Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

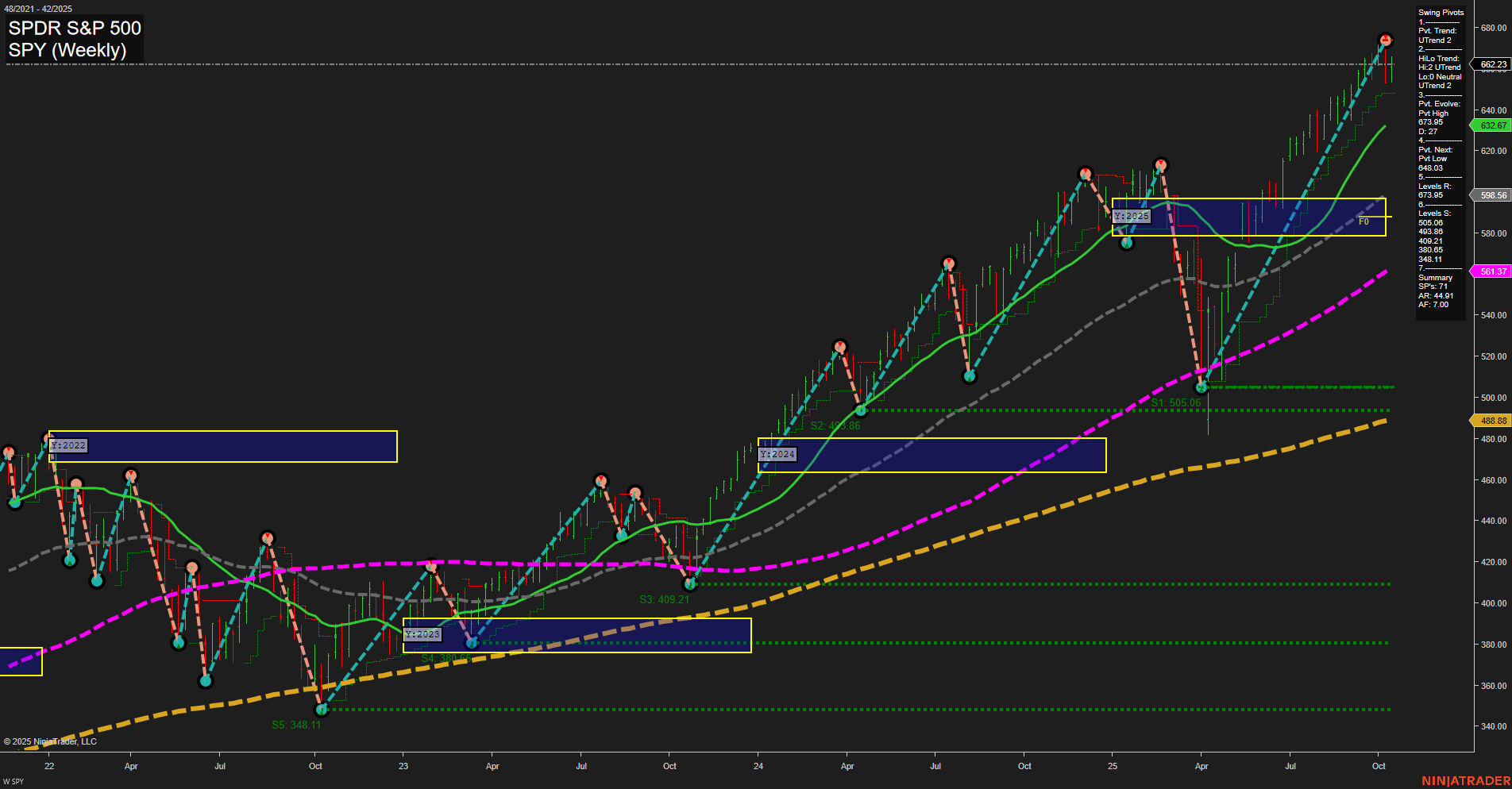

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MS Release: 2025-10-15 T:BMO

- BAC Release: 2025-10-15 T:BMO

Earnings Summary and Market Conclusion:

On October 15, 2025, both Morgan Stanley (MS) and Bank of America (BAC) are set to report earnings before the market open. This dual release from major U.S. financial institutions is likely to draw heightened attention from index futures traders, as the results may provide critical cues regarding the health of the banking sector and broader economic sentiment. Historically, earnings from large banks can trigger notable pre-market moves in the S&P 500 and related futures contracts, especially as investors gauge loan growth, credit quality, and trading revenues. However, with high-profile tech names like NVIDIA and the broader “MAG7” group scheduled to report later in the week, overall market momentum and trading volume have typically shown a tendency to slow ahead of these major tech releases, as participants await fresh guidance from the sector most responsible for year-to-date equity gains. Consequently, while reactions to MS and BAC results could spark initial volatility, broader market participation and directional conviction may remain muted until the pivotal NVDA and mega-cap tech earnings are out, keeping day traders on alert for compressed ranges and cautious positioning.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Thursday 08:33 – High Impact Events:

- Core Producer Price Index (PPI) m/m, PPI m/m: Key inflation readings directly influence rate expectations. Higher-than-expected data may raise concerns about persistent inflation, increasing probability of hawkish Fed outlook; softer prints could spark bullish sentiment as rate hikes look less likely.

- Core Retail Sales m/m, Retail Sales m/m: Crucial indicators of consumer demand and overall economic health. Strong upside surprises can reinforce expectations for resilient growth, potentially pushing yields and the dollar higher; weak readings may weigh on equities and indices futures as growth prospects temper.

- Unemployment Claims: Labor market temperature check. Lower claims point to continued strength, supporting bullish risk appetite; higher claims signal softening labor conditions—potential market risk-off reaction if accompanied by weak retail sales or inflation data.

- Thursday 12:00 – Oil-Focused Event:

- Crude Oil Inventories (Low Impact): Movements in oil can indirectly shape inflation expectations and indices futures. A significant drawdown or supply disruption may reignite inflation fears and pressure indices, while a build could ease inflation concerns.

EcoNews Conclusion

- Thursday morning’s high-impact data cluster (PPI, Retail Sales, Unemployment Claims at 08:33) is expected to drive pronounced volatility and directional momentum in indices futures as traders quickly reassess inflation and growth expectations in real time.

- Sharp moves are likely if inflation prints and consumer spending signals diverge or present a unified theme (hot inflation + strong sales fueling rate hike fears vs. soft inflation + slowing sales supporting dovish pivots).

- Any unexpected surge in oil prices following the Crude Oil Inventories report can directly impact market sentiment due to renewed inflation and geopolitical concerns.

For full details visit: Forex Factory EcoNews

Market News Summary

- Gold & Precious Metals: Gold continues its historic rally, breaking the $4,200/oz mark on Fed rate cut expectations and surging safe-haven demand. Silver tracks higher as well, powered by similar factors including geopolitical volatility, dollar weakness, and dovish central bank outlooks. Analysts suggest the rally may have room to run, with bullish technicals supporting potential upside targets above $4,200 for gold and $54 for silver. Italy and gold miners benefit as physical reserves and production translate into outsized gains.

- Equities & Indices Futures: US indices futures trend higher on optimism over potential Fed easing and resilience in real-economy sectors. Recent sessions saw healthcare outperforming, while chip stocks support broader gains. European markets also rebound after recent declines, as focus shifts to resolving US-China trade disputes and positive policy developments in France. Despite this, headline risk remains around AI valuation concerns and volatility in tech mega-caps.

- AI & Technology: Sentiment softens around AI as questions about overvaluation and limited productivity impact emerge, casting doubt on sustainability of recent sector-driven rallies. Anticipation mounts for tech earnings, with the market eyeing potential surprises from top firms as enthusiasm for AI cools.

- Energy & Commodities: Oil prices extend weakness, with supply surpluses and demand worries weighing. OPEC output growth, International Energy Agency oversupply warnings, and heightened US-China trade tensions create a bearish outlook. Traders await key inventory data, but short-term energy sentiment remains pressured. Natural gas follows similar trends, affected by recessionary fears and policy uncertainty.

- Macro & Policy: Fed officials signal increased caution over economic risks, especially in the labor market. Renewed dovish signals amplify market bets on near-term rate cuts. In policy news, France suspends unpopular pension reforms, supporting local markets, while Malaysia plans tariff talks with the US on the semiconductor sector at an upcoming ASEAN summit.

- Other: Volatility remains elevated, but some commentators note a growing willingness from investors to push aside macro risks in pursuit of growth-focused trades. Bitcoin experiences a significant drop, highlighting ongoing risks in crypto asset class.

News Conclusion

- Gold and silver maintain powerful momentum, with all-time highs fueled by safe-haven flows and dovish central bank expectations.

- Equity indices futures are buoyant, underpinned by sector rotation into healthcare and cyclical stocks, and renewed optimism about monetary policy support.

- AI enthusiasm slows as skepticism on valuations rises, while upcoming tech earnings may set the tone for further price action.

- Energy markets stay under pressure due to oversupply and softening demand outlooks, driven by macro concerns and global trade tensions.

- Macro themes center on labor market softness and monetary policy speculation, while regional policy decisions and international trade discussions add to the evolving landscape.

Market News Sentiment:

Market News Articles: 41

- Negative: 39.02%

- Neutral: 31.71%

- Positive: 29.27%

Sentiment Summary:

Out of 41 market news articles analyzed, 39.02% present a negative sentiment, 31.71% remain neutral, and 29.27% are positive.

Conclusion:

Current market news exhibits a predominance of negative sentiment, with negative articles outnumbering both neutral and positive coverage. Neutral and positive sentiments are present but relatively less prominent in the overall news flow.

GLD,Gold Articles: 24

- Positive: 58.33%

- Neutral: 41.67%

Sentiment Summary: The majority of recent market news concerning GLD and gold is positive, with 58.33% of articles reflecting a favorable tone and 41.67% maintaining a neutral stance.

This indicates that current market coverage on GLD and gold trends more positive than neutral, with no reported negative sentiment in the latest articles.

USO,Oil Articles: 5

- Negative: 60.00%

- Neutral: 40.00%

Sentiment Summary: The recent news coverage on USO and oil is predominantly negative, with 60% of articles showing negative sentiment and 40% remaining neutral.

This indicates that the current newsflow around USO and oil is mostly unfavorable, with no positive articles reported in the reviewed period.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 15, 2025 07:16

- IWM 247.90 Bullish 1.43%

- IJH 65.08 Bullish 0.91%

- GLD 380.79 Bullish 0.71%

- GOOG 246.19 Bullish 0.63%

- DIA 462.71 Bullish 0.44%

- TLT 90.86 Bullish 0.32%

- AAPL 247.77 Bullish 0.04%

- MSFT 513.57 Bearish -0.09%

- SPY 662.23 Bearish -0.12%

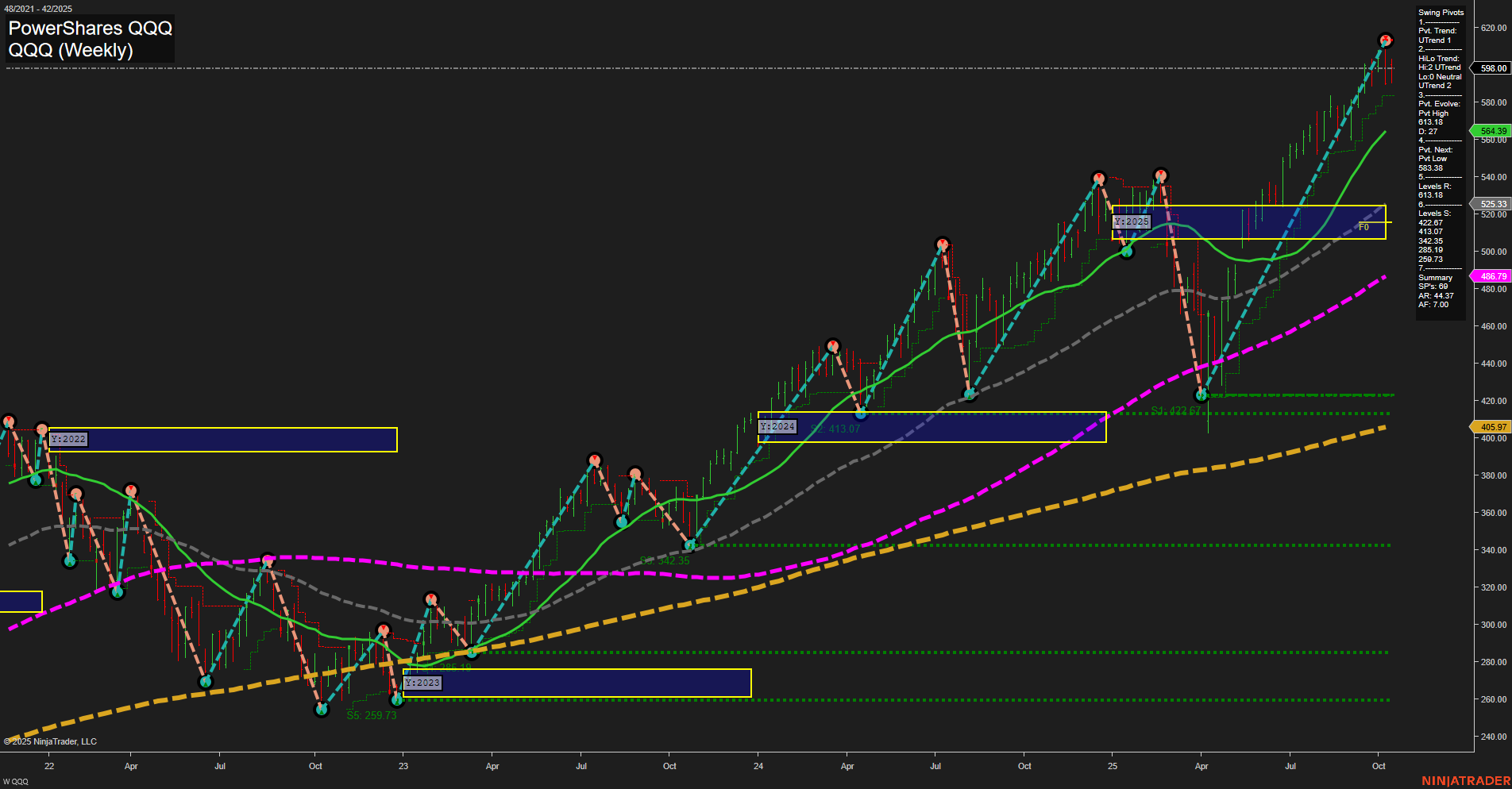

- QQQ 598.00 Bearish -0.67%

- META 708.65 Bearish -0.98%

- TSLA 429.24 Bearish -1.53%

- AMZN 216.39 Bearish -1.67%

- USO 69.00 Bearish -1.82%

- IBIT 63.91 Bearish -2.89%

- NVDA 180.03 Bearish -4.40%

ETF Stocks: Market Summary

- IWM: 247.90 (Bullish, +1.43%) – The Russell 2000 ETF exhibits strength, marking a notable uptrend among small-cap equities.

- IJH: 65.08 (Bullish, +0.91%) – Mid-cap stocks have also advanced, supporting a broader market rally outside megacaps.

- DIA: 462.71 (Bullish, +0.44%) – The Dow-tracking ETF aligns with positive sentiment in blue-chip equities.

- SPY: 662.23 (Bearish, -0.12%) – S&P 500 ETF is marginally lower, reflecting mixed sentiment across the largest U.S. companies.

- QQQ: 598.00 (Bearish, -0.67%) – The Nasdaq 100 ETF is under pressure, primarily as technology and growth stocks see pullbacks.

Summary: Small- and mid-cap sectors show bullish momentum, while large-cap indices, especially tech-heavy ones, are facing mild declines, creating a mixed landscape for U.S. equity ETFs.

“Mag7” Stocks Overview

- AAPL: 247.77 (Bullish, +0.04%) – Apple edges higher, but momentum is modest.

- GOOG: 246.19 (Bullish, +0.63%) – Google displays steady gains, helping offset tech sector weakness.

- MSFT: 513.57 (Bearish, -0.09%) – Microsoft is slightly lower, signaling caution in big-tech buying.

- META: 708.65 (Bearish, -0.98%) – Meta shares trade notably lower amid broader tech selloff.

- NVDIA: 180.03 (Bearish, -4.40%) – NVIDIA experiences significant downside, weighing on semiconductor and growth sentiment.

- TSLA: 429.24 (Bearish, -1.53%) – Tesla continues to retreat, reflecting headwinds in the electric vehicle space.

- AMZN: 216.39 (Bearish, -1.67%) – Amazon extends its pullback, consistent with pressure across leading growth names.

Summary: The Mag7 group shows a clear tilt toward the downside, with only Apple and Google showing mild strength and others registering meaningful losses, notably NVIDIA, TSLA, and AMZN.

Other Major ETFs

- GLD: 380.79 (Bullish, +0.71%) – Gold ETF gains, possibly as traders seek a hedge amid mixed equity performance.

- TLT: 90.86 (Bullish, +0.32%) – The long-dated Treasury ETF moves higher, hinting at a search for relative safety.

- USO: 69.00 (Bearish, -1.82%) – Oil ETF sees a sharp decline, suggesting weakness in the energy complex today.

- IBIT: 63.91 (Bearish, -2.89%) – Bitcoin ETF trades much lower, reflecting underperformance in crypto-linked assets.

Summary: Traditional safe-haven assets, such as gold and long-term bonds, are showing gains, while energy and crypto-exposed ETFs are notably weaker, contributing to the market’s risk-off flavor.

State of Play: Long/Short/Mixed Themes

- Long/Bullish Momentum: Small- and mid-cap equities (IWM, IJH), blue-chip Dow stocks (DIA), gold (GLD), and U.S. long bonds (TLT).

- Short/Bearish Pressure: Large-cap growth/tech—especially QQQ, META, TSLA, AMZN, NVDA—along with oil (USO) and Bitcoin ETF (IBIT).

- Mixed Dynamics: S&P 500 (SPY) and select large-cap tech stocks (AAPL, GOOG flat to modestly higher, versus broader Mag7 weakness).

Conclusion: Today’s snapshot reveals a mixed U.S. market. Momentum is concentrated in small/mid-caps and defensive areas, while technology, energy, and crypto assets are experiencing notable downside. Market participants are expressing caution, with selective risk-taking evident outside the mega-cap growth sphere.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-15: 07:16 CT.

US Indices Futures

- ES Uptrend on all grids, new highs at 6812.25, above NTZ/F0%, rising supports, upward MA benchmarks, swing pivots unbroken uptrend, resistance at 6812.25/6731.25, supports 6540.25/6410.93.

- NQ Persistent uptrend on weekly, short-term pullback on daily, above all fib grids, highs at all-time highs, swing pivots rising, daily support zones tested, resistance at recent highs.

- YM Bullish across all grids, new weekly high at 47,323, support at 45,271, above all MA benchmarks, higher highs/lows, mixed signals on daily, daily support at 45,883, intermediate uptrend remains.

- EMD Long-term bullish, neutral short/intermediate trends, above all fib grids, testing resistance 3352.2, support 3149.1, MA benchmarks long-term up, daily bounce post-pullback, resistance near previous highs.

- RTY Strong rally, bullish all timeframes, above all fib grids, weekly high 2527.9, resistance 2555.5/2536.8, support 2341.0/2460.0, higher highs/lows, all MA benchmarks in uptrend.

- FDAX Bullish on weekly, consolidation on daily, above all MA/fib grids, weekly pivots higher highs, resistance at 24,891, supports 24,174, short-term neutral as market digests rally.

Overall State

- Short-Term: Mixed to Bullish (NQ short-term bearish, FDAX/EMD/ YM neutral; ES, RTY bullish)

- Intermediate-Term: Bullish (EMD neutral), consolidation phases active in some indices

- Long-Term: Bullish across all indices

Conclusion

US Indices Futures exhibit prevailing bullish higher timeframe momentum as confirmed by YSFG, MSFG, and WSFG structures. ES, YM, RTY, and FDAX maintain higher highs and are above all major fib and MA benchmarks, confirming intact uptrends. NQ and EMD show short-term retrace or consolidation, but intermediate and long-term metrics remain constructive. Support and resistance levels have risen in tandem with recent highs, and benchmarks continue to trend up across most indices, reinforcing longer-term strength. Short-term rotations and pullbacks are present in some instruments, notably in NQ and FDAX, consistent with consolidation phases within persistent trend structures. No immediate HTF reversal is signaled, and directional correlations suggest continued trend dominance pending major support breaks or reversals on key swing pivots and benchmarks.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts