After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

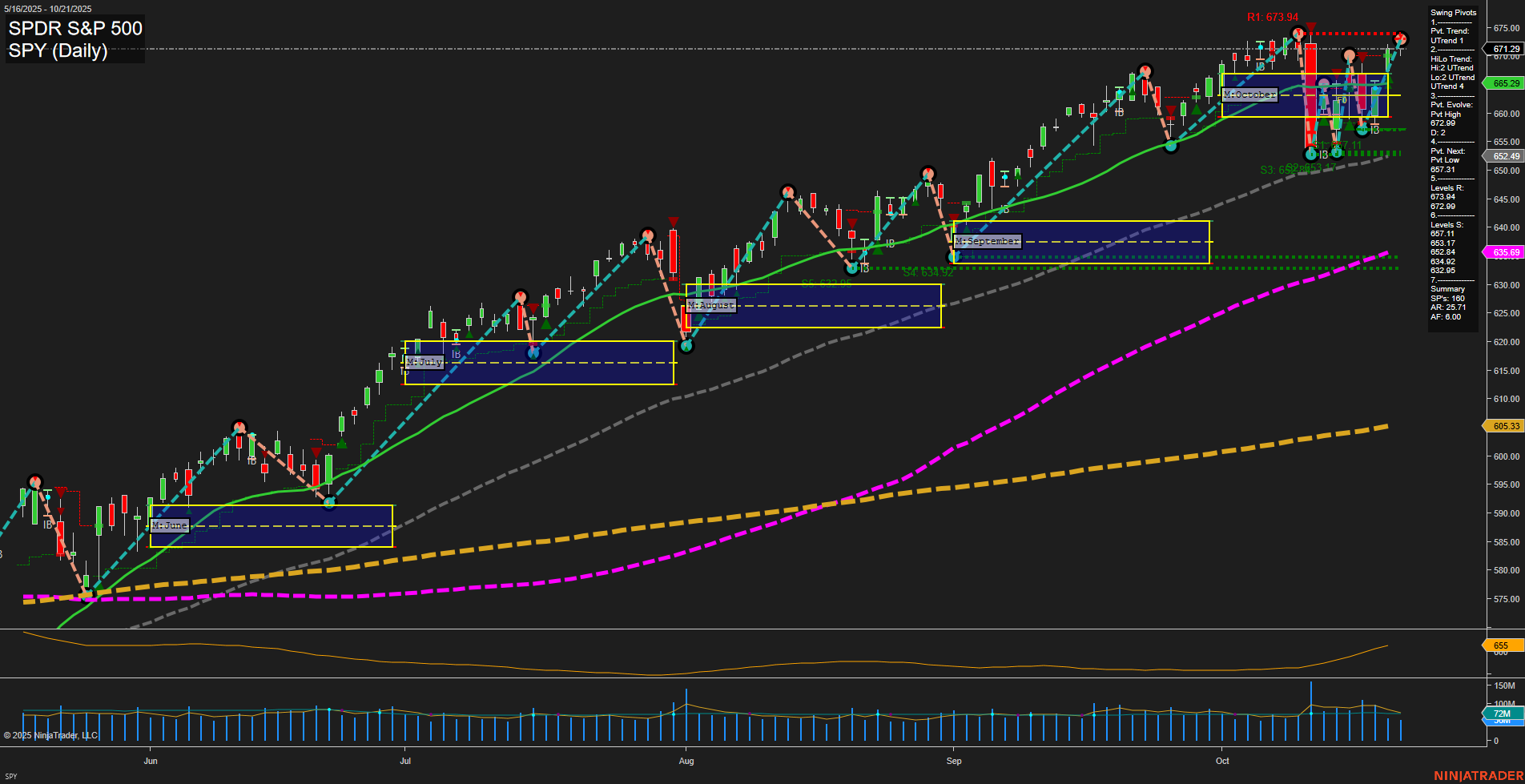

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Gold and Precious Metals: Gold prices saw a significant drop, experiencing their worst rout in over a decade. The selloff raised questions about gold’s defensive role, with related metals such as silver and platinum also under pressure amid broad profit-taking. While short-term sentiment is weak, long-term forecasts remain constructive, supported by ongoing central bank buying and strong demand from markets like China. Technical levels show gold finding near-term support at the 20-day average.

- Equity Markets and Earnings: Major indices retreated as renewed U.S.-China trade tension and high valuations led to volatility and a sharp pullback, particularly in tech stocks. Concerns about a potential correction have emerged, with focus shifting to upcoming earnings from major tech firms. Analysts boosted forecasts for Nasdaq following strong quarterly results, while business development companies are seen as potential value plays given attractive entry points.

- Macro and Policy: Market uncertainty was amplified by the government shutdown, which has impacted access to economic data for the Federal Reserve. The SEC remains vigilant for irregularities despite the shutdown. Headlines highlighted the U.S. national debt reaching record highs and continued debate over tariffs, with President Trump mulling further restrictions on Chinese tech exports.

- Energy Markets: Crude oil rebounded, posting its biggest one-day gain in a month as inventories declined and traders assessed supply risks after recent lows. Natural gas also received a lift from falling gasoline stocks, although some analysts discussed the outlook given volatile price action.

- Other Notables: The NHL announced a first-of-its-kind licensing deal with prediction market operators, underlining the growing intersection of sports and financial markets. Meanwhile, discussions on meme stocks and the AI sector highlighted undercurrents of market risk below headline performance.

News Conclusion

- Markets experienced heightened volatility amid renewed U.S.-China trade tensions, a sharp sell-off in precious metals, and concerns over high equity valuations leading into earnings season. Gold’s steep decline has prompted debate about its traditional role, but underlying longer-term demand factors remain intact. Oil markets showed signs of stability following strong inventory data. Policy uncertainty from the government shutdown and rising U.S. debt added to the cautious tone, as participants focused closely on macro and micro signals for direction.

Market News Sentiment:

Market News Articles: 41

- Neutral: 41.46%

- Negative: 31.71%

- Positive: 26.83%

GLD,Gold Articles: 22

- Negative: 63.64%

- Neutral: 36.36%

USO,Oil Articles: 6

- Positive: 66.67%

- Neutral: 33.33%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 22, 2025 05:00

- USO 70.63 Bullish 3.46%

- MSFT 520.54 Bullish 0.56%

- GOOG 252.53 Bullish 0.47%

- TLT 92.06 Bullish 0.07%

- META 733.41 Bullish 0.02%

- GLD 377.28 Bullish 0.01%

- NVDA 180.28 Bearish -0.49%

- SPY 667.80 Bearish -0.52%

- DIA 465.78 Bearish -0.73%

- TSLA 438.97 Bearish -0.82%

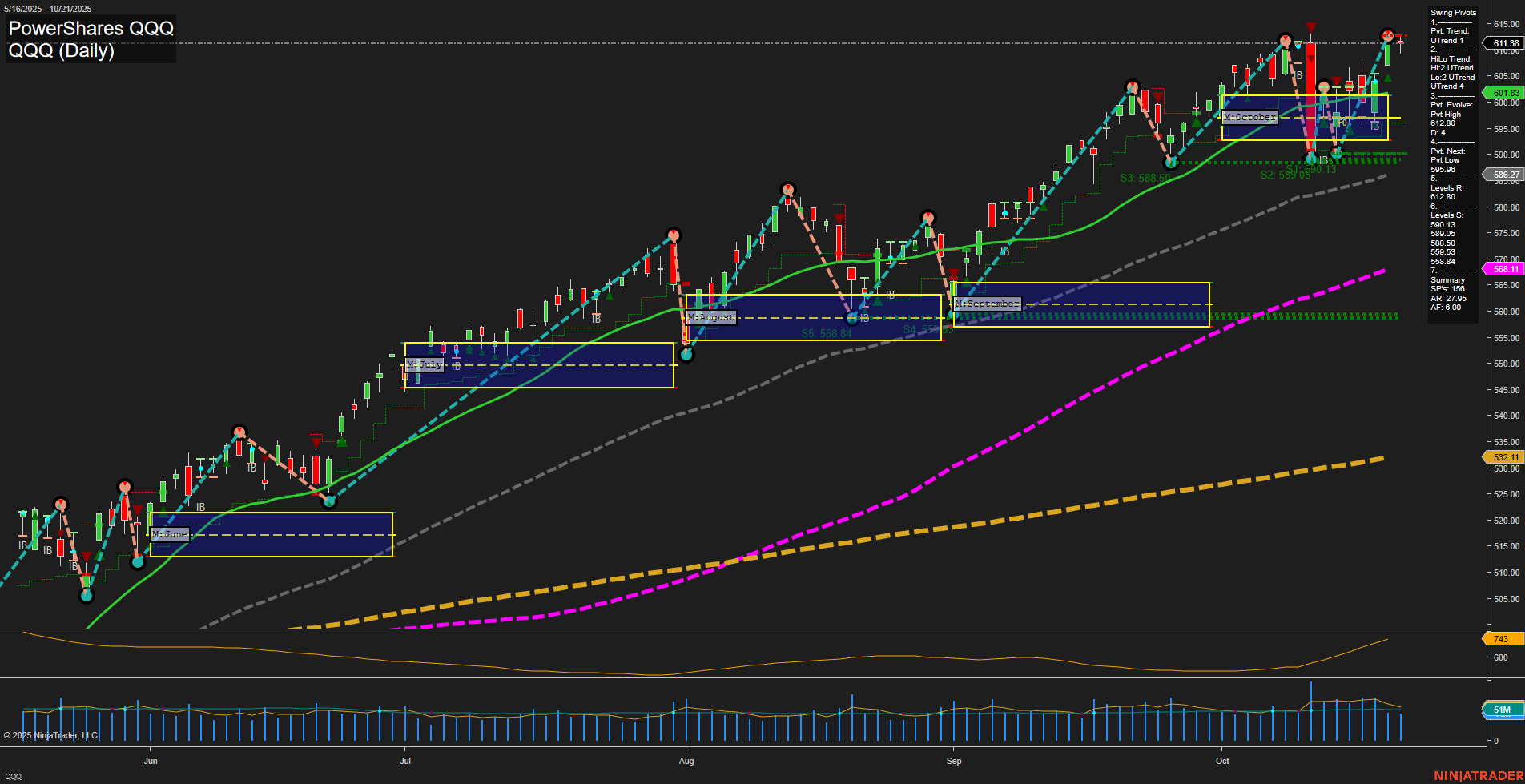

- QQQ 605.49 Bearish -0.96%

- IJH 64.74 Bearish -1.18%

- IWM 243.34 Bearish -1.48%

- AAPL 258.45 Bearish -1.64%

- AMZN 217.95 Bearish -1.84%

- IBIT 61.21 Bearish -3.59%

Market Summary Snapshot (as of 10/22/2025 17:00)

ETF Stocks Overview

- SPY: 667.80 -0.52% (Bearish) – S&P 500 tracking ETF turning lower, suggesting broad large-cap momentum is under pressure.

- QQQ: 605.49 -0.96% (Bearish) – NASDAQ 100 ETF trending down, with leading tech weakness seen.

- IWM: 243.34 -1.48% (Bearish) – Russell 2000 small caps underperforming, risk sentiment skewed negative.

- IJH: 64.74 -1.18% (Bearish) – Mid-cap ETF also showing broad declines.

- DIA: 465.78 -0.73% (Bearish) – Dow Jones ETF experiencing downside, large-caps broadly weaker.

Summary: ETF stock indexes are negative across the board with pronounced weakness in small and mid-caps, reflecting a risk-off tone.

Magnificent 7 (MAG7) Leaders

- MSFT: 520.54 +0.56% (Bullish) – Microsoft stands out positive among large-cap techs.

- GOOG: 252.53 +0.47% (Bullish) – Alphabet shows moderate strength.

- META: 733.41 +0.02% (Bullish) – Flat to slightly positive.

- NVDA: 180.28 -0.49% (Bearish) – Nvidia turns red amid sector softness.

- AAPL: 258.45 -1.64% (Bearish) – Apple under pressure, notable drop.

- AMZN: 217.95 -1.84% (Bearish) – Amazon also lagging, deeper red print.

- TSLA: 438.97 -0.82% (Bearish) – Tesla in retreat with risk-sensitive stocks.

Summary: MAG7 shows a mixed session, with MSFT, GOOG, and META resisting broader selling, but NVDA, AAPL, AMZN, and TSLA notably weak.

Key Asset ETFs: Bonds, Gold, Oil, and Crypto

- TLT: 92.06 +0.07% (Bullish) – Slight uptick for long bonds in tentative risk-off flows.

- GLD: 377.28 +0.01% (Bullish) – Gold ETF flat, demonstrating defensive tone.

- USO: 70.63 +3.46% (Bullish) – Energy notably strong, crude-related ETF surging.

- IBIT: 61.21 -3.59% (Bearish) – Bitcoin ETF sharply lower, exhibiting significant volatility.

Summary: Defensive assets like bonds and gold hold steady, with oil outperforming. Crypto shows outsized losses on the day.

Overall State of Play

- Broad equity and risk-asset weakness seen, especially in core ETF stocks, small/mid caps, and parts of tech.

- Mixed performance among top tech leaders, as only select MAG7 names are positive.

- Oil surges against the trend; crypto (IBIT) notably underperforms.

- Defensive bond and gold ETFs are steady to mildly positive, suggesting some risk-averse repositioning.

Diversified assets show a split: energy outperforms while broad equities and crypto lag, with defensive themes emerging in gold and bonds.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts