Market Roundup – NYSE After Market Close Bearish as of November 18, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

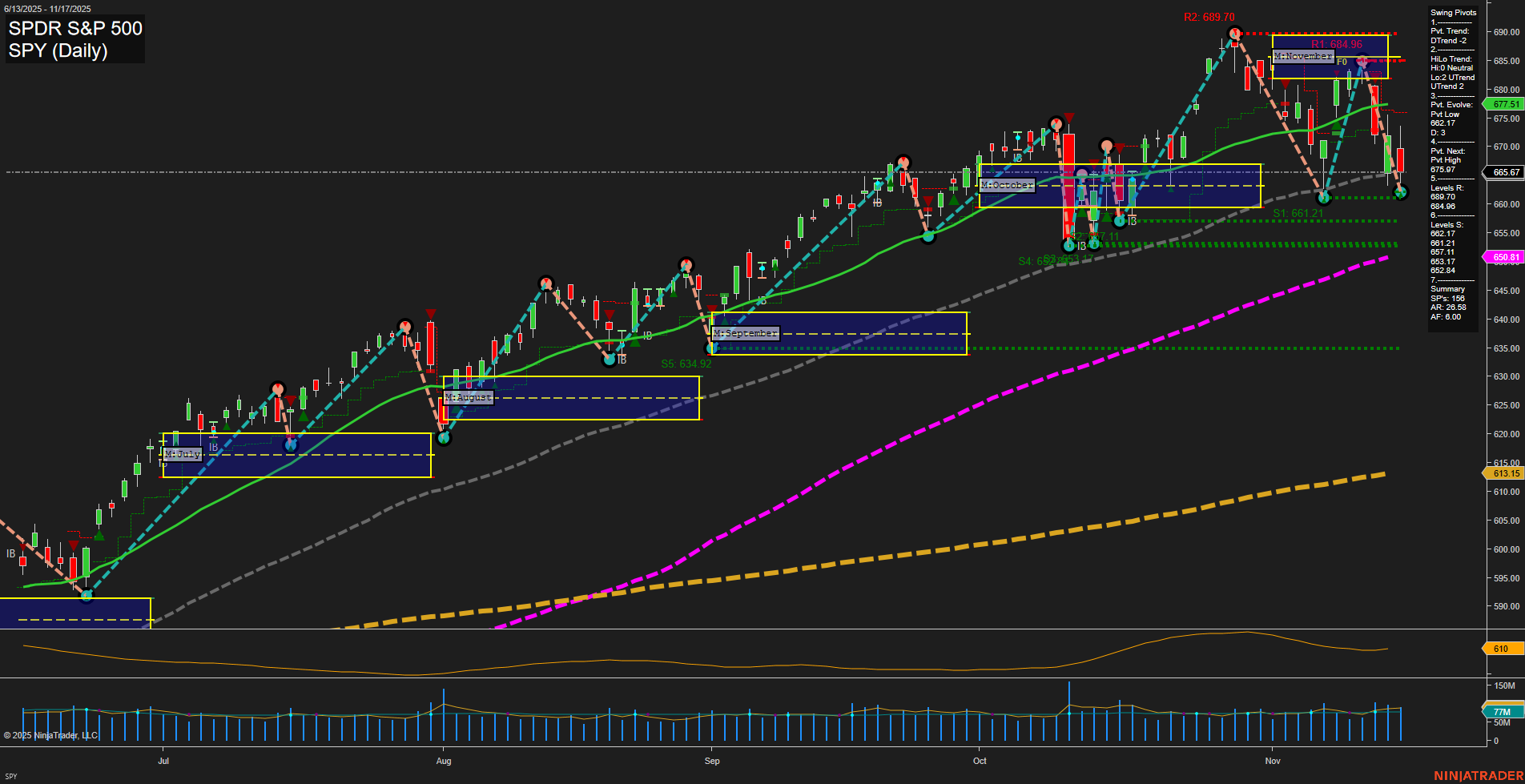

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Commodities & Energy: Global refining margins are at multi-year highs, fueled by Russian sanctions and limited Western capacity, supporting bullish sentiment in oil and energy. Crude oil prices are firming on supply risks, while technical setups suggest potential upside. Natural gas also participates in the energy move.

- Gold & Precious Metals: The gold market is volatile, with unseasonably strong demand from China and forecasts for significant gains into 2026. Despite recent price declines tied to shrinking rate cut expectations, gold has shown resilience, with prices rebounding off key technical support. Silver and platinum mirror this choppy action. Central bank demand, especially led by China, is creating longer-term support for gold, though short-term pullbacks persist.

- Equities & Indices: Stock market breadth is weak, with S&P 500 and Nasdaq under pressure; both indices have extended their losing streaks, with a notable portion of components in correction territory. Defensive sectors have not performed as expected during the tech selloff, and tech names like Amazon, Nvidia, Tesla, and Meta are all experiencing sharp declines. Despite this, trend metrics for broad equities remain constructive, and rotations into healthcare and biotech are emerging. High bullish investor activity is observed in technology and AI-related options despite the tech pullback.

- Macroeconomic & Fed Signals: The Federal Reserve notes rising risks from regulatory and economic slowdowns, with jobs data upcoming as a potential market catalyst. The lack of strong economic data is complicating the policy outlook, while ongoing weakness is especially evident in small caps and growth indices.

- Markets Outside US: India stands out with robust GDP growth and strong corporate earnings, presenting opportunities amid U.S. volatility. Discussions around 2026 risks and opportunities suggest a mixed but cautious outlook further out.

- Portfolio Rebalancing & Sentiment: Commentators highlight the importance of risk assessment in turbulent conditions, noting increasing red flags and urging consideration of portfolio rebalancing as market volatility rises.

News Conclusion

- Oil and energy remain supported by supply risks and strong refining margins, with technical signals flashing potential further gains.

- Gold is displaying mixed short-term movement but retains long-term upside potential according to major forecasts, aided by strong physical and central bank demand.

- Major U.S. indices continue to face challenges as breadth deteriorates and large-cap tech corrects, but shifts toward defensives and healthcare offer glimpses of rotation.

- Macro uncertainty persists, with the Federal Reserve highlighting risks amid slowing economic indicators; upcoming economic data releases may influence near-term market direction.

- International markets like India are outperforming, contrasting with U.S. equity struggles.

- Volatility is high, and market observers emphasize the need for active risk management and readiness to adapt to rapidly evolving conditions.

Market News Sentiment:

Market News Articles: 50

- Negative: 40.00%

- Neutral: 36.00%

- Positive: 24.00%

GLD,Gold Articles: 16

- Negative: 37.50%

- Positive: 31.25%

- Neutral: 31.25%

USO,Oil Articles: 8

- Positive: 62.50%

- Neutral: 25.00%

- Negative: 12.50%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 18, 2025 05:00

- USO 72.50 Bullish 1.68%

- IBIT 52.66 Bullish 1.07%

- GLD 374.35 Bullish 0.73%

- IJH 63.21 Bullish 0.32%

- IWM 233.47 Bullish 0.30%

- AAPL 267.44 Bearish -0.01%

- TLT 89.06 Bearish -0.03%

- GOOG 284.96 Bearish -0.22%

- META 597.69 Bearish -0.72%

- SPY 660.08 Bearish -0.84%

- DIA 461.30 Bearish -1.08%

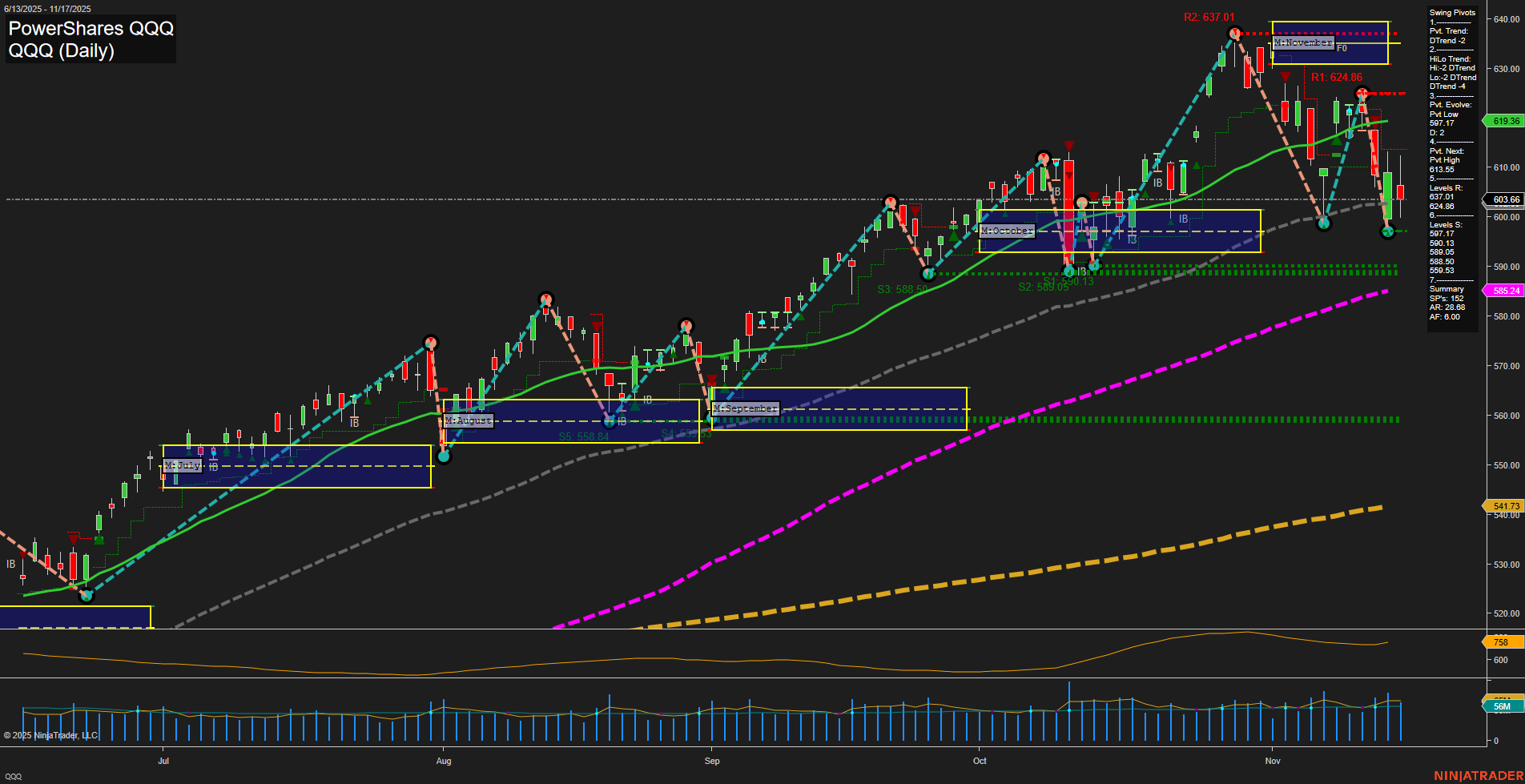

- QQQ 596.31 Bearish -1.22%

- TSLA 401.25 Bearish -1.88%

- MSFT 493.79 Bearish -2.70%

- NVDA 181.36 Bearish -2.81%

- AMZN 222.55 Bearish -4.43%

Market State of Play – Traders Snapshot (as of 11/18/2025)

ETF Leaders

- Bullish: Energy & Commodities

- USO: $72.50 +1.68% (Crude Oil ETF rally, strength in energy sector)

- GLD: $374.35 +0.73% (Gold ETF showing safe haven demand)

- Bullish: Mid and Small Caps

- IJH: $63.21 +0.32% (S&P MidCap 400 ETF, modest gains)

- IWM: $233.47 +0.30% (Russell 2000 ETF, positive small cap momentum)

- Bullish: Digital Assets

- IBIT: $52.66 +1.07% (Bitcoin ETF, continued digital asset interest)

- Mixed/Weakness: Long-Duration Bonds

- TLT: $89.06 -0.03% (Long-term bonds, slight weakness)

Major Broad Market ETFs

- SPY: $660.08 -0.84% (S&P 500 ETF under downward pressure)

- QQQ: $596.31 -1.22% (Nasdaq 100 ETF, tech-driven sell-off)

- DIA: $461.30 -1.08% (Dow ETF, broad weakness in blue chips)

Mag7 and Mega-Cap Performance

- AMZN: $222.55 -4.43% (Significant decline)

- NVDA: $181.36 -2.81%

- MSFT: $493.79 -2.70%

- TSLA: $401.25 -1.88%

- QQQ (proxy): $596.31 -1.22%

- DIA (proxy): $461.30 -1.08%

- SPY (proxy): $660.08 -0.84%

- META: $597.69 -0.72%

- GOOG: $284.96 -0.22%

- AAPL: $267.44 -0.01% (Stabilizing, near flat)

Key Takeaways

- Energy, gold, and digital assets present relative strength as traditional mega-cap names trade lower.

- Broad-based equity weakness concentrated in large- and mega-cap tech; smaller caps more resilient.

- Interest-sensitive assets (long bonds) drifting lower; no strong bid yet.

Observations are for informational context only—no recommendations are being provided.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts