Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

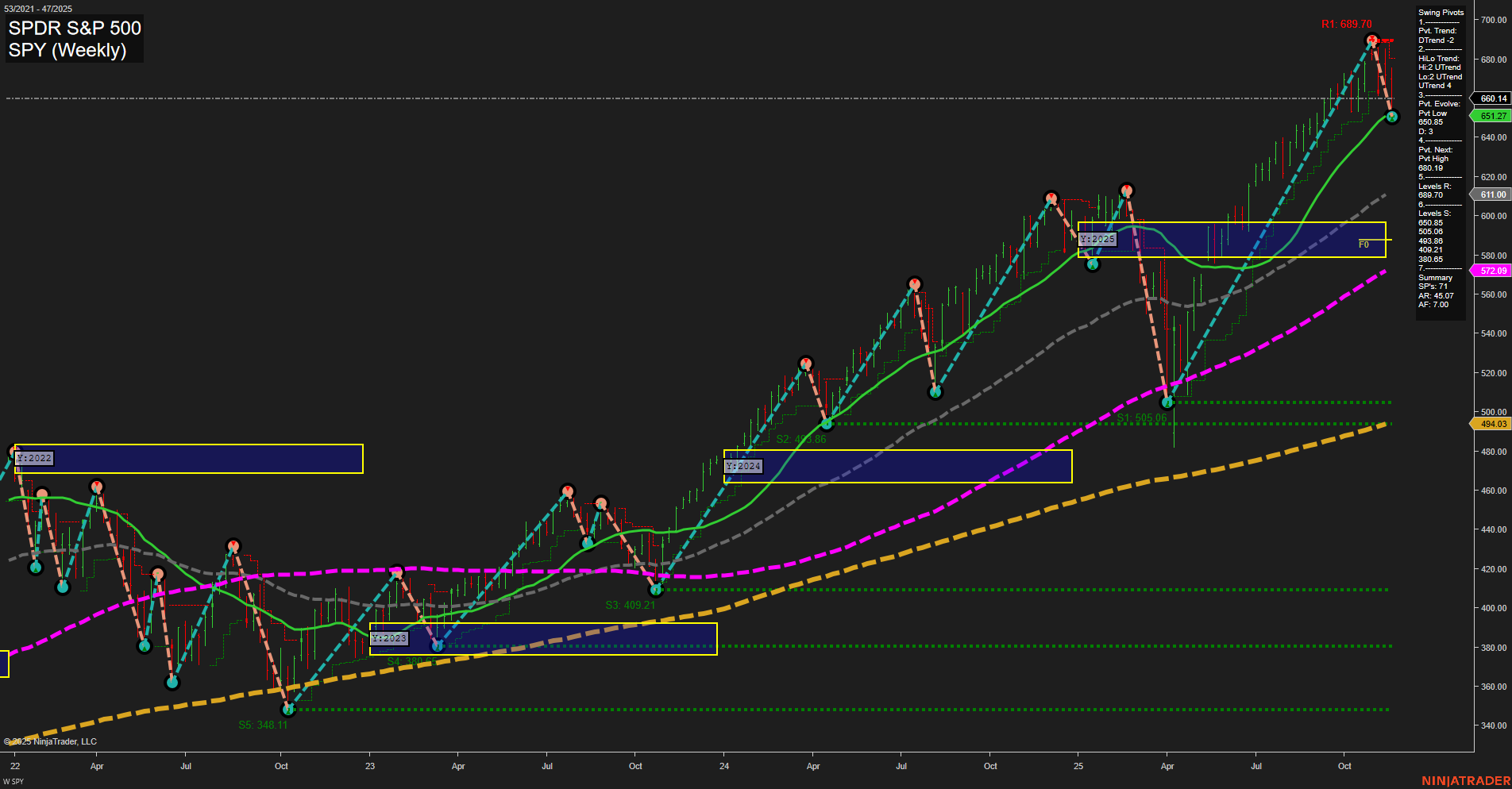

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

- 2025-11-27 Thanksgiving Day

- 2025-11-28 Thanksgiving Day (09:30-13:00)

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday 08:30 ET – High Impact USD Data Cluster: US Core PPI, PPI, Core Retail Sales, and Retail Sales released simultaneously. Strong moves in index futures are likely as these data give critical insights into inflation pressure and consumer activity. Surprises in inflation or sales could drive volatility with a directional impulse at the open.

- Wednesday 08:30 ET – High Impact USD Cluster: Unemployment Claims and Preliminary GDP releases create a further focal point for US growth and labor market outlook, compounded by Core PCE Price Index at 10:00 ET which is a key Fed-watched inflation figure. All three could act as a significant catalyst for index price action.

- Wednesday 10:30 ET – Oil-related Event: Crude Oil Inventories (Medium Impact) may influence market sentiment and sector rotation, particularly if there are notable surprises, further impacting inflation expectations.

EcoNews Conclusion

- This series of high impact releases over Tuesday and Wednesday sets up multiple potential volatility windows for index futures, centered on the 8:30 ET and 10:00 ET time cycles—prime times for fast momentum and reversals.

- Market momentum and volume may slow in the days leading up to major events such as PCE and GDP, which are included in this week’s schedule.

- Expect heightened sensitivity around inflation data (PPI, Core PCE) and growth figures (GDP), with 10:00 AM events often acting as catalysts for intraday trend changes.

- Should oil inventories spark a rise in oil prices, this may directly impact indices due to renewed concerns about inflation and energy sector moves.

For full details visit: Forex Factory EcoNews

Market News Summary

- Gold is outperforming as investors pivot from growth to hard assets amid tightening liquidity, with the S&P 500 under pressure.

- Over the past decade, the SPDR S&P 500 ETF Trust has surged more than 200%, underscoring the long-term strength of broad U.S. equities.

- Markets are bracing for $150 billion in upcoming Treasury settlements, raising concerns about intensified liquidity drains and potential further downside for the S&P 500.

- The holiday-shortened week heightens focus on U.S. consumer activity following recent market volatility.

- The S&P 500 and Nasdaq faced losses last week, though optimism over potential Fed rate cuts provided some relief ahead of Thanksgiving. Diverging analyst views are noted on Alibaba’s performance with a mix of upgrades and downgrades.

- Treasury Secretary Scott Bessent sees no recession in 2026 but acknowledges ongoing challenges in housing and interest-rate-sensitive sectors.

- Gold prices are steady at key support levels, with traders watching for action around a critical pivot as Federal Reserve policy expectations remain in focus.

- Crude oil futures posted a bearish weekly setup due to fragile demand, swift Russian supply returns, and mixed signals from U.S. inventories.

- The recent S&P 500 decline has reset the technical trend, potentially setting up a bottom in the 6490 area in the coming week.

News Conclusion

- Defensive assets like gold are currently favored as liquidity tightens and growth equities face renewed pressure.

- Despite near-term headwinds, the S&P 500’s long-term track record remains robust, though further volatility may emerge with large Treasury settlements and a shortened trading week.

- Market sentiment is being shaped by mixed economic signals, evolving rate expectations, and ongoing sector-specific challenges, with technical levels in both equities and gold under careful watch.

- Crude oil continues to exhibit a bearish tone, reflecting ongoing concerns over global demand and supply dynamics.

Market News Sentiment:

Market News Articles: 4

- Neutral: 75.00%

- Positive: 25.00%

GLD,Gold Articles: 2

- Neutral: 50.00%

- Positive: 50.00%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 23, 2025 06:15

- GOOG 299.65 Bullish 3.33%

- IWM 235.60 Bullish 2.83%

- IJH 63.76 Bullish 2.41%

- AAPL 271.49 Bullish 1.97%

- AMZN 220.69 Bullish 1.63%

- SPY 659.03 Bullish 1.00%

- DIA 462.57 Bullish 0.98%

- META 594.25 Bullish 0.87%

- QQQ 590.07 Bullish 0.75%

- TLT 89.50 Bullish 0.30%

- GLD 374.27 Bearish -0.15%

- NVDA 178.88 Bearish -0.97%

- TSLA 391.09 Bearish -1.05%

- USO 69.30 Bearish -1.21%

- MSFT 472.12 Bearish -1.32%

- IBIT 47.97 Bearish -2.02%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-11-23: 18:15 CT.

US Indices Futures

- ES Weekly: YSFG up, MSFG and WSFG down, below NTZ (ST/IT), swing pivots down, key resistance 6953.75–6744.25, support 6525.00, 6274.43, long-term MA bullish.

- NQ Weekly: YSFG up, MSFG and WSFG down, below NTZ (ST/IT), swing pivots down (ST) with IT resilience, support below, resistance at highs, long-term MA bullish.

- YM: Data unavailable.

- EMD Weekly: YSFG/long-term neutral, MSFG and WSFG down, below NTZ, short/intermediate pivots down, support 3107.0, resistance 3352.2/3523.1, short-term MAs down, long-term MAs intact.

- RTY: Data unavailable.

- FDAX Weekly: YSFG up, MSFG and WSFG down, below NTZ (ST/IT), swing pivots down, resistance 24,891, support 23,138/19,274, long-term MA bullish.

Overall State

- Short-Term: Bearish

- Intermediate-Term: Bearish to Neutral

- Long-Term: Bullish (except EMD neutral, FDAX long-term up)

Conclusion

US Indices Futures are exhibiting higher timeframe corrective activity, with all observed contracts showing alignment of short- and intermediate-term session fib grids (MSFG/WSFG) to the downside and price located below or near key neutral zones. Swing pivots confirm short-term downtrends for ES, NQ, EMD, and FDAX, while YM and RTY data remain unavailable. Long-term technicals (YSFG, 200 MA, yearly pivots) indicate persistent bullish structure for ES, NQ, and FDAX, with EMD maintaining a neutral long-term context. Support and resistance levels are well defined on all instruments, with volatility and volume elevated, reflecting an active corrective or retracement phase within dominant long-term uptrends. Directional correlations are strong across US indices, with FDAX exhibiting parallel structure. No clear trend reversal signals are confirmed on higher timeframes; ongoing structure implies monitoring key support for possible structure shifts.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

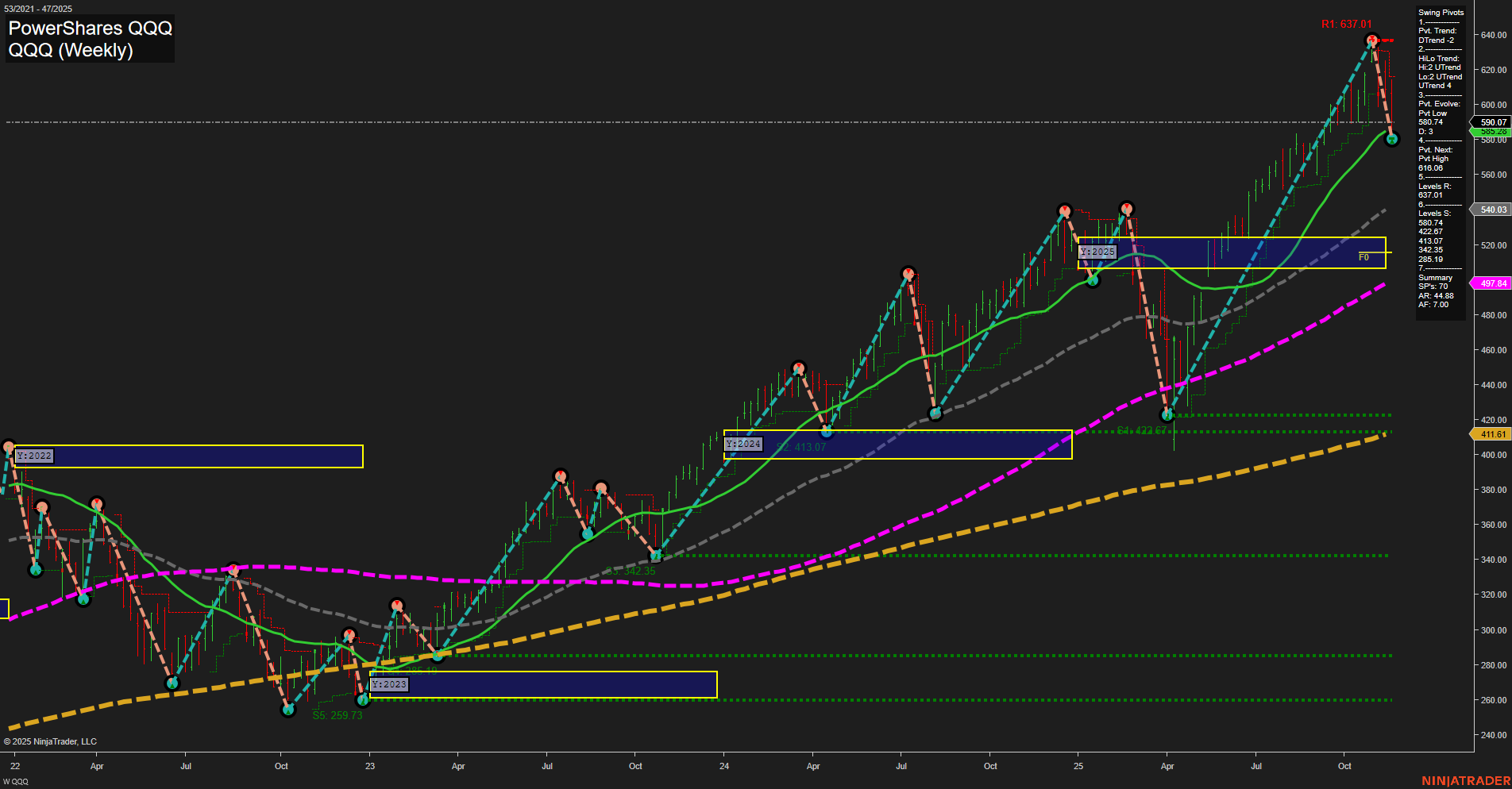

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts