After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

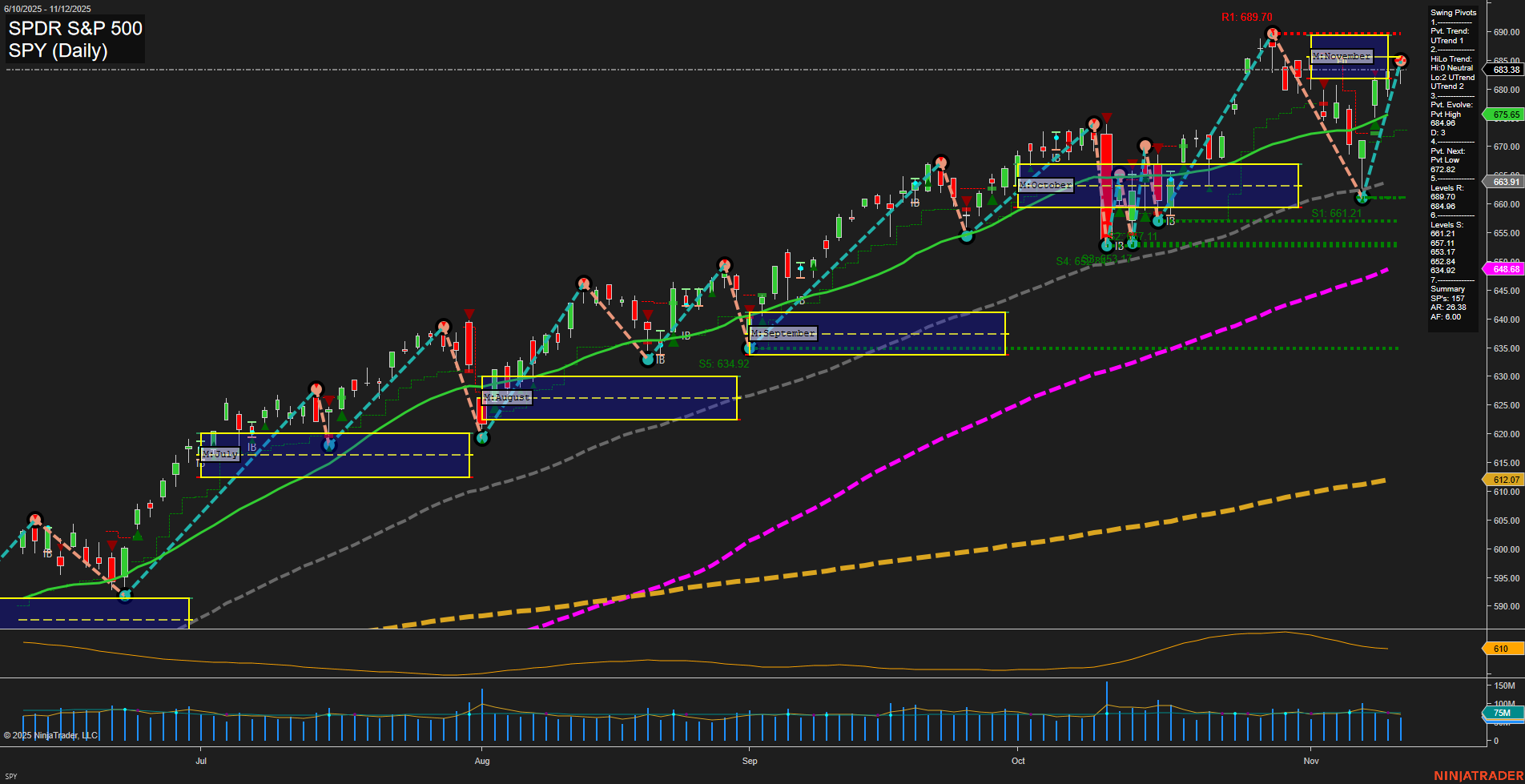

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Gold & Commodities: Gold surged to new highs above $4,200, fueled by renewed hopes of a December Fed rate cut and broader uncertainty over U.S. debt; however, choppy trading and profit taking triggered sharp reversals. Silver followed gold’s choppy action. Opinions on gold’s further upside remain divided as markets balance safe-haven demand with erratic economic signals.

- Central Banks & Fed: Prospects for a December Fed rate cut are clouded by internal FOMC divisions and mixed data, with market hopes for a cut fading. Rising uncertainty over Fed policy contributed to sharp equity market moves, especially in rate-sensitive growth and tech stocks.

- Oil & Energy: U.S. crude inventories rose more than expected last week, even as prices tried to stabilize. Crude broke down below key support levels after a failed technical breakout, but long-term demand forecasts remain strong. Global oil demand is projected to grow steadily through 2040. Energy sector earnings are expected to see an extended run, partly on AI-driven efficiencies.

- Indices & Equities: U.S. indices suffered their biggest declines in a month, with the Nasdaq dropping over 2% and the Dow plunging sharply after recent record closes. Sentiment turned bearish as hopes for imminent Fed easing faded and AI sector volatility spiked. Market action on Thursday reflected a positioning reset after extremely bullish sentiment in prior weeks. Nonetheless, the end of the government shutdown was seen as supportive longer term, coinciding with a historically strong period for equities.

- AI & Tech: Debate continues over whether AI is a bubble or transformational opportunity. Volatility in leading tech names persisted as investors weighed rapid growth against valuation risks. Some analysts remain positive on AI’s long-term impact, citing continued market leadership and growth potential.

- International Flows: European officials are exploring reducing their reliance on U.S. dollar funding in response to policy and geopolitical shifts. Venezuela faces prolonged challenges in ramping up oil production despite global supply diversification efforts.

- Market Position & Flows: Valuations remain a concern, as much good news had already been priced in ahead of earnings. Investors are reassessing exposure, with sector rotation and cyclical patterns influencing price action.

News Conclusion

- Markets experienced heightened volatility following the end of the U.S. government shutdown, as attention quickly shifted to Fed policy uncertainty and weak economic data signals.

- Equities, especially in the tech sector, saw significant pullbacks driven by renewed skepticism about the likelihood of a near-term rate cut, as well as concerns about AI spending and stretched valuations.

- Gold and energy markets reflected safe-haven flows and fundamental supply considerations, with notable swings tied to both macro and technical factors.

- Despite short-term fluctuations, longer-term themes such as AI, seasonal equity momentum, and projected energy demand continue to shape trader positioning and market sentiment heading into year-end.

Market News Sentiment:

Market News Articles: 37

- Neutral: 43.24%

- Positive: 32.43%

- Negative: 24.32%

GLD,Gold Articles: 14

- Positive: 42.86%

- Negative: 28.57%

- Neutral: 28.57%

USO,Oil Articles: 13

- Negative: 46.15%

- Neutral: 30.77%

- Positive: 23.08%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 13, 2025 05:00

- META 609.89 Bullish 0.14%

- USO 69.85 Bullish 0.09%

- AAPL 272.95 Bearish -0.19%

- GLD 382.87 Bearish -0.81%

- TLT 89.38 Bearish -0.82%

- MSFT 503.29 Bearish -1.54%

- SPY 672.04 Bearish -1.66%

- DIA 474.74 Bearish -1.66%

- IJH 64.34 Bearish -1.86%

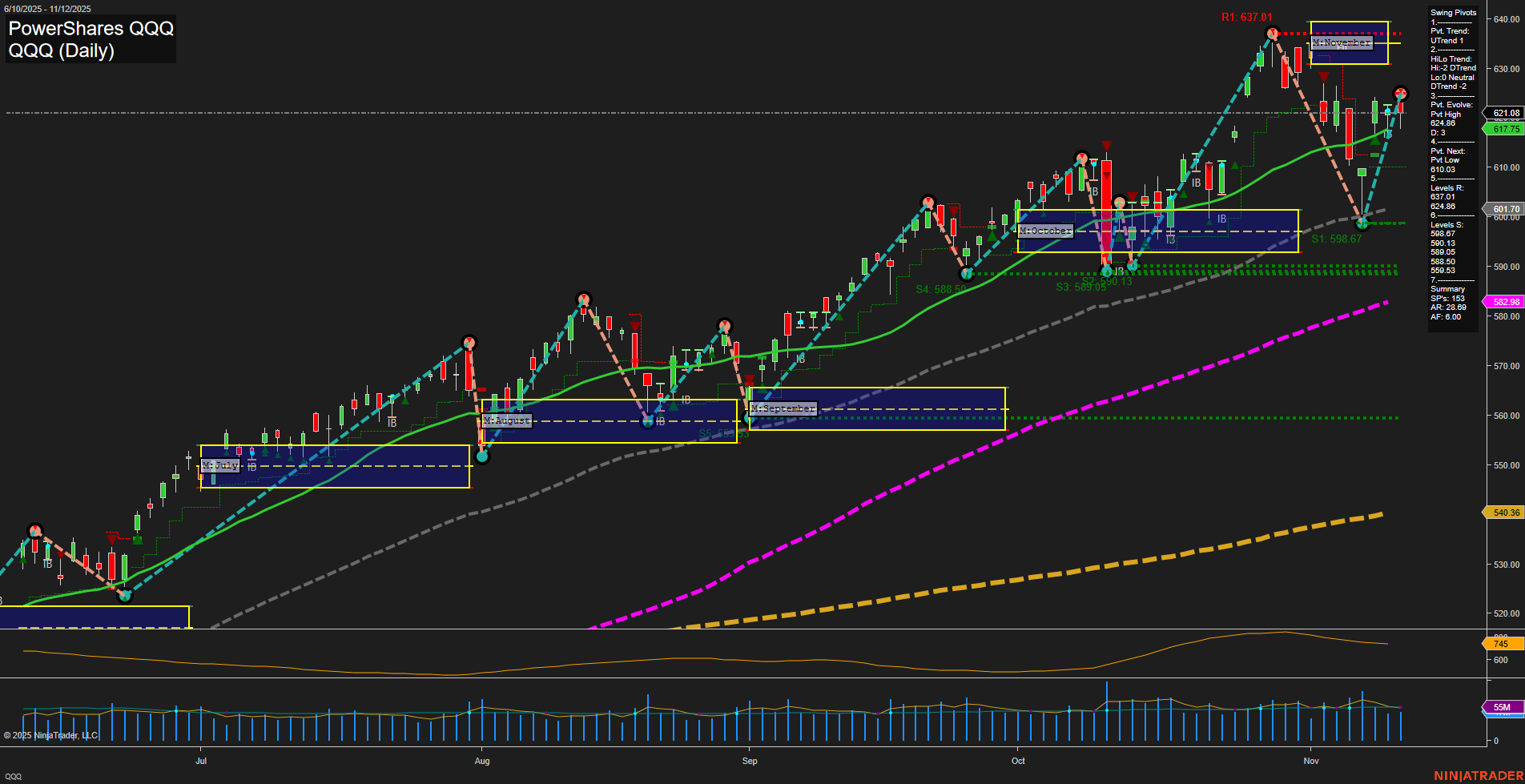

- QQQ 608.40 Bearish -2.04%

- AMZN 237.58 Bearish -2.71%

- IWM 236.79 Bearish -2.81%

- GOOG 279.12 Bearish -2.89%

- IBIT 55.59 Bearish -3.47%

- NVDA 186.86 Bearish -3.58%

- TSLA 401.99 Bearish -6.64%

Market Summary: State of Play (as of 11/13/2025 17:00:00)

ETF Stocks: SPY, QQQ, IWM, IJH, DIA

- SPY 672.04 (Bearish -1.66%)

- QQQ 608.40 (Bearish -2.04%)

- IWM 236.79 (Bearish -2.81%)

- IJH 64.34 (Bearish -1.86%)

- DIA 474.74 (Bearish -1.66%)

Summary: All core US equity ETFs tracked here are showing broad bearish price action with losses ranging from -1.66% to -2.81%. The small-cap (IWM) and mid-cap (IJH) segments are also in negative territory, indicating widespread weakness across index funds.

Mag7: Key Large-cap Tech Stocks

- META 609.89 (Bullish 0.14%)

- AAPL 272.95 (Bearish -0.19%)

- MSFT 503.29 (Bearish -1.54%)

- AMZN 237.58 (Bearish -2.71%)

- GOOG 279.12 (Bearish -2.89%)

- NVDA 186.86 (Bearish -3.58%)

- TSLA 401.99 (Bearish -6.64%)

Summary: Within the largest tech names, META stands out with a modest bullish uptick (+0.14%). All others are experiencing declines, with TSLA (-6.64%) and NVDA (-3.58%) showing steepest losses. This reflects a highly mixed-to-negative sentiment across the megacap tech landscape.

Other ETFs: TLT, GLD, USO, IBIT

- USO 69.85 (Bullish 0.09%)

- GLD 382.87 (Bearish -0.81%)

- TLT 89.38 (Bearish -0.82%)

- IBIT 55.59 (Bearish -3.47%)

Summary: USO (crude oil) is posting a slight gain, indicating some resilience in energy. GLD (gold), TLT (long-term treasury), and IBIT (Bitcoin-linked ETF) are all bearish, with notable pressure on IBIT and modest declines in GLD and TLT.

Overall State

The prevailing theme in this market snapshot is widespread bearishness across major indices, large-cap tech, and most alternative ETFs, with only isolated pockets of bullish momentum in META and USO.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts