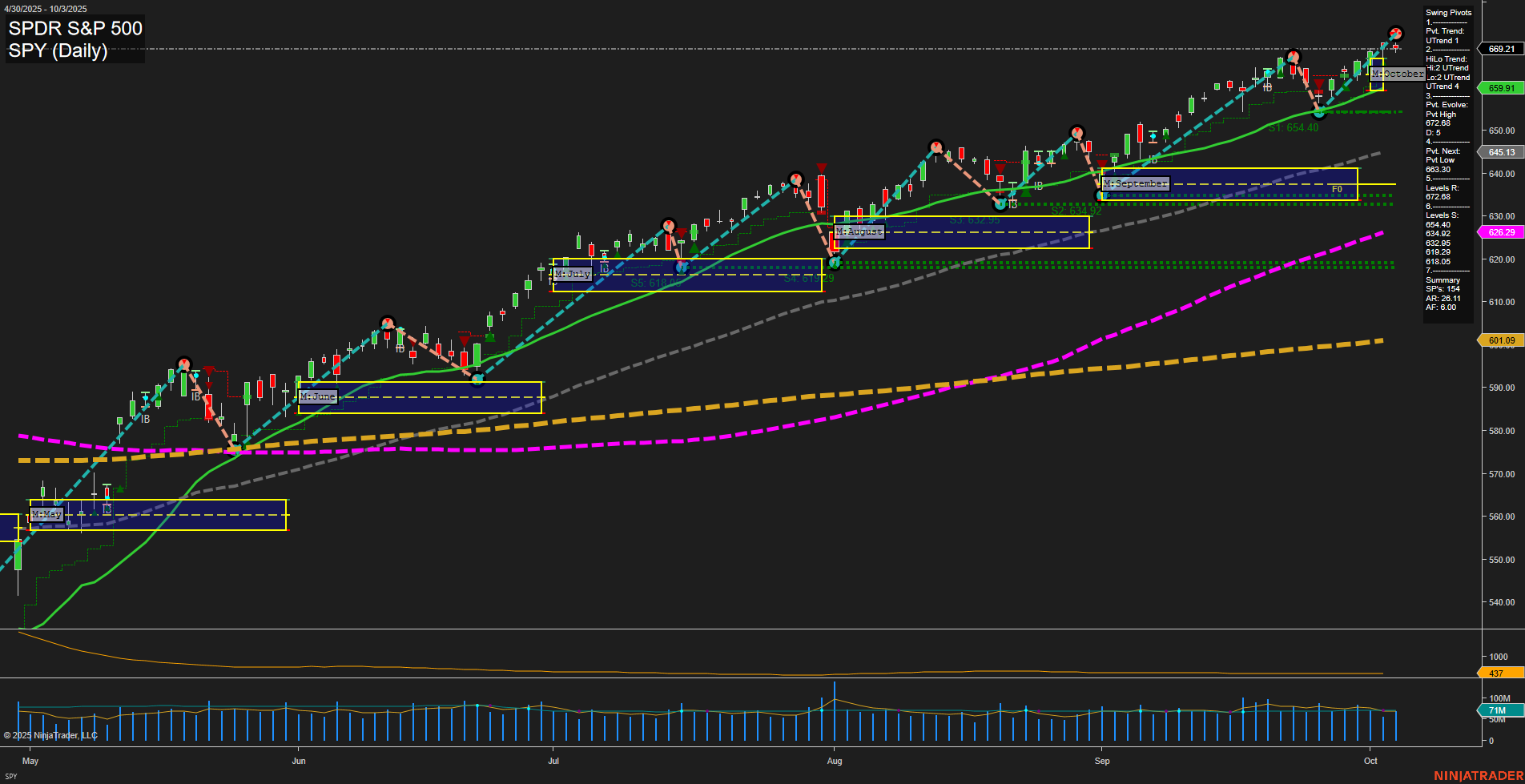

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Indices and Wall Street: Major U.S. indices, including the S&P 500 and Nasdaq, reached new record highs amid continued enthusiasm for AI and technology stocks. Notably, the S&P 500 achieved its 32nd record close of the year. Optimism around upcoming Q3 earnings, with expectations for positive surprises, is supporting momentum. Several analysts highlighted ongoing bullish signals, despite pockets of concern.

- Tech & AI Focus: Technology and AI-related stocks drove market leadership, strengthened by news of AMD’s surge after an OpenAI partnership. Market commentary suggested this tech-driven bull market still has room to run.

- Precious Metals: Gold prices soared above $3,950, approaching the $4,000 mark, driven by global uncertainty and political crises, especially in France. While some warn of a possible correction at these elevated levels, the rally remains notable.

- Commodities—Oil & Energy: Oil markets saw mixed sentiment following OPEC+’s modest production increase of 137,000 bpd. Oil prices initially climbed, but a rise in inventories and weak macroeconomic data brought a more bearish tone by the end of the session.

- Macro & Currency Moves: The euro and yen weakened against the dollar following leadership changes in Japan and political developments in France. Despite headlines around a U.S. government shutdown, market impact appears limited so far. Concern was noted for the financial sector with hints of deeper issues in credit markets and a lack of BLS economic data due to the shutdown.

- Earnings Season & Buybacks: Anticipation is high for robust third-quarter earnings—especially in tech—and corporate buybacks remain a strong supporting factor for equities, though fewer firms are participating in repurchases compared to previous years.

- Labor Market Concerns: Reporting disruptions from the government shutdown have limited official U.S. employment visibility, but alternative data suggest continued softness and rising unemployment.

News Conclusion

- U.S. equities are fueled by strong momentum in tech and AI, driving indices to fresh highs. Sentiment is positive with rate-cut optimism in play and expectations that third-quarter earnings could exceed forecasts.

- Gold is experiencing a powerful rally amid global uncertainty, but caution is advised on the potential for a pullback as prices near record territory.

- Oil price action remains volatile, with initial bullishness on limited OPEC+ supply increases giving way to concerns over inventory builds and softer macro trends.

- Currency markets are reacting to political developments in Europe and Japan, and financial-sector stress is being monitored closely amid ongoing U.S. macro and labor-market uncertainty.

- Day traders face an environment of heightened volatility, record highs in indices and gold, and an earnings season that could provide fresh catalysts for short-term moves.

Market News Sentiment:

Market News Articles: 47

- Positive: 40.43%

- Neutral: 29.79%

- Negative: 29.79%

GLD,Gold Articles: 17

- Positive: 70.59%

- Neutral: 23.53%

- Negative: 5.88%

USO,Oil Articles: 7

- Neutral: 57.14%

- Positive: 28.57%

- Negative: 14.29%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 6, 2025 05:00

- TSLA 453.25 Bullish 5.45%

- MSFT 528.57 Bullish 2.17%

- IBIT 71.29 Bullish 2.12%

- GOOG 251.51 Bullish 2.05%

- GLD 364.38 Bullish 1.88%

- USO 72.87 Bullish 1.62%

- QQQ 607.71 Bullish 0.75%

- META 715.66 Bullish 0.72%

- AMZN 220.90 Bullish 0.63%

- IWM 246.81 Bullish 0.40%

- SPY 671.61 Bullish 0.36%

- IJH 65.88 Bullish 0.17%

- DIA 466.84 Bearish -0.14%

- AAPL 256.69 Bearish -0.52%

- TLT 88.67 Bearish -0.79%

- NVDA 185.54 Bearish -1.11%

Market Summary – State of Play (as of 10/06/2025 17:00:00)

Major ETF Stocks

- SPY: 671.61 (Bullish +0.36%) – S&P 500 ETF ended the session with modest gains, reflecting ongoing confidence in large-cap U.S. equities.

- QQQ: 607.71 (Bullish +0.75%) – The Nasdaq 100 ETF displayed relative strength, buoyed by tech sector resilience.

- IWM: 246.81 (Bullish +0.40%) – Russell 2000 ETF ticked higher, indicating steady performance in small cap stocks.

- IJH: 65.88 (Bullish +0.17%) – The S&P MidCap 400 ETF saw slight positive movement, with sector rotation favoring midcaps.

- DIA: 466.84 (Bearish -0.14%) – Dow Jones ETF slipped slightly, underperforming broader indices.

Overview: ETF stocks mostly trended higher, except for DIA (Dow Jones), which showed mild weakness.

Mag 7 (Mega Cap Tech)

- TSLA: 453.25 (Bullish +5.45%) – Tesla surged, posting the largest gain among Mag 7 stocks today.

- MSFT: 528.57 (Bullish +2.17%) – Microsoft advanced strongly, supporting tech ETF movement.

- GOOG: 251.51 (Bullish +2.05%) – Alphabet made solid gains as tech outperformed.

- META: 715.66 (Bullish +0.72%) – Meta Platforms edged higher, tracking positive tech trends.

- AMZN: 220.90 (Bullish +0.63%) – Amazon participated in the broader market strength.

- AAPL: 256.69 (Bearish -0.52%) – Apple lagged, slipping modestly against the broader bullish tone.

- NVDA: 185.54 (Bearish -1.11%) – Nvidia declined, the weakest among the group, weighing on semiconductor sentiment.

Overview: Tech mega caps were mostly bullish, led by strong momentum in Tesla, Microsoft, and Google; Apple and Nvidia were notable underperformers.

Other Key ETFs

- TLT: 88.67 (Bearish -0.79%) – Long-term Treasury ETF declined further, reflecting higher yields and continued bond market weakness.

- GLD: 364.38 (Bullish +1.88%) – Gold ETF rallied, indicating renewed demand for safe haven assets.

- USO: 72.87 (Bullish +1.62%) – U.S. Oil ETF climbed as energy prices found renewed upward momentum.

- IBIT: 71.29 (Bullish +2.12%) – Bitcoin ETF posted strong gains, aligning with increased interest in digital assets.

Overview: Commodity-linked ETFs (GLD, USO) performed well alongside digital asset ETF IBIT, while TLT remained under pressure.

General Sentiment

The snapshot reveals a broadly bullish tone across major equity indices and technology leaders, with select weakness in Apple, Nvidia, and the Dow ETF. Notably, energy, metals, and digital asset ETFs outperformed, while long-duration bonds continued to face headwinds.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts