After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

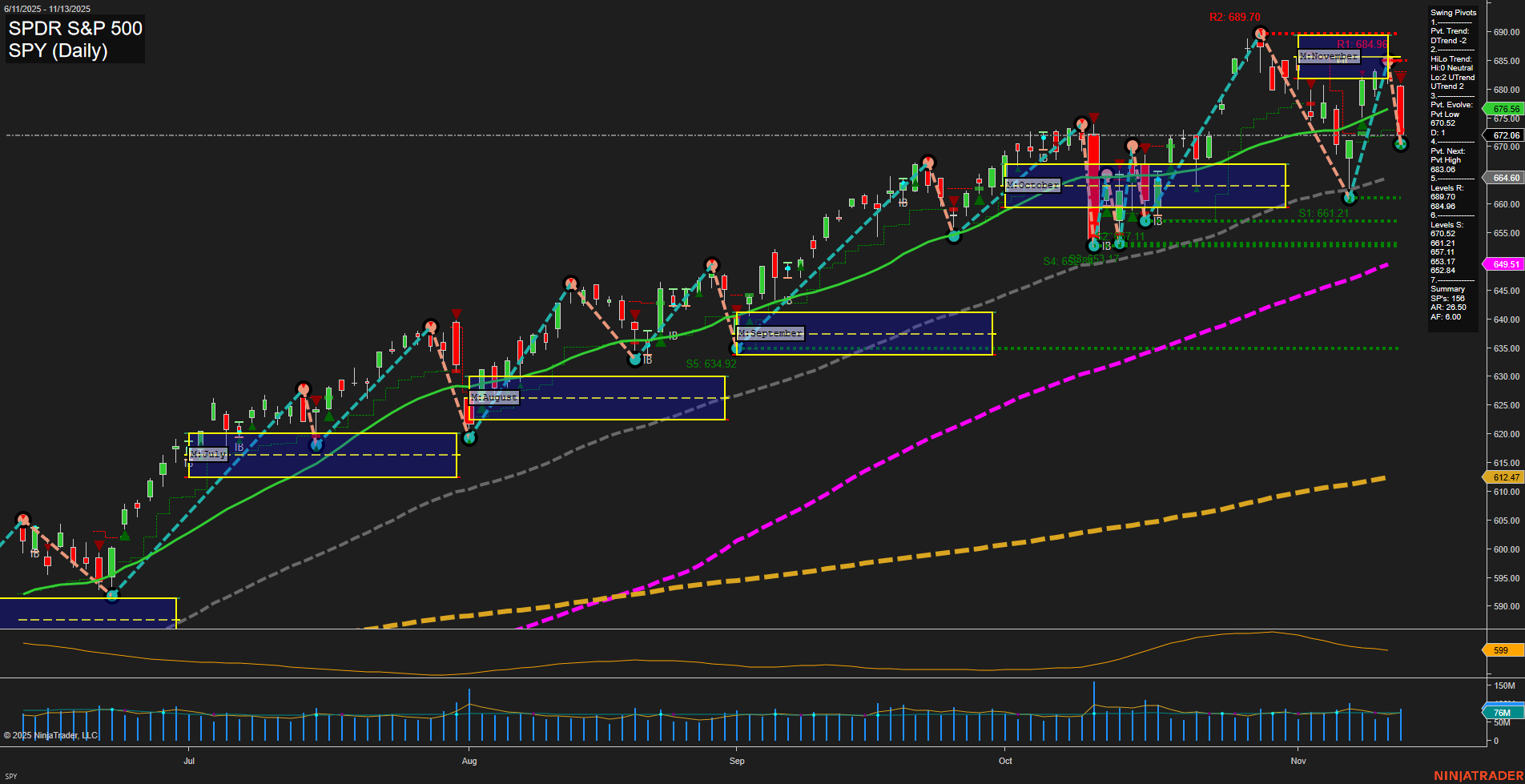

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Indices: The market experienced strong volatility but ended the week higher, with the S&P 500 posting a fourth gain in five weeks, up 0.1%. Growth sectors tumbled midweek before rebounding on Friday. Volatility was largely driven by the end of a government shutdown and anticipation for delayed labor market data.

- Sector Rotation & Tech: Tech stocks dominated the week’s volatility, with mixed economic signals and shifting investor sentiment. While AI-related stocks faded and the “AI narrative” showed emerging weaknesses, broader tech shares bounced back strongly to close the week. High P/E ratios in the S&P 500 are being supported by record profit margins, helping to sustain bullish broader sentiment.

- Commodities: Oil rallied amid geopolitical tensions, specifically drone strikes at a Russian export hub, even as US crude stockpiles rose to record levels. Gold held above $4,000 but failed to break to new all-time highs, stabilizing after a short-term pullback.

- Bitcoin & Crypto: Bitcoin continued its slide, reaching six-month lows below $90,000, failing to recover while equities rebounded. Weak demand for crypto ETFs contributed to the pressure.

- Macro Drivers: Market volatility is being exacerbated by a lack of fresh economic data after the government shutdown, and uncertainty regarding the Federal Reserve’s December rate decision. Hopes for a near-term rate cut are fading, with officials divided on the path forward.

- Sector Highlights: US industrial automation stocks are gaining attention due to strong tech investment payoffs. Classic “buy the dip” behavior helped indices recover by week’s end. Consumer-focused moves included tariffs being slashed on key imports to ease price pressures.

- Technical Signals & Flows: Technical analysis indicates healthy underlying volatility; strategists caution against heavy reliance on historical return charts for allocation decisions. Lower-fee S&P 500 tracking products like SPLG are competing with legacy ETFs for flows.

News Conclusion

- Equity markets closed the week with a modest rebound after significant intra-week swings, demonstrating continued resilience despite macro and sector-specific volatility.

- High levels of uncertainty persist, driven by unclear Fed policy signals and the lag in economic data following the government shutdown. The anticipated release of jobs data is a focal point for next week’s trading.

- Tech sector volatility and emerging weakness in AI narratives create shifting leadership within US equities. Broader sentiment remains supported by historically strong profit margins despite elevated valuations.

- Commodities such as oil and gold remain reactive to geopolitical developments and monetary policy uncertainty. Cryptocurrencies underperformed, diverging from the late-week relief in risk assets.

- This environment underscores rapid sector rotation, macro headline sensitivity, and divergence between asset classes as defining features of the current market landscape.

Market News Sentiment:

Market News Articles: 62

- Negative: 40.32%

- Neutral: 37.10%

- Positive: 22.58%

GLD,Gold Articles: 16

- Positive: 37.50%

- Neutral: 31.25%

- Negative: 31.25%

USO,Oil Articles: 9

- Positive: 55.56%

- Neutral: 33.33%

- Negative: 11.11%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 14, 2025 05:00

- USO 71.38 Bullish 2.19%

- NVDA 190.17 Bullish 1.77%

- MSFT 510.18 Bullish 1.37%

- TSLA 404.35 Bullish 0.59%

- IWM 237.48 Bullish 0.29%

- QQQ 608.86 Bullish 0.08%

- SPY 671.93 Bearish -0.02%

- META 609.46 Bearish -0.07%

- AAPL 272.41 Bearish -0.20%

- IJH 64.20 Bearish -0.22%

- TLT 88.87 Bearish -0.57%

- DIA 471.80 Bearish -0.62%

- GOOG 276.98 Bearish -0.77%

- AMZN 234.69 Bearish -1.22%

- GLD 375.96 Bearish -1.80%

- IBIT 53.48 Bearish -3.80%

Market Summary: ETFs, Mag7, Select Assets (As of 11/14/2025 17:00)

Overview

Today’s market snapshot presents a mixed landscape for traders. Select high-growth and energy assets show notable strength, while several core indices and mega-cap technology names trend weaker into the session close.

ETF Indices: Bulls, Bears, and Mixed

- Bullish:

- USO (71.38, +2.19%) – Crude oil ETF outperformed, reflecting strong gains in the energy sector.

- IWM (237.48, +0.29%) – Russell 2000 ETF showed moderate upside, suggesting some resilience in small caps.

- QQQ (608.86, +0.08%) – Tech-heavy Nasdaq ETF held marginally higher, helped by select technology stocks.

- Bearish:

- SPY (671.93, -0.02%) – S&P 500 ETF edged slightly lower, indicating broad market caution.

- IJH (64.20, -0.22%) – Midcap ETF fell modestly, lagging behind small cap peers.

- DIA (471.80, -0.62%) – Dow Jones Industrial ETF saw pronounced selling pressure relative to other indices.

- TLT (88.87, -0.57%) – Long-term treasury ETF declined, signaling softness in bond prices.

- Other Assets:

- GLD (375.96, -1.80%) – Gold ETF experienced a sharp decline, indicating risk-off sentiment not yet benefiting safe havens.

- IBIT (53.48, -3.80%) – Bitcoin ETF dropped sharply, suggesting a notable risk-off tone in crypto-exposed assets.

Mag7 Tech & Select Leaders

- Bullish:

- NVDA (190.17, +1.77%) – Nvidia led the Mag7 with robust outperformance.

- MSFT (510.18, +1.37%) – Microsoft showed strong momentum within the tech sector.

- TSLA (404.35, +0.59%) – Tesla advanced, albeit more modestly.

- Bearish:

- META (609.46, -0.07%) – Meta Platforms slipped, reversing its recent upside streak.

- AAPL (272.41, -0.20%) – Apple dipped below water, continuing in a cautious mode.

- GOOG (276.98, -0.77%) – Alphabet saw deeper losses compared to its peers.

- AMZN (234.69, -1.22%) – Amazon lagged, with the sharpest Mag7 decline of the group.

Summary

The session demonstrates sector rotation with strength in energy (USO) and select high-growth tech leaders (NVDA, MSFT, TSLA), while most broad market indices, precious metals, and crypto proxies (GLD, IBIT) slipped. The Mag7 stocks are mixed: outperformance is concentrated in chips and cloud, while e-commerce and search lagged. Fixed income (TLT) and industrials (DIA) remain on the defensive.

Note: This market summary is for informational use only and does not constitute trading advice.

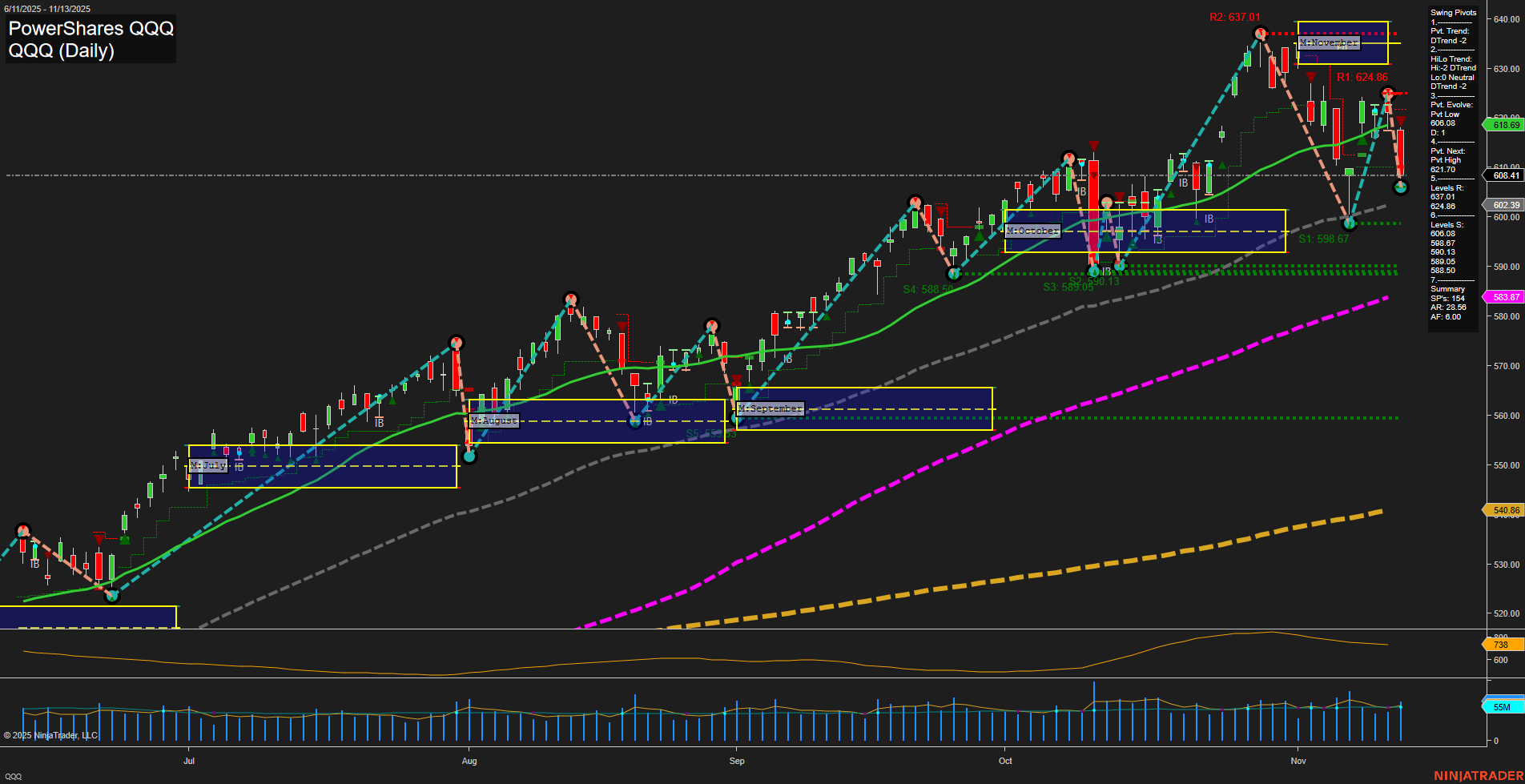

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts