Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

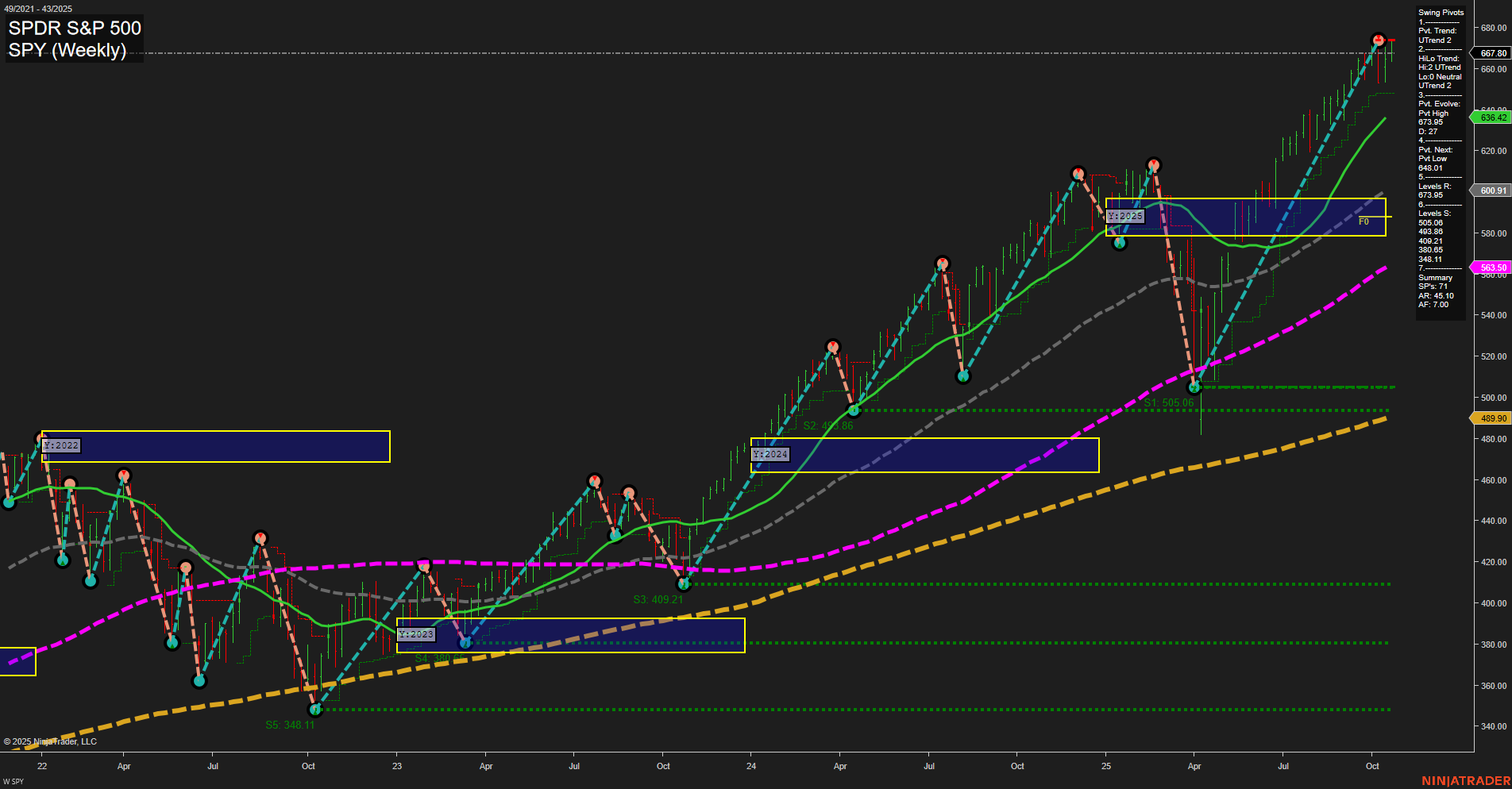

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- INTC Release: 2025-10-23 T:AMC

Intel (INTC) is scheduled to report its earnings after the market close on October 23, 2025. As one of the largest semiconductor companies, Intel’s results and guidance are closely watched for signals on demand trends across AI, PC, and server markets. In the lead-up to Intel’s report, indices futures traders can expect market momentum and trading volume to remain subdued, with many participants adopting a wait-and-see approach. This is particularly noticeable given the upcoming earnings results from major peers like Nvidia (NVDA) and the broader Magnificent 7 (MAG7) tech stocks, which together drive significant sentiment and direction for tech-heavy indices. Uncertainty around AI chip demand and macro technology spend will likely keep risk appetite in check until these key results are released.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Friday 08:30 – High Impact – Core CPI m/m, CPI m/m, CPI y/y (USD): This cluster of inflation data is in sharp focus for the equity index futures markets. Any upside surprises in these prints could signal persistent inflationary pressures, bolstering expectations of a less dovish Fed and potentially sparking downward moves in indices. Conversely, softer-than-expected CPI numbers would likely fuel risk-on sentiment, supporting index futures.

- Friday 09:45 – High Impact – Flash Manufacturing PMI, Flash Services PMI (USD): Purchasers’ manager indices provide early insight into the pace of economic activity. Higher readings may raise concerns about overheating or sticky inflation, translating into renewed market volatility. Weak results may reinforce growth slowdown themes.

EcoNews Conclusion

- The back-to-back release of inflation data and PMIs on Friday morning brings the potential for high volatility and sharp index futures price action.

- Market momentum and volume may slow in the lead-up to Friday’s CPI release.

- News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- AI & Markets: Concerns of an AI bubble are rising, with economists warning that if AI investment wanes, both the stock market and the broader U.S. economy could see negative impacts. Market momentum remains heavily dependent on corporate AI-driven spending, which some observers note is being fueled by complex vendor relationships rather than straightforward demand.

- Oil & Commodities: U.S. sanctions against Russian oil giants Rosneft and Lukoil sparked a sharp rebound in global oil prices—WTI and Brent both rallied, with prompt contracts quickly regaining a premium. Supply concerns mounted, especially for Asian importers like India and China, who may face disruptions as Russian crude becomes harder to access. The commodity rally extended to natural gas as well, with technical setups signaling potential breakouts.

- Equities & Indexes: U.S. stocks experienced volatility, with some profit-taking and sector rotation pressure. Despite dips in growth names, major indexes like the S&P 500 and Nasdaq retained key support levels. Experts anticipate that positive momentum could resume, driven by expected profit growth and prospects of lower interest rates. A poll of money managers indicated a bullish outlook into 2026, with AI and earnings playing crucial roles.

- Earnings & Stock Selection: Earnings season featured mixed results—Tesla missed expectations and saw shares drop, while companies exceeding lofty forecasts (like Intuitive Surgical) delivered strong gains. Market behavior suggests upside may be limited when expectations outpace reality, even for fundamentally strong firms.

- Safe Havens & ETFs: Gold attracted renewed interest as a possible equity hedge, with some strategists projecting significant upside. Mega cap ETFs such as MGC outperformed traditional benchmarks, emphasizing balanced exposure to both growth leaders and value stocks. Gold and silver saw solid price gains amid volatility.

- Macro & Cross-Asset Flows: Treasury yields declined as investors braced for key CPI inflation data, with market jitters evident amid government shutdown uncertainty and limited economic data. European markets like the FTSE 100 were poised for a cautious open, boosted somewhat by rising oil prices.

- Sector Notes: Regional banks remained pressured by lingering credit concerns. Health care was cited as potentially undervalued relative to other areas. Political uncertainty and government spending visibility were also highlighted as factors clouding earnings interpretations and overall market sentiment.

News Conclusion

- Markets are navigating a complex environment marked by shifting macro drivers—rapid adjustments in commodity prices due to geopolitics, evolving sentiment around the AI sector, and uncertainty stemming from government shutdowns and economic data gaps.

- Recent U.S. sanctions on Russian energy are fueling commodity rallies and have significant cross-market implications, particularly for energy-sensitive indices and international trade flows.

- Equity markets remain volatile but have shown resilience near technical support. Forward-looking expectations are high, especially in tech and AI, but the gap between earnings results and investor hopes warrants close attention.

- Safe haven assets like gold and diversified mega cap ETFs are seeing increased attention as traders weigh inflation, valuation concerns, and the prospect of delayed or muted economic data releases.

- Overall, the landscape is defined by heightened volatility, ongoing sector rotation, and a sharp focus on macro events—with both risks and opportunities shifting rapidly across asset classes.

Market News Sentiment:

Market News Articles: 38

- Neutral: 39.47%

- Negative: 34.21%

- Positive: 26.32%

Sentiment Summary:

Out of 38 recent market news articles, 39.47% reflected a neutral sentiment, 34.21% showed a negative tone, and 26.32% were positive.

Conclusion:

The current distribution of sentiment in market news coverage is relatively balanced, with a slight tilt toward neutral and negative viewpoints over positive ones.

GLD,Gold Articles: 17

- Negative: 52.94%

- Neutral: 29.41%

- Positive: 17.65%

Sentiment Summary:

Out of 17 recent articles on GLD and gold, 52.94% carry a negative sentiment, 29.41% are neutral, and 17.65% are positive.

This indicates that current media coverage is primarily negative, with fewer articles expressing a favorable outlook and a notable proportion maintaining a neutral stance.

USO,Oil Articles: 10

- Positive: 40.00%

- Neutral: 40.00%

- Negative: 20.00%

Sentiment Summary: Out of 10 recent articles on USO and Oil, 40% reflect a positive sentiment, 40% are neutral, and 20% are negative.

This indicates a generally balanced marketplace outlook, with positive and neutral coverage prevailing over negative sentiment in current news.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 23, 2025 07:16

- USO 70.63 Bullish 3.46%

- MSFT 520.54 Bullish 0.56%

- GOOG 252.53 Bullish 0.47%

- TLT 92.06 Bullish 0.07%

- META 733.41 Bullish 0.02%

- GLD 377.28 Bullish 0.01%

- NVDA 180.28 Bearish -0.49%

- SPY 667.80 Bearish -0.52%

- DIA 465.78 Bearish -0.73%

- TSLA 438.97 Bearish -0.82%

- QQQ 605.49 Bearish -0.96%

- IJH 64.74 Bearish -1.18%

- IWM 243.34 Bearish -1.48%

- AAPL 258.45 Bearish -1.64%

- AMZN 217.95 Bearish -1.84%

- IBIT 61.21 Bearish -3.59%

Market Summary: State of Play (as of 2025-10-23 07:16)

ETF Stocks

- SPY: 667.80

Bearish (-0.52%)

The flagship S&P 500 ETF is experiencing downside pressure, reflecting broad market softness across large caps. - QQQ: 605.49

Bearish (-0.96%)

Nasdaq-100 exposure weakened, underperforming large-cap peers, likely due to tech stock losses. - IWM: 243.34

Bearish (-1.48%)

Small cap ETF down notably, highlighting risk-off sentiment and increased selling in riskier equities. - IJH: 64.74

Bearish (-1.18%)

Mid-cap segment also under pressure, echoing the weakness in smaller cap indices. - DIA: 465.78

Bearish (-0.73%)

Dow Jones ETF losing ground, showing broad-based equity pullback across blue chips.

Mag7 Stocks

- AAPL: 258.45

Bearish (-1.64%)

Apple leading declines among major techs. - MSFT: 520.54

Bullish (0.56%)

Microsoft stands out with gains against the tech rout. - GOOG: 252.53

Bullish (0.47%)

Alphabet sees moderate upside, contrasting most large techs. - AMZN: 217.95

Bearish (-1.84%)

Amazon sharply negative, adding weight to bearish Big Tech sentiment. - META: 733.41

Bullish (0.02%)

Meta ekes out a marginal gain, relatively resilient among peers. - NVDA: 180.28

Bearish (-0.49%)

Nvidia declining, continuing volatility seen in semiconductor segment. - TSLA: 438.97

Bearish (-0.82%)

Tesla extending further losses in the growth stock space.

Key Sector/Theme ETFs & Alternatives

- USO (Oil): 70.63

Bullish (3.46%)

U.S. Oil Fund surges, indicating strong crude demand or geopolitical drivers. - TLT (Long Bonds): 92.06

Bullish (0.07%)

Long duration Treasury ETF slightly positive; could point to safe-haven flows or rate move reactions. - GLD (Gold): 377.28

Bullish (0.01%)

Gold ETF holds steady, typically reflecting risk-hedging or inflation concerns. - IBIT (Bitcoin): 61.21

Bearish (-3.59%)

Crypto ETF sharply lower, indicating risk aversion and volatility in digital assets.

Summary

The market snapshot shows a mixed, risk-off tone across major indices and high-profile Tech, with defensive flows into commodities and bonds. Most major equity ETFs and Mag7 names are under pressure, though key outliers in tech (MSFT, GOOG, META) and energy (USO) display some strength. Crypto-linked products notably weaker.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-23: 07:16 CT.

US Indices Futures

- ES Uptrend on YSFG, MSFG, WSFG, price above NTZ/F0%, swing pivots rising, support at 6540.25, resistance at 6812.25, all major MA benchmarks trending upward.

- NQ YSFG and MSFG up, WSFG short-term down, price consolidating below swing high 24964, key resistance 25394, support at 24418.50/24158.50, long-term MAs rising.

- YM All session Fib grids bullish, swing pivots up, price above NTZ, resistance at 47348, support at 45234, all MA benchmarks confirm trend up, fast momentum.

- EMD YSFG above center, MSFG down, WSFG up, swing pivots down short/intermediate-term, support at 3149/3183.2, resistance at 3352.2/3523.1, long-term MAs up.

- RTY YSFG/MSFG/WSFG up, swing pivots up (weekly), short-term pivots down (daily), resistance 2559.9, support 2381.8/2440, intermediate/long MAs up, short-term consolidation.

- FDAX YSFG/WSFG/MSFG up (weekly), all MAs rising, pivot high at 24319, support at 22764; Daily: short-term up, intermediate-term neutral, resistance 24487/24891, above all NTZ levels.

Overall State

- Short-Term: Mixed (ES bullish/neutral, NQ neutral, YM bullish, EMD/RTY bearish, FDAX bullish)

- Intermediate-Term: Bullish in most (except EMD bearish, FDAX neutral)

- Long-Term: Bullish (all indices)

Conclusion

US Indices Futures remain in strong long-term bullish uptrends, confirmed by higher YSFG, MSFG, and WSFG levels, and upward-trending major moving averages. Current swing pivots are predominantly rising; however, several indices display short-term pullbacks or consolidation, as evidenced by neutral or bearish short-term trends (notably EMD and RTY daily). Most indices trade above key NTZ/F0% levels, indicating trend continuation on higher timeframes, with significant support beneath and recent resistance at swing highs. Absence of major HTF reversal signals suggests the larger directional structure remains upward, while short-term and intermediate-term corrections are occurring within a broader bullish framework.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

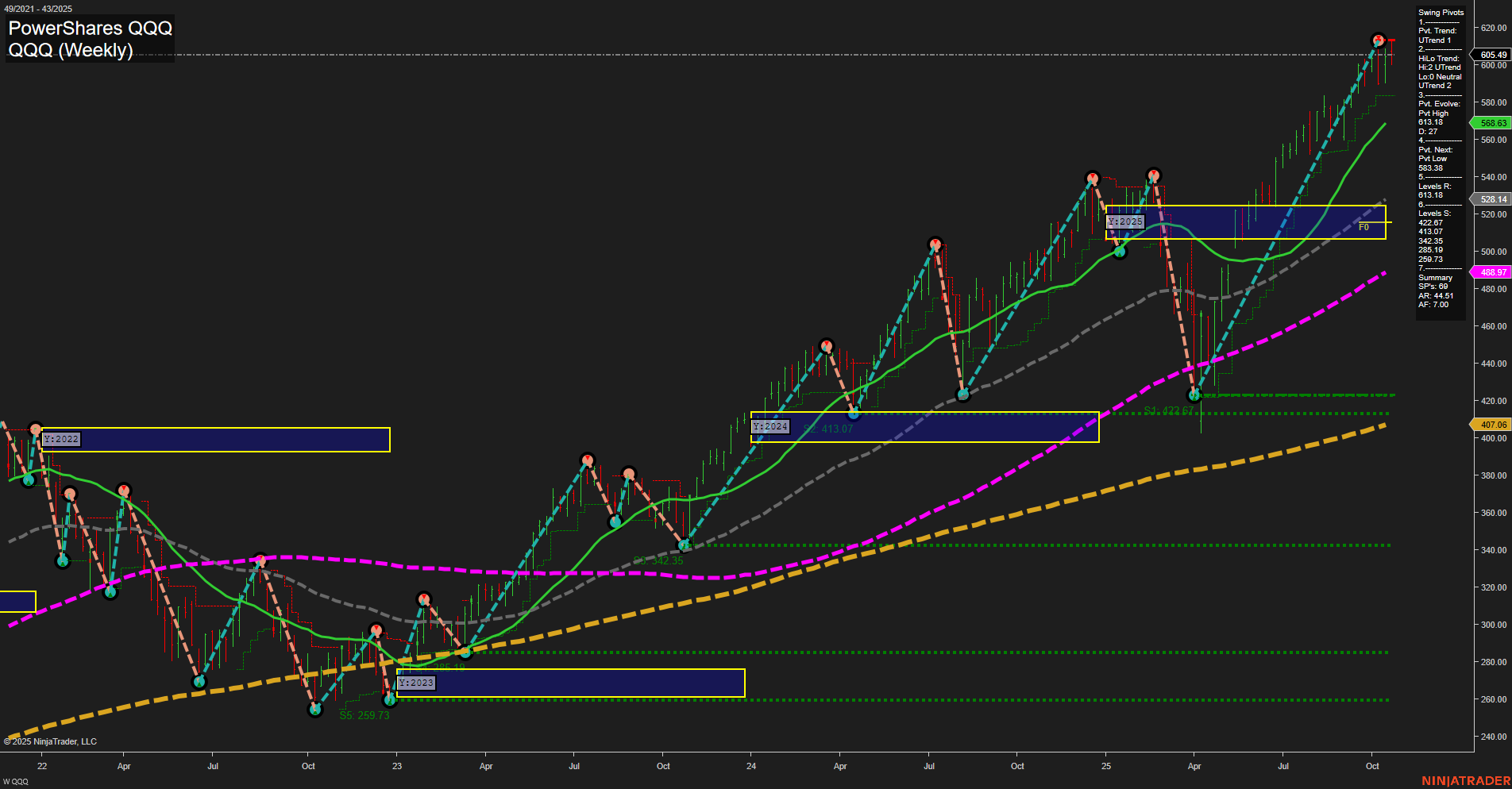

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts