Market Roundup – NYSE After Market Close Bearish as of December 9, 2025 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

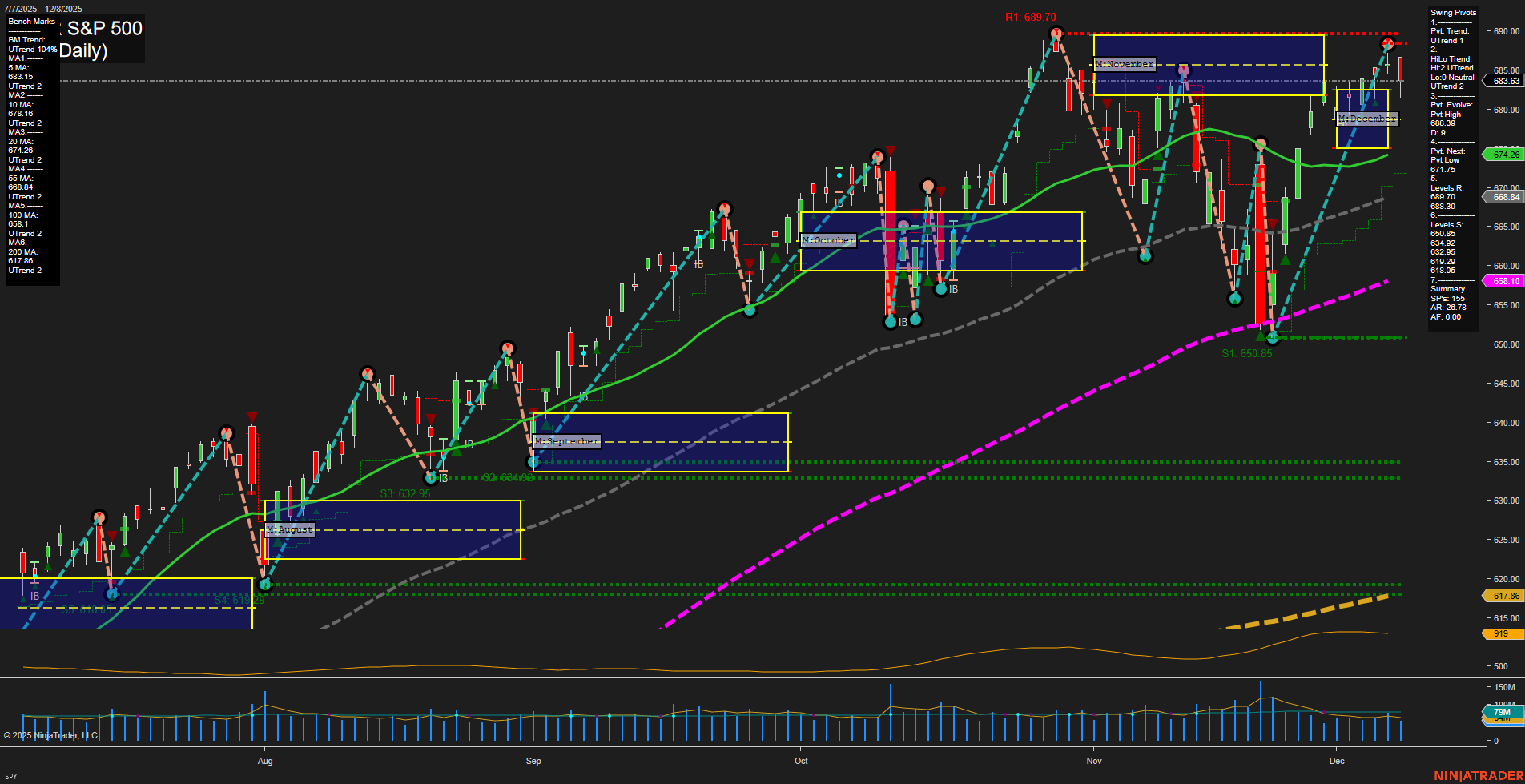

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Gold and silver surged, with gold consolidating near record levels and silver climbing above $60, reflecting renewed demand for precious metals. The rally propelled related mining stocks to fresh highs, while the Bank for International Settlements flagged both asset classes, alongside equities, as being in bubble territory.

- Major US equity indices posted mixed performance, with small-caps hitting record highs. Technology stocks rebounded, buoyed by optimism over AI-driven growth and improved earnings outlooks for 2026, while a new dividend ETF targeting SMID caps launched amid the upbeat mood.

- The S&P 500 outlook remains constructive, supported by strong technology earnings and robust macro indicators. However, some analysts anticipate a period of consolidation in 2026, with potential pullbacks after consecutive years of stellar gains.

- Market participants have nearly fully priced in a Federal Reserve rate cut at the December meeting, with the focus turning to the tone of forward guidance and expectations for 2026. Policymakers are relying on limited data due to a government shutdown, and there is potential for hawkish communication even if rates are lowered.

- Fed leadership remains under scrutiny, with Kevin Hassett seen as the likely next chair. Debate continues over the central bank’s independence and its response to political pressure, but consensus points toward further easing capacity in coming months.

- Oil markets retreated as supplies rose and technical levels failed, with WTI and Brent trending lower, while natural gas prices experienced volatility but are expected to remain firm over the longer term as usage expands.

- Japanese markets face risks as surging debt service costs and policy shifts challenge fiscal stability, generating calls for vigilance as the Bank of Japan turns more hawkish.

- Market sentiment remains broadly positive, reflected in record foreign inflows, low put/call ratios, and expectations for a potential year-end rally driven by Fed action and supportive macro trends.

News Conclusion

- Current market action is dominated by expectations for a Federal Reserve rate cut, with both equities and precious metals pricing in supportive monetary policy.

- Risk assets remain strong, particularly small-caps and technology stocks, driven by robust earnings and transformative AI trends, although elevated valuations and speculation in certain sectors have drawn warnings.

- Commodities, led by gold and silver, continue to benefit from safe-haven flows and are poised for increased volatility around central bank decisions.

- Oil and energy markets underperformed, facing oversupply pressures and unfavorable technical momentum, contrasting with the more buoyant tone in metals and equities.

- Attention is shifting to central bank guidance for 2026, with potential for increased volatility after a stretch of strong returns and as macroeconomic data remains in flux.

Market News Sentiment:

Market News Articles: 42

- Neutral: 42.86%

- Positive: 40.48%

- Negative: 16.67%

GLD,Gold Articles: 13

- Positive: 69.23%

- Negative: 15.38%

- Neutral: 15.38%

USO,Oil Articles: 9

- Neutral: 55.56%

- Negative: 33.33%

- Positive: 11.11%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 9, 2025 05:00

- IBIT 52.85 Bullish 2.58%

- TSLA 445.17 Bullish 1.27%

- GOOG 317.75 Bullish 1.05%

- GLD 387.40 Bullish 0.51%

- AMZN 227.92 Bullish 0.45%

- IWM 251.39 Bullish 0.21%

- MSFT 492.02 Bullish 0.20%

- QQQ 625.05 Bullish 0.12%

- TLT 87.97 Bullish 0.10%

- IJH 66.17 Bearish -0.06%

- SPY 683.04 Bearish -0.09%

- AAPL 277.18 Bearish -0.26%

- NVDA 184.97 Bearish -0.31%

- DIA 476.42 Bearish -0.36%

- USO 69.86 Bearish -0.89%

- META 656.96 Bearish -1.48%

Market State of Play: Snapshot Summary

ETF Stocks (Broad Indices & Sectors)

- SPY (S&P 500 ETF): 683.04 Bearish (-0.09%)

Showing mild weakness, signaling minor pullback across large-cap equities. - QQQ (Nasdaq 100 ETF): 625.05 Bullish (+0.12%)

Strength persisting among top tech and growth names. - IWM (Russell 2000 ETF): 251.39 Bullish (+0.21%)

Small caps displaying resilience, with continued upside momentum. - IJH (S&P MidCap 400 ETF): 66.17 Bearish (-0.06%)

Mid-caps lagging with marginal downside pressure. - DIA (Dow Jones ETF): 476.42 Bearish (-0.36%)

Blue chips experiencing pronounced selling relative to other indices.

MAG7 (Mega Cap Tech Leaders)

- AAPL (Apple): 277.18 Bearish (-0.26%)

Apple trading lower, a contrast to some of its peers today. - MSFT (Microsoft): 492.02 Bullish (+0.20%)

Microsoft advancing, supporting the tech-laden indices. - GOOG (Alphabet): 317.75 Bullish (+1.05%)

Strong outperformance in communication services. - AMZN (Amazon): 227.92 Bullish (+0.45%)

Solid upward movement in the e-commerce giant. - META (Meta Platforms): 656.96 Bearish (-1.48%)

Notable decline, the weakest performer within the ‘MAG7’ group. - NVDA (Nvidia): 184.97 Bearish (-0.31%)

Nvidia easing back following prior outperformance. - TSLA (Tesla): 445.17 Bullish (+1.27%)

Tesla leads with robust gains, fueling sector optimism.

Other Notable ETFs

- IBIT (Bitcoin ETF): 52.85 Bullish (+2.58%)

Exceptional strength in crypto-linked assets. - GLD (Gold ETF): 387.40 Bullish (+0.51%)

Gold holding firm, suggesting persistent demand for safe havens. - USO (Oil ETF): 69.86 Bearish (-0.89%)

Energy complex weak; crude oil-related assets under pressure. - TLT (20+ Yr Treasury ETF): 87.97 Bullish (+0.10%)

Long-duration bonds making modest gains.

Summary (No Recommendations)

As of the latest market snapshot, performance is mixed across major indices and mega-cap tech stocks: Small caps and select technology names are advancing, while large cap indices such as SPY and DIA show cautious trading. Crypto and gold ETFs display particular strength, in contrast to energy and some blue chips which lag.

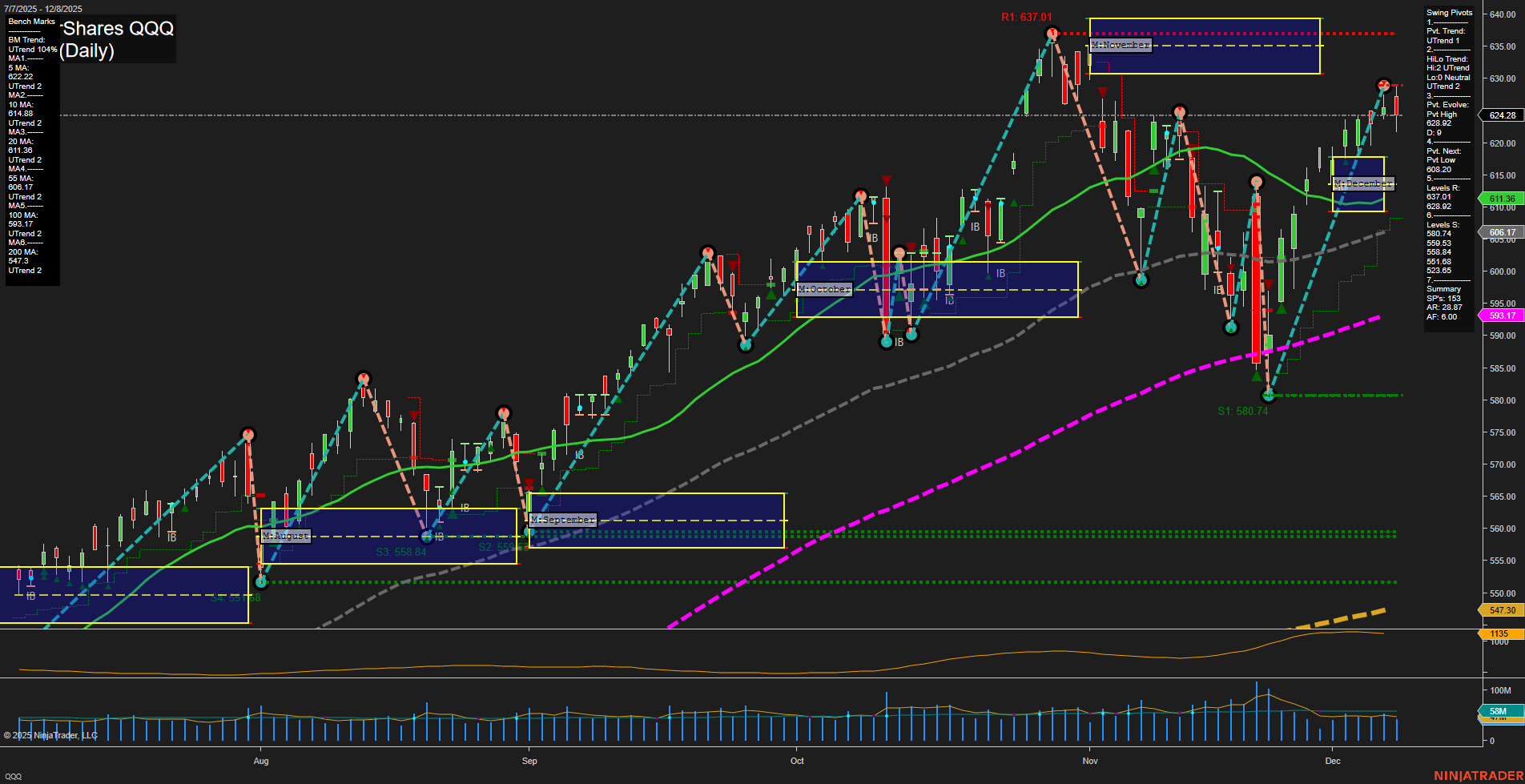

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts