After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

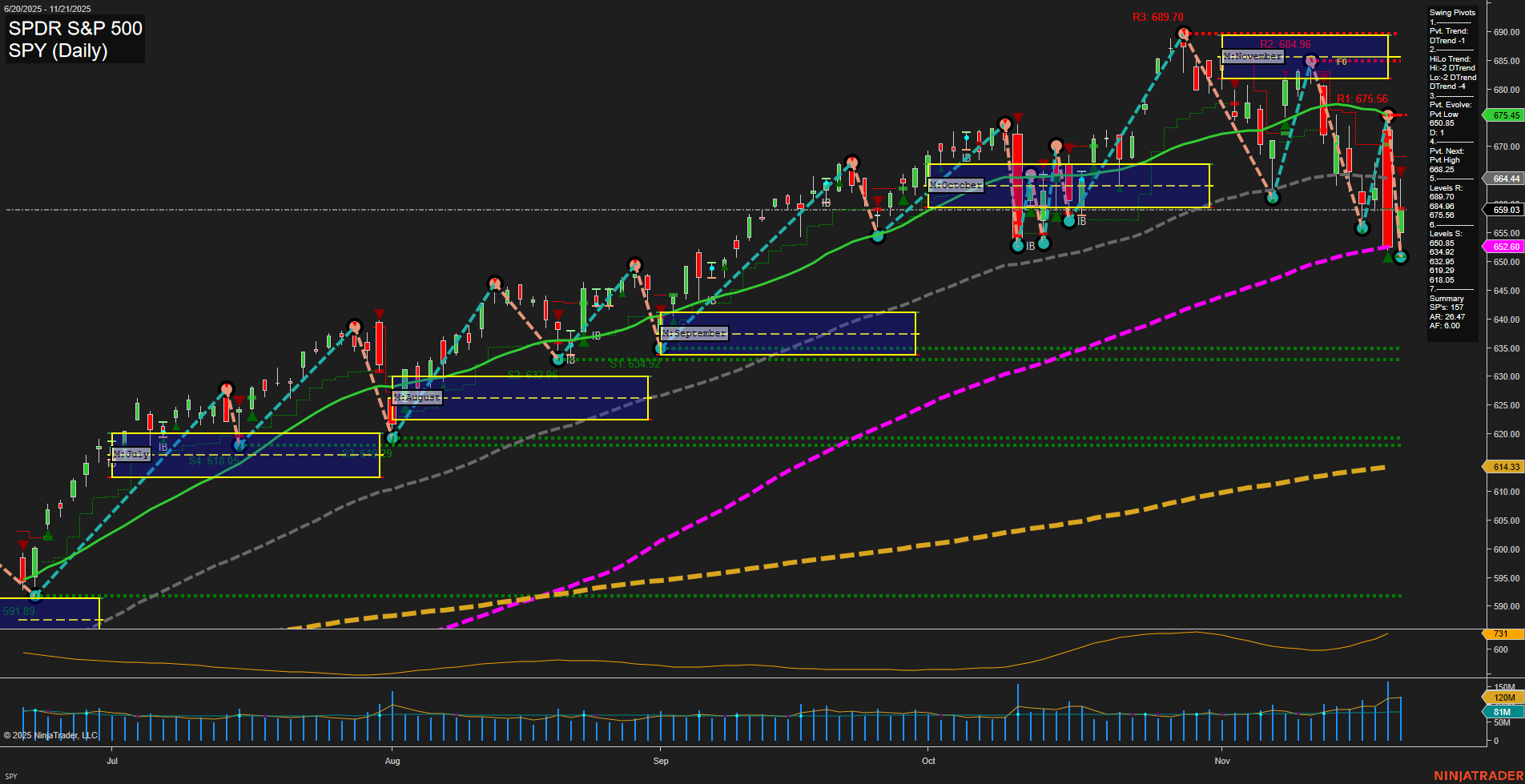

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- U.S. Stocks & Indices: Major U.S. stock indexes rebounded sharply to start Thanksgiving week, with the S&P 500 and Nasdaq posting their best gains since May. Alphabet’s gains reignited AI enthusiasm, while tech stocks and health care outperformed. Volatility spiked earlier in November, but inflows into the Vanguard S&P 500 ETF (VOO) set records, showing robust investor interest despite broader market swings.

- Fed Rate Cut Expectations: Renewed hopes for Federal Reserve rate cuts helped boost equity sentiment. U.S. futures and global stocks rose moderately as traders positioned around future monetary policy. However, some mixed economic signals remain, including high margin debt and subdued consumer confidence.

- Commodities: Gold reached near $4,100, with strong investment demand limiting downside. Silver and platinum also advanced, while the gold trade is becoming crowded and sensitive to U.S. holiday spending data. Oil markets rebounded from monthly lows, supported by ongoing Ukraine peace talks.

- ETFs & Flows: ETF flows continued their upward trend, with discussions highlighting the growth prospects for both active and passive strategies in the industry.

- Holiday Spending & Consumer Trends: Early data suggests consumers remain active heading into the holidays, which could set up favorable conditions for equities if sustained.

- Europe & Asia: European equities showed intermittent outperformance versus the U.S., while Japan saw historic bond market volatility due to inflation and policy actions. Markets in Asia were mixed with some regional holidays.

- Cryptocurrency: Bitcoin rebounded slightly, but remains well off recent highs, with debates ongoing about its longer-term outlook.

- Noteworthy Developments: U.S. GDP reporting faced delays, and Nasdaq 100 index membership changes are anticipated, potentially affecting major ETFs.

News Conclusion

- U.S. stocks started Thanksgiving week with robust gains, as rate cut optimism and strong performance from tech and health care led markets higher. ETF inflows remained resilient even during recent volatility.

- Precious metals continued strong momentum, with gold at multi-year highs and oil rebounding alongside renewed interest in peace developments.

- Mixed economic signals persist, with high market risk appetite standing in contrast to weak consumer sentiment, highlighting growing divergence among market and economic indicators.

- Market attention is shifting to U.S. holiday spending trends and upcoming economic data releases as key drivers for short-term sentiment, notably in both equities and commodities.

- European markets are watching for reforms to sustain recent outperformance, while Japan contends with bond market turbulence.

- Overall, optimism is building for a positive finish to November, but volatility and contrasting macro signals continue to shape near-term index futures trading setups.

Market News Sentiment:

Market News Articles: 43

- Positive: 55.81%

- Neutral: 34.88%

- Negative: 9.30%

GLD,Gold Articles: 16

- Neutral: 50.00%

- Positive: 37.50%

- Negative: 12.50%

USO,Oil Articles: 8

- Negative: 62.50%

- Neutral: 25.00%

- Positive: 12.50%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 24, 2025 05:00

- TSLA 417.78 Bullish 6.82%

- GOOG 318.47 Bullish 6.28%

- IBIT 50.57 Bullish 5.42%

- META 613.05 Bullish 3.16%

- QQQ 605.16 Bullish 2.56%

- AMZN 226.06 Bullish 2.43%

- NVDA 182.55 Bullish 2.05%

- IWM 239.90 Bullish 1.83%

- AAPL 275.92 Bullish 1.63%

- USO 70.42 Bullish 1.62%

- GLD 380.20 Bullish 1.58%

- SPY 668.73 Bullish 1.47%

- IJH 64.40 Bullish 1.00%

- TLT 90.01 Bullish 0.57%

- DIA 464.44 Bullish 0.40%

- MSFT 474.00 Bullish 0.40%

Market Summary Snapshot (As of 11/24/2025 17:00:00)

ETF Stocks Overview

- SPY (668.73, +1.47%): Bullish momentum continues in S&P 500 tracking ETF, echoing broad market optimism.

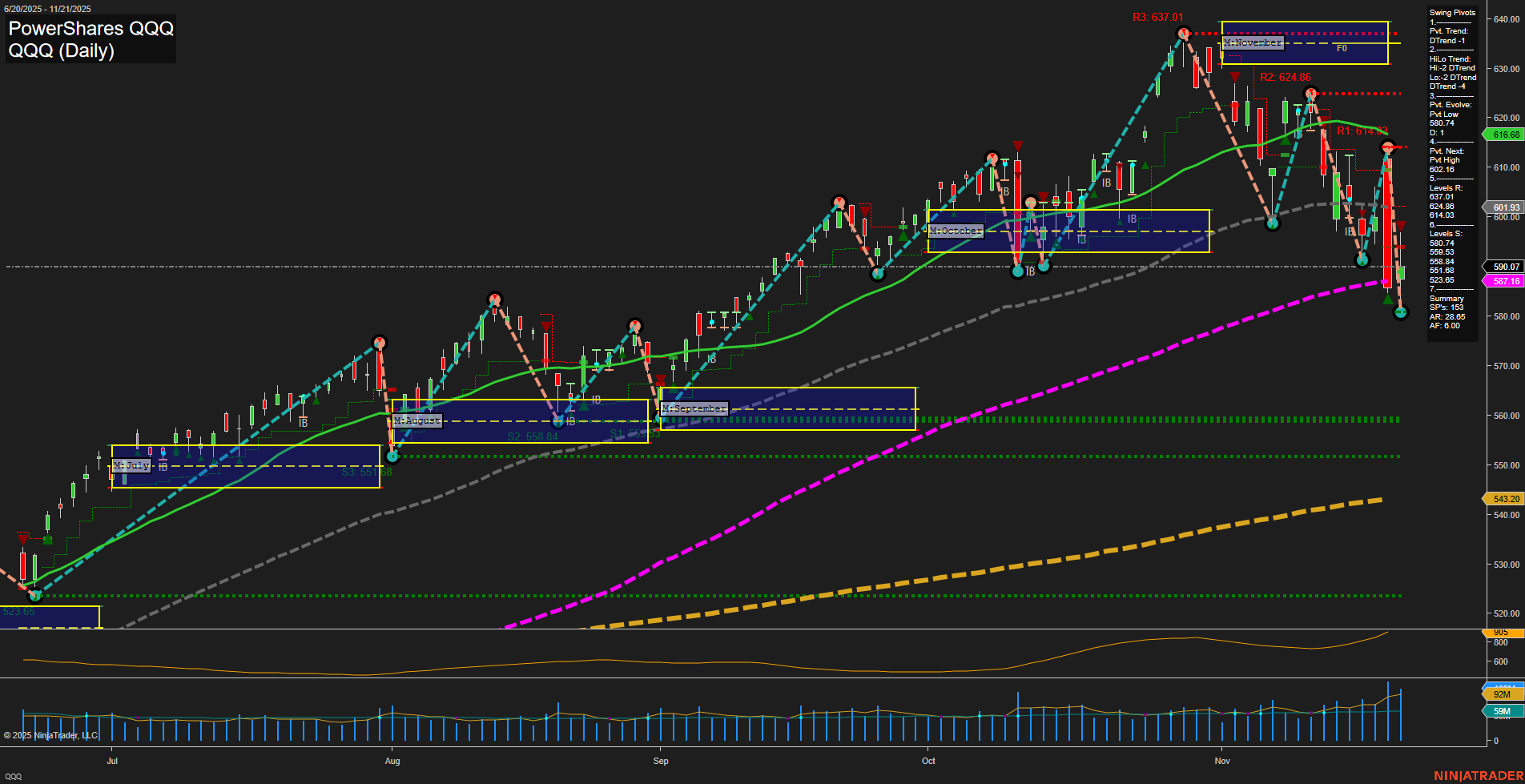

- QQQ (605.16, +2.56%): Nasdaq-100 ETF sees notable strength, led by tech sector gains.

- IWM (239.90, +1.83%): Small-cap ETF climbs, signaling risk appetite in smaller equities.

- IJH (64.40, +1.00%): Mid-cap ETF participates in the broad market uptrend, though less pronounced.

- DIA (464.44, +0.40%): Dow Jones ETF advances modestly, underperforming tech-centric peers.

Overall ETF Stock Tone: Market-wide bullishness, leadership by growth and technology, all major indices in positive territory.

Magnificent 7 (Mag7) Performance

- TSLA (417.78, +6.82%): Standout rally, showing exceptional strength amid heavy volume.

- GOOG (318.47, +6.28%): Strong tech surge, contributing to indices’ gains.

- META (613.05, +3.16%): Meta platforms continues its upward trajectory.

- AMZN (226.06, +2.43%): Amazon participates in broad-based tech moves.

- NVDA (182.55, +2.05%): Nvidia maintains upward momentum.

- AAPL (275.92, +1.63%): Apple sustains gains, albeit with less intensity than other tech names.

- MSFT (474.00, +0.40%): Microsoft posts a modest rise, trailing sector heavyweights.

Overall Mag7 Tone: Strong bullish sentiment with pronounced outperformance by TSLA and GOOG; broad participation across the group.

Key Thematic and Commodity ETFs

- IBIT (50.57, +5.42%): Crypto-linked ETF shows strong upside, possibly tracking digital asset strength.

- USO (70.42, +1.62%): Oil ETF rising with commodity strength.

- GLD (380.20, +1.58%): Gold ETF gains, suggesting persistent demand for hedges.

- TLT (90.01, +0.57%): Long-term Treasury ETF modestly higher, indicating some demand for safer assets even as equities rally.

Thematic ETF Tone: Crypto and commodities ETFs outpace traditional bond proxies, all reflecting risk-on market dynamics with some defensive positioning in gold and treasuries.

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts