Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

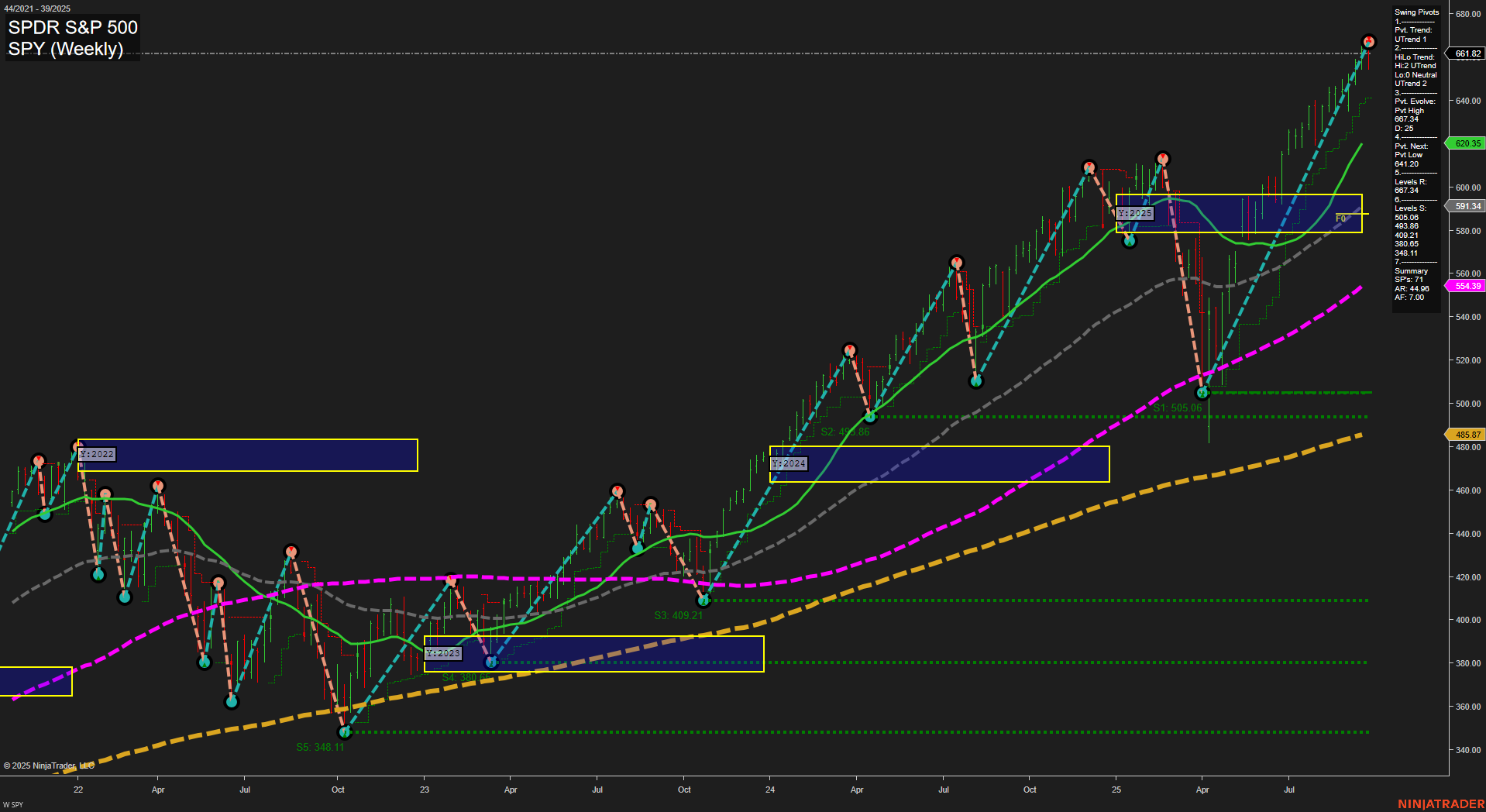

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 10:00 – USD JOLTS Job Openings (High Impact): The JOLTS data will provide insight into labor market tightness. Large deviations from expectations can trigger index volatility as markets adjust their outlook for future Fed policy and economic momentum.

- Wednesday 08:15 – USD ADP Non-Farm Employment Change (High Impact): This employment gauge serves as an early indicator for Friday’s official NFP data. A significant surprise could prompt pre-positioning and fast moves in index futures.

- Wednesday 10:00 – USD ISM Manufacturing PMI (High Impact): The ISM PMI is closely monitored for signs of economic resilience or slowdown. Print divergences from forecasts may cause sharp reactions, influencing short-term trend direction.

- Wednesday 06:15 – OPEC Meetings (Medium Oil Impact): Any surprise announcements on production or quotas can move oil prices. Higher oil prices may raise inflation concerns, translating to pressure on equity indices.

- Thursday 08:30 – USD Unemployment Claims (High Impact): Weekly claims data acts as a barometer for labor market health. Unexpected spikes or drops can quickly impact market sentiment and risk appetite at the open.

- Friday 08:30 – USD Non-Farm Employment Change, Average Hourly Earnings, Unemployment Rate (High Impact): The NFP employment trio is a major market mover. Surprises across jobs growth or wages can reset expectations for monetary policy and prompt heavy market repositioning. Fast price movements and increased volume can be expected around the release.

- Friday 10:00 – USD ISM Services PMI (High Impact): This gauge of the U.S. service sector can spark volatility if it diverges materially from market expectations, especially if earlier labor data is also market-moving.

EcoNews Conclusion

- Multiple high-impact U.S. employment and PMI reports are scheduled Tuesday, Wednesday, and especially Friday morning, likely to drive sharp index futures moves at release times.

- The OPEC meeting on Wednesday could introduce fresh volatility if any surprise oil supply measures or price moves emerge, as high oil prices can directly affect inflation and equity markets.

- News events around the 10 AM time cycle (JOLTS, ISM Manufacturing, ISM Services) often serve as catalysts for intraday trend reversals or continuations; traders should expect increased momentum and volume during these windows.

- Market momentum and volume may slow heading into Friday’s Non-Farm Payrolls (NFP), with potential for whipsaws and sustained volatility following its release.

For full details visit: Forex Factory EcoNews

Market News Summary

- S&P 500 posted its first weekly loss in nearly a month after setting a new record high, dipping 0.3% for the week. The index remains in a bullish long-term trend, but technical analysis indicates that the sustained upward channel is showing vulnerability and further upside could be limited after the recent pullback.

- Oil futures rallied as supply constraints intensified due to Russia’s export bans and OPEC+ production shortfalls. This bullish momentum is projected to continue, targeting higher prices. However, OPEC+ is expected to approve another production increase in November, seeking to recapture market share amid higher prices.

- Gold prices reached $3791.26 as investors look to upcoming NFP jobs data and Fed policy indications for cues on the rally’s sustainability. Strong US employment numbers could trigger short-term volatility or a pullback.

- Concerns over a possible US government shutdown grew, with lawmakers at an impasse as the funding deadline approaches. This uncertainty is viewed as a negative risk factor for equities and the broader economy, especially with the potential impacts on sectors like airlines.

- Trade tensions resurfaced after President Trump imposed new tariffs on key imports—pharmaceuticals, heavy trucks, and furniture—raising potential headwinds for specific industries and overall business sentiment.

- Recession warning signals emerged as business spending fell sharply in Q2, with the ongoing trade war cited as a key factor beneath steady GDP figures.

- Dividend strategies drew interest for their resilience in tougher markets and ability to generate cash flows. Options like high-quality dividend stocks and monthly dividend ETFs are highlighted as income-generating approaches during volatile periods.

- Investor confidence among major money managers remained robust as the market set new highs, with optimism persisting even during a seasonally weak period.

- Debate over earnings reporting frequency continued, with arguments for more regular disclosures—especially during volatile markets—rather than scaling back to semi-annual reports.

News Conclusion

- The market experienced volatility with the S&P 500 pulling back after reaching record levels; the long-term uptrend remains, but technical signs point to potential near-term caution.

- Energy markets were marked by bullish momentum on tighter supply; however, impending production increases from OPEC+ could weigh on prices ahead.

- Gold’s direction hinges on upcoming economic data releases and central bank policy, introducing event-driven volatility for the asset.

- Political and trade developments introduced fresh uncertainties, with a government shutdown and new tariffs presenting risks to business activity and market sentiment.

- Defensive income strategies and portfolio resiliency remain a thematic focus, while institutional confidence in the broader market backdrop remains notable.

Market News Sentiment:

Market News Articles: 10

- Neutral: 40.00%

- Negative: 40.00%

- Positive: 20.00%

GLD,Gold Articles: 1

- Positive: 100.00%

USO,Oil Articles: 2

- Positive: 50.00%

- Neutral: 50.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: September 28, 2025 06:15

- TSLA 440.40 Bullish 4.02%

- IJH 65.34 Bullish 1.02%

- MSFT 511.46 Bullish 0.87%

- IWM 241.34 Bullish 0.86%

- AMZN 219.78 Bullish 0.75%

- DIA 462.28 Bullish 0.62%

- GLD 346.74 Bullish 0.58%

- SPY 661.82 Bullish 0.57%

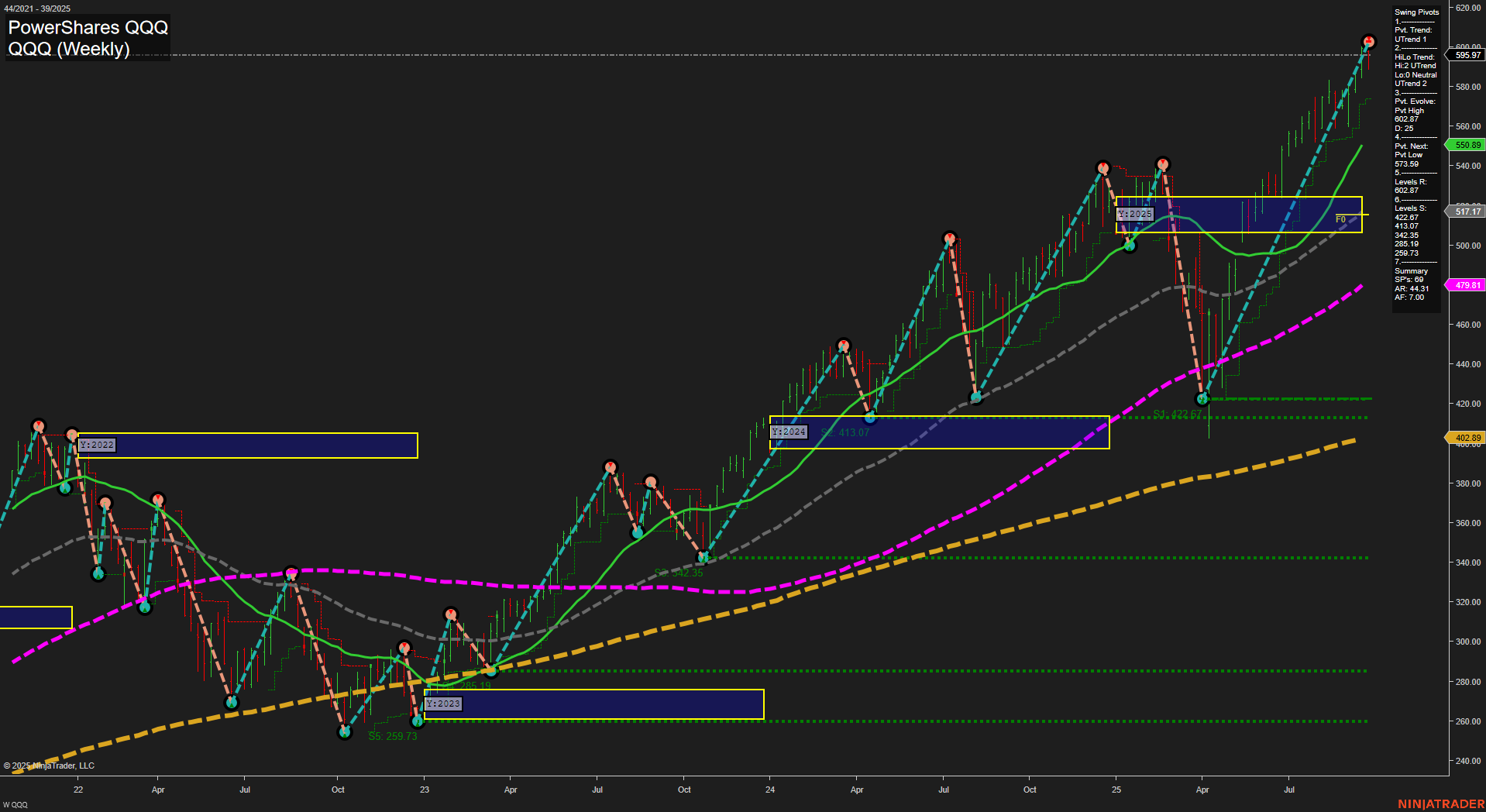

- QQQ 595.97 Bullish 0.41%

- NVDA 178.19 Bullish 0.28%

- GOOG 247.18 Bullish 0.25%

- USO 77.02 Bullish 0.04%

- TLT 88.90 Bearish -0.09%

- IBIT 61.94 Bearish -0.26%

- AAPL 255.46 Bearish -0.55%

- META 743.75 Bearish -0.69%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-09-28: 18:15 CT.

US Indices Futures

- ES Bullish all HTFs, price above YSFG/MSFG/WSFG, all MAs up, swing pivots confirm uptrend, resistance 6756.75, support 6360.15, structure confirms trend continuation, no exhaustion present.

- NQ Bullish intermediate/long-term, short-term pullback, price above YSFG/MSFG/WSFG, major MAs up, swing pivots show correction, support 24122.5, resistance 25027.25, elevated volatility, correction within broader uptrend.

- YM Bullish all timeframes, trading above all Fib grids/NTZ, all MAs up, swing pivots in uptrend, resistance 47055, support below, no immediate reversal, trend continuation environment supported.

- EMD Bullish all timeframes, above YSFG/MSFG/WSFG, all MAs trending up, swing highs at 3296.1, V-shaped recovery, support 3186.7, consolidating near highs, trend continuation with periodic consolidation.

- RTY Intermediate/long-term bullish, short-term pullback, price above major Fib grid centers, MAs trend up except short-term, pivot high 2510.3, support 2331.1, pullback phase within larger uptrend, volatility elevated.

- FDAX Long-term bullish, intermediate-term bearish, short-term neutral, price consolidating above 200-MA, YSFG/WSFG up, MSFG down, resistance 24891, support 19274/16231, short-term trend indecisive, range-bound conditions observed.

Overall State

- Short-Term: Mixed (Bullish ES/EMD/YM, Neutral FDAX, Bearish NQ/RTY)

- Intermediate-Term: Bullish (Except FDAX Bearish)

- Long-Term: Bullish (All indices)

Conclusion

US Indices Futures higher time-frame technical analysis reflects continued bullish structure in ES, NQ, YM, EMD, and RTY, with FDAX showing long-term strength but intermediate-term corrective action. Prices largely remain above yearly, monthly, and weekly session Fibonacci grid (YSFG/MSFG/WSFG) benchmarks, and upward momentum is supported by major moving averages. Swing pivot structures confirm prevailing uptrends, though short-term corrections and consolidations are present in NQ, RTY, and FDAX. Support levels are generally well below current price, and resistance is defined by recent swing highs. Trend continuation remains the HTF context, with any short-term pullbacks seen as occurring within established bullish market structures. No conclusive reversal or exhaustion signals noted; HTF remains constructive for trend analysis.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts