Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

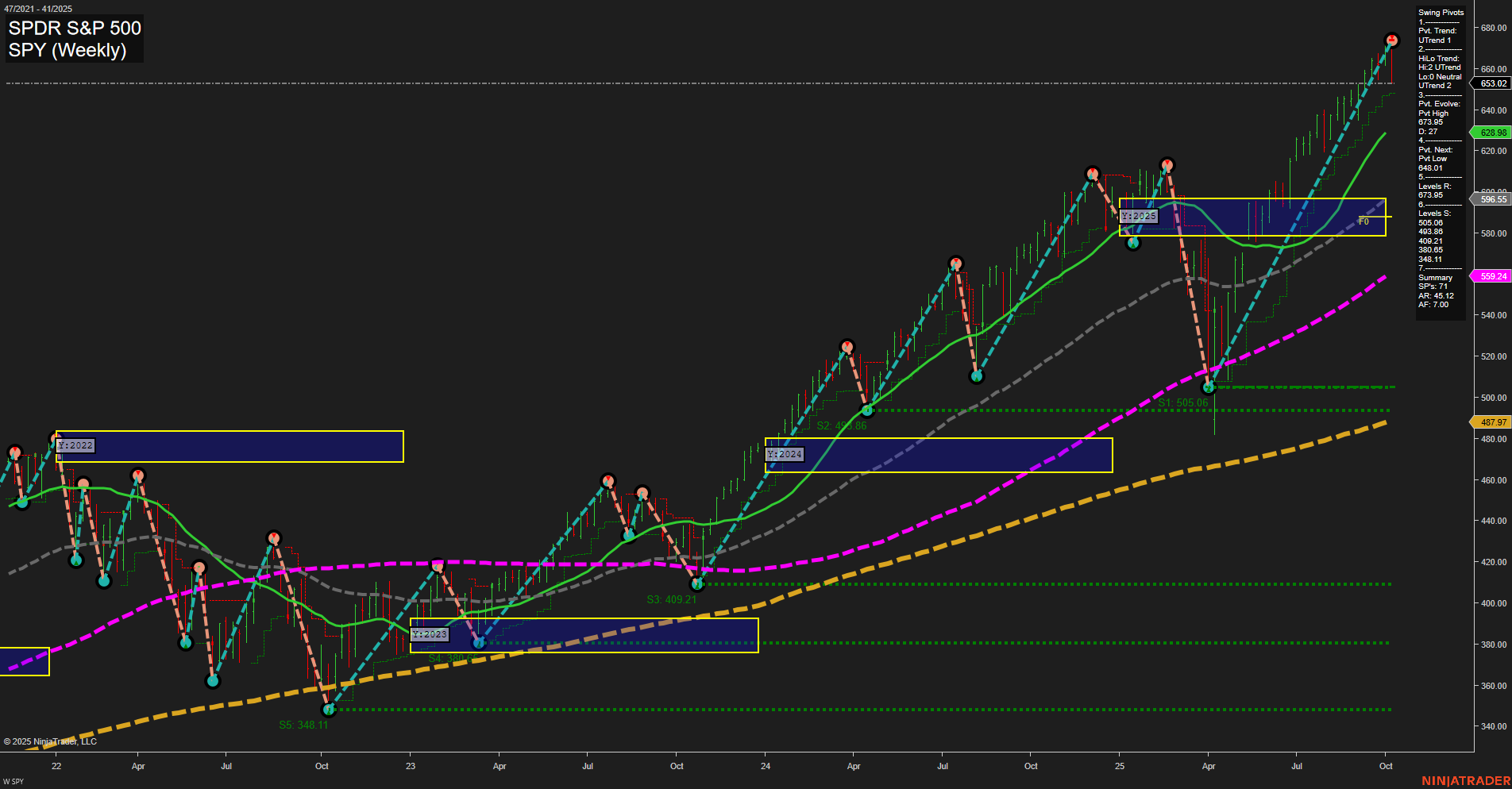

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MS Release: 2025-10-15 T:BMO

- BAC Release: 2025-10-15 T:BMO

- C Release: 2025-10-14 T:BMO

- GS Release: 2025-10-14 T:BMO

- WFC Release: 2025-10-14 T:BMO

- JPM Release: 2025-10-14 T:BMO

Looking ahead to the next earnings cycle, major US banks including JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC), and Goldman Sachs (GS) will report pre-market on October 14th, followed by Morgan Stanley (MS) and Bank of America (BAC) on October 15th. As these financial heavyweights lead Q3 earnings season, their results and outlooks will significantly influence S&P 500 and Dow Jones futures, particularly given their weighting in major indices. Historically, indices futures can see subdued momentum and lighter volume leading up to these key financial sector reports amid cautious sentiment and a wait-and-see approach from traders. This quietness is often exacerbated in the broader market as participants also anticipate upcoming earnings and guidance from NVDA, the remaining MAG7, and leading AI tech stocks, which have recently been a primary driver of index performance and volatility. In summary, expect narrow pre-earnings ranges and potential for volatility spikes as traders react to the big bank earnings and prepare for the tech sector’s turn.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 12:20 – Fed Chair Powell Speaks: Traders will closely monitor Powell’s comments for new signals on interest rate policy and the economic outlook. High volatility in index futures is likely around the event as markets react to any perceived hawkish or dovish shift.

- Thursday 08:33 – Core PPI m/m, Core Retail Sales m/m, PPI m/m, Retail Sales m/m, Unemployment Claims (all High Impact): A cluster of critical inflation and consumer data releases, along with unemployment figures, arrives simultaneously. Expect substantial market reaction in index futures with sharp price moves possible. Data surprises may shift expectations for Fed policy actions ahead of the next FOMC.

EcoNews Conclusion

- Major U.S. inflation and retail sales data, combined with Fed Chair Powell’s remarks, are key drivers for index futures this week and can create significant volatility during the release windows.

For full details visit: Forex Factory EcoNews

Market News Summary

- Stock-index futures and Dow futures rebounded sharply after President Trump assured markets that U.S.-China trade tensions would “all be fine,” following a steep Friday selloff triggered by threats of new 100% tariffs on Chinese imports. Hopes for constructive Trump-Xi talks at the upcoming APEC Summit contributed to positive sentiment, lifting European market open expectations and supporting gains in oil futures.

- Recent volatility has been dominated by U.S.-China trade developments, with technical analysis of the S&P 500 pointing to the largest single-day drop since April, attributed to tariff headlines and overbought conditions rather than underlying weakness.

- While AI-related equities remain resilient, market commentary is split between concerns of a looming bubble and confidence that recent action is a standard liquidity-driven dip rather than a systemic reversal. Investors and strategists warn of potential red flags but emphasize the current lack of deeper negative catalysts.

- Gold and silver extended rallies as geopolitical risks remain heightened and expectations for rate cuts continue. Bank of America raised its gold price forecast for 2026 to $5,000/oz, while some caution that the autumn rally in precious metals may be losing steam. Oil markets recovered from recent lows as traders looked ahead to U.S.-China talks and noted China’s ongoing crude stockpiling.

- The new earnings season kicks off this week under volatile conditions, with major banks like JPMorgan, Goldman Sachs, and Bank of America scheduled to report. Regulatory action saw IPO rules eased during the government shutdown, potentially boosting new listings. Forecasts regarding economic growth and labor markets have been revised, while the Fed’s independence is expected to wane.

- ETF strategies and sector focus remain in the news, with the Goldman Sachs Nasdaq-100 Premium Income ETF highlighted for yield generation, and oversold utilities stocks drawing attention as potential opportunities.

- OPEC maintained its oil demand outlook and noted a shrinking 2026 supply deficit amid increased output from both OPEC+ and Russia.

News Conclusion

- U.S. index futures and global markets are responding favorably to de-escalation signals in U.S.-China trade rhetoric, helping markets recover from last week’s sharp declines.

- Intense volatility remains as headlines around tariffs and presidential remarks drive rapid swings, but fundamental strength in sectors like AI and technical factors suggest recent selloffs are not yet reflective of deeper market cracks.

- Safe-haven assets such as gold and silver continue to attract flows amid uncertainty, supported by optimistic long-term forecasts, though some analysts see current momentum slowing.

- The focus shifts to corporate earnings, central bank policy, and macro forecasts as traders monitor whether early week optimism sustains through coming announcements.

- Oil and commodity markets are adjusting to both supply increases and cautious optimism over U.S.-China trade talks.

Market News Sentiment:

Market News Articles: 25

- Neutral: 48.00%

- Negative: 28.00%

- Positive: 24.00%

Sentiment Summary: Out of 25 market news articles, 48% present a neutral outlook, 28% indicate negative sentiment, and 24% reflect positive sentiment.

Conclusion: The bulk of recent market news maintains a neutral tone, with negative sentiment slightly outweighing positive sentiment among the remaining coverage.

GLD,Gold Articles: 7

- Negative: 42.86%

- Positive: 42.86%

- Neutral: 14.29%

Sentiment Summary: Gold-related market news sentiment is evenly split, with approximately 43% of articles showing a positive tone, 43% presenting a negative view, and about 14% remaining neutral.

Conclusion: The current news flow around gold is mixed, with no clear directional consensus among recent articles.

USO,Oil Articles: 6

- Neutral: 66.67%

- Positive: 16.67%

- Negative: 16.67%

Sentiment Summary:

Out of 6 recent articles covering USO and oil, 66.67% held a neutral sentiment, while positive and negative sentiment were equally represented at 16.67% each.

This indicates that the majority of market coverage is taking a neutral stance, with balanced, but less prevalent, positive and negative perspectives.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 13, 2025 07:16

- TLT 90.62 Bullish 1.61%

- GLD 369.12 Bullish 1.01%

- DIA 454.87 Bearish -1.86%

- GOOG 237.49 Bearish -1.95%

- MSFT 510.96 Bearish -2.19%

- SPY 653.02 Bearish -2.70%

- IJH 63.25 Bearish -2.83%

- IWM 237.79 Bearish -2.99%

- AAPL 245.27 Bearish -3.45%

- QQQ 589.50 Bearish -3.47%

- IBIT 66.20 Bearish -3.70%

- META 705.30 Bearish -3.85%

- USO 69.39 Bearish -4.30%

- NVDA 183.16 Bearish -4.89%

- AMZN 216.37 Bearish -4.99%

- TSLA 413.49 Bearish -5.06%

Market State of Play: ETF Stocks, Magnificent 7, and Select ETFs (as of 10/13/2025 07:16:00)

Overview

The current market snapshot reflects a broadly negative session across major equity ETFs and high-profile large caps, while select safe-haven and rate-sensitive assets show isolated gains. Below is a categorized summary for traders monitoring trends and positioning.

ETF Stocks

- SPY: 653.02 (Bears dominate, down -2.70%)

- QQQ: 589.50 (Bearish, declining -3.47%)

- IWM: 237.79 (Bearish, sliding -2.99%)

- IJH: 63.25 (Bearish, off -2.83%)

- DIA: 454.87 (Bearish, lower -1.86%)

Summary: Major index ETFs (SPY, QQQ, IWM, IJH, DIA) are in clear downside momentum, with losses exceeding -2% across the board, led by QQQ and small/mid caps.

The Magnificent 7

- AAPL: 245.27 (Bearish, -3.45%)

- MSFT: 510.96 (Bearish, -2.19%)

- GOOG: 237.49 (Bearish, -1.95%)

- AMZN: 216.37 (Bearish, -4.99%)

- META: 705.30 (Bearish, -3.85%)

- NVDA: 183.16 (Bearish, -4.89%)

- TSLA: 413.49 (Bearish, -5.06%)

Summary: The leading technology and consumer names are sharply lower, with TSLA, AMZN, and NVDA each down nearly 5% or more. No members of the group are bucking the downtrend.

Other Key ETFs

- TLT: 90.62 (Bullish, +1.61%)

- GLD: 369.12 (Bullish, +1.01%)

- USO: 69.39 (Bearish, -4.30%)

- IBIT: 66.20 (Bearish, -3.70%)

Summary: Treasury bonds (TLT) and gold (GLD) are attracting inflows and are up modestly, while oil (USO) and the spot bitcoin ETF (IBIT) join the broad risk-off move and are sharply lower.

Market Themes

- Widespread selloff in equities and growth sectors.

- Flight to safety indicated by TLT and GLD’s gains.

- Risk assets, including crypto and oil, under pressure.

Note: This is a factual market snapshot and not a recommendation for any trading action or position.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-13: 07:16 CT.

US Indices Futures

- ES Bullish YSFG, Neutral MSFG, Bullish WSFG; making higher highs, major MAs up, swing pivot high at 6867.75, supports at 6429.69, recent volatility, possible short-term retracement.

- NQ Bullish across YSFG, MSFG, WSFG; at new highs 24904.25, above NTZ/F0% levels, major MAs up, pivot high at 25034, distant support at 23040, strong trend, no reversal signals.

- YM Bullish YSFG, Bearish MSFG, Bullish WSFG; weekly chart short-term up, intermediate pullback, swing high at 46105, supports at 42223, 43807, corrective phase within broader uptrend.

- EMD Bearish YSFG, Bearish MSFG, Bearish WSFG; weekly and daily charts show downside momentum, pivots confirm downtrend, support near 3149, resistance above, all MAs trending down, consolidating post sell-off.

- RTY Bullish YSFG, Bullish MSFG, Bullish WSFG; strong uptrend, large bars, swing high 2518.5, support 2235.1, major MAs up, price above NTZ/F0%, recovery phase, no exhaustion signs.

- FDAX Bullish YSFG, Bullish MSFG, Bearish WSFG; long-term up, short-term pullback, below weekly NTZ, MAs largely up, resistance 24469/24891, supports 23819/24411, in retracement zone within broader trend.

Overall State

- Short-Term: Mixed (RTY, NQ: Bullish; ES: Bullish; YM, EMD, FDAX: Bearish/Neutral)

- Intermediate-Term: Mixed (NQ, RTY, FDAX: Bullish; ES, YM, EMD: Bearish/Neutral)

- Long-Term: Bullish (all except EMD: Neutral/Bearish)

Conclusion

US Indices Futures display a primarily bullish HTF structure, with NQ and RTY leading on strength across all grids and benchmarks, ES and YM maintaining bullish long-term trend but showing consolidation or pullback signals at the MSFG/WSFG levels. EMD is in a downside correction with all timeframe trends weak, while FDAX remains in a broader bullish uptrend despite short-term retracement. Key benchmarks, swing pivots, and support/resistance levels highlight elevated volatility, short-term corrections, and continuation of larger structural uptrends in major indices.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

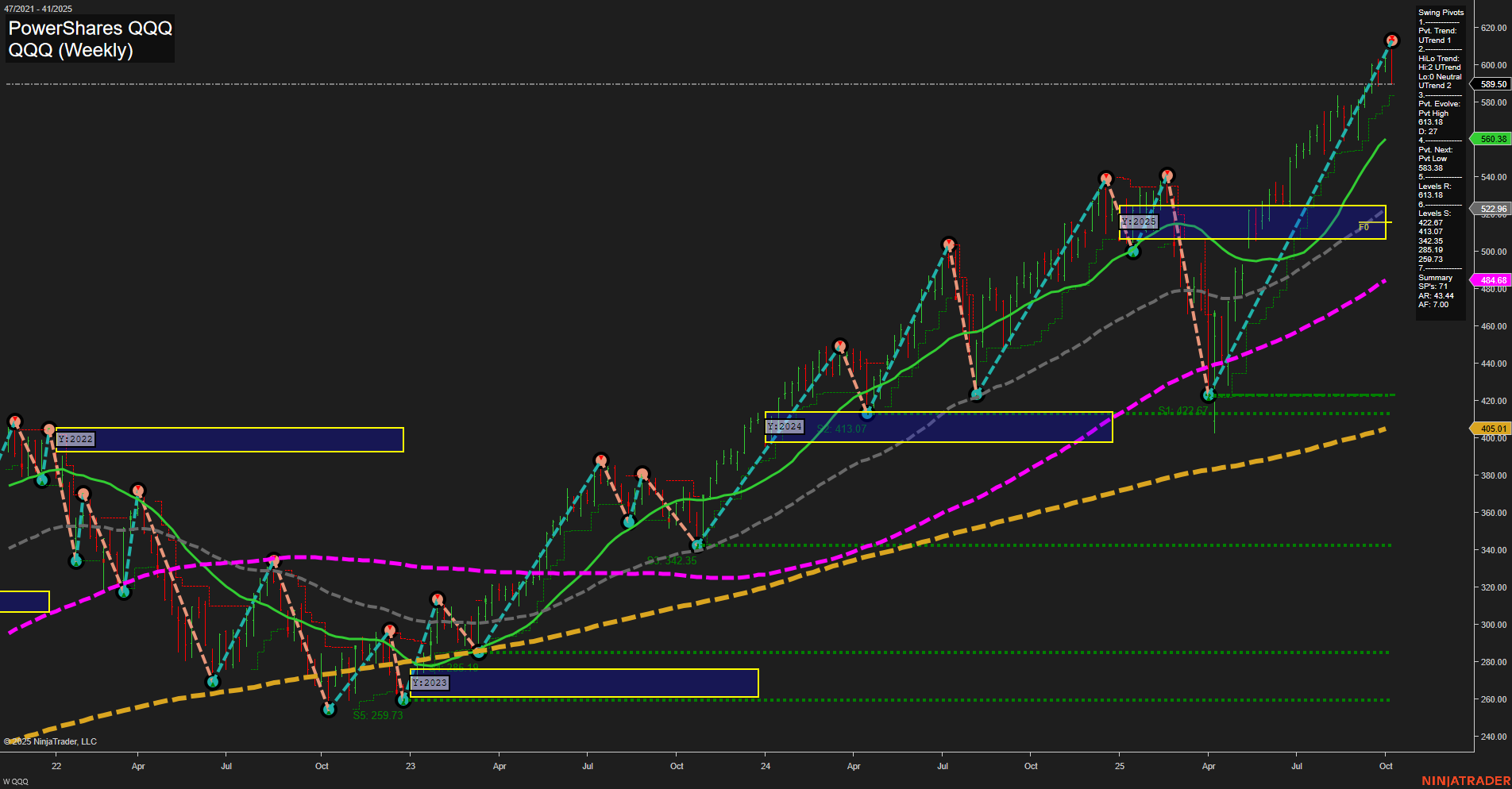

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts