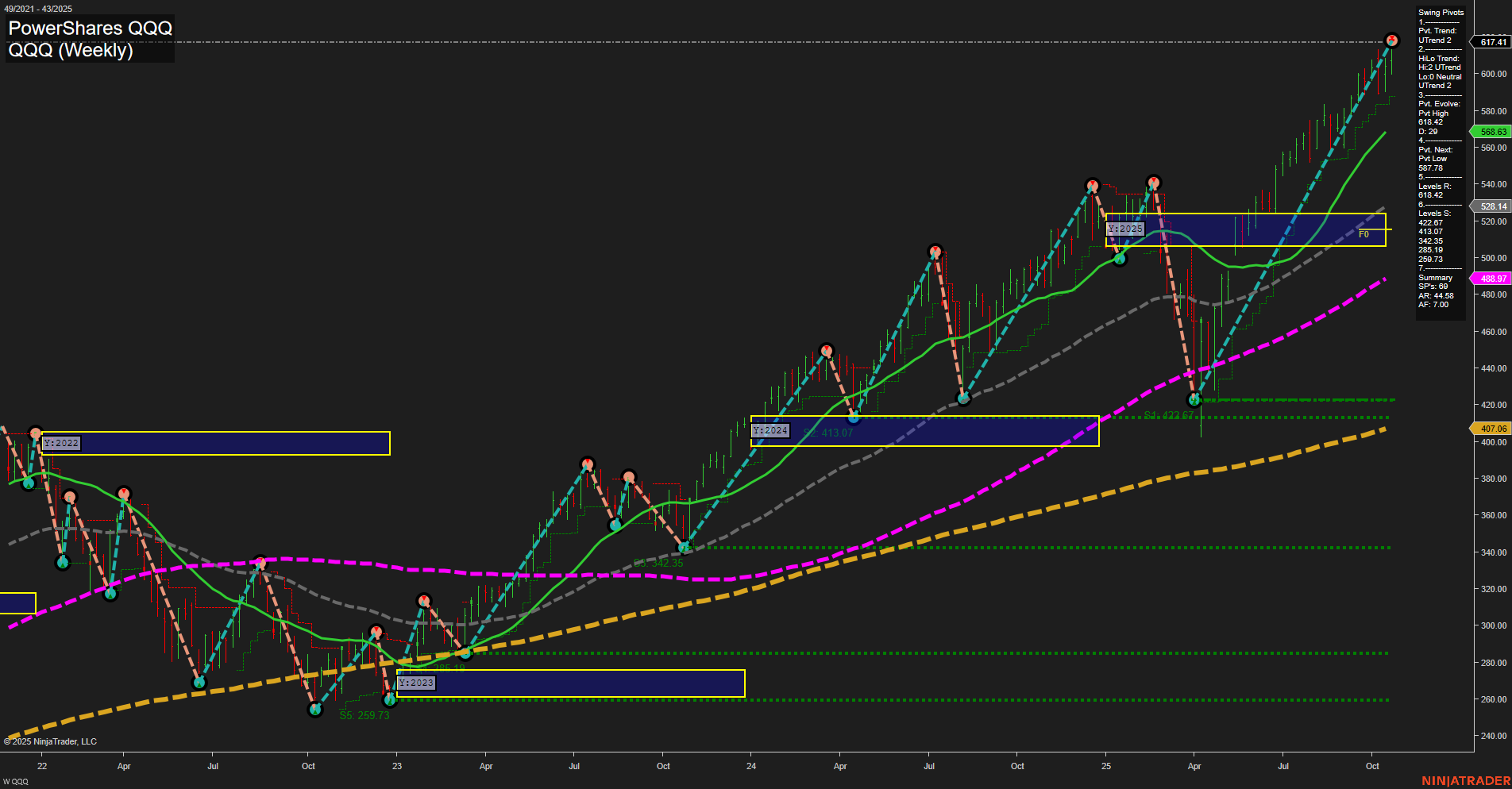

Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- AAPL Release: 2025-10-30 T:AMC

- AMZN Release: 2025-10-30 T:AMC

- MSFT Release: 2025-10-29 T:AMC

- GOOGL Release: 2025-10-29 T:AMC

- META Release: 2025-10-29 T:AMC

Looking into the coming week, day traders should anticipate subdued index futures momentum and tighter ranges in the lead-up to key earnings releases from major tech names. MSFT, GOOGL, and META all report after the close on October 29th, with AAPL and AMZN following after the close on October 30th. These clusterings—concentrated within a two-day window—will likely keep SPX, NDX, and related futures quieter as participants await direction from these MAG7 and AI-adjacent bellwethers. Liquidity and volume typically thin as hedging and positioning pause prior to such high-impact news, increasing the risk of sharp moves on headline releases. With additional anticipation for NVDA’s upcoming report, index futures will likely price in earnings premium until there is greater visibility from these tech giants. Overall, expect market participants to remain in wait-and-see mode until the bulk of these tech earnings cross the wires.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- Oil: Crude oil is showing a bullish reversal pattern, but further upside hinges on Russian supply actions and overcoming resistance near $63.74.

- Silver: Silver traders are cautious, watching for deeper value support between $41.40–$38.31 as market sentiment turns bearish and attention shifts to Fed guidance.

- Gold & Silver: Both metals, along with equities, are rallying as investors react to stagflation concerns and increasing uncertainty ahead of an important Fed meeting.

- Federal Reserve: Markets widely expect a 25 basis point rate cut at the upcoming FOMC meeting. The Fed faces pressure from a weakening labor market and an economic slowdown, with quantitative tightening nearing a potential conclusion.

- Stocks: The stock market’s recent rally encounters heightened volatility risk this week as the Fed’s policy decision coincides with major tech earnings releases. Roughly 160 S&P 500 companies are set to report.

- S&P 500: Technical analysis signals a bullish bias following last week’s price action, though the outlook remains sensitive to ongoing geopolitical events and earnings season.

- Gold Outlook: Bullish views on gold intensify, driven by a weaker dollar, persistent inflation, and robust central bank demand.

- Themes: There is an ongoing rotation toward disciplined, fundamentals-based strategies in equities. Electricity’s strategic role is rising, likened to becoming the “new oil.” AI-related stocks remain prominent but could face future disruptions.

News Conclusion

- This week presents elevated risks due to overlapping central bank decisions and key earnings metrics, especially in the tech sector.

- Commodities, particularly gold, are in focus amid inflation and currency volatility, while silver searches for support.

- Market liquidity conditions and Fed policy trajectory remain core market drivers, alongside global supply concerns and shifting sector leadership within equities.

Market News Sentiment:

Market News Articles: 5

- Neutral: 60.00%

- Negative: 40.00%

GLD,Gold Articles: 4

- Negative: 50.00%

- Positive: 25.00%

- Neutral: 25.00%

USO,Oil Articles: 2

- Neutral: 50.00%

- Positive: 50.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: October 26, 2025 06:15

- GOOG 260.51 Bullish 2.67%

- NVDA 186.26 Bullish 2.25%

- AMZN 224.21 Bullish 1.41%

- AAPL 262.82 Bullish 1.25%

- IWM 249.43 Bullish 1.22%

- QQQ 617.10 Bullish 1.07%

- DIA 472.21 Bullish 1.05%

- SPY 677.25 Bullish 0.82%

- META 738.36 Bullish 0.59%

- MSFT 523.61 Bullish 0.59%

- IJH 65.99 Bullish 0.56%

- IBIT 62.83 Bullish 0.43%

- TLT 91.47 Bullish 0.04%

- USO 73.18 Bearish -0.15%

- GLD 377.52 Bearish -0.34%

- TSLA 433.72 Bearish -3.40%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-10-26: 18:15 CT.

US Indices Futures

- ES Strong bullish trend, all YSFG/MSFG/WSFG up, price at new highs, above all S/R and NTZ/F0%, higher highs/lows, MAs rising, last swing high 6872.50, support at 6200.31.

- NQ Daily bullish on all timeframes, price at new highs, above weekly/monthly/yearly fib grids, all MAs up, swing pivots confirm uptrend, higher highs/lows, volatility/volume elevated.

- YM No current higher timeframe technical data available.

- EMD Bullish across timeframes, above all key MAs, price above YSFG/MSFG/WSFG NTZ/F0%, swing high 3349.3, recent low 3149.0, supports at 3149.0/2997.4, momentum/structure intact.

- RTY No current higher timeframe technical data available.

- FDAX Weekly trend firmly bullish, making higher highs/lows, above all session grid NTZ, swing high at 24,819, support at 22,764. Daily chart neutral ST/IT, long-term bullish, MA mixed, price consolidating below 24,891, moderate volatility/volume.

Overall State

- Short-Term: Bullish (except FDAX: Neutral)

- Intermediate-Term: Bullish (except FDAX: Neutral)

- Long-Term: Bullish (all covered indices)

Conclusion

US indices futures (ES, NQ, EMD) are in strong higher-timeframe uptrends, confirmed by all session fib grids (YSFG, MSFG, WSFG), rising benchmark moving averages, and ongoing higher swing pivots. Resistance remains thin above recent highs, with wide support zones below. FDAX exhibits bullish weekly structure with consolidation on the daily, moderating the near-term outlook but reinforcing long-term uptrend. Overall HTF context maintains prevailing upside momentum, with all observed US indices and leading benchmarks consistent in trend direction. No reversal or exhaustion signals evident in current structure; correlations favor ongoing strength as long as key support levels persist.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts