After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

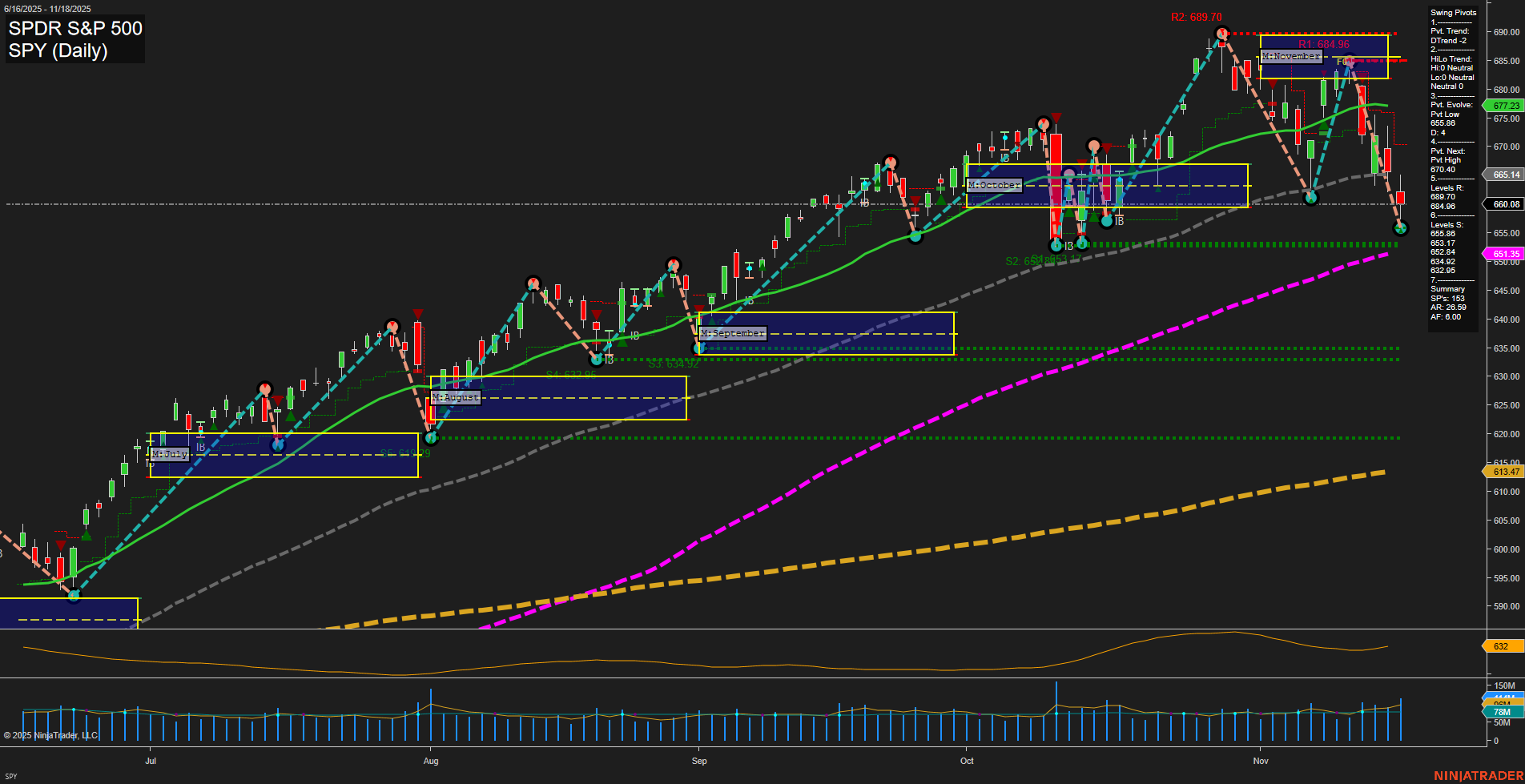

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- US stock indices attempted early recovery as benchmarks tested key technical levels, with focus on Nvidia’s earnings to potentially set near-term market direction.

- Tech stocks stabilized after a recent tough stretch, with renewed investor interest in buying the dip and a rebound helping the S&P 500 snap a four-day losing streak.

- Nvidia’s results indicated a stronger outlook for the AI sector, contributing to late-session gains in major indices.

- Dividend strategies remained popular, as both individual stocks and ETFs offering high yields attracted attention amid market uncertainty.

- Crude oil inventories fell due to increased exports and refinery activity, but WTI oil prices retreated later as gasoline inventories rose and traders responded to new data.

- Gold, silver, and platinum pulled back from highs as a strong dollar and upcoming economic releases impacted sentiment, though gold miners announced increased dividends and more M&A activity.

- The trade deficit contracted sharply following recent US tariffs, and Wells Fargo projected a US growth rebound in 2026 with changes in fiscal and tariff policies.

- Stimulus check proposals and approved chip exports to the Middle East generated speculation about demand for consumer and tech stocks such as SPY, AAPL, NVDA, and TSLA.

- The BLS delayed the full October jobs report, but the September nonfarm payrolls were set for imminent release after a data blackout.

- AI themes remained prominent, with analysts seeing recent volatility as opportunities and noting shifts from hardware to software leadership in the sector.

- Holiday season consumer spending patterns and sector rotation considerations (such as the emergence of gold as a core allocation) were highlighted amid changing macro conditions.

News Conclusion

- US equities showed signs of stabilization and recovery, especially in the tech sector, bolstered by positive earnings and renewed investor sentiment around AI-related companies.

- Defensive strategies focused on dividends and sector diversification were prevalent given ongoing market uncertainty and macro policy shifts.

- Commodities markets remained volatile, with oil pulled lower by supply data and metals responding to a strong dollar and anticipation of economic reports.

- Policy changes—including tariffs, fiscal stimulus, and international agreements—continued to drive short-term market volatility and longer-term growth projections.

- Economic data releases, especially on employment and inflation, remained key market catalysts amid ongoing data disruptions and event-driven trading.

Market News Sentiment:

Market News Articles: 43

- Neutral: 51.16%

- Positive: 34.88%

- Negative: 13.95%

GLD,Gold Articles: 13

- Neutral: 53.85%

- Positive: 38.46%

- Negative: 7.69%

USO,Oil Articles: 7

- Negative: 42.86%

- Neutral: 28.57%

- Positive: 28.57%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 19, 2025 05:00

- NVDA 186.52 Bullish 2.85%

- GOOG 292.99 Bullish 2.82%

- TSLA 403.99 Bullish 0.68%

- QQQ 599.87 Bullish 0.60%

- AAPL 268.56 Bullish 0.42%

- SPY 662.63 Bullish 0.39%

- GLD 374.96 Bullish 0.16%

- IJH 63.30 Bullish 0.14%

- DIA 461.76 Bullish 0.10%

- AMZN 222.69 Bullish 0.06%

- IWM 233.43 Bearish -0.02%

- TLT 88.88 Bearish -0.20%

- META 590.32 Bearish -1.23%

- MSFT 487.12 Bearish -1.35%

- USO 70.88 Bearish -2.23%

- IBIT 50.73 Bearish -3.67%

Market Summary: ETF Stocks, Magnificent 7, and Key ETFs (as of 11/19/2025 17:00)

Overall Market State

The trading session reflects a split market with Large Cap Tech and Broad Market ETFs showing continued bullish momentum, while select mega caps, midcaps, and thematic ETFs face headwinds. Rotation and sector-specific moves are visible with mixed sentiment across risk assets.

ETF Stocks: State of Play

- SPY (S&P 500): Bullish +0.39% — Maintains its uptrend, tracking general market optimism.

- QQQ (Nasdaq 100): Bullish +0.60% — Tech-heavy ETF outperforms broader indexes.

- DIA (Dow 30): Bullish +0.10% — Marginal gains reflect rotation into blue-chips.

- IJH (S&P Midcap 400): Bullish +0.14% — Modest gains in midcaps.

- IWM (Russell 2000): Bearish -0.02% — Relative weakness in small caps persists.

Summary: Predominantly bullish among large and mid-cap ETFs; small caps lag.

Magnificent 7: Diverse Performance

- NVDA: Bullish +2.85% — Strong leadership from semiconductors.

- GOOG: Bullish +2.82% — Momentum in AI and cloud driving gains.

- TSLA: Bullish +0.68% — Recovers to join the broader tech rally.

- AAPL: Bullish +0.42% — Gradual trend higher.

- AMZN: Bullish +0.06% — Flat but retains positive bias.

- META: Bearish -1.23% — Faces selling pressure.

- MSFT: Bearish -1.35% — Marked weakness in an otherwise tech-led market.

Summary: Tech giants display bifurcation: strong positive momentum for NVDA, GOOG, and TSLA, with AAPL and AMZN steady. META and MSFT diverge to the downside.

Other Key ETFs: Mixed Themes

- TLT (Long-term Treasuries): Bearish -0.20% — Government bonds under pressure; yields may be rising.

- GLD (Gold): Bullish +0.16% — Minor gains amid mixed risk sentiment.

- USO (Oil): Bearish -2.23% — Energy sector retraces as crude prices slide.

- IBIT (Bitcoin ETF): Bearish -3.67% — Crypto-linked assets experience pronounced drawdown.

Summary: Gold steady; treasuries, energy, and crypto weaker on the day.

Session Takeaways

- Bullish leadership notably persists in tech hardware, AI-oriented equities, and major stock index ETFs.

- Mixed sector dynamics: While some mega caps stride higher, defensive and alternative asset ETFs trade on weaker footing.

- Rotation theme: The divergence between certain large-caps, small-caps, and thematic ETFs suggests ongoing sector rotation and selective risk appetite.

Data is a snapshot only. No trading advice or recommendations.

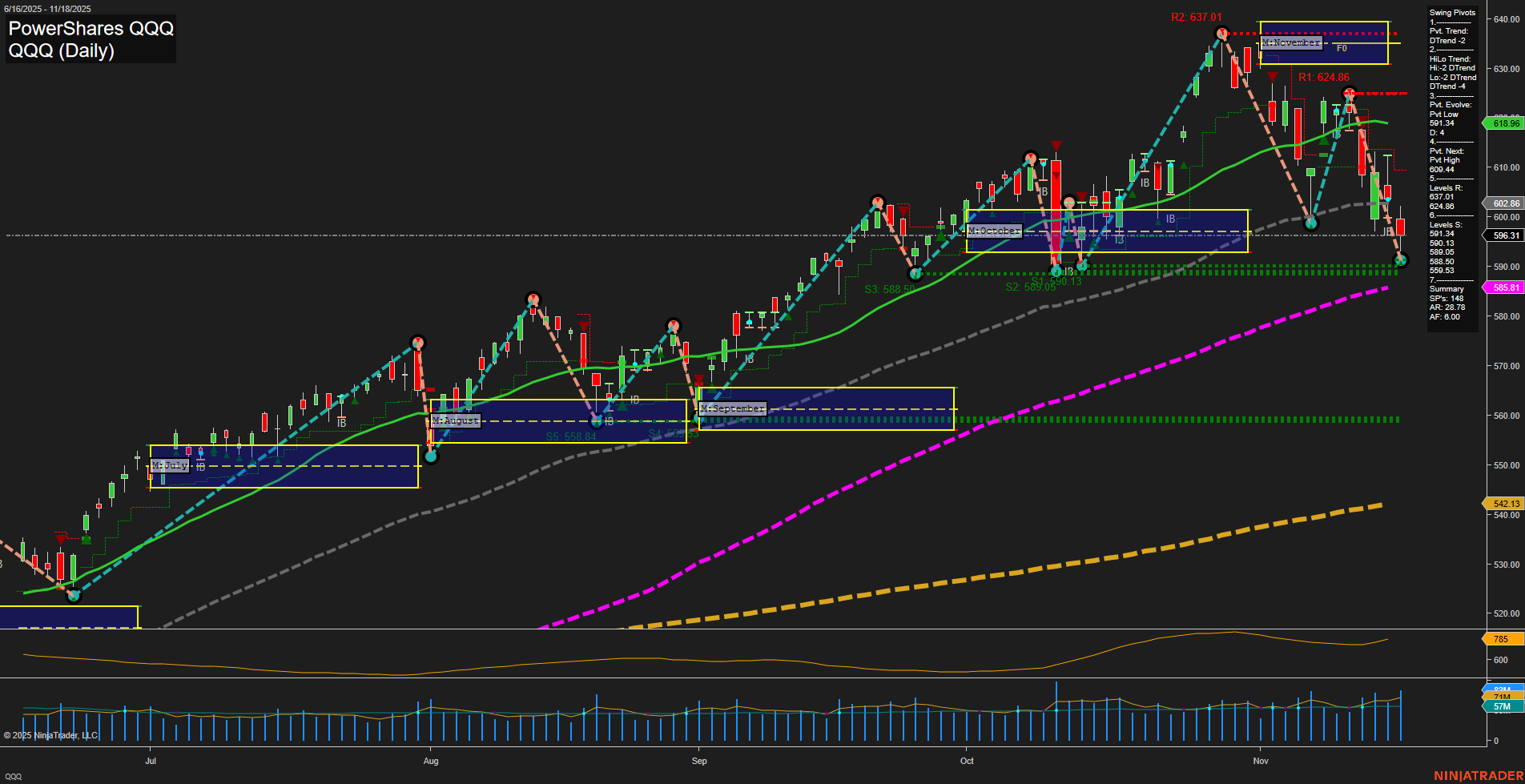

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts