Market Roundup – NYSE After Market Close Bearish as of December 8, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

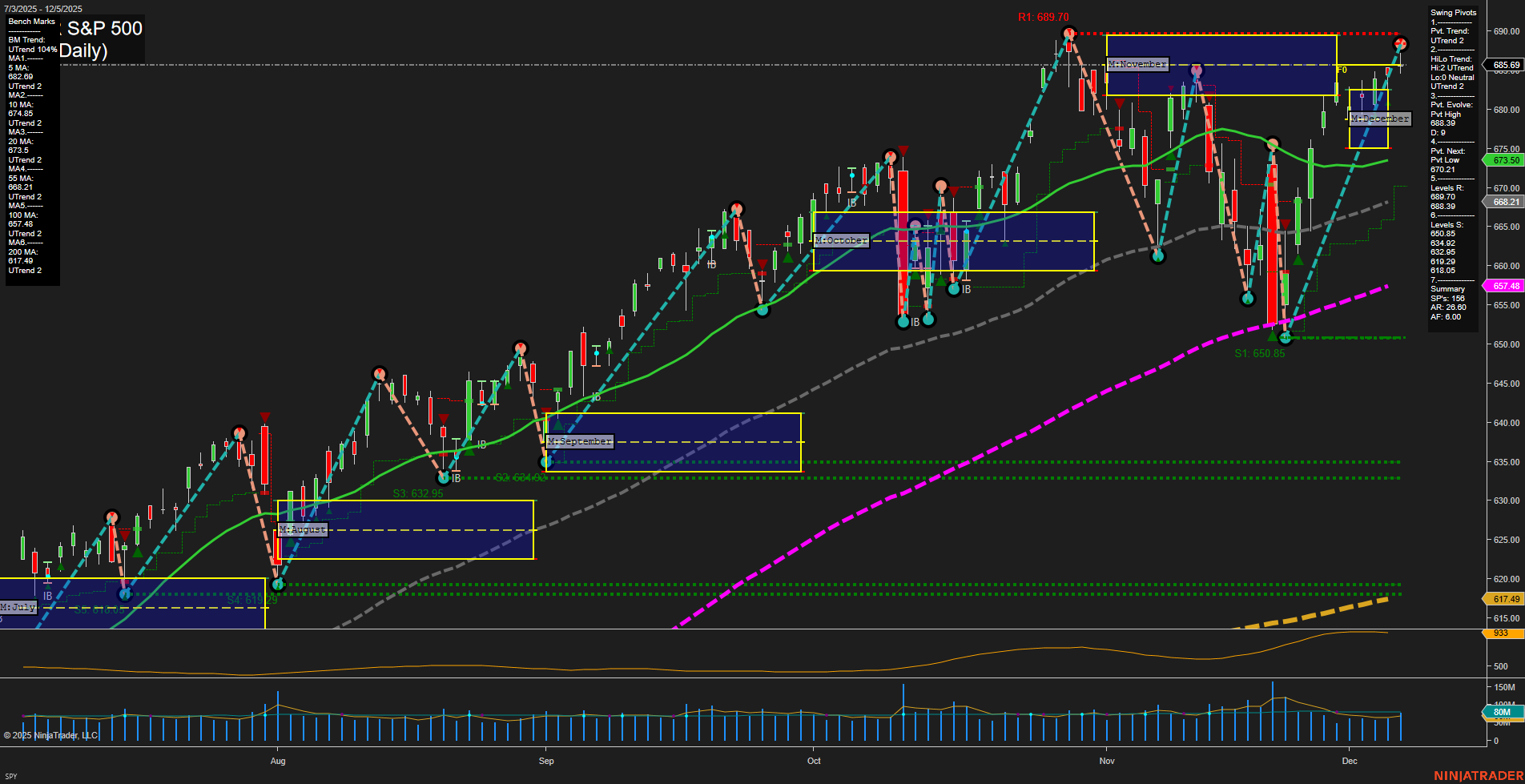

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- The Bureau of Labor Statistics delayed the release of October and November Producer Price Index data, merging both into one report, now scheduled for January 14.

- Market sentiment continues to point to an expected Federal Reserve rate cut this week, with betting odds, analysts, and institutions broadly forecasting a 25 basis points reduction on Wednesday.

- The economic backdrop is characterized by cooling inflation and a softening labor market, as indicated by a decline in private sector jobs and subdued inflation gauges.

- US equities traded lower mid-session amid anticipation of the Fed meeting, rising Treasury yields, and mild risk-off sentiment, while select tech stocks and the QQQ ETF outperformed.

- The software sector is experiencing growing divergence, with some technology names displaying weakening momentum even as the broader tech trend remains strong.

- The energy complex saw crude oil prices fall over 1% as Iraq restored production, adding to global supply.

- Precious metals, particularly gold, retreated below $4,200 as yields increased and traders positioned ahead of the Fed announcement.

- The S&P 500 is the focus of multiple bullish outlooks for 2026, with some strategists projecting gains of 12% to over 20%, led by strength in AI, technology, and expanded earnings revisions.

- Optimistic GDP growth of 3% for the US in 2025 remains projected, despite policy uncertainty and market volatility.

- Treasury markets have underperformed in December, pressured by rising yields and policy uncertainty, while mortgage rates spiked even as a Fed cut appears imminent.

- European market stability is under scrutiny as the ECB expressed concern about policy proposals in Italy that could affect central bank independence.

- As the Federal Reserve decision nears, major US indices have dipped, led by the Dow, while technology maintains relative strength; market attention has shifted to probable future policy paths.

News Conclusion

- The upcoming Federal Reserve decision is a central market driver, with high consensus on a rate cut while traders assess ongoing inflation and labor data trends.

- Expectations for US equity growth into 2026 remain robust, especially for the S&P 500 and sectors tied to AI and technology, even as some individual tech stocks show technical caution.

- Bond and commodity markets are showing mixed signals, with rising yields pressuring Treasuries and precious metals, and energy prices reacting to supply changes.

- Macro headlines have shifted the focus to rate policy, earnings, and sector rotations as traders position for the year-end and assess implications for index futures and related assets.

Market News Sentiment:

Market News Articles: 57

- Positive: 47.37%

- Neutral: 38.60%

- Negative: 14.04%

GLD,Gold Articles: 11

- Negative: 45.45%

- Positive: 36.36%

- Neutral: 18.18%

USO,Oil Articles: 6

- Neutral: 50.00%

- Negative: 50.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 8, 2025 05:00

- NVDA 185.55 Bullish 1.72%

- IBIT 51.52 Bullish 1.64%

- MSFT 491.02 Bullish 1.63%

- IWM 250.87 Bullish 0.04%

- QQQ 624.28 Bearish -0.19%

- GLD 385.42 Bearish -0.26%

- SPY 683.63 Bearish -0.30%

- AAPL 277.89 Bearish -0.32%

- TLT 87.88 Bearish -0.33%

- DIA 478.15 Bearish -0.39%

- IJH 66.21 Bearish -0.50%

- META 666.80 Bearish -0.98%

- AMZN 226.89 Bearish -1.15%

- USO 70.49 Bearish -1.99%

- GOOG 314.45 Bearish -2.37%

- TSLA 439.58 Bearish -3.39%

Market Overview: ETF Stocks, Mag7, & Key Assets Snapshot (12/08/2025 17:00)

This summary provides a trader-focused view of major equities ETFs, the Mag7 leaders, and select alternative ETFs. Activity is sorted as Long (Bullish), Short (Bearish), or Mixed, based on individual asset momentum at the close.

Long (Bullish) Standouts

- NVDA: $185.55 (+1.72%) — Strongest single-stock gainer, displaying upside momentum among semiconductor and AI peers.

- IBIT: $51.52 (+1.64%) — The Bitcoin ETF advances, reflecting digital asset strength or speculative flows.

- MSFT: $491.02 (+1.63%) — Holds a bullish bias, possibly supported by large-cap tech resilience.

- IWM: $250.87 (+0.04%) — Marginal gain for small-cap ETF; relative stability amid broader mixed signals.

Short (Bearish) & Downside Trends

- TSLA: $439.58 (−3.39%) — Leads declines among Mag7 stocks, with the sharpest drop in today’s group.

- GOOG: $314.45 (−2.37%) — Notable tech weakness; significant underperformance versus peers.

- USO: $70.49 (−1.99%) — Energy ETF down, possibly reflecting oil price softness.

- AMZN: $226.89 (−1.15%) and META: $666.80 (−0.98%) — Both showing measured declines; sentiment weaker in e-commerce and social media giants.

- IJH: $66.21 (−0.50%), DIA: $478.15 (−0.39%), TLT: $87.88 (−0.33%) — Midcap, Dow, and long-term Treasury ETFs each trade lower, signaling pressure across index products and fixed income.

- AAPL: $277.89 (−0.32%) — Apple joins peers in a modest pullback, part of wider tech softness.

- SPY: $683.63 (−0.30%), GLD: $385.42 (−0.26%) — S&P 500 and gold ETFs both edge lower, indicating risk-off moves aren’t universally supporting safe-havens.

- QQQ: $624.28 (−0.19%) — The Nasdaq-100 ETF modestly down, underperforming some components while echoing the tech-heavy sector’s volatility.

Mixed Landscape

- Equities ETF performance is varied: Small caps (IWM) hold steady, mid and large caps (IJH, SPY, DIA) drift lower, with most Mag7 stocks in retreat except MSFT and NVDA.

- Alternative plays (GLD, TLT, USO) offer little diversification as each trends lower, with only IBIT distinguishing itself on the upside.

- Market breadth leans negative, but significant gains in select tech and digital assets provide active trading pockets.

Summary Table

| Asset | Last | Direction | % Change |

|---|---|---|---|

| NVDA | 185.55 | Bullish | +1.72% |

| IBIT | 51.52 | Bullish | +1.64% |

| MSFT | 491.02 | Bullish | +1.63% |

| IWM | 250.87 | Bullish | +0.04% |

| QQQ | 624.28 | Bearish | -0.19% |

| GLD | 385.42 | Bearish | -0.26% |

| SPY | 683.63 | Bearish | -0.30% |

| AAPL | 277.89 | Bearish | -0.32% |

| TLT | 87.88 | Bearish | -0.33% |

| DIA | 478.15 | Bearish | -0.39% |

| IJH | 66.21 | Bearish | -0.50% |

| META | 666.80 | Bearish | -0.98% |

| AMZN | 226.89 | Bearish | -1.15% |

| USO | 70.49 | Bearish | -1.99% |

| GOOG | 314.45 | Bearish | -2.37% |

| TSLA | 439.58 | Bearish | -3.39% |

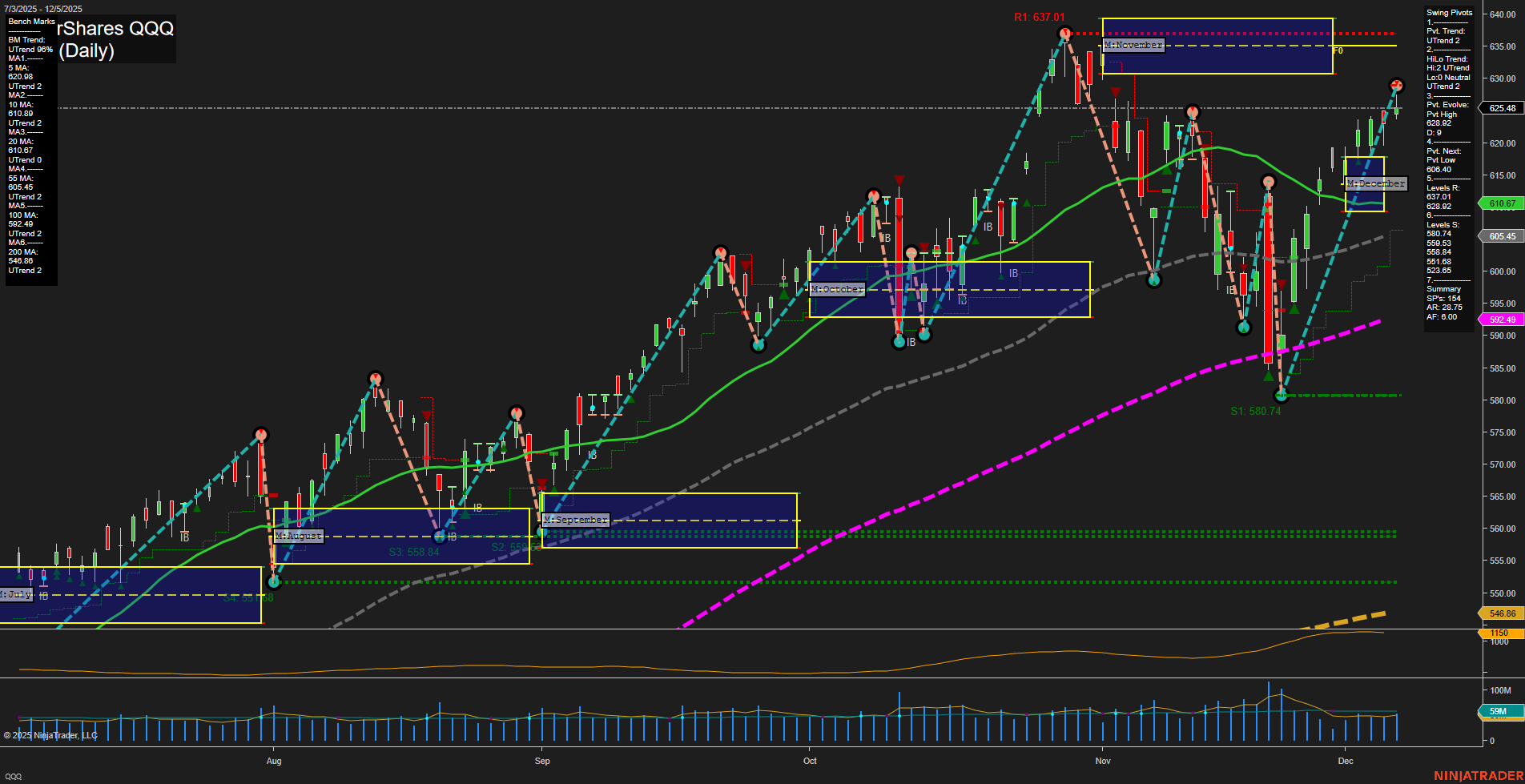

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts