Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

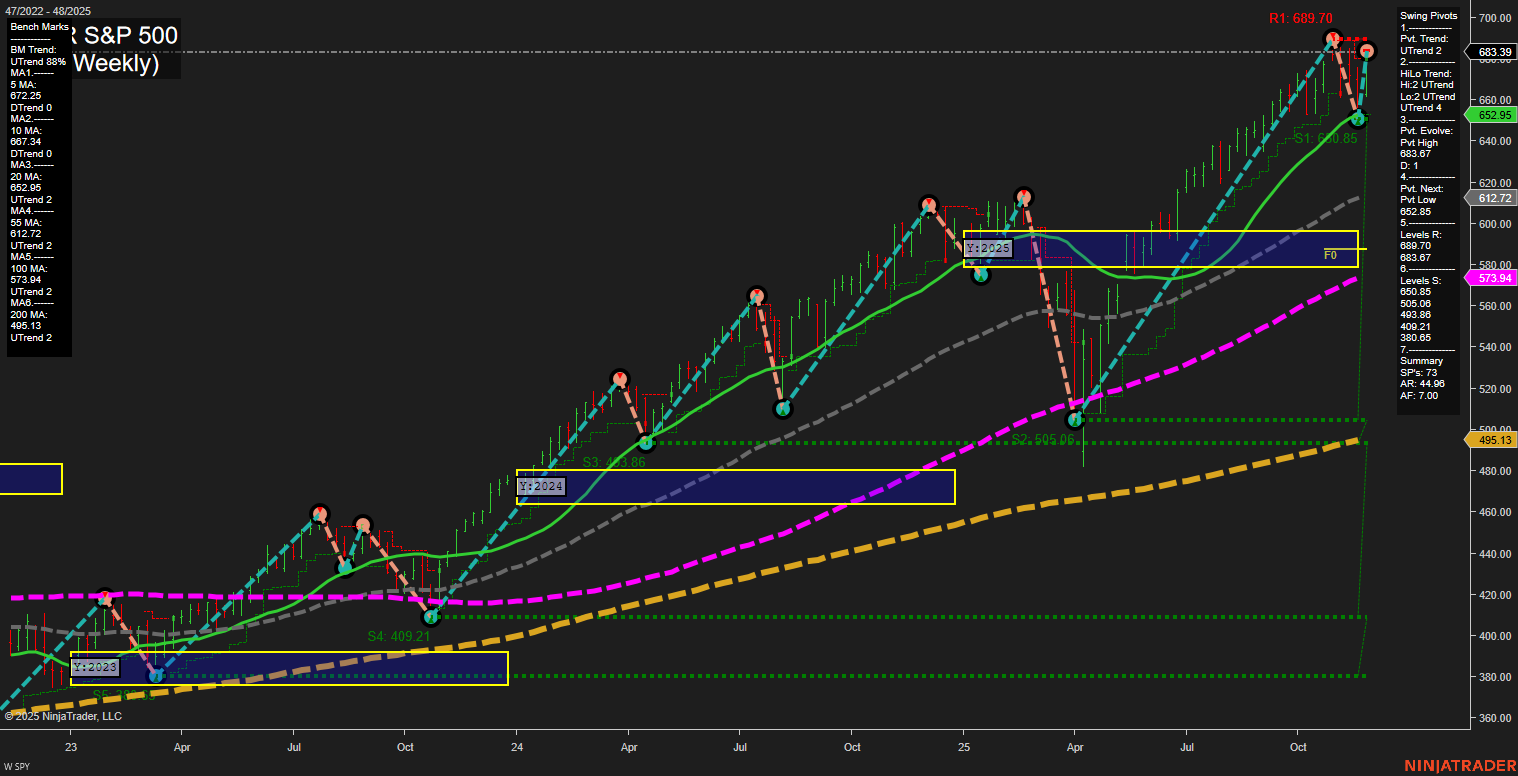

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

No monitored earnings reports are pending in the next 7 days.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

No monitored EcoNews market events.

For full details visit: Forex Factory EcoNews

Market News Summary

- Oil: WTI oil prices saw modest gains as traders balanced ongoing peace talks, increased supply, softening demand, and shifting OPEC strategies. Recent analysis suggests short-term oversupply could weigh on crude, maintaining a bearish outlook for the week.

- S&P 500: The S&P 500 finished November slightly lower, down 0.6%, despite a notable late-month rally. Recent days have witnessed a rebound, with the index trading near all-time highs as Federal Reserve cut expectations rise and AI sector exuberance eases.

- Gold: Gold surged toward record highs, fueled by dollar weakness, growing expectations for Fed rate cuts, and persistent geopolitical risks. Analysts anticipate a bullish setup for gold into December, underpinned by strong structural and institutional demand.

- Interest Rates & Liquidity: U.S. equities rose over the holiday-shortened week as investors anticipated a more dovish Fed, with benchmark yields nearing multi-year lows. However, liquidity strains emerged, with overnight funding rates exceeding the Fed’s upper bound and increased usage of the Fed’s repo facility.

- Economic Outlook: Economic polarization persists, as higher-income consumers maintain spending while others face financial strain. November’s rally demonstrated market resilience amid volatility, though liquidity and cash availability remain in focus.

- Rotation & ETFs: Portfolio sector rotation models outpaced the S&P 500 with active timing strategies. ETFs linked to major trends have performed well, though approaching future returns with caution is advised. Concerns were raised about the risks in high-yield CEFs and covered call ETFs, despite their popularity for yield-seeking investors.

News Conclusion

- Short-term oil sentiment remains cautious on oversupply risks and wavering demand, while OPEC’s guidance is closely monitored.

- U.S. equities closed November with resilience after early volatility, supported by growing anticipation of Fed rate cuts and renewed market optimism.

- Liquidity challenges and funding pressures signal ongoing undercurrents despite headline market gains.

- Gold remains in favor as both a portfolio stabilizer and hedge, driven by dovish monetary policy signals and sustained geopolitical tensions.

- Sector rotation and trend-based ETF strategies are finding success, but yield-oriented funds carry heightened risks beneath surface-level returns.

- Economic activity is bifurcated, and future market direction appears closely tied to interest rate policy, liquidity conditions, and adaptability to cyclical rotations.

Market News Sentiment:

Market News Articles: 9

- Positive: 55.56%

- Neutral: 33.33%

- Negative: 11.11%

GLD,Gold Articles: 3

- Neutral: 66.67%

- Positive: 33.33%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: November 30, 2025 06:15

- META 647.95 Bullish 2.26%

- AMZN 233.22 Bullish 1.77%

- USO 71.07 Bullish 1.47%

- MSFT 492.01 Bullish 1.34%

- GLD 387.88 Bullish 1.24%

- IBIT 51.55 Bullish 1.02%

- TSLA 430.17 Bullish 0.84%

- QQQ 619.25 Bullish 0.81%

- DIA 477.18 Bullish 0.60%

- IWM 248.75 Bullish 0.59%

- SPY 683.39 Bullish 0.55%

- IJH 66.34 Bullish 0.53%

- AAPL 278.85 Bullish 0.47%

- GOOG 320.12 Bearish -0.05%

- TLT 90.21 Bearish -0.47%

- NVDA 177.00 Bearish -1.81%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-11-30: 18:15 CT.

US Indices Futures

- ES Weekly YSFG, MSFG up, WSFG trend down, price above major MAs, recent highs near resistance, swing pivots up, S/R: 6953.75/6844.50 (res), 6525.00/5182.50 (sup).

- NQ Weekly YSFG, MSFG bullish, WSFG down, above major MA benchmarks, recent sharp pullback and recovery, swing pivots mixed, S/R: 26399 (res), 23904.50 (sup).

- YM Insufficient data available for YM; technical summary not accessible.

- EMD Weekly YSFG, MSFG, WSFG up, all MAs trending higher, swing high 3321.9, swing pivots up, testing resistance 3352.2, support 3107.0.

- RTY Weekly YSFG, MSFG bullish, WSFG trend down, price below NTZ, swing pivots up, all MAs rising, new swing high 2508.1, S/R: 2566.5/2300.7.

- FDAX Weekly YSFG, MSFG bullish, WSFG consolidating, price above YSFG/WSFG, 20-wk MA flat, pivots corrective, S/R: resistance 24891, key support 22893.

Overall State

- Short-Term: Mostly Bullish to Neutral across indices, with ES, EMD, RTY, FDAX showing short-term uptrends or consolidation.

- Intermediate-Term: Predominantly Bullish; NQ, EMD, RTY, FDAX intermediate trends remain supportive, select brief consolidations noted.

- Long-Term: Bullish across all indices per YSFG and major MA benchmarks.

Conclusion

US Indices Futures on higher timeframes display long-term and intermediate uptrends, substantiated by YSFG and MSFG alignment and price above major benchmarks. WSFG trends are mixed with select indices (ES, RTY, FDAX) consolidating or near resistance after recent rallies, while NQ recently rebounded sharply after a deep pullback. Noted swing pivots are predominantly upward, affirming trend continuation bias. Key resistance and support levels are defined above and below current price action, indicating wide ranges from recent volatility. FDAX shows consolidation but retains its larger uptrend structure. Intermediate and long-term context remains aligned to the upside, with short-term volatility phases and some indices testing resistance levels or consolidating recent moves.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

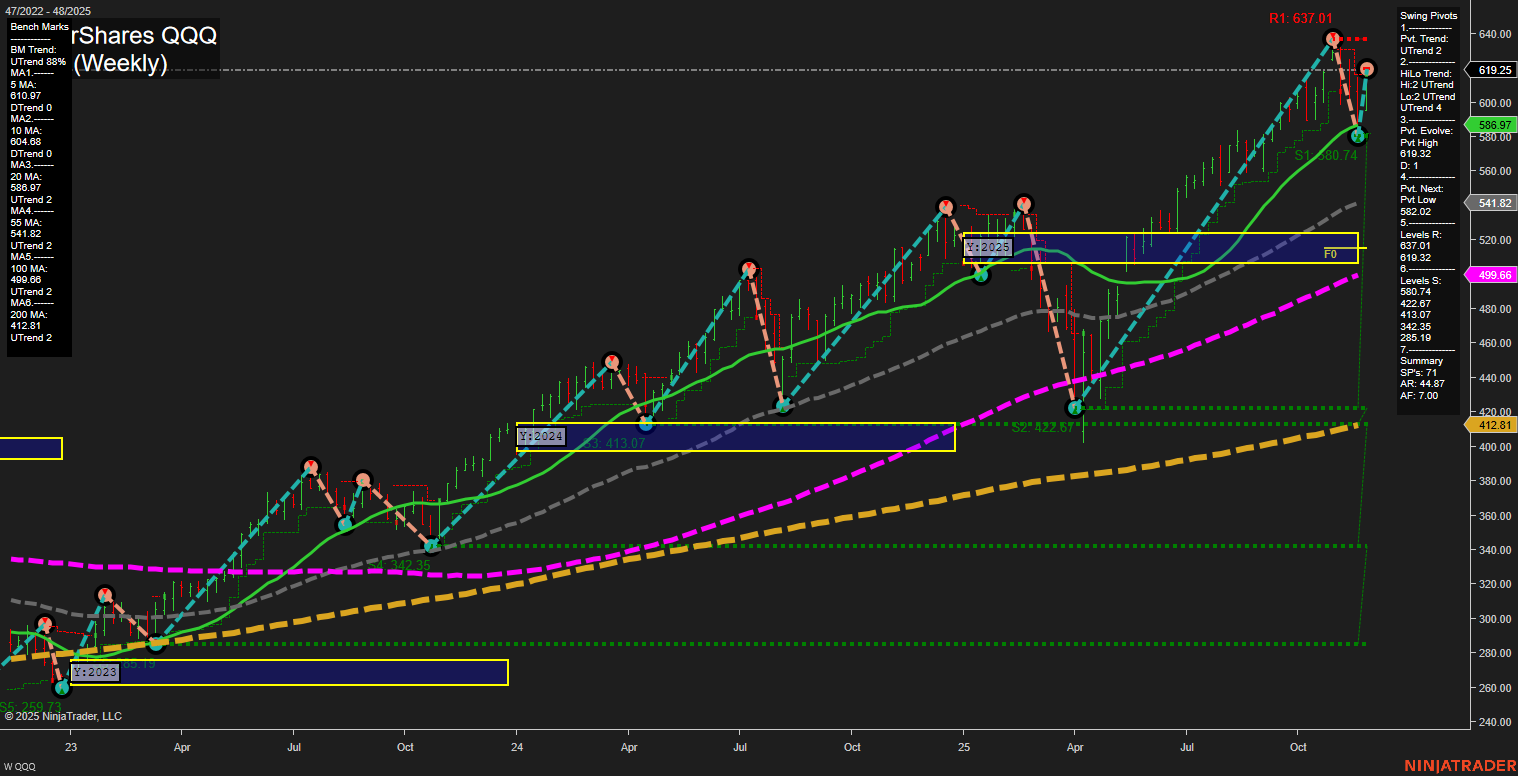

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts