Market Roundup – NYSE After Market Close Bullish as of October 15, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

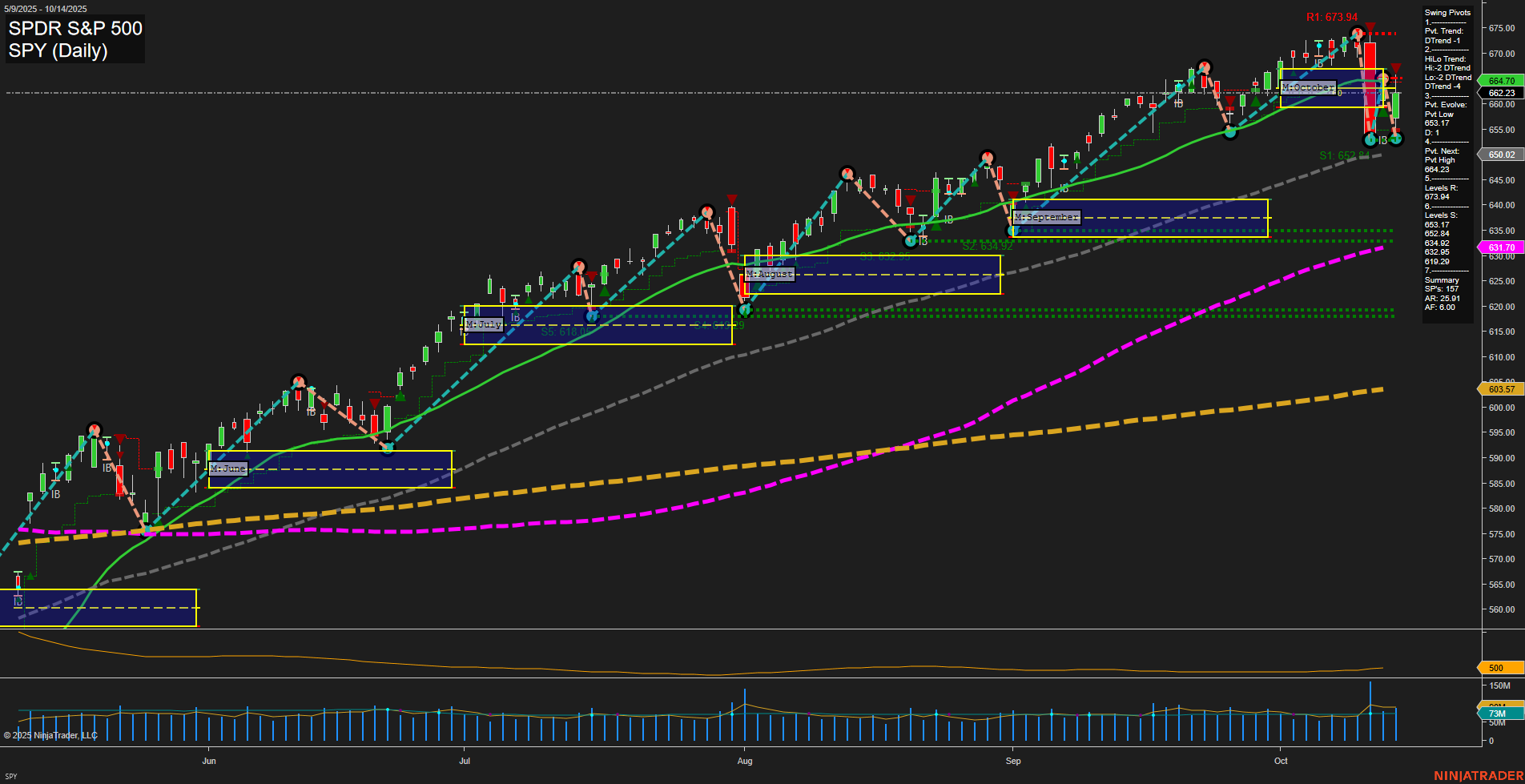

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Gold & Precious Metals: Gold surged to fresh all-time highs above $4,200, driven by rate-cut expectations and safe-haven demand amid heightened volatility and trade tensions. Silver and platinum rallied in tow. Gold mining stocks and ETFs like Newmont, Kinross, GLD, and broader miners outperformed as investor interest revived.

- Bank & Corporate Earnings: Robust quarterly results from major banks signaled continued strength in the economy. Prime brokerage divisions performed exceptionally well, and the S&P 500 moved higher on finance sector optimism. The nation’s largest banks pointed to healthy dealmaking and consumer spending, keeping market sentiment upbeat.

- Market Volatility & Trade Tensions: VIX volatility index climbed above 20 once more, and volatility persisted amid rising U.S.-China trade tensions. U.S. officials criticized China over rare earth export restrictions, escalating tariff rhetoric. Concerns mounted about supply chain pressures, higher inflation from tariffs, and associated price increases.

- Sectors & Stock Themes: Utilities, a traditionally defensive sector, outpaced tech stocks this year despite the ongoing AI narrative. Some agriculture and commodity-linked stocks posted double-digit gains following prospects of new tariffs on Chinese trade and political announcements. Tech headlines focused on hyperscaler capital expenditure peaking, with some concerns about future AI-related growth.

- Retail & Institutional Flows: A spike in retail options activity was observed as traders “bought the dip” after last Friday’s sharp selloff. At the same time, asset allocators highlighted gold and silver as preferred defensive positions. Funding strain emerged in short-term repo markets, with banks tapping Fed facilities as overnight rates ticked higher.

- Economic Outlook & Fed Commentary: Fed officials discussed substantial disinflation potential from housing. However, the Beige Book noted limited overall economic growth since September, with inflation concerns due to tariffs.

News Conclusion

- Gold’s strong rally and record highs stand out as a dominant theme, driven by geopolitical risks, demand for hedges, and interest rate expectations.

- Bank earnings and robust prime brokerage activity supported index futures, while persistent volatility and macro uncertainties from trade disputes and funding markets continued to influence intraday swings.

- Inflationary pressures remain a concern as trade and tariff actions prompt price increases, while the Fed’s rate stance and comments regarding disinflation potential from housing will remain pivotal to market direction.

- Defensive assets and sectors are in focus, with utilities, precious metals, and select commodities attracting capital amid ongoing uncertainty.

- Market participants continue to navigate choppy conditions, adjusting sector exposures and watching for headline-driven price moves.

Market News Sentiment:

Market News Articles: 42

- Positive: 40.48%

- Neutral: 33.33%

- Negative: 26.19%

GLD,Gold Articles: 22

- Positive: 72.73%

- Neutral: 22.73%

- Negative: 4.55%

USO,Oil Articles: 5

- Negative: 60.00%

- Neutral: 20.00%

- Positive: 20.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 15, 2025 05:00

- GOOG 251.71 Bullish 2.24%

- GLD 387.39 Bullish 1.73%

- TSLA 435.15 Bullish 1.38%

- META 717.55 Bullish 1.26%

- IWM 250.33 Bullish 0.98%

- QQQ 602.22 Bullish 0.71%

- AAPL 249.34 Bullish 0.63%

- SPY 665.17 Bullish 0.44%

- IJH 65.14 Bullish 0.09%

- DIA 462.71 Bearish 0.00%

- USO 68.99 Bearish -0.01%

- MSFT 513.43 Bearish -0.03%

- NVDA 179.83 Bearish -0.11%

- TLT 90.66 Bearish -0.22%

- AMZN 215.57 Bearish -0.38%

- IBIT 63.17 Bearish -1.16%

Market Summary: ETF Stocks

- SPY (665.17): Bullish momentum remains with a modest gain of 0.44%. The broad S&P 500 continues to find buyers, although activity appears measured.

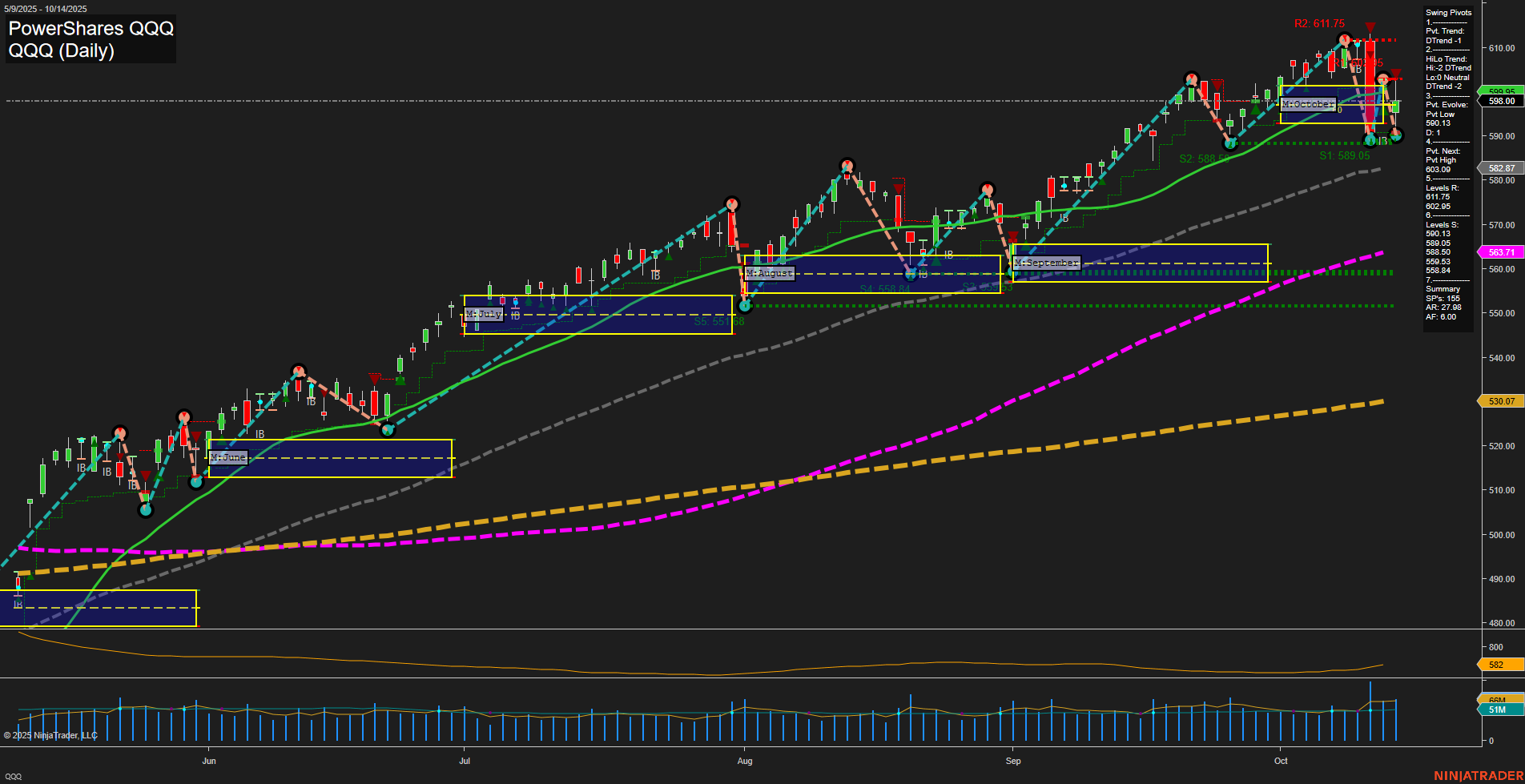

- QQQ (602.22): Tech-focused ETF is positive, up 0.71% as traders show sustained interest in growth-oriented sectors.

- IWM (250.33): The small-cap space shows strength with nearly a 1% advance, indicating a risk-on bias.

- IJH (65.14): Mid-caps hover just above flat territory, reflecting cautious optimism (0.09%).

- DIA (462.71): Flat and Bearish—Dow blue chips see no price change, signaling underperformance vs. peers.

Market Summary: Mag7

- GOOG (251.71): Outperforms among mega-cap techs with a 2.24% rally.

- AAPL (249.34): Positive sentiment continues, gaining 0.63% today.

- MSFT (513.43): Slight downward drift, off -0.03% as rotation occurs within the sector.

- AMZN (215.57): Pullback of -0.38% suggests profit-taking or rotation.

- META (717.55): A solid move higher (1.26%), showing leadership in social and digital media.

- TSLA (435.15): Momentum continues, advancing 1.38%.

- NVDA (179.83): Marginally lower by -0.11%, possibly pausing after previous rallies.

Market Summary: Other ETFs

- GLD (387.39): Gold ETF with a strong 1.73% move, reflecting safe haven demand or inflation themes.

- TLT (90.66): Long-term Treasuries see a modest decline (-0.22%), indicating a slight risk-off in bonds.

- USO (68.99): Oil ETF edges lower (-0.01%), suggesting sideways or consolidating energy markets.

- IBIT (63.17): Crypto-exposed ETF under pressure, falling -1.16%, with risk appetite subdued in this segment.

Positioning Overview

- Long Bias: Bullish momentum is strongest in tech (GOOG, META, TSLA), small caps (IWM), and precious metals (GLD).

- Short/Defensive: Pressure seen in some mega-cap techs (NVDA, MSFT, AMZN), bonds (TLT), and alternative assets (IBIT).

- Mixed: SPY, QQQ, and IJH display cautious optimism, while blue-chip names (DIA) and commodities (USO) hold steady or show mild weakness.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts