Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

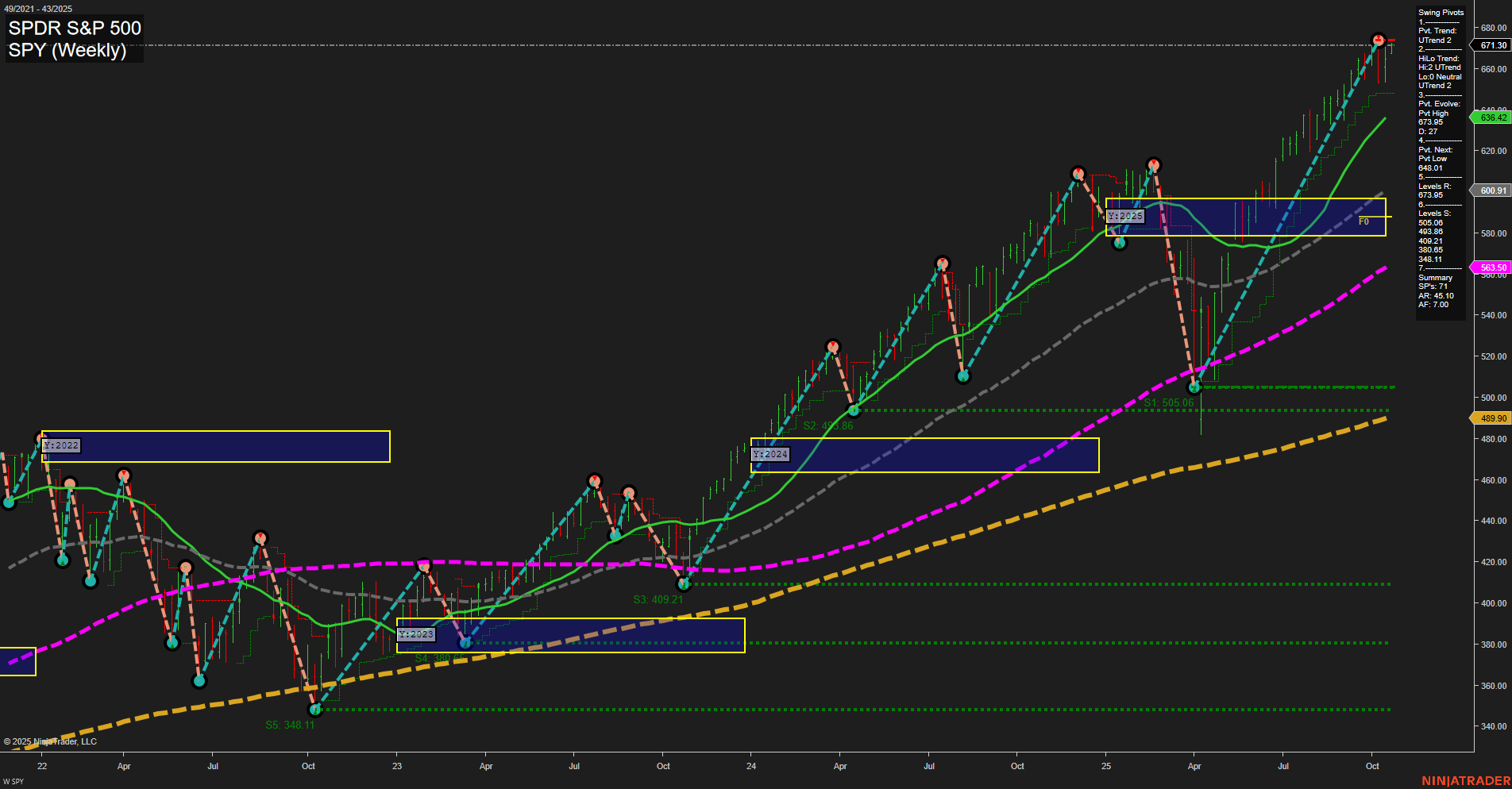

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- INTC Release: 2025-10-23 T:AMC

- TSLA Release: 2025-10-22 T:AMC

- IBM Release: 2025-10-22 T:AMC

Earnings Summary and Market Conclusion

As we look ahead to the upcoming earnings releases, traders should note that IBM and Tesla (TSLA) both report after the close on October 22, followed by Intel (INTC) after the close on October 23. These releases are likely to drive sharp sector moves, especially in technology and AI-adjacent stocks. In the days leading up to these reports, indices futures have typically seen lighter momentum and subdued volumes, as market participants pause ahead of major tech and semiconductor earnings events. This cautious tone is reinforced by anticipation for subsequent releases from NVDA, other MAG7, and related AI technology companies, which historically set broader direction for the indices. Consequently, we expect continued range-bound or slightly choppy trading in the run-up to these headline events, as the market absorbs positioning and awaits new information that could break the current equilibrium.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Wednesday 10:30 – USD Crude Oil Inventories (Low)

Slightly lower inventory data may nudge oil prices up, signaling higher input costs that could add inflationary pressures. This can increase volatility in energy-heavy sectors of index futures. - Friday 08:30 – USD Core CPI m/m, CPI m/m, CPI y/y (High)

The trio of key inflation data releases will be decisive for near-term index direction. A higher-than-expected print will likely trigger market volatility, as it heightens expectations for tighter Fed policy, impacting equities and futures sentiment. - Friday 09:45 – USD Flash Manufacturing PMI, Flash Services PMI (High)

These forward-looking data points take on added importance after CPI. Stronger-than-expected readings could boost risk-on trades but may also reinforce inflation concerns if pricing indices are elevated.

EcoNews Conclusion

- Friday’s high-impact inflation data (CPI, Core CPI) is likely to be the main market mover for US indices futures, setting the tone for volatility and directional momentum across session highs and lows.

- 10:00 AM news—such as consumer sentiment and new home sales—often lines up with significant intraday market moves, capable of fueling either reversals or continuation patterns depending on the earlier reaction to CPI and PMI data.

- As oil inventories remain low, any upward move in oil prices could directly impact inflation expectations and market sentiment due to concerns around input costs and geopolitics.

- Expectations of the CPI release may also contribute to reduced momentum and volume earlier in the week as traders await these major data points.

For full details visit: Forex Factory EcoNews

Market News Summary

- Global Indices: Major world indexes posted gains, with Hong Kong’s Hang Seng up 31.8% year-to-date. European stocks opened higher, extending positive momentum. U.S. equities ended the week resiliently, led by the Nasdaq and S&P 500 testing record highs. However, futures for the S&P 500, Dow, and Nasdaq edged lower pre-market Tuesday, indicating potential consolidation after Monday’s rally.

- Sector Focus & Valuation: Quality and growth stocks have lagged value even as overall global growth strengthens. Some U.S. stocks now trade at high valuations, creating challenges for finding attractive entry points, especially in consumer tech. Defense stocks were noted as supporting Europe’s rally.

- Gold: Gold remains near record highs, with volatility at a 5-year peak driven by haven demand and heavy option activity. The rally is attributed to both market uncertainty and institutional flows, despite easing U.S.-China trade tensions and positive news elsewhere. AI-driven fintech firms are seeing skepticism from potential gold sellers even as prices soar.

- Earnings Season: Corporate earnings are acting as a key market catalyst, overshadowing central bank (Fed) influence in the near term. Strong results are driving risk appetite, although mixed sentiment persists regarding whether high-performing tech stocks may introduce risk.

- Commodities: Oil prices declined sharply on oversupply concerns and ongoing U.S.-China tensions, even as trade deal optimism persists. Technical analysis highlights oil’s strong downtrend; in contrast, natural gas holds a bullish structure, and lower gas prices are seen as easing consumer pressures in the U.S.

- Macro Risks: The job market has weakened in recent weeks. The ongoing U.S. government shutdown is impacting economic services, with potential for longer-term damage if unresolved. Indices appear priced for optimistic outcomes on U.S.-China trade negotiations, with key risks still in play.

- Sentiment & Volatility: The CNN Money Fear & Greed Index indicates investor fear remains, though it has eased somewhat. Volatility is up in credit markets, led by regional bank concerns, while VIX remains elevated.

News Conclusion

- Markets are rotating after a significant global rally, pausing as investors focus on corporate earnings and valuations.

- Despite prevailing risk-on sentiment in equities and gains across global indices, concerns remain about oil oversupply, the job market, and unresolved macro issues like the U.S. government shutdown.

- Gold’s surge and elevated volatility reflect ongoing uncertainty, even as some traditional economic risks appear to moderate.

- Broader market sentiment appears cautiously optimistic but fragile, with positioning sensitive to earnings results, commodity swings, and policy developments.

Market News Sentiment:

Market News Articles: 36

- Positive: 38.89%

- Neutral: 33.33%

- Negative: 27.78%

Sentiment Summary:

Out of 36 market news articles, 38.89% were positive, 33.33% were neutral, and 27.78% were negative.

Conclusion:

Current news sentiment is leaning slightly positive overall, with a balanced distribution among positive, neutral, and negative coverage.

GLD,Gold Articles: 14

- Neutral: 50.00%

- Positive: 50.00%

Sentiment Summary: Market news coverage for GLD and gold is evenly split, with 50% of articles showing a positive sentiment and 50% remaining neutral.

This balanced sentiment indicates a lack of strong directional bias in recent reporting on gold.

USO,Oil Articles: 8

- Negative: 75.00%

- Neutral: 25.00%

Sentiment Summary: Recent news coverage on USO and oil is predominantly negative, with 75% of articles conveying a negative sentiment and 25% maintaining a neutral tone.

This indicates that current market news sentiment regarding USO and oil is largely negative among reported articles.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 21, 2025 07:16

- IBIT 62.93 Bullish 4.07%

- AAPL 262.24 Bullish 3.94%

- GLD 403.15 Bullish 3.64%

- META 732.17 Bullish 2.13%

- IWM 248.16 Bullish 1.95%

- TSLA 447.43 Bullish 1.85%

- AMZN 216.48 Bullish 1.61%

- GOOG 257.02 Bullish 1.27%

- QQQ 611.54 Bullish 1.26%

- IJH 65.26 Bullish 1.23%

- DIA 467.02 Bullish 1.13%

- SPY 671.30 Bullish 1.04%

- MSFT 516.79 Bullish 0.62%

- TLT 91.55 Bullish 0.38%

- USO 67.83 Bearish -0.22%

- NVDA 182.64 Bearish -0.32%

Market Summary: ETF Stocks, Magnificent 7, and Thematic ETFs (as of 10/21/2025)

ETF Stocks Overview

- SPY: 671.30 (+1.04%) – Bullish

- QQQ: 611.54 (+1.26%) – Bullish

- IWM: 248.16 (+1.95%) – Bullish

- IJH: 65.26 (+1.23%) – Bullish

- DIA: 467.02 (+1.13%) – Bullish

All major US equity ETFs are registering solid gains, reflecting broad-based strength across large cap (SPY, DIA), tech (QQQ), and small/mid-cap indices (IWM, IJH). Sentiment is decisively bullish for core equity benchmarks.

Magnificent 7 Performance Snapshot

- AAPL: 262.24 (+3.94%) – Bullish

- MSFT: 516.79 (+0.62%) – Bullish

- GOOG: 257.02 (+1.27%) – Bullish

- AMZN: 216.48 (+1.61%) – Bullish

- META: 732.17 (+2.13%) – Bullish

- NVDA: 182.64 (−0.32%) – Bearish

- TSLA: 447.43 (+1.85%) – Bullish

The majority of the Mag7 stocks are advancing, with AAPL and META leading relative outperformance. NVDA is an outlier, trading on the downside in an otherwise bullish group.

Other Key Thematic/Alternative ETFs

- IBIT: 62.93 (+4.07%) – Bullish

- TLT: 91.55 (+0.38%) – Bullish

- GLD: 403.15 (+3.64%) – Bullish

- USO: 67.83 (−0.22%) – Bearish

IBIT (Bitcoin ETF) and GLD (Gold ETF) are showing strong bullish momentum, suggesting robust risk appetite in cryptocurrencies and safe-haven demand for gold. TLT (long-duration Treasuries) is up modestly. USO (Oil ETF) is slightly lower, indicating weakness in the energy complex.

State of Play: Long/Short/Mixed Sentiment

- Long/Bullish: Predominant theme across US equities, Mag7 stocks (except NVDA), Bitcoin, and Gold.

- Short/Bearish: NVDA and USO are registering mild declines against the bullish backdrop.

- Mixed: Overall, market tone is strongly bullish with only isolated weakness seen in select energy and semiconductor-related names.

No trading recommendations. Data reflects current sentiment snapshot and does not constitute investment advice.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-21: 07:16 CT.

US Indices Futures

- ES Bullish across YSFG, MSFG, WSFG, trading above all grid levels, above NTZ/F0%, swing pivots up, support at 6461.54, resistance at 6812.25, moving averages trending up.

- NQ Strong uptrend on YSFG, MSFG, WSFG, above all NTZ/F0%, swing pivots rising, support at 24072.50, recent pivot high 25394, moving averages up, all long signals triggered.

- YM Bullish HTF trend, well above YSFG, MSFG, WSFG, above NTZ/F0%, swing pivot high at 47239, support at 45228, all moving averages rising, trend continuation signals active.

- EMD Consolidating above YSFG, MSFG, WSFG, neutral short- and intermediate-term pivots, support at 3149–3133, resistance 3350–3523, short-term MAs down, longer-term MAs up, mixed signals.

- RTY Weekly charts bullish, above all YSFG, MSFG, WSFG, pivot high at 2559.9, support well below, all MAs rising, daily timeframe shows short-term neutral pivot, consolidating after rally.

- FDAX Persistent uptrend YSFG, MSFG, WSFG, above NTZ/F0%, weekly pivot high at 24611, support at 22767, daily pivot high 24891, all MAs trending upward, trend continuation structure.

Overall State

- Short-Term: Bullish to Neutral (EMD, RTY short-term neutral; others bullish)

- Intermediate-Term: Bullish to Neutral (EMD neutral; others bullish)

- Long-Term: Bullish (all indices bullish)

Conclusion

US Indices Futures are broadly trending higher on higher timeframes, with ES, NQ, YM, RTY, and FDAX all above yearly, monthly, and weekly session fib grid benchmarks and NTZ/F0% levels. Swing pivots confirm uptrends for most indices; EMD is consolidating with neutral short/intermediate pivots but maintains a bullish long-term structure above 200-period moving averages. All major benchmarks show rising moving averages, with most recent signals in alignment with prevailing trends. Support levels remain well-defined below while current price action is testing or breaking recent highs, indicating a HTF market state favoring ongoing trend structure, with only EMD and RTY showing near-term consolidation or pullback characteristics within durable broader uptrends.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

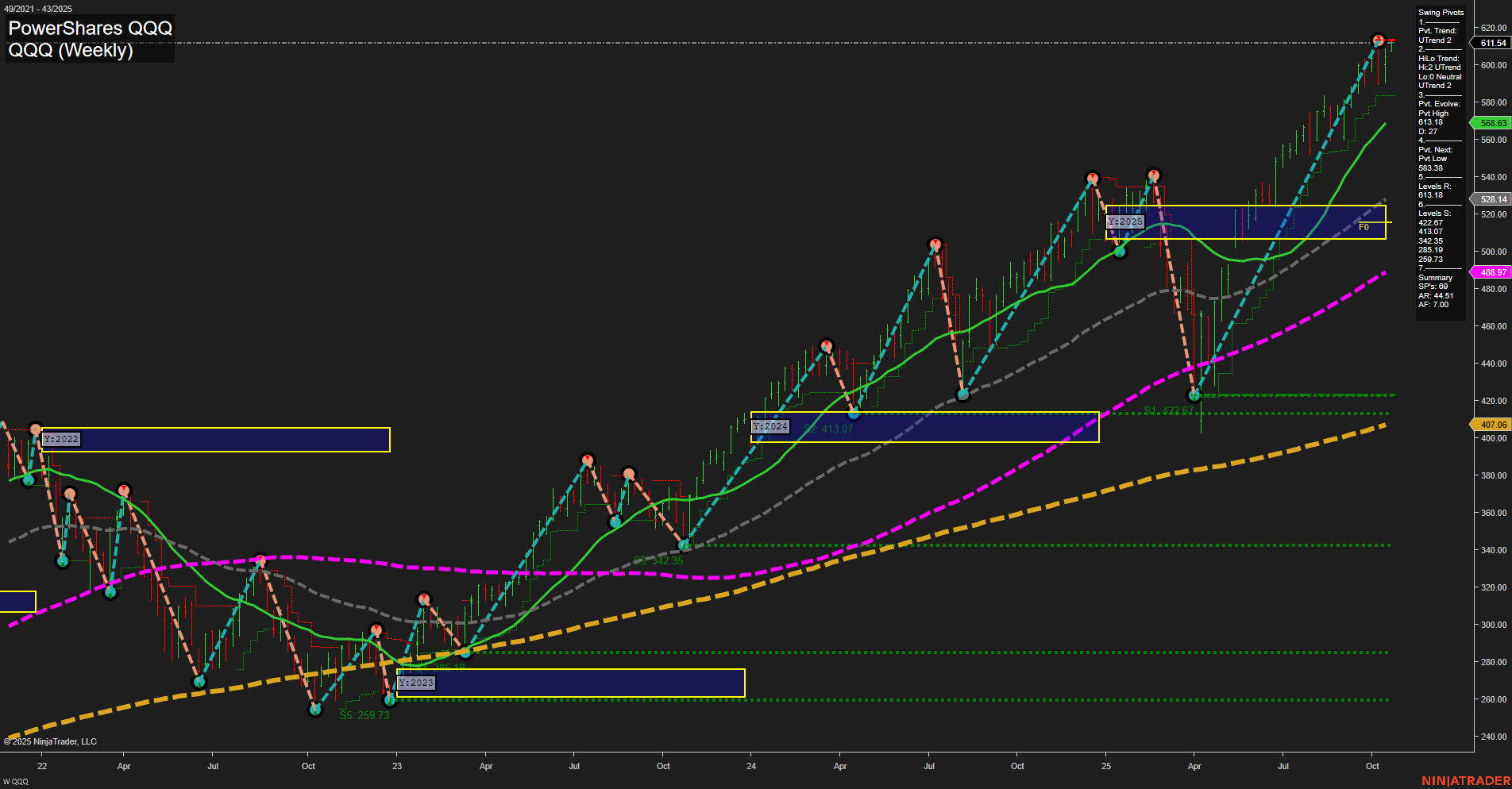

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts