Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

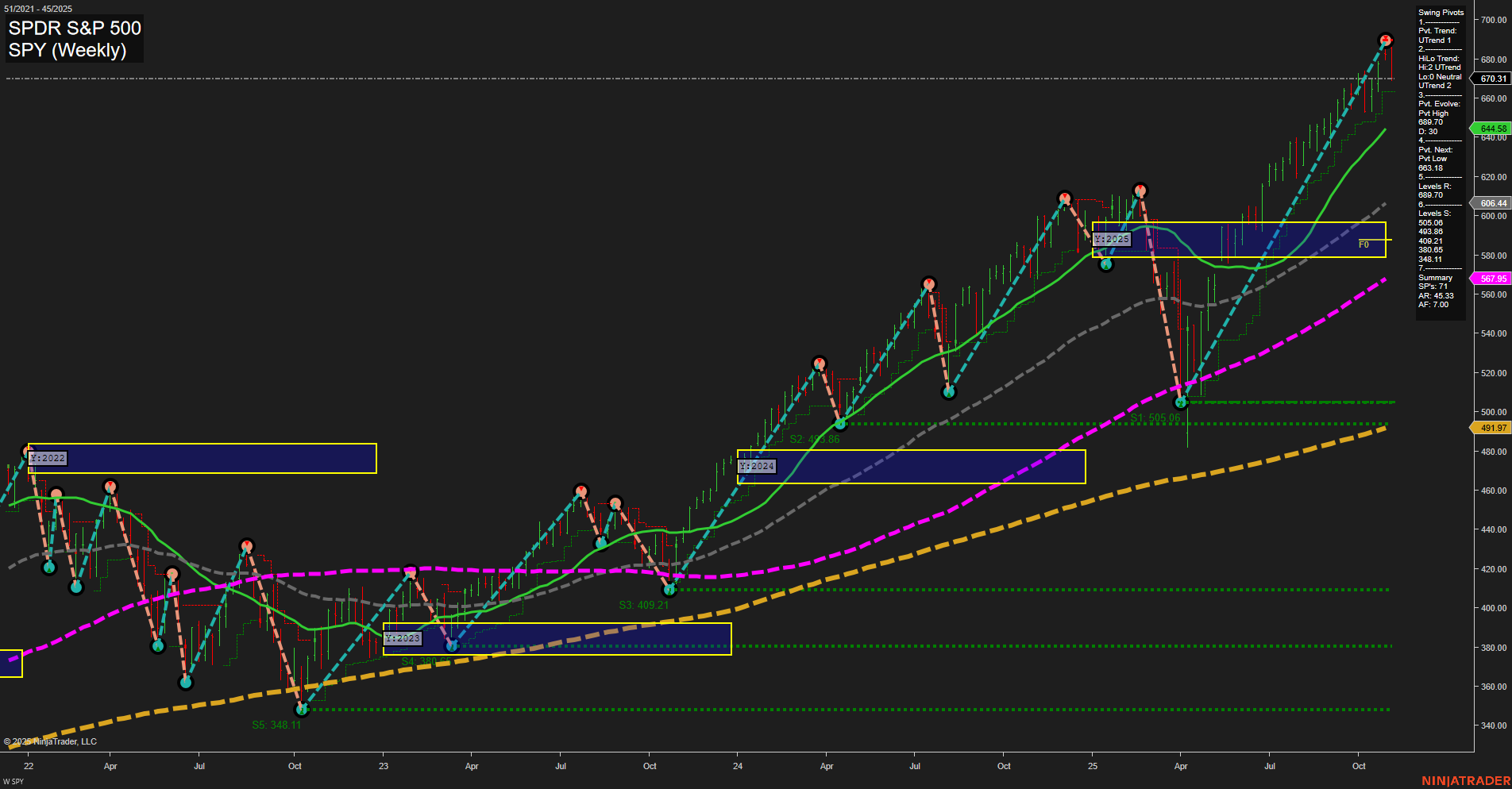

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MCHP Release: 2025-11-06 T:AMC

Microchip Technology (MCHP) reported earnings after the market close on November 6, 2025. With major tech names like NVDA and the broader MAG7 group set to announce results in the coming days, market participants largely shifted into a holding pattern ahead of MCHP’s report. This led to reduced momentum and lighter volumes in index futures trading, as traders waited for fresh catalysts from both MCHP and the anticipated AI-related tech earnings. The subdued activity reflects caution with potential volatility events ahead, especially as expectations remain high for the AI sector and mega-cap tech stocks. Indices are likely to remain range-bound and sensitive to forthcoming earnings news, with any surprises from MCHP or the upcoming tech releases potentially acting as significant market movers.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- No high impact, market-moving economic events are scheduled for today.

EcoNews Conclusion

- With the absence of high impact data releases, markets may look to technicals or broader risk sentiment for direction.

- News events around the 10 AM time cycle often act as a catalyst for reversals or continuations.

For full details visit: Forex Factory EcoNews

Market News Summary

- The AAII Sentiment Survey showed a drop in bullish sentiment and a notable rise in neutral sentiment, reflecting increased uncertainty among individual investors.

- Sentiment across Wall Street has weakened following high-profile bankruptcies, with apprehension about potential underlying issues.

- Ongoing concerns over the U.S. government shutdown and rapid AI sector expansion have pressured markets, particularly technology shares, and fueled risk-off moves.

- Gold prices have strengthened amid signs of economic stress, rising inflation, and as a safe-haven amid worries over U.S. growth and manufacturing slowdowns.

- Oil rebounded modestly from technical support but remains under bearish pressure due to oversupply and weak demand, heading for consecutive weekly losses.

- Natural gas and oil held steady despite oversupply anxieties, as geopolitical risks provided a counterbalance.

- U.S. tech stocks endured a difficult session, with layoffs spiking in October, contributing to downside momentum in indices futures.

- Dow Jones and Nasdaq 100 futures came under renewed pressure after a slump in Chinese exports and resurfacing US-China trade tensions.

- Bank stocks closed October at their lowest valuations since May, notably underperforming the broader market.

- The “Fear & Greed” index shifted to “Extreme Fear” as the Nasdaq tumbled more than 400 points, reflecting heightened investor anxiety.

- Market concentration in a narrow group of AI-driven stocks remains a significant risk, with fatigue setting in for some high-profile tech themes.

- Despite market turbulence, gold maintains support above key technical levels, underpinned by expectations for Fed rate cuts and safe-haven demand, keeping upside targets in play.

- Gold’s multi-week rally, driven by currency debasement concerns, remains top of mind as prices consolidate near $4,000 per ounce with prospects for further escalation.

- News of progress in the China trade deal offered some optimism, though the positive impact was tempered by ongoing global economic concerns.

- Staple stock valuations have come down but only select names are seen as potentially attractive, indicating caution within defensive sectors.

- Private-sector jobs data contributed to a negative tone for the market open, especially for Nasdaq futures, exacerbated by the lack of official data during the government shutdown.

News Conclusion

- Markets remain volatile with sentiment mixed to negative, driven by concerns over government shutdown, tech sector weakness, and economic slowdown signs.

- AI and tech stocks are under pressure amid valuation worries and increasing layoffs, raising fears about the sector’s near-term outlook.

- Gold appears resilient as investors seek safety amid economic stress and uncertainty, with the potential for further gains if risk-off sentiment persists.

- Oil prices struggle to find lasting support due to bearish demand factors, despite short-term rebounds linked to geopolitical risks.

- Indices futures, especially the Nasdaq and Dow, are tracking lower in pre-market action as investors react to fresh global growth concerns and sector-specific risks.

- Market behavior reflects caution with heavy attention on macroeconomic developments and sector rotation, particularly into perceived safe-haven assets.

Market News Sentiment:

Market News Articles: 49

- Negative: 53.06%

- Neutral: 24.49%

- Positive: 22.45%

Sentiment Summary:

Out of 49 market news articles, 53.06% have a negative tone, 24.49% are neutral, and 22.45% are positive.

This indicates a predominantly negative sentiment in recent market news coverage.

GLD,Gold Articles: 16

- Neutral: 50.00%

- Positive: 37.50%

- Negative: 12.50%

Sentiment Summary: Recent coverage on GLD and gold is predominantly neutral (50%), with a notable portion of articles showing positive sentiment (37.5%) and a smaller share reflecting negativity (12.5%).

This indicates that current market news is mostly balanced or undecided, though there is a modest tilt toward positive sentiment compared to negative.

USO,Oil Articles: 6

- Negative: 66.67%

- Neutral: 16.67%

- Positive: 16.67%

Sentiment Summary: The majority of recent market news articles related to USO and oil are negative (66.67%), with a smaller portion being neutral (16.67%) and positive (16.67%).

Conclusion: Overall, sentiment in the latest news coverage about USO and oil is predominantly negative, with few articles expressing positive or neutral views. Traders may wish to monitor the news flow for further developments.

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 7, 2025 07:16

- TLT 89.76 Bullish 0.90%

- GOOG 285.34 Bullish 0.21%

- GLD 366.07 Bearish -0.12%

- AAPL 269.77 Bearish -0.14%

- USO 70.88 Bearish -0.21%

- DIA 469.28 Bearish -0.81%

- IJH 64.16 Bearish -0.96%

- SPY 670.31 Bearish -1.07%

- IWM 240.35 Bearish -1.77%

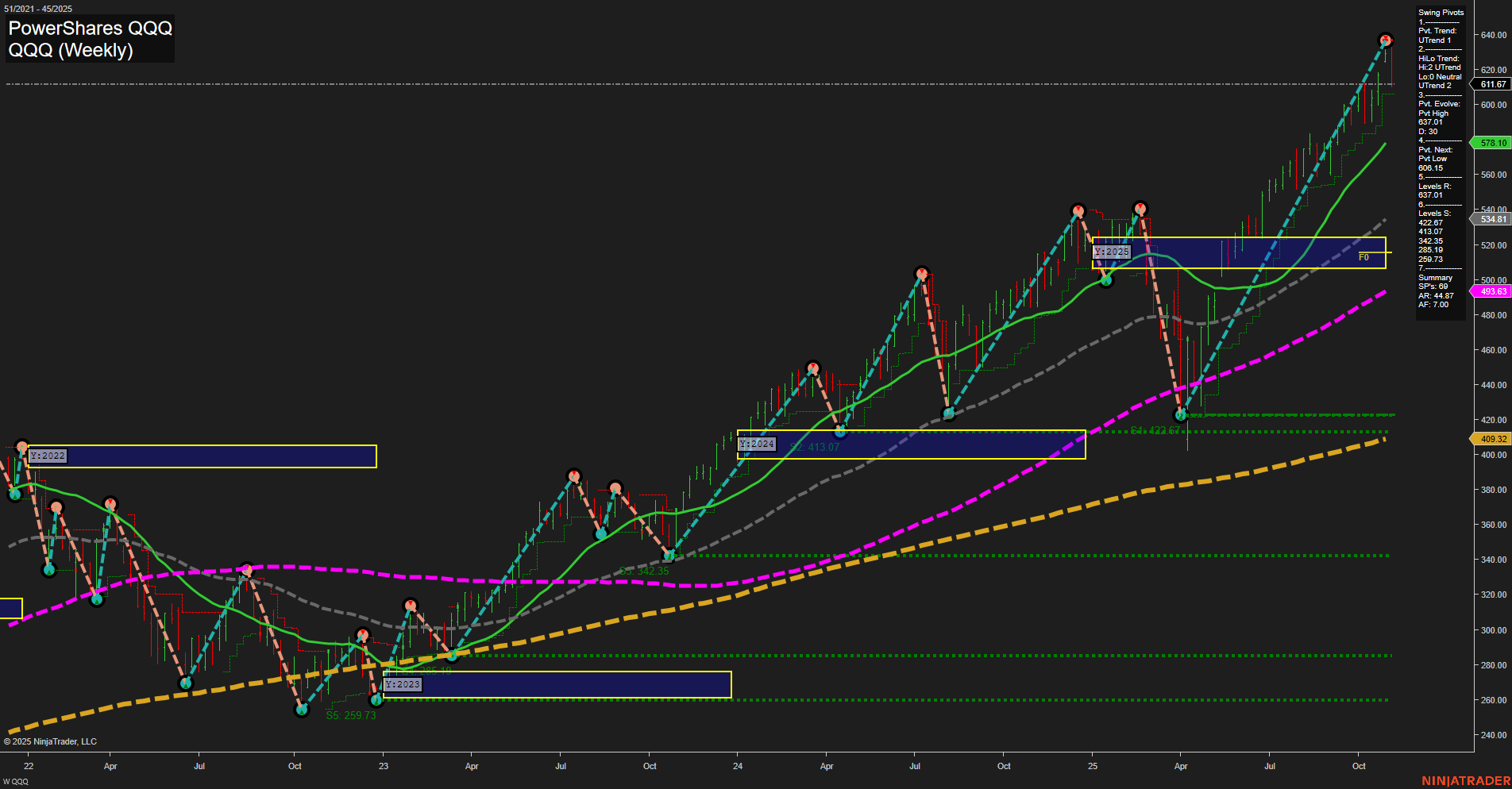

- QQQ 611.67 Bearish -1.86%

- MSFT 497.10 Bearish -1.98%

- META 618.94 Bearish -2.67%

- IBIT 57.26 Bearish -2.82%

- AMZN 243.04 Bearish -2.86%

- TSLA 445.91 Bearish -3.50%

- NVDA 188.08 Bearish -3.65%

Market State Summary – ETF Stocks, Mag7, and Key ETFs

ETF Stocks Overview

- SPY (670.31, -1.07%): Bearish momentum dominates, with the S&P 500 ETF declining, signaling broad weakness in large-cap equities.

- QQQ (611.67, -1.86%): The Nasdaq-tracking ETF shows notable downside, highlighting risk-off sentiment in tech-heavy holdings.

- IWM (240.35, -1.77%): Small caps are under heavy pressure, signaled by a sharp drop in the Russell 2000 ETF.

- IJH (64.16, -0.96%): Mid-caps continue to face headwinds, posting a considerable loss.

- DIA (469.28, -0.81%): The Dow ETF reflects overall bearishness in blue-chips, though less severe than in tech indices.

Summary: The ETF stock set, except for TLT, is predominantly experiencing bearish price action, reflecting broad weakness across market caps and sectors.

Mag7 Performance

- AAPL (269.77, -0.14%): Slightly bearish on the day, showing resilience relative to peers.

- MSFT (497.10, -1.98%): Faces a sharp decline, contributing to tech-led weakness.

- GOOG (285.34, +0.21%): The only bullish Mag7 constituent, bucking the broader tech selloff.

- AMZN (243.04, -2.86%): Suffering an accelerated drop amid a negative session for large-cap tech.

- META (618.94, -2.67%): Heavily sold, reflecting pessimism in social media and advertising tech.

- NVDA (188.08, -3.65%): Leads to the downside among Mag7, emphasizing a risk-off mood in semiconductors.

- TSLA (445.91, -3.50%): Also sharply lower as traders rotate out of growth and EV names.

Summary: Mag7 is predominantly bearish, with only GOOG showing a modest gain. The group is contributing to negative market breadth, especially in technology.

Other Notable ETFs

- TLT (89.76, +0.90%): Bullish action signals flows into longer-duration Treasuries, often a flight-to-safety move.

- GLD (366.07, -0.12%): Edges lower, suggesting muted demand for gold despite broader risk-off dynamics.

- USO (70.88, -0.21%): Weakness in oil ETF may reflect concerns over global growth or shifting supply/demand dynamics.

- IBIT (57.26, -2.82%): Bearish session for this digital asset ETF, tracking alongside broader risk aversion.

Summary: Safe-haven flows are evident in TLT, while other alternative asset ETFs like GLD, USO, and IBIT are under pressure.

Overall Market Tone

Bearish sentiment dominates across major equity ETFs and the Mag7, with declines spanning large-cap, tech, small-cap, and mid-cap exposures. The notable exception is TLT, pointing to increased demand for long-term bonds, while only GOOG remains in positive territory among major tech names. Risk-off dynamics prevail across most other asset classes.

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-11-07: 07:16 CT.

US Indices Futures

- ES Bearish WSFG and pivots, testing support 6292/6224, YSFG/MSFG bullish, above key MAs, corrective pullback within long-term uptrend.

- NQ Bearish daily swing, WSFG down, testing 25415.25 support, MSFG/YSFG up, major MAs bullish, probable consolidation after recent highs.

- YM Weekly uptrend, short-term pullback below NTZ, WSFG down, MSFG/YSFG up, above key MAs, resistance at highs, corrective within bullish trend.

- EMD Bearish on all short/intermediate grids, pivots lower, price below NTZs, MAs down short-term, long-term neutral, key support at 3140.

- RTY Mixed/neutral WSFG, short/intermediate pullback, below NTZs, swing pivots up on weekly, long-term YSFG bullish, cluster support at 2381.8.

- FDAX Strong short/intermediate downtrend, below WSFG/MSFG NTZ, pivots down, resistance at 24891, major MAs down except 200-day, YSFG bullish.

Overall State

- Short-Term: Bearish

- Intermediate-Term: Bearish to Neutral

- Long-Term: Bullish

Conclusion

US Indices Futures are in a corrective or pullback phase on higher timeframes, with WSFG and MSFG trends pointing down for most instruments, and daily swing pivots confirming downside momentum. Despite short-term bear structure, all indices maintain YSFG and long-term moving averages in uptrends, signaling continuation of broader bullish market structure. Major support and resistance levels are being tested, with volume and volatility elevated. Leading index (NQ) also exhibiting corrective behavior, aligning with ES and YM correlations. Longer-term uptrends remain valid unless key support fails decisively.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts