Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

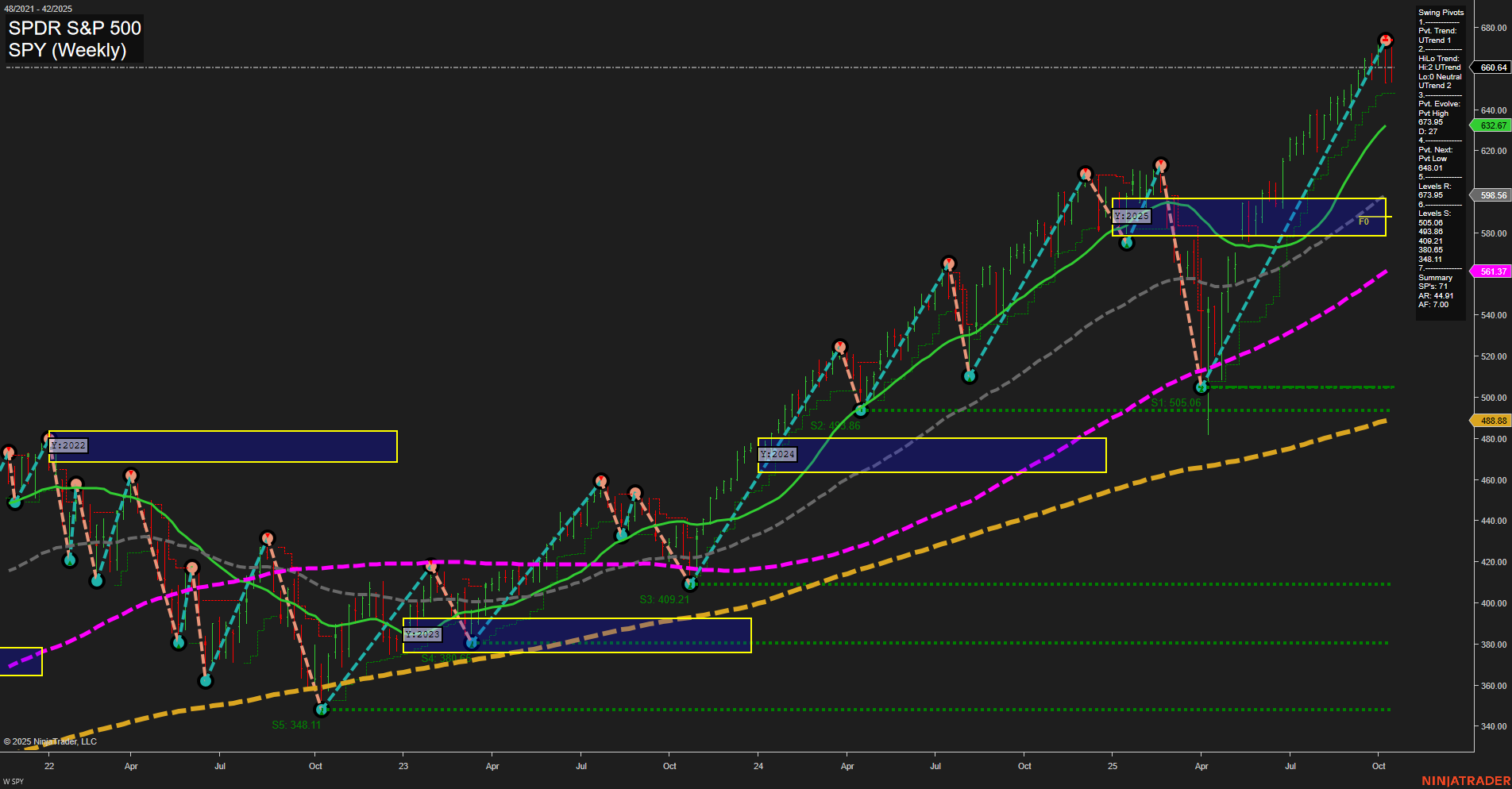

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- AMZN Release: 2025-10-23 T:AMC

- INTC Release: 2025-10-23 T:AMC

- TSLA Release: 2025-10-22 T:AMC

- IBM Release: 2025-10-22 T:AMC

Earnings Summary and Market Conclusion:

Looking ahead to the upcoming earnings releases, indices futures traders should note several high-impact events on the calendar: Tesla and IBM are set to report after market close on October 22nd, with Amazon and Intel following on October 23rd. These companies are key components or significant influencers of the major indices, particularly the Nasdaq and S&P 500, given their weighting and sector leadership, especially in tech and AI. As is common in the lead-up to such major reports, market momentum and volume could moderate, as participants position defensively and await new information. This effect may be even more pronounced with traders also anticipating results from NVDA and other core MAG7 and AI-related names in the near future. Overall, this cluster of tech and AI earnings has the potential to spark sharp post-release volatility and directional clarity, but until then, expect relatively muted index movement as the market digests positioning and braces for headline risk.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- Precious Metals: Gold and silver prices continue to surge, hitting record highs due to safe-haven demand, Federal Reserve rate cut expectations, a weakening U.S. dollar, and ongoing U.S.-China tensions. Analysts highlight continued bullish momentum, with gold’s long-term uptrend intact and gold equities rallying more than tech stocks since August. Some also note bullish forecasts for silver due to potential supply shocks.

- Equities Indices: Major U.S. indices—S&P 500, Dow Jones, Nasdaq 100—suffered notable sell-offs, with futures dropping considerably. Sentiment is pressured by concerns over regional bank credit health, potential market corrections, and high levels of margin debt, with some expecting a 5–10% correction as reasonable.

- Banking Sector: Widespread concerns over souring regional bank loans spark increased volatility and weigh on both U.S. and Asian financial stocks, especially after key losses and fraud disclosures. This backdrop is softening the outlook for the economy and potentially making it easier for the Fed to justify further rate cuts.

- Energy Commodities: Crude oil continues to weaken, breaking technical supports and facing bearish outlooks amidst geopolitical uncertainty—specifically, an upcoming Trump-Putin summit and ongoing discussions around Ukraine.

- Crypto Assets: Cryptocurrency markets are lagging other risk assets, under pressure from global trade tension headlines and broader market uncertainty. Despite this, proponents continue to push the “digital gold” narrative for Bitcoin amid generational shifts in investing.

- Macro Flows: Despite record inflows in money-market funds, analysts suggest this cash is unlikely to pour into equities or bonds soon, even as rate cuts loom. The overall risk appetite remains cautious.

- ETF Trends: Exchange-traded funds remain active vehicles for adjusting market exposure, with increasing attention on flows amid volatility.

News Conclusion

- Strong risk-off sentiment is prevailing, propelling gold and silver to all-time highs, while equity indices experience significant sell-offs and market volatility rises.

- Regional bank credit concerns and margin debt risks are damping market confidence, resulting in broad weakness across financial stocks both in the U.S. and Asia.

- Oil prices are under pressure due to technical breakdowns and rising geopolitical uncertainty.

- Investors continue to seek safe havens and defensive positions while closely monitoring Federal Reserve actions and macroeconomic developments.

- The outlook suggests continued volatility, preference for safe-haven assets, and caution toward riskier sectors as economic and macro risks persist.

Market News Sentiment:

Market News Articles: 37

- Neutral: 43.24%

- Negative: 35.14%

- Positive: 21.62%

Sentiment Summary: Out of 37 market news articles, 43.24% were neutral, 35.14% were negative, and 21.62% were positive.

Conclusion: News sentiment is currently balanced, with a slight skew toward neutrality and a notable portion of negative coverage. Positive sentiment is present but represents the smallest share among the articles reviewed.

GLD,Gold Articles: 18

- Positive: 66.67%

- Neutral: 22.22%

- Negative: 11.11%

Sentiment Summary:

Out of 18 recent articles related to GLD and Gold, approximately 67% have a positive sentiment, about 22% are neutral, and roughly 11% are negative.

This indicates that recent news coverage for GLD and Gold has leaned predominantly positive, with a smaller portion of neutral and negative articles.

USO,Oil Articles: 5

- Negative: 80.00%

- Neutral: 20.00%

Sentiment Summary: The recent news coverage for USO and Oil is predominantly negative, with 80% of articles reflecting a negative sentiment and 20% presenting a neutral stance.

This indicates that most current market news is highlighting concerns or challenges related to USO and Oil.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 17, 2025 07:16

- GLD 396.45 Bullish 2.34%

- NVDA 181.81 Bullish 1.10%

- TLT 91.34 Bullish 0.75%

- GOOG 251.88 Bullish 0.07%

- MSFT 511.61 Bearish -0.35%

- QQQ 599.99 Bearish -0.37%

- AMZN 214.47 Bearish -0.51%

- DIA 459.56 Bearish -0.68%

- SPY 660.64 Bearish -0.68%

- AAPL 247.45 Bearish -0.76%

- META 712.07 Bearish -0.76%

- IJH 64.34 Bearish -1.23%

- TSLA 428.75 Bearish -1.47%

- USO 67.81 Bearish -1.71%

- IWM 245.06 Bearish -2.11%

- IBIT 61.43 Bearish -2.75%

Market Summary Snapshot

10/17/2025 07:16:00

ETF Stocks Overview

- SPY: 660.64

-0.68% (Bearish) - QQQ: 599.99

-0.37% (Bearish) - IWM: 245.06

-2.11% (Bearish) - IJH: 64.34

-1.23% (Bearish) - DIA: 459.56

-0.68% (Bearish)

ETF Stock sentiment: Predominantly bearish, with broad-based ETFs (SPY, QQQ, IWM, IJH, DIA) all posting declines, especially notable in small- and mid-cap segments (IWM, IJH).

Mag7 Snapshot

- AAPL: 247.45

-0.76% (Bearish) - MSFT: 511.61

-0.35% (Bearish) - GOOG: 251.88

+0.07% (Bullish) - AMZN: 214.47

-0.51% (Bearish) - META: 712.07

-0.76% (Bearish) - NVDA: 181.81

+1.10% (Bullish) - TSLA: 428.75

-1.47% (Bearish)

Mag7 sentiment: Mixed. While NVDA and GOOG show upward momentum, the other top technology and growth names are all trading lower, with TSLA notably weak.

Other Notable ETFs & Assets

- GLD (Gold): 396.45

+2.34% (Bullish) - TLT (Treasuries): 91.34

+0.75% (Bullish) - USO (Oil): 67.81

-1.71% (Bearish) - IBIT (Bitcoin ETF): 61.43

-2.75% (Bearish)

Other asset sentiment: Gold and long-duration Treasuries are both showing strength (bullish), while oil and the Bitcoin ETF are under pressure.

Summary View

- Broad Stock ETFs: Weakness across the board; risk-off sentiment.

- Technology/Mag7: Pockets of strength (NVDA, GOOG) in a generally weak environment.

- Safe Havens: Gold and Treasuries exhibiting relative strength amid equity and risk asset declines.

- Commodities & Crypto: Oil and Bitcoin ETF notably weaker in this session.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-17: 07:16 CT.

US Indices Futures

- ES Neutral-to-bearish ST/IT (below MSFG NTZ, swing pivots down), long-term bullish (above YSFG support), consolidating near highs, support 6540.25/6420.5, resistance 6700/6812.25.

- NQ Bearish ST/IT (below MSFG NTZ, pivots down), bullish long-term (well above YSFG/WSFG, MA uptrends), momentum sharp, support 24110.0, resistance 25750.5.

- YM Bearish ST/IT (MSFG/Pivots lower), bullish long-term (above major MAs, YSFG up), support 45387/45000, resistance 46573/46033, corrective phase with trend structure intact.

- EMD Bearish ST/IT (below MSFG NTZ, pivots down), long-term neutral (flat YSFG, MA mixed), consolidating, resistance 3293.2/3350, support 3182/3149.1.

- RTY Neutral ST (pivot down, MAs flat), bullish IT/LT (above MSFG/YSFG, MA uptrends), consolidating after rally, resistance 2559.9, support 2381.8/2275.2.

- FDAX Bearish ST (below WSFG/MSFG NTZ, pivots down), neutral IT (HiLo up/MA down), bullish LT (above YSFG, MA up), corrective with support 23798/22720, resistance 24891/24386.

Overall State

- Short-Term: Bearish-to-Neutral

- Intermediate-Term: Bearish-to-Neutral

- Long-Term: Bullish (except EMD Neutral)

Conclusion

Broad US indices futures present long-term bullish technical structures (all above key YSFG and major MA supports), though current short- and intermediate-term trends are corrective or consolidative with lower pivots and pullbacks present across ES, NQ, YM, EMD, and FDAX. RTY retains bullish IT/LT context but is neutral short term. Key technical benchmarks (MSFG/WSFG/YSFG, swing pivots) highlight active support/resistance zones: ES and NQ consolidating after recent highs, YM and FDAX in corrective moves within their longer bullish cycles, EMD consolidates with no clear LT direction. Overall, higher timeframe technicals suggest ongoing correction or consolidation within an uptrend phase, with pivotal support and resistance levels guiding potential range-bound or trending scenarios.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

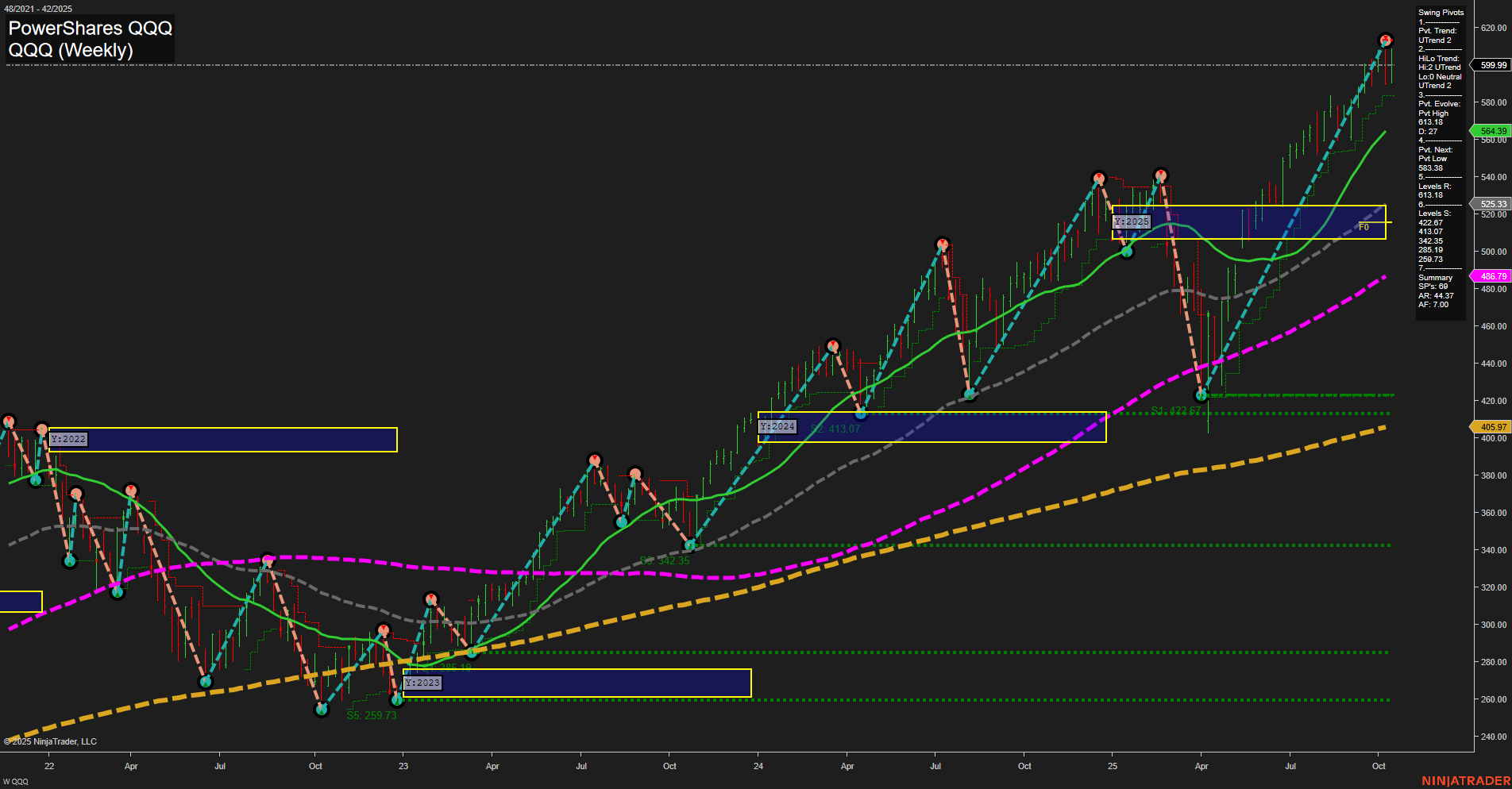

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts