Market Roundup – NYSE After Market Close Bullish as of December 22, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

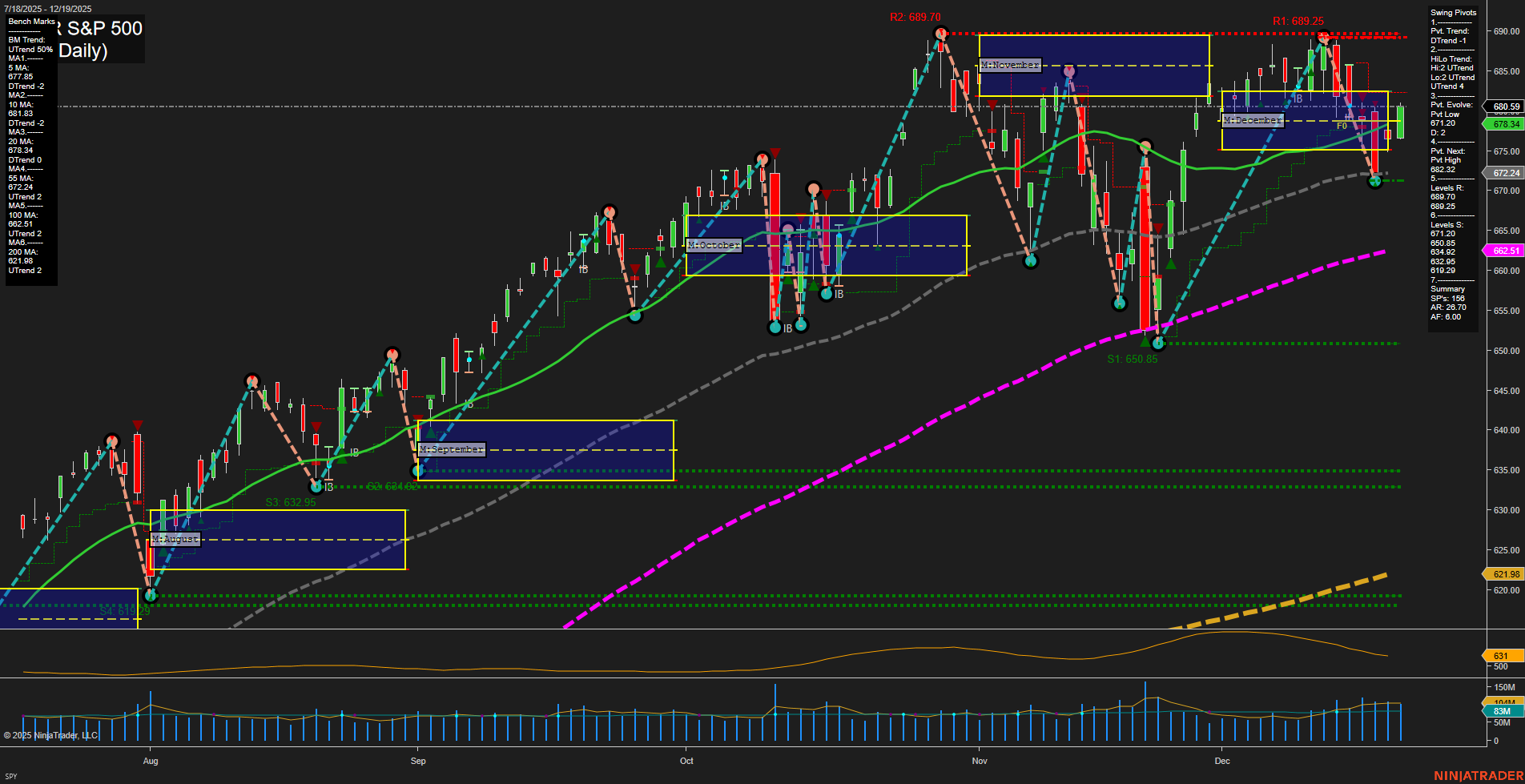

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Equities: U.S. stocks advanced toward record levels, with broad-based gains across most S&P 500 sectors and notable strength in AI-related names. Despite concerns over stretched valuations and sector concentration, the S&P 500 is poised for its eighth consecutive month of gains. Some market commentary points towards possible double-tops and future corrections, including high-profile warnings of a potential 10% pullback in 2026 and caution over shifting market leadership.

- Metals & Commodities: Precious metals such as gold and silver surged to new all-time highs, buoyed by safe-haven demand amid macroeconomic and geopolitical uncertainty. Copper prices also reached records. The rally is supported by factors such as speculation on future Fed rate cuts, global political tensions, and large-scale bullion purchases.

- Macro & Economic Data: U.S. GDP showed resilience despite headwinds including inflation and tariffs, with economic activity remaining above trend. The Chicago Fed National Activity Index indicated slight improvement, aligning with broader market optimism. Data releases suggest any economic slowdown has been modest and not yet a major concern.

- Federal Reserve & Policy: The Fed’s future path on interest rates remains in sharp focus. Some voices within the Fed warn of rising recession risks if rate cuts don’t materialize, while others see no urgency for policy adjustments. The central bank continues to balance inflation concerns with labor market dynamics going into 2026.

- Sector Dynamics & Thematic Trends: AI remains a prominent market theme, driving tech sector advances and investor positioning. Space sector stocks are surging due to IPO speculation and policy support, while commodity-linked equities benefit from record metal prices. The bond market’s declining yields have added a supportive backdrop for equities, provided inflation stays contained.

- Cryptocurrency: Bitcoin declined below $89,000 amid a shift toward safe-haven gold, while crypto-related equities outperformed the underlying tokens.

- 2026 Outlook: Looking ahead, strategists and market participants debate scenarios for 2026—including potential corrections, tailwinds from lower yields, and sector rotation opportunities, with both optimism and caution in focus.

News Conclusion

- U.S. equities continue to climb, underpinned by strong economic data, sector-wide rallies, and persistent AI enthusiasm, but there are emerging warnings about elevated valuations and concentrated risk.

- Gold and silver set fresh highs as investors seek safety, driving strong performance in commodity-related assets.

- The macroeconomic backdrop is robust, with economic indicators showing ongoing expansion and only limited signs of slowdown.

- Market attention remains fixed on the Federal Reserve, with divided perspectives about the necessity and timing of rate cuts in 2026.

- While optimism for continued gains into 2026 persists, market participants remain watchful of volatility triggers such as sector rotations, the potential for pullbacks, and global macro shifts.

Market News Sentiment:

Market News Articles: 45

- Positive: 44.44%

- Neutral: 28.89%

- Negative: 26.67%

GLD,Gold Articles: 20

- Positive: 65.00%

- Neutral: 25.00%

- Negative: 10.00%

USO,Oil Articles: 8

- Positive: 75.00%

- Neutral: 12.50%

- Negative: 12.50%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 22, 2025 05:00

- USO 69.73 Bullish 2.50%

- GLD 408.23 Bullish 2.31%

- TSLA 488.73 Bullish 1.56%

- NVDA 183.69 Bullish 1.49%

- IWM 253.58 Bullish 1.11%

- GOOG 311.33 Bullish 0.88%

- IJH 67.42 Bullish 0.85%

- SPY 684.83 Bullish 0.62%

- DIA 483.46 Bullish 0.48%

- AMZN 228.43 Bullish 0.47%

- META 661.50 Bullish 0.41%

- IBIT 50.09 Bullish 0.36%

- QQQ 619.21 Bullish 0.35%

- MSFT 484.92 Bearish -0.21%

- TLT 87.36 Bearish -0.22%

- AAPL 270.97 Bearish -0.99%

Market Summary: ETFs, Mag7, and Key Asset ETFs (as of 12/22/2025 17:00:00)

ETF Stocks Overview

- SPY: 684.83 Bullish (+0.62%) – S&P 500 tracking ETF continues its positive momentum, albeit with modest gains.

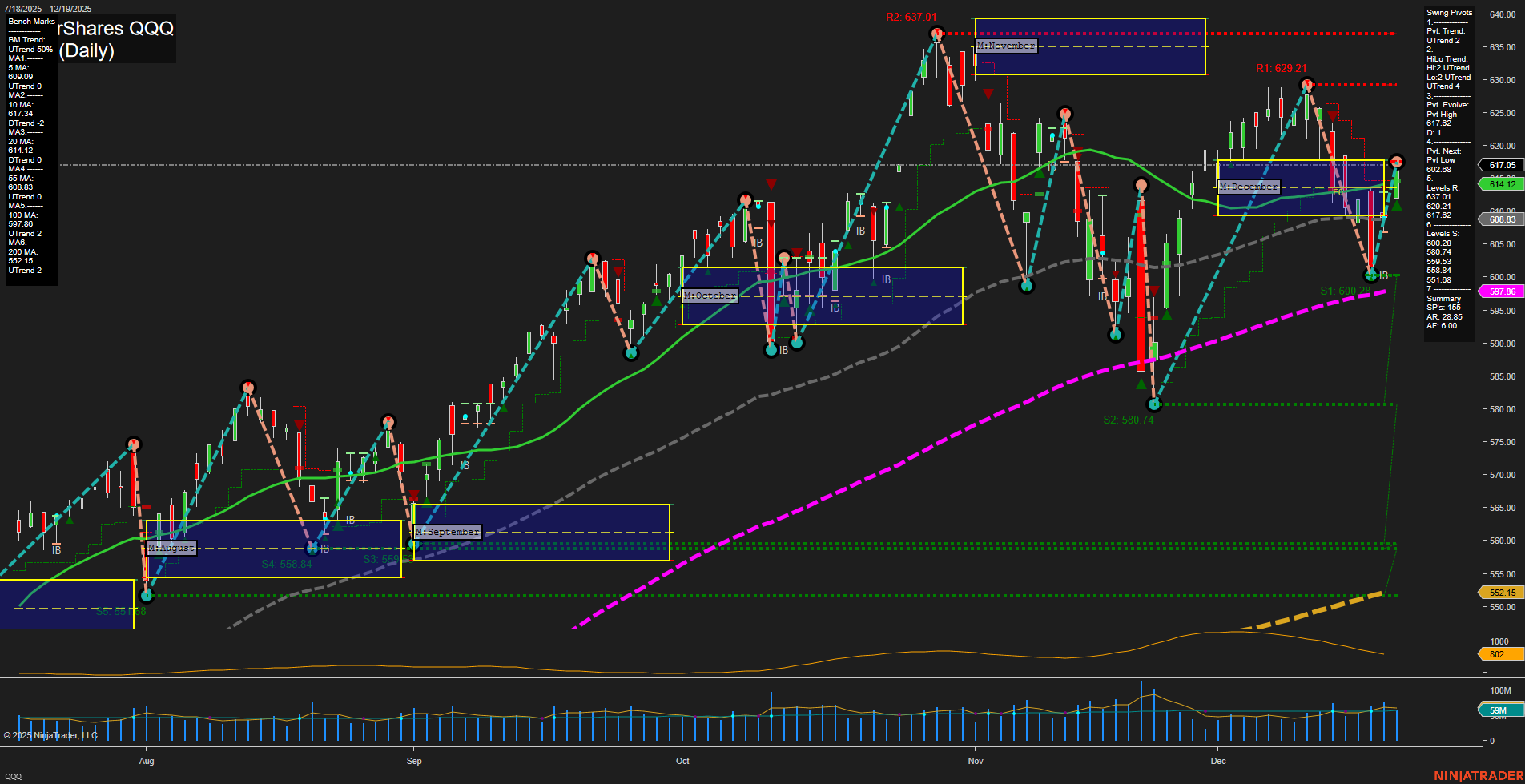

- QQQ: 619.21 Bullish (+0.35%) – Nasdaq-100 ETF shows ongoing strength but at a slower pace.

- IWM: 253.58 Bullish (+1.11%) – Russell 2000 ETF outperforms among broad indices, highlighting small-cap strength.

- IJH: 67.42 Bullish (+0.85%) – S&P Midcap 400 ETF adds to the mixed-cap rally.

- DIA: 483.46 Bullish (+0.48%) – Dow Jones ETF stays in bullish territory with steady growth.

Mag7 (Mega Cap Techs): Divergence Appears

- Nvidia (NVDA): 183.69 Bullish (+1.49%) – NVDA leads the group, maintaining its leadership position.

- Tesla (TSLA): 488.73 Bullish (+1.56%) – TSLA extends gains, contributing to overall tech enthusiasm.

- Google (GOOG): 311.33 Bullish (+0.88%) – GOOG posts a solid up session.

- Amazon (AMZN): 228.43 Bullish (+0.47%) – Moderate gains for AMZN continue.

- Meta (META): 661.50 Bullish (+0.41%) – META keeps pace with the tech sector’s advance.

- Microsoft (MSFT): 484.92 Bearish (-0.21%) – MSFT diverges, trading slightly lower.

- Apple (AAPL): 270.97 Bearish (-0.99%) – AAPL underperforms, showing notable weakness compared to peers.

Note: Out of the Mag7, only MSFT and AAPL are in the red, indicating mixed action within the group.

Other Major ETFs & Commodities

- USO: 69.73 Bullish (+2.50%) – Crude oil proxy USO jumps strongly, reflecting positive sentiment in energy markets.

- GLD: 408.23 Bullish (+2.31%) – Gold ETF surges, highlighting renewed demand for precious metals.

- IBIT: 50.09 Bullish (+0.36%) – Bitcoin ETF climbs moderately.

- TLT: 87.36 Bearish (-0.22%) – Long-term Treasuries ETF under pressure, mirroring recent bond market weakness.

Summary State of Play

- Bullish: The majority of broad market ETFs, energy, gold, and most megacap techs are showing positive momentum.

- Bearish: Weakness is limited to select leaders: MSFT, AAPL, and TLT (long bonds).

- Mixed: While the overall market tone is positive, internal divergences among megacap stocks and sectors call attention to tactical shifts within the leaders.

Traders are seeing a generally bullish market environment, with outperformance in oil, gold, small-caps, and key tech names, though with some rotation or short-term weakness in select megacaps and bonds.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts