Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

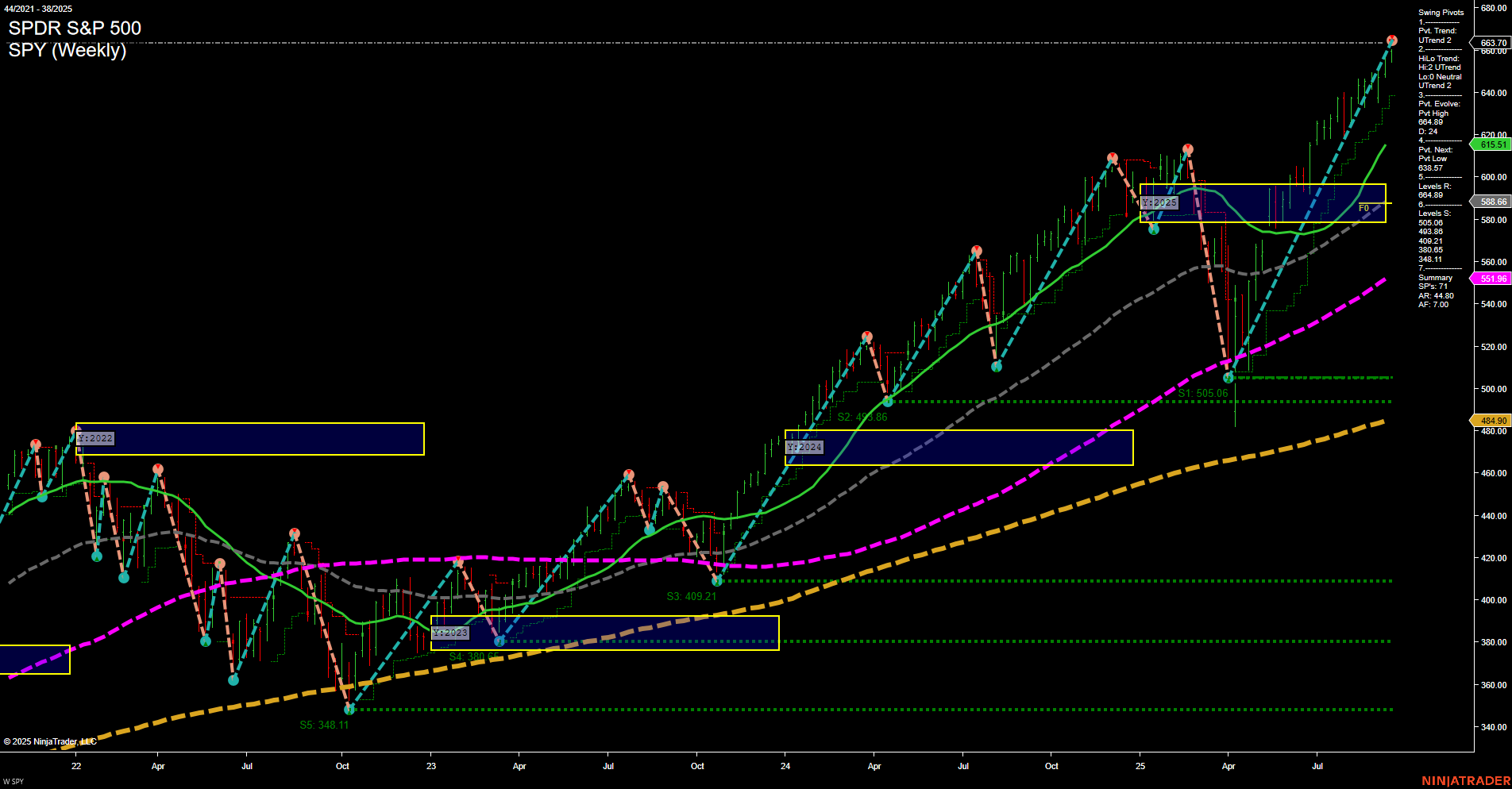

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MU Release: 2025-09-23 T:AMC

Ahead of the Micron Technology (MU) earnings release scheduled for September 23rd after market close, indices futures traders should anticipate a period of lighter momentum and reduced volume, especially as the market awaits not only MU’s results, but also upcoming key catalysts from NVDA, the MAG7 group, and AI-related tech stocks. This “hurry up and wait” environment is typical when the sector’s bellwethers are imminently reporting, as traders often prefer to reduce directional bets and wait for fresh information before making significant moves. With Micron’s earnings closely tied to the broader AI and semiconductor narrative, any outlook provided could set the tone for sector sentiment and influence index behavior, but in the run-up to this release, expect a quieter tape with potential for sharp moves upon news and during related conference calls.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary: High Impact Events This Week

- Tuesday 09:45 – USD Flash Manufacturing & Services PMI: Markets highly sensitive to these early indicators of business activity. Strong readings signal economic resilience and may drive bullish indices sentiment; weak data increases recession fears.

- Tuesday 12:35 – USD Fed Chair Powell Speaks: Any shift in Fed tone on inflation or rate policy can spark sharp moves in S&P 500 Futures, Nasdaq, and Dow contracts.

- Thursday 08:30 – USD Final GDP q/q, Unemployment Claims: GDP print influences weekly trend; surprise readings (especially revisions) often trigger volatility. Unemployment Claims provide timely labor market signals impacting short-term risk sentiment.

- Friday 08:30 – USD Core PCE Price Index m/m: This is the Fed’s preferred inflation measure. Higher-than-expected inflation can spark fears of prolonged tightening, while softer data may fuel relief rallies in equities futures.

EcoNews Conclusion

- Key inflection points this week will be Tuesday’s PMI/Fed Chair speech, Thursday’s pre-market GDP & jobless data, and Friday’s PCE inflation.

- Market momentum and volume may slow in the days leading up to Friday’s PCE print.

- News events around the 10 AM time cycle, such as Powell’s remarks and Friday’s sentiment data, often act as catalysts for sharp market reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- Gold: Gold prices are nearing record highs, fueled by Federal Reserve rate cuts and robust demand from India. Market sentiment remains bullish, with forecasts indicating potential for further gains and notable price targets on the horizon. Upcoming PCE data could trigger a fresh breakout, reinforcing the upward momentum.

- Oil: Crude oil prices are under pressure, trading below the 52-week moving average. Persistently weak demand and abundant supply from OPEC contribute to a bearish outlook in the near term.

- Platinum: Platinum is gaining attention as a potential next mover in precious metals. Tightening supply deficits and technical signals point to upside possibilities, potentially following gold’s recent strength.

- Equities & Indices: A bullish environment prevails for US stocks and index futures. The S&P 500 continues to rally with strong momentum, recently breaking above 6600 and aiming for further gains. Short-term dips are being bought, as the uptrend remains intact unless significant support levels break. Growth-focused ETFs are also highlighted for investment consideration, despite markets being near all-time highs.

- Federal Reserve & Economic Policy: The Fed’s recent rate cuts are influencing multiple asset classes. Discussions around rate policy and leadership changes feature in the news, with some analysts suggesting that the central bank is lagging behind the curve, and raising questions about future directions. Further coverage explores the impact of lower rates on mortgages, broader investments, and consumer finances.

News Conclusion

- The current trend remains bullish across precious metals and equity indices, supported by accommodative monetary policy and strong technical setups.

- Oil markets face continued downward pressure due to weak demand and high supply, contrasting with positive momentum seen elsewhere.

- Market direction is closely linked to Federal Reserve actions and expectations, impacting asset prices and sector rotations across futures and stocks.

- Uncertainty persists around central bank leadership and policy trajectory, which could inject volatility as traders assess potential implications for rates and risk assets.

Market News Sentiment:

Market News Articles: 6

- Positive: 66.67%

- Neutral: 33.33%

GLD,Gold Articles: 3

- Positive: 100.00%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 21, 2025 06:15

- AAPL 245.50 Bullish 3.20%

- TSLA 426.07 Bullish 2.21%

- MSFT 517.93 Bullish 1.86%

- GOOG 255.24 Bullish 1.15%

- GLD 339.18 Bullish 1.06%

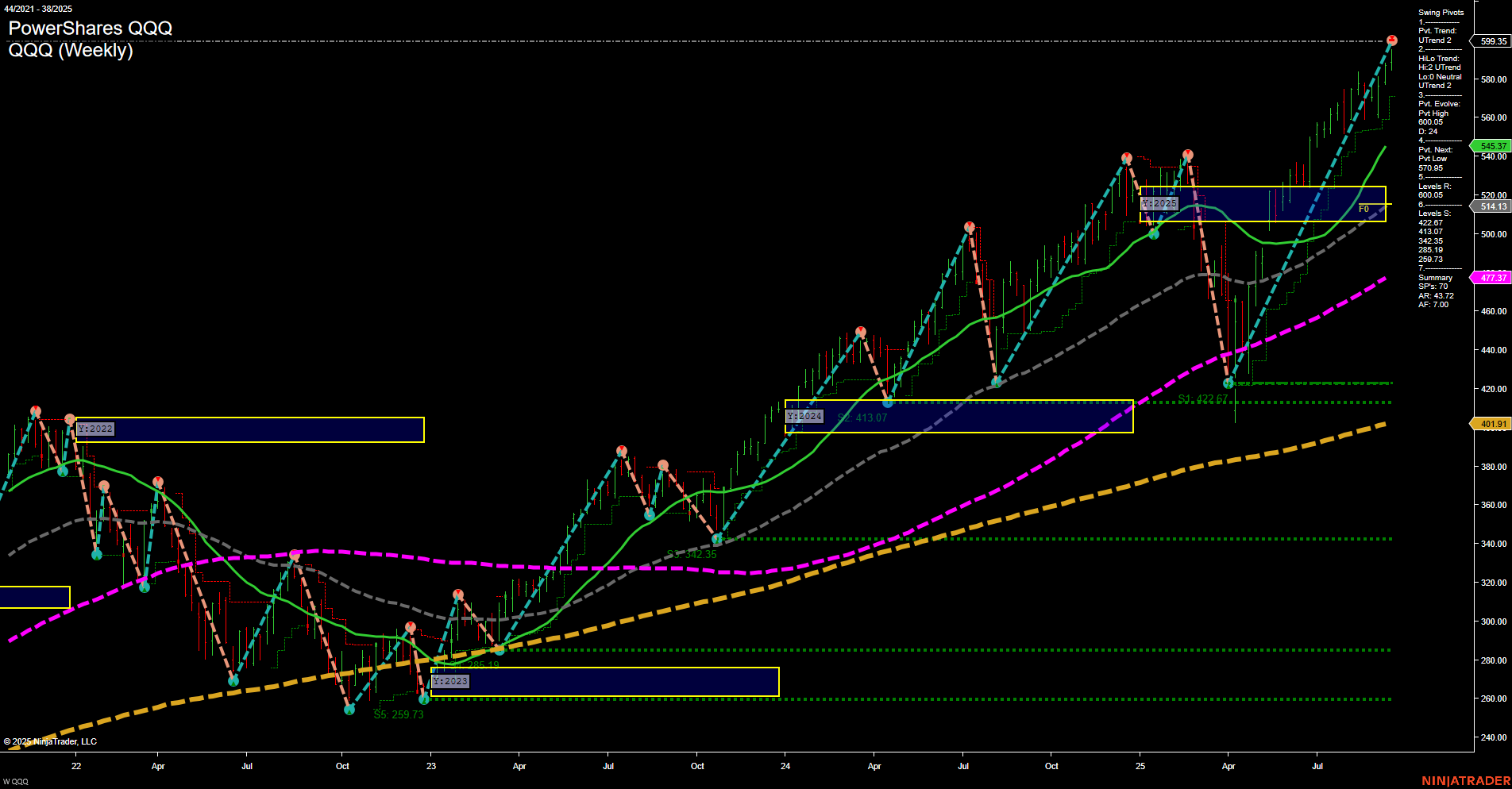

- QQQ 599.35 Bullish 0.68%

- NVDA 176.67 Bullish 0.24%

- SPY 663.70 Bullish 0.22%

- AMZN 231.48 Bullish 0.11%

- DIA 462.94 Bullish 0.07%

- TLT 89.02 Bearish -0.19%

- META 778.38 Bearish -0.24%

- IWM 242.98 Bearish -0.76%

- IJH 65.61 Bearish -0.80%

- USO 73.52 Bearish -1.57%

- IBIT 65.37 Bearish -2.07%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-09-21: 18:15 CT.

US Indices Futures

- ES Strong bullish trend, above all YSFG/MSFG/WSFG centers, new highs, uptrend pivots, support 6314.65, resistance breakout, all benchmarks up.

- NQ Bullish momentum, price above all session grids, pivots at ATH, uptrend all timeframes, support well below current, moving averages trending up.

- YM New highs, strong uptrend, above WSFG/MSFG/YSFG, swing pivots upward, support 44001, resistance breakout, benchmarks all up, V-shaped recovery confirmed.

- EMD Bullish intermediate/long-term, neutral short-term weekly, price near resistance, MSFG/YSFG up, WSFG near NTZ, pivots rising, all moving averages up.

- RTY Bullish all timeframes, above all grid centers, swing pivot at new high (2401.1), benchmarks up, resistance levels tested and surpassed, volatility elevated.

- FDAX Bearish short/intermediate-term, bullish long-term, below WSFG/MSFG NTZ, yearly grid up, price in correction, support at 23410, resistance at 24147-24738, 200MA uptrend holds.

Overall State

- Short-Term: Bullish (except FDAX: Bearish)

- Intermediate-Term: Bullish (FDAX: Bearish/Neutral)

- Long-Term: Bullish (all indices)

Conclusion

US indices (ES, NQ, YM, RTY, EMD) show established bullish structures on HTF—all grid timelines (YSFG, MSFG, WSFG) confirm uptrends except EMD’s weekly short-term (neutral) and FDAX (bearish ST/IT, bullish LT). Swing pivots and support/resistance indicate healthy buffer zones for ES, NQ, YM, RTY, EMD, with rising supports and resistance levels clearing. All primary moving averages trend upward, signaling aligned market strength. Recent technical signals reinforce prevailing upward momentum, with FDAX in corrective phase but maintaining long-term structure. Overall, context across US indices reflects robust HTF uptrends, while FDAX consolidates inside a long-term bullish regime.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts