Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

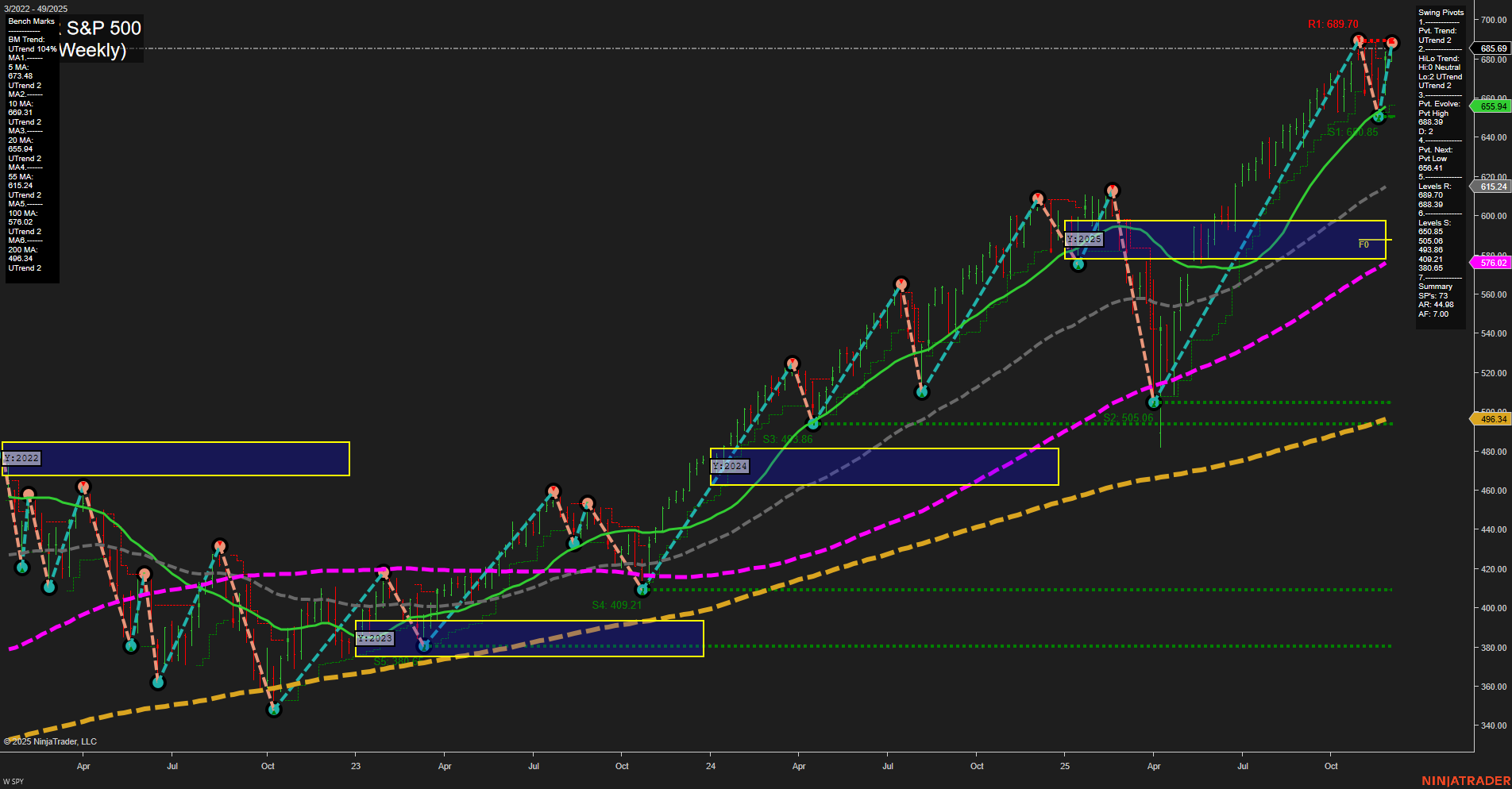

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- AVGO Release: 2025-12-11 T:AMC

- ADBE Release: 2025-12-10 T:AMC

- ORCL Release: 2025-12-10 T:AMC

Looking ahead to the upcoming earnings releases from major tech names—Oracle (ORCL) and Adobe (ADBE) on December 10th after market close, followed by Broadcom (AVGO) on December 11th after close—indices futures traders should anticipate subdued momentum and reduced trading volume in the days prior. The market is likely to enter a wait-and-see mode, with participants holding off larger bets until these influential reports are out, especially as traders also await critical news from other AI-related giants including NVDA and the broader MAG7 group. This earnings cluster is poised to drive significant index movement once reported, but until then, activity is expected to remain muted as the market digests prevailing uncertainty in the tech sector.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:20 – High USD ADP Weekly Employment Change: A significant labor market report that can set early direction for indices, particularly as traders gauge labor market resilience ahead of broader jobs data releases.

- Tuesday 10:00 – High USD JOLTS Job Openings: Closely watched labor demand gauge; larger-than-expected numbers may suggest ongoing strength in the labor market, pressuring rate cut expectations and boosting yield-sensitive sectors. As a 10 AM event, it is positioned as a potential catalyst for intraday reversals or continuations.

- Wednesday 08:30 – High USD Employment Cost Index q/q: An important inflation-related wage data point. A hotter reading would reinforce rate-hike fears, while a softer print could support risk assets.

- Wednesday 14:00 – High USD Federal Funds Rate, FOMC Economic Projections, FOMC Statement: Critical for index futures. The decision and updated projections set the market tone, with any hawkish surprises likely triggering volatility. The FOMC Statement provides forward guidance, directly impacting risk sentiment.

- Wednesday 14:30 – High USD FOMC Press Conference: Markets closely monitor commentary for additional signals on future rate policy and economic outlook, further amplifying volatility during the session.

- Thursday 08:30 – High USD Unemployment Claims: Weekly labor data with the potential to move markets if there is a deviation from consensus. Traders assess for early signs of labor market shifts post-FOMC.

EcoNews Conclusion

- Market momentum and volume may slow in the days leading up to the Wednesday FOMC decision, with potential for sudden volatility at the time of release.

- News events around the 10 AM cycle, such as the Tuesday JOLTS report, can serve as inflection points for intraday price action.

For full details visit: Forex Factory EcoNews

Market News Summary

- Crude Oil Futures: Light crude futures broke above their 50-day moving average as supply concerns and anticipated Fed rate cuts fueled buying. However, there is uncertainty over continued strength.

- S&P 500 Index: The S&P 500 extended its win streak, putting it near all-time highs. The 50-day moving average remains above the 200-day, indicating positive momentum since July.

- Gold: Spot gold prices held firm as traders anticipated FOMC news. Volatility is expected, with safe-haven demand and Fed policy uncertainty contributing to a bullish bias.

- Silver: Silver saw record highs, driven by strong ETF inflows, increased industrial demand, expectations for lower rates, and a falling gold-silver ratio. Forecasts point to the potential for further gains.

- ETF Comparison (VCLT vs. TLT): VCLT, a corporate bond ETF, offers higher yields and lower expenses compared to TLT’s treasury focus, but with more concentrated holdings and different risk profiles.

- FOMC Outlook: The upcoming Fed meeting could mark a key regime shift in long-term rates and may push the 30-year Treasury yield higher, according to market expectations. Traders will watch the pace of dissent and dot plot projections.

- High-Yield Income Caution: Portfolios chasing yields above 10% face significant risks, as sustainable income typically requires balancing higher returns with capital preservation—historically, double-digit yields are challenging for income-focused investors.

- Stock Funds: Stock funds have returned 12.6% year-to-date as a late-November rally boosted performance.

- Fed Meeting Expectations: Markets broadly expect a rate cut at the upcoming Fed meeting, but forecasts vary, and some expect volatility around the announcement.

- Wall Street Outlook: The Fed is anticipated to ease rates by year-end, but internal divisions at the FOMC may influence market direction. Key corporate earnings from tech leaders are also in focus.

- U.S. Economic Growth: Treasury Secretary Bessent projected 3% real GDP growth and a robust holiday season, crediting resilient consumer spending.

- S&P 500 Technical Analysis: The S&P 500 broke its November trend channel, signaling shifting market dynamics. Stock selection has become more difficult as previous leadership wanes and select growth stocks show signs of weakness.

News Conclusion

- Markets are at a crossroads, with the Federal Reserve’s upcoming decisions and internal divisions poised to influence stocks, bonds, and commodities outlooks as the year closes.

- Strength persists in equities and precious metals amid policy anticipation and historic inflows, but divergent technical signals and sector performance suggest a more selective and volatile environment in the near term.

- Persistent supply and rate cut expectations propel commodities like oil and silver, while uncertainty in bond and equity markets highlights the need for careful interpretation of macro and technical drivers.

- Economic growth projections remain positive into year-end, anchored by consumer resilience and ongoing optimism despite mixed signals from different asset classes.

Market News Sentiment:

Market News Articles: 6

- Negative: 33.33%

- Positive: 33.33%

- Neutral: 33.33%

GLD,Gold Articles: 2

- Positive: 50.00%

- Neutral: 50.00%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 7, 2025 06:15

- META 673.42 Bullish 1.80%

- GOOG 322.09 Bullish 1.16%

- USO 71.92 Bullish 0.74%

- MSFT 483.16 Bullish 0.48%

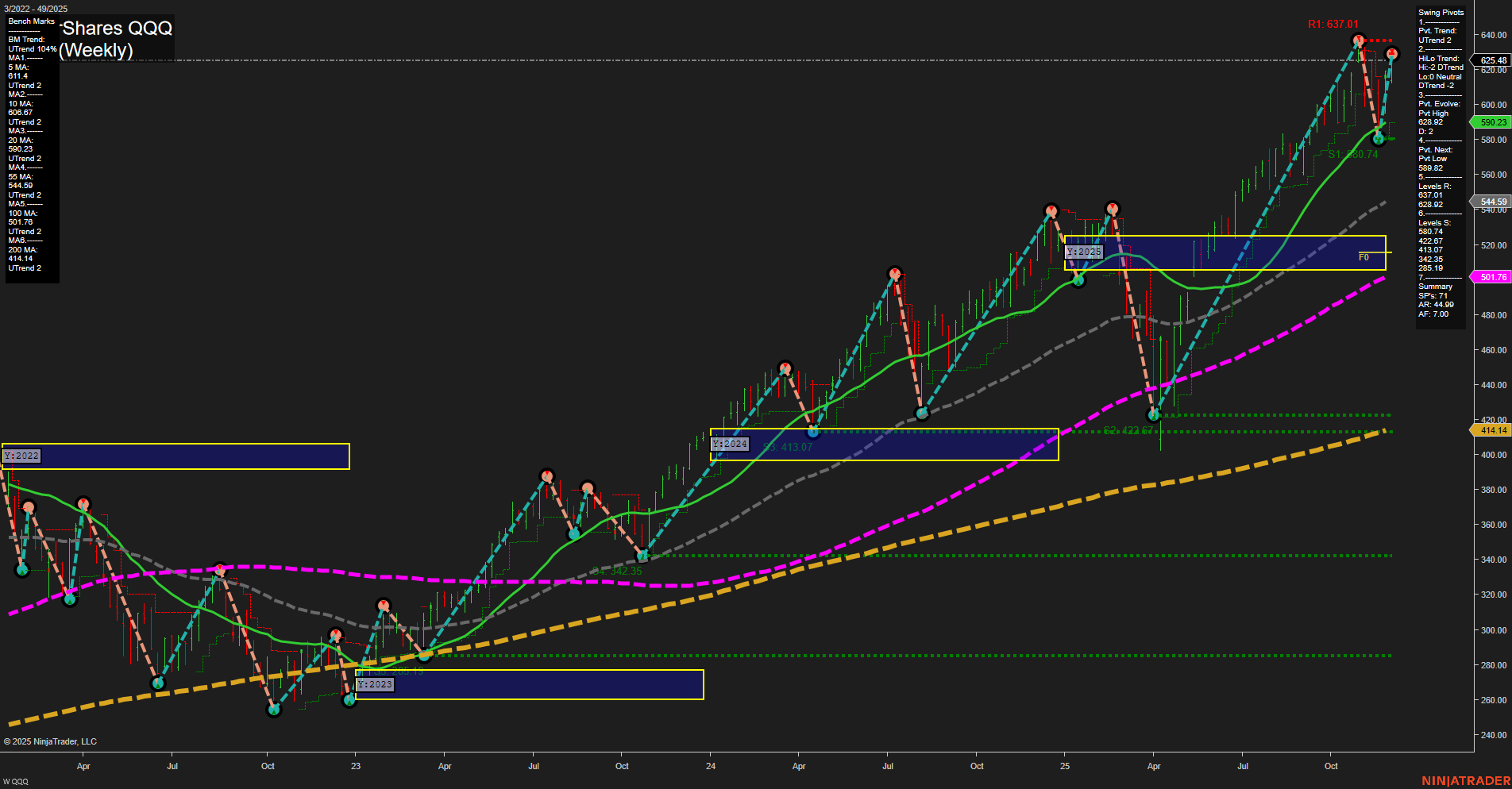

- QQQ 625.48 Bullish 0.41%

- DIA 480.03 Bullish 0.20%

- SPY 685.69 Bullish 0.19%

- AMZN 229.53 Bullish 0.18%

- TSLA 455.00 Bullish 0.10%

- IJH 66.54 Bullish 0.03%

- GLD 386.44 Bearish -0.18%

- IWM 250.77 Bearish -0.42%

- TLT 88.17 Bearish -0.46%

- NVDA 182.41 Bearish -0.53%

- AAPL 278.78 Bearish -0.68%

- IBIT 50.69 Bearish -3.47%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-12-07: 18:15 CT.

US Indices Futures

- ES Bullish all timeframes, price above all YSFG/MSFG/WSFG NTZ, above all MA benchmarks, recent swing pivot high at 6953.75, supports at 6715.00/6605.00/6525.00, trend continuation structure.

- NQ Bullish short/lon-term, neutral intermediate-term, above all YSFG/MSFG/WSFG NTZ, all MA benchmarks rising, last pivot high at 26399.00, support at 24888.00, trend continuation post-pullback.

- YM Data unavailable for review.

- EMD Bullish all timeframes, above all YSFG/MSFG/WSFG NTZ, MA benchmarks up, recent high 3340.6, support at 3247.6, higher highs/lows, volatility elevated, trend continuation phase.

- RTY Bullish all timeframes, above all session fib grids NTZ, MA benchmarks trending up, recent pivot high 2544.8, support 2444.3, higher highs/lows, V-shaped recovery, breakout above resistance.

- FDAX Neutral short-term, bullish intermediate/long-term, above all major fib grid levels, short-term uptrend from 22963 pivot, resistance 23983–24891, support 23504/22963, recovery phase, intermediate-term resistance nearby.

Overall State

- Short-Term: Bullish (except FDAX neutral)

- Intermediate-Term: Bullish (NQ neutral, FDAX neutral)

- Long-Term: Bullish

Conclusion

US Indices Futures continue HTF uptrends with all major contracts trading above key YSFG, MSFG, and WSFG benchmarks and session fib grid NTZ levels, supported by rising moving averages and established higher swing pivot structures. Recent signals corroborate trend continuation, though NQ and FDAX show intermediate-term consolidation or resistance. Support levels are positioned below current price providing structural context for potential retracements; overall market correlation upholds a bullish technical environment into the end of the session cycle.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts