After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

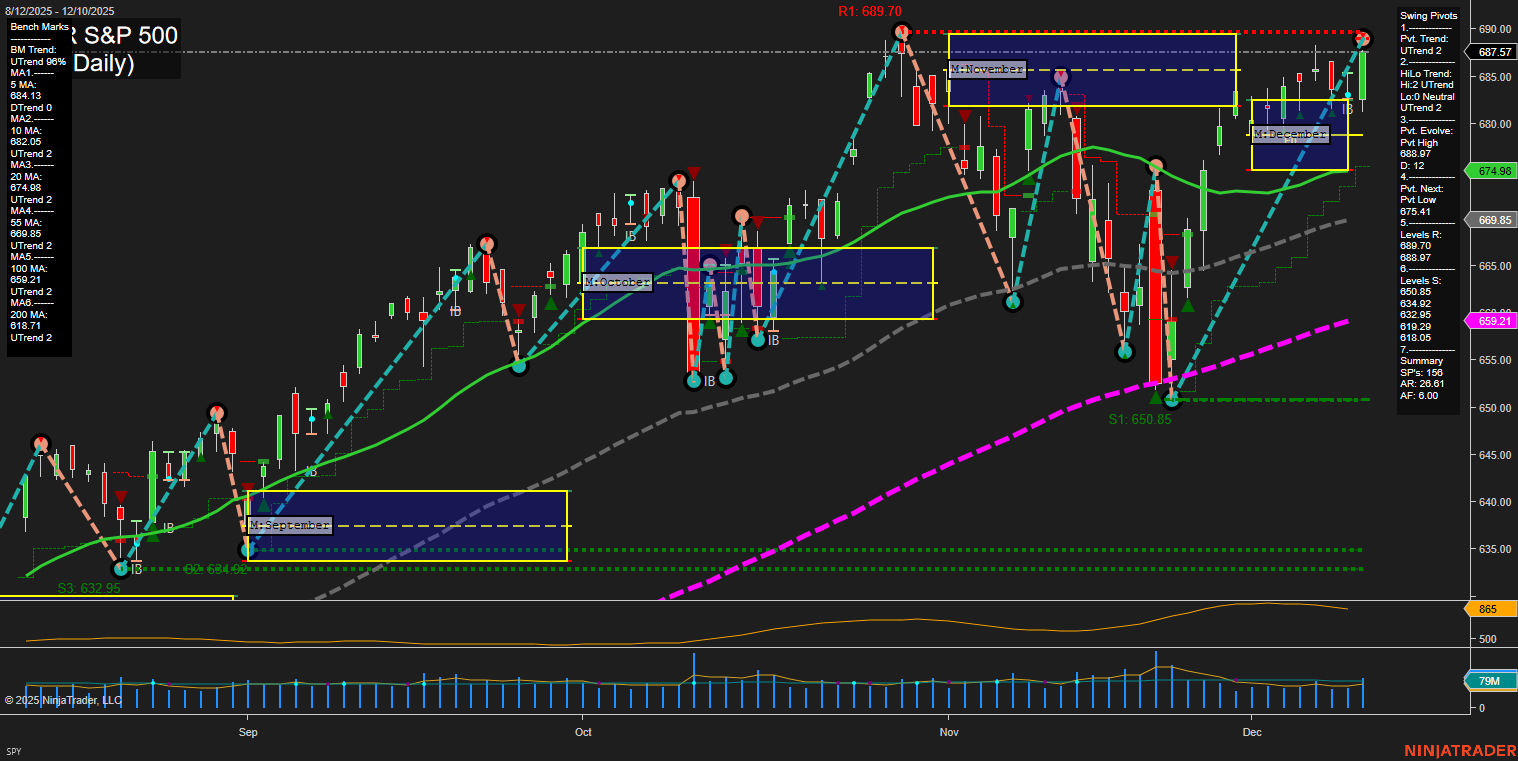

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- S&P 500 & Earnings Outlook: Profit growth for the S&P 500 is projected in the low-to-mid teens for 2026, with artificial intelligence boosting margins and efficiencies across multiple sectors. Analysts see the index moving toward 7,700 by end-2026, based on robust tech and AI-led growth. Recent sessions saw the S&P 500 set a record close, buoyed by investor optimism even beyond the AI sector.

- Small Caps & Value Stocks: The Russell 2000 Value Index has risen nearly 12% since late November, outpacing the Nasdaq’s 6% gain. A small-cap rally reminiscent of the “January effect” arrived early, strengthening further as investors rotated out of tech into other market segments.

- Fed Policy & Rates: The Federal Reserve cut rates by 25 basis points, with most officials projecting only one cut in 2026. Opinions in the market are mixed, with some caution that the latest rate cut could appear aggressive in hindsight if macro data changes. The board also unanimously reappointed regional bank presidents, reducing uncertainty over central bank leadership.

- Sector & Asset Moves: Real estate stocks advanced as mortgage rates fell, supporting housing market activity. Gold surged above prior highs, maintaining a strong uptrend with projections for prices to average $4,325/oz in 2026. However, crude oil broke to fresh pullback lows, under pressure from both technical weakness and news of US action against Venezuelan oil tankers.

- International Indices & Geopolitics: The Nikkei 225 fell nearly 1%, dominated by a steep drop in SoftBank and concern over potential Bank of Japan tightening. The US is expected to step up seizures of oil tankers near Venezuela, raising the stakes in energy markets.

- AI & Market Dynamics: AI adoption is accelerating from R&D into real-world business, driving margin expansion. A recent correction in AI stocks was attributed to a normal adjustment in valuations and pace of adoption, not a signal of weakness for the sector long term.

- Investor Sentiment: The broadening rally has moved beyond tech, with investors favoring areas linked to improving economic data and monetary policy trends. Caution persists regarding potential inflation risks and the sustainability of high-yield strategies in portfolios.

News Conclusion

- Market sentiment is generally positive, with record closes for key US equity indices, strong gains in value and small-cap stocks, and support for risk assets due to rate cuts and AI-driven growth forecasts.

- Uncertainty lingers in commodities and global equities due to geopolitical risks and central bank policy divergence, as seen in oil and Japanese markets.

- The upward trend in gold and real estate reflects ongoing investor search for diversification and yield as rate landscapes evolve.

- Attention remains on earnings growth, particularly tied to AI and technology sectors, which are seen as key drivers into 2026 despite recent corrections and sector shifts.

- Mixed opinions on the pace of future rate cuts and inflation expectations suggest potential for increased volatility in the months ahead.

Market News Sentiment:

Market News Articles: 53

- Neutral: 47.17%

- Positive: 33.96%

- Negative: 18.87%

GLD,Gold Articles: 11

- Neutral: 63.64%

- Positive: 27.27%

- Negative: 9.09%

USO,Oil Articles: 14

- Neutral: 50.00%

- Negative: 35.71%

- Positive: 14.29%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 11, 2025 05:00

- DIA 487.87 Bullish 1.35%

- IWM 257.80 Bullish 1.17%

- GLD 393.24 Bullish 1.08%

- MSFT 483.47 Bullish 1.03%

- IJH 68.06 Bullish 0.95%

- META 652.71 Bullish 0.40%

- SPY 689.17 Bullish 0.23%

- TLT 88.19 Bearish -0.14%

- AAPL 278.03 Bearish -0.27%

- QQQ 625.58 Bearish -0.32%

- AMZN 230.28 Bearish -0.65%

- IBIT 52.10 Bearish -0.74%

- TSLA 446.89 Bearish -1.01%

- NVDA 180.93 Bearish -1.55%

- USO 69.25 Bearish -1.83%

- GOOG 313.70 Bearish -2.27%

ETF Stocks: Market Summary

ETF performance today is broadly mixed, with notable bullish momentum in traditional index trackers:

- DIA (Dow Jones): 487.87, +1.35% — Strong upward move, leading larger-cap ETFs.

- IWM (Russell 2000): 257.80, +1.17% — Small-caps are advancing, suggesting increased risk-on appetite.

- IJH (S&P Mid-Cap): 68.06, +0.95% — Mid-caps join the rally.

- SPY (S&P 500): 689.17, +0.23% — Large-cap stocks showing moderate gains.

- QQQ (Nasdaq 100): 625.58, -0.32% — Under pressure, indicative of softness in mega-cap techs.

MAG7: Mega-Cap Stocks Overview

- MSFT: 483.47, +1.03% — Microsoft bucks tech-sector softness with notable gains.

- META: 652.71, +0.40% — Moderate upside, relatively stable.

- AAPL: 278.03, -0.27% — Slight negativity in Apple, underperforming broader indices.

- AMZN: 230.28, -0.65% — Amazon trading lower.

- NvDA: 180.93, -1.55% — Nvidia leading decliners in the MAG7 group.

- GOOG: 313.70, -2.27% — Marked weakness in Alphabet shares.

- TSLA: 446.89, -1.01% — Tesla continues its downward trajectory today.

Other Major ETFs: Sentiment Snapshot

- GLD (Gold): 393.24, +1.08% — Gold ETFs supported, suggesting haven interest.

- TLT (20+ Year Treasuries): 88.19, -0.14% — Slight bear trend in long bonds, signalling some yield pressure.

- USO (Oil): 69.25, -1.83% — Oil ETF sharply lower, reflecting energy volatility.

- IBIT (Bitcoin ETF): 52.10, -0.74% — Crypto proxy softer, echoing risk-off elements.

State of Play Summary

- Long/Bullish: Traditional equity ETFs (DIA, IWM, IJH, SPY), Metals (GLD), select mega-cap tech (MSFT, META).

- Short/Bearish: Duration (TLT), Crypto-linked ETF (IBIT), Energy (USO), most MAG7 tech leaders (AAPL, QQQ, AMZN, TSLA, NVDA, GOOG).

- Mixed: Large-cap indices show resilience, but notable divergence among tech heavyweights and macro assets.

Overall, index-linked ETFs are broadly higher, but tech leaders are under pressure, with specific weakness in GOOG, NVDA, and TSLA. Defensive flows into gold persist, while oil and crypto ETFs are trending down.

No trading advice or recommendations.

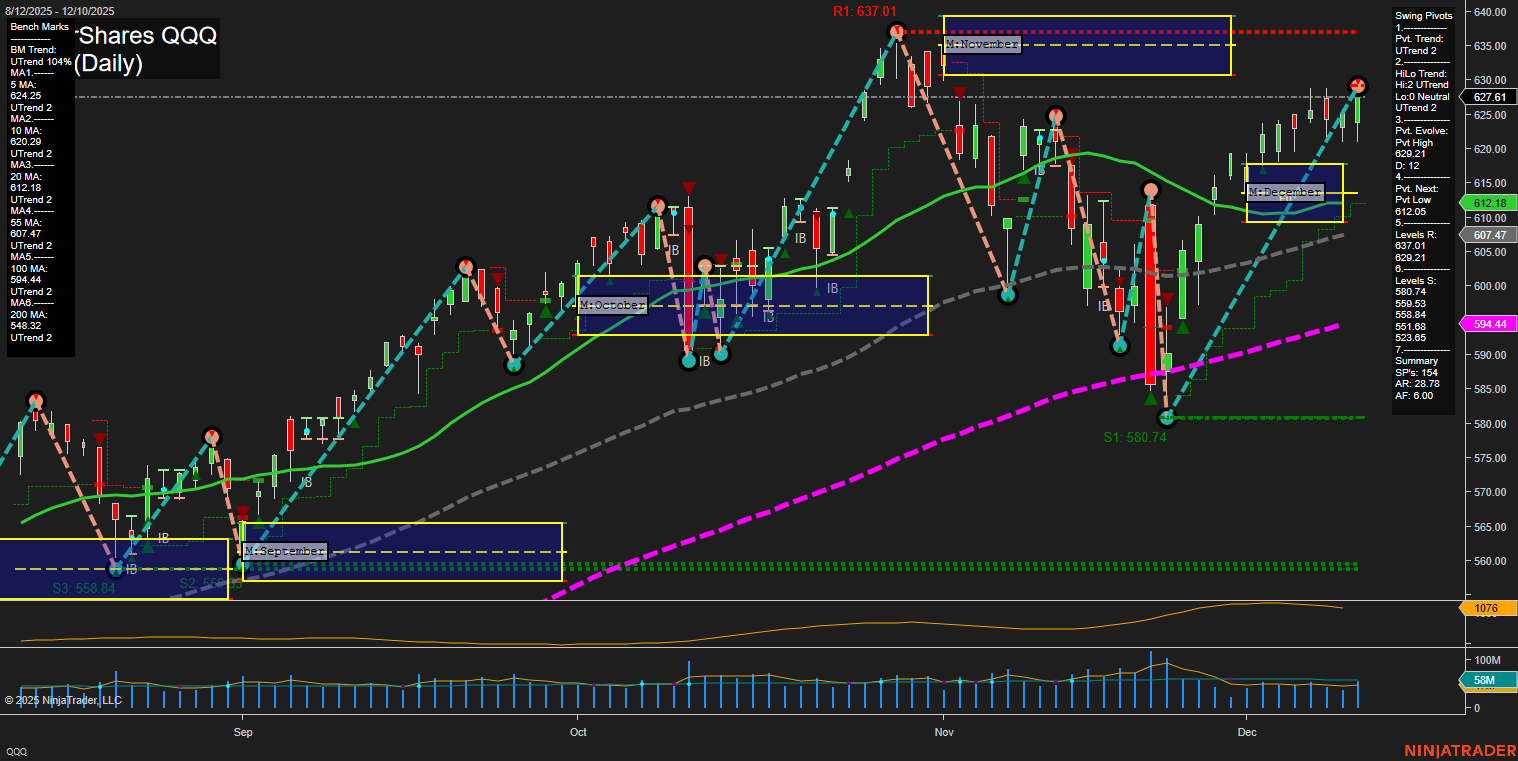

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts