After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

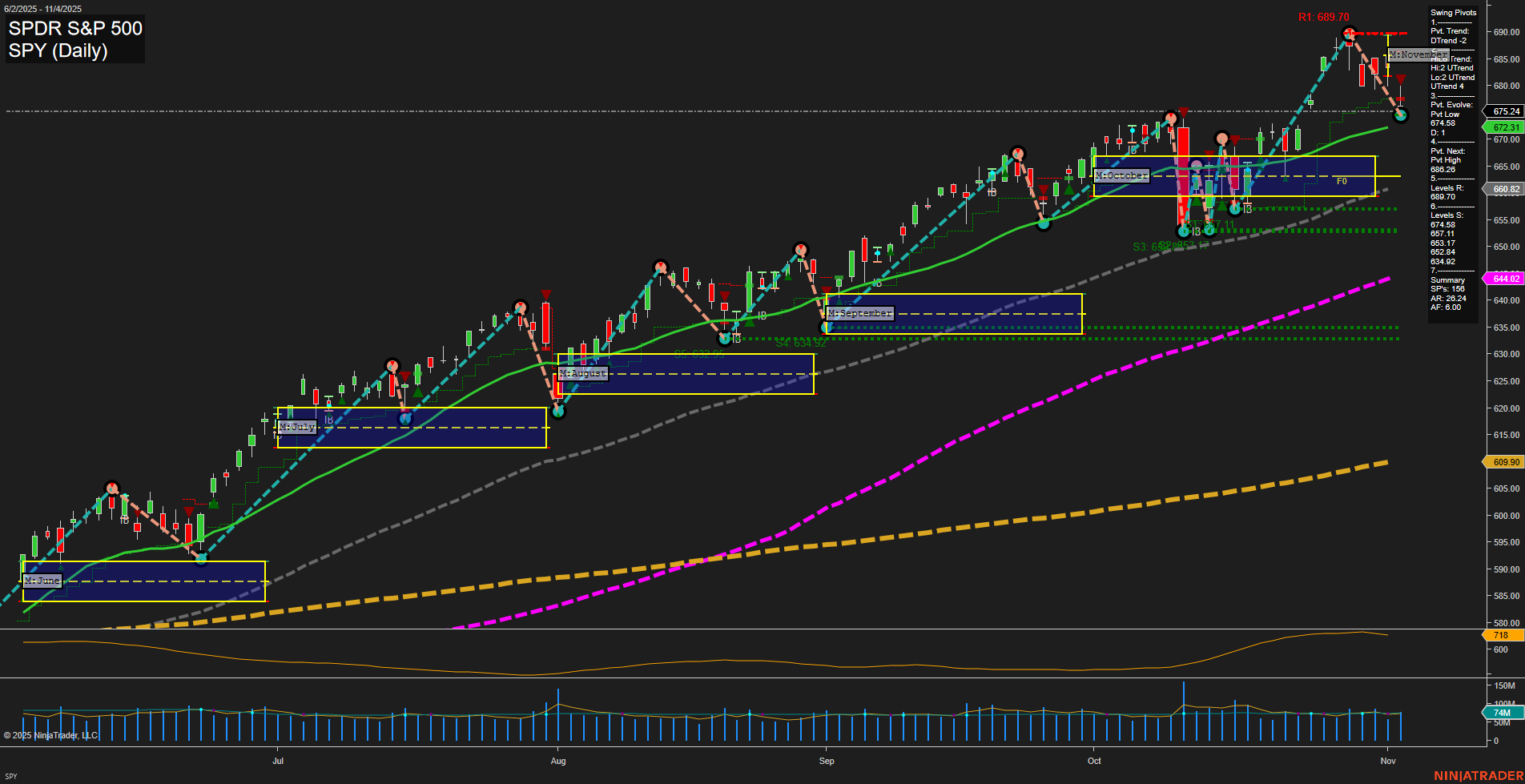

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Precious Metals: Gold, silver, and platinum saw renewed buying interest and price rebounds, even as U.S. Treasury yields rose. Analysts described gold’s recent consolidation as a healthy pause, with history and surging sales data suggesting further upside potential. China’s gold market global influence expanded as Cambodia planned to store reserves in Shanghai Gold Exchange vaults. Silver sales surged, marking a robust month for precious metal demand. Some chart patterns, however, indicate caution with potential downside risks unless gold surpasses key resistance levels.

- Oil & Energy: The oil market faced downward pressure as inventories rose unexpectedly, pushing WTI crude to test weekly lows. U.S. oil production hit records, but the resulting price drops threatened profitability for smaller producers. Texas Pacific Land reported earnings below expectations, citing weaker oil prices. The Trump administration’s slow approach to refilling strategic reserves indicated a cautious policy stance.

- Equities & Indices: U.S. stocks continued to show resilience, with investor “FOMO” reportedly supporting gains. Positive sentiment was echoed by wealth advisors and research analysts seeing continued buying opportunities, despite warnings that the coming year may be rocky based on technical and macroeconomic signals. There was cautious optimism about potential market gains into year-end, though some anticipate choppiness.

- AI & Tech: AI stocks remained a major market driver, with surges in valuations mentioned, but analysts warned of elevated volatility. Netflix announced a 10-for-1 stock split, bucking the slowdown in split announcements seen earlier in the year and signaling management confidence.

- Economic Data & Policy: U.S. household debt continued to rise, and consumer sentiment showed a bifurcated pattern, with lower-income households pulling back while higher-income spending remained strong. The Supreme Court heard arguments on the legality of tariffs, and prediction markets dialed down expectations for their approval. Central banks, including the Bank of Canada and the Fed, emphasized balanced policy stances, with the Fed updating big bank grading frameworks.

- Sector & Macro Highlights: Miami’s business momentum grew following recent political events in New York City. Some ETFs highlighted broader themes of portfolio growth and income. The U.S. will cut flight traffic by 10% in select markets due to ongoing government shutdown pressures. Logistics companies like GXO reported increased foreign trade zone demand linked to tariff trends.

- Crypto & Digital Assets: Bitcoin showed sensitivity to shifts in market liquidity, rebounding amid broader market uncertainty.

News Conclusion

- Precious metals outperformed expectations and demonstrated strong underlying demand, even in the face of higher yields and consolidations. Gold in particular may see further support from both macroeconomic factors and global buying trends.

- Oil and energy markets remain under pressure from oversupply and rising inventories, putting profitability at risk for smaller operators and causing earnings shortfalls.

- U.S. equities maintained upward momentum on strong investor risk appetite, but technical and macro signals suggest that increased volatility and market choppiness could persist into next year.

- AI and large-cap tech continue to dominate market attention, while announcement of new stock splits, such as Netflix’s, point to selected management confidence despite cautious trends across the sector.

- Key policy decisions, consumer trends, and central bank communications reflect a complex macroeconomic backdrop, with both opportunities and risks apparent across asset classes.

Market News Sentiment:

Market News Articles: 58

- Neutral: 46.55%

- Positive: 31.03%

- Negative: 22.41%

GLD,Gold Articles: 15

- Positive: 66.67%

- Neutral: 33.33%

USO,Oil Articles: 10

- Negative: 70.00%

- Neutral: 30.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 5, 2025 05:00

- TSLA 462.07 Bullish 4.01%

- IBIT 58.92 Bullish 3.04%

- GOOG 284.75 Bullish 2.41%

- IWM 244.68 Bullish 1.44%

- META 635.95 Bullish 1.38%

- GLD 366.51 Bullish 1.16%

- IJH 64.78 Bullish 0.68%

- QQQ 623.28 Bullish 0.65%

- DIA 473.11 Bullish 0.47%

- AMZN 250.20 Bullish 0.35%

- SPY 677.58 Bullish 0.35%

- AAPL 270.14 Bullish 0.04%

- TLT 88.96 Bearish -1.09%

- USO 71.03 Bearish -1.25%

- MSFT 507.16 Bearish -1.39%

- NVDA 195.21 Bearish -1.75%

Market Summary: ETF Stocks, Mag7, & Key ETFs (as of 11/05/2025 17:00)

ETF Stocks Overview

- SPY: 677.58 (Bullish +0.35%)

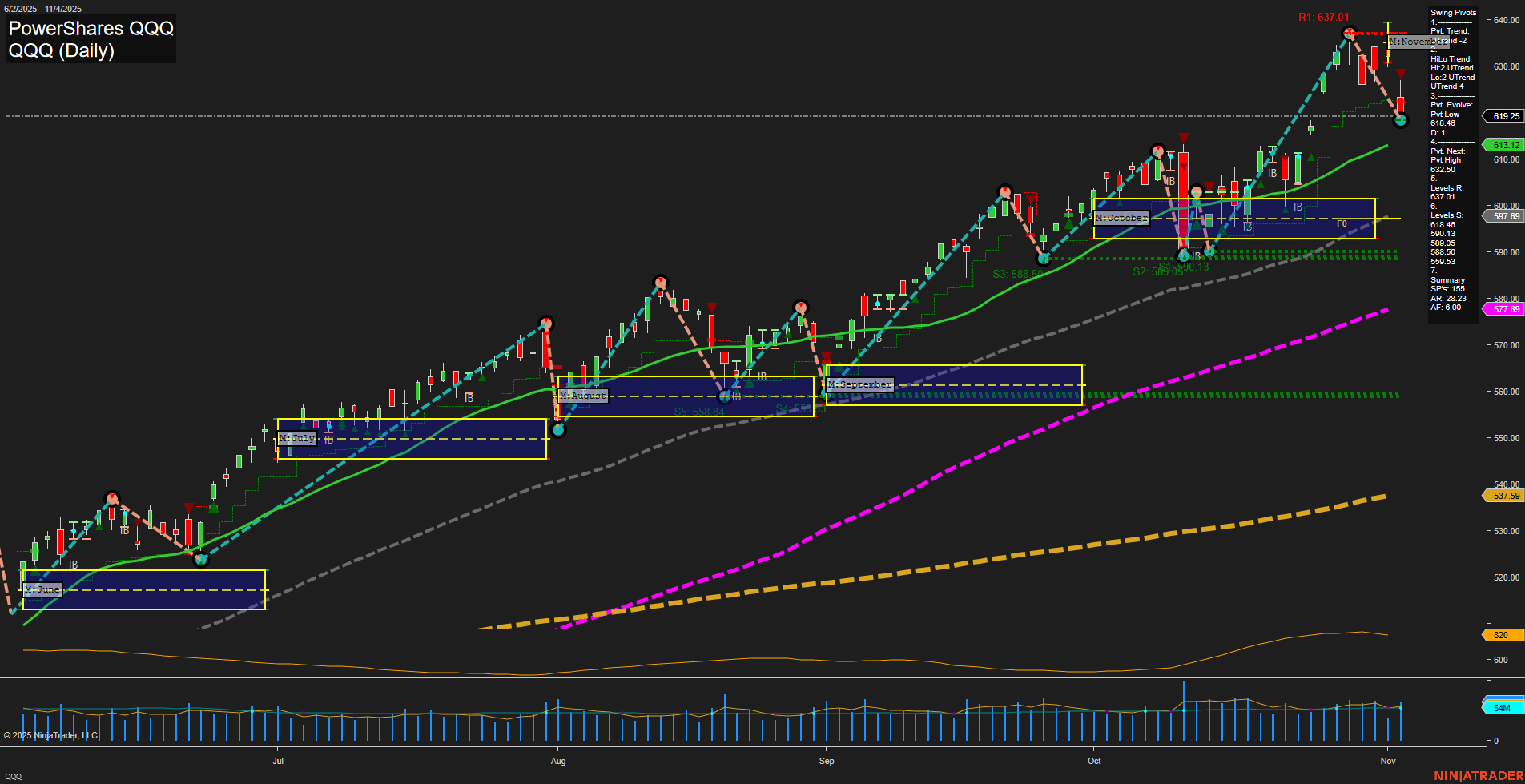

- QQQ: 623.28 (Bullish +0.65%)

- IWM: 244.68 (Bullish +1.44%)

- IJH: 64.78 (Bullish +0.68%)

- DIA: 473.11 (Bullish +0.47%)

State of Play: The main index ETFs are showing broad bullish sentiment, with small caps (IWM) leading the advance. Gains range from moderate (SPY, DIA) to more pronounced in the mid- and small-cap segments.

Mag7 Performance Snapshot

- TSLA: 462.07 (Bullish +4.01%)

- GOOG: 284.75 (Bullish +2.41%)

- META: 635.95 (Bullish +1.38%)

- AMZN: 250.20 (Bullish +0.35%)

- AAPL: 270.14 (Bullish +0.04%)

- MSFT: 507.16 (Bearish -1.39%)

- NVDA: 195.21 (Bearish -1.75%)

State of Play: The Mag7 are mixed: TSLA and GOOG post strong bullish moves, while META, AMZN, and AAPL are modestly positive. In contrast, MSFT and NVDA are under short-term pressure.

Key Theme & Commodity ETFs

- IBIT (Bitcoin ETF): 58.92 (Bullish +3.04%)

- GLD (Gold Trust): 366.51 (Bullish +1.16%)

- TLT (Long-Term Treasuries): 88.96 (Bearish -1.09%)

- USO (Oil Fund): 71.03 (Bearish -1.25%)

State of Play: Risk-on attitude is evident with strong moves in IBIT (crypto) and continued gains in gold (GLD). Bonds (TLT) and oil (USO) are seeing near-term selling pressure, aligning with a shift away from defensive plays.

Overall Sentiment

- Long (Bullish): SPY, QQQ, IWM, IJH, DIA, TSLA, GOOG, META, AMZN, AAPL, IBIT, GLD

- Short (Bearish): TLT, USO, MSFT, NVDA

- Mixed Leadership: Mag7 stocks are split, with outperformance in TSLA and GOOG, and weakness in MSFT and NVDA.

Summary: Broad risk-seeking is present, especially in growth and small caps, and key tech leaders, with notable exceptions in some mega-cap names. Defensive and energy sectors are currently out of favor.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts