Trading 360° view: Market SPY Weekly view, holidays, earnings, eco-news, market-news summary, news sentiment, and major ETFs, MAG7, Higher Time Frame Analysis Indices Futures Summary, and QQQ Weekly view.

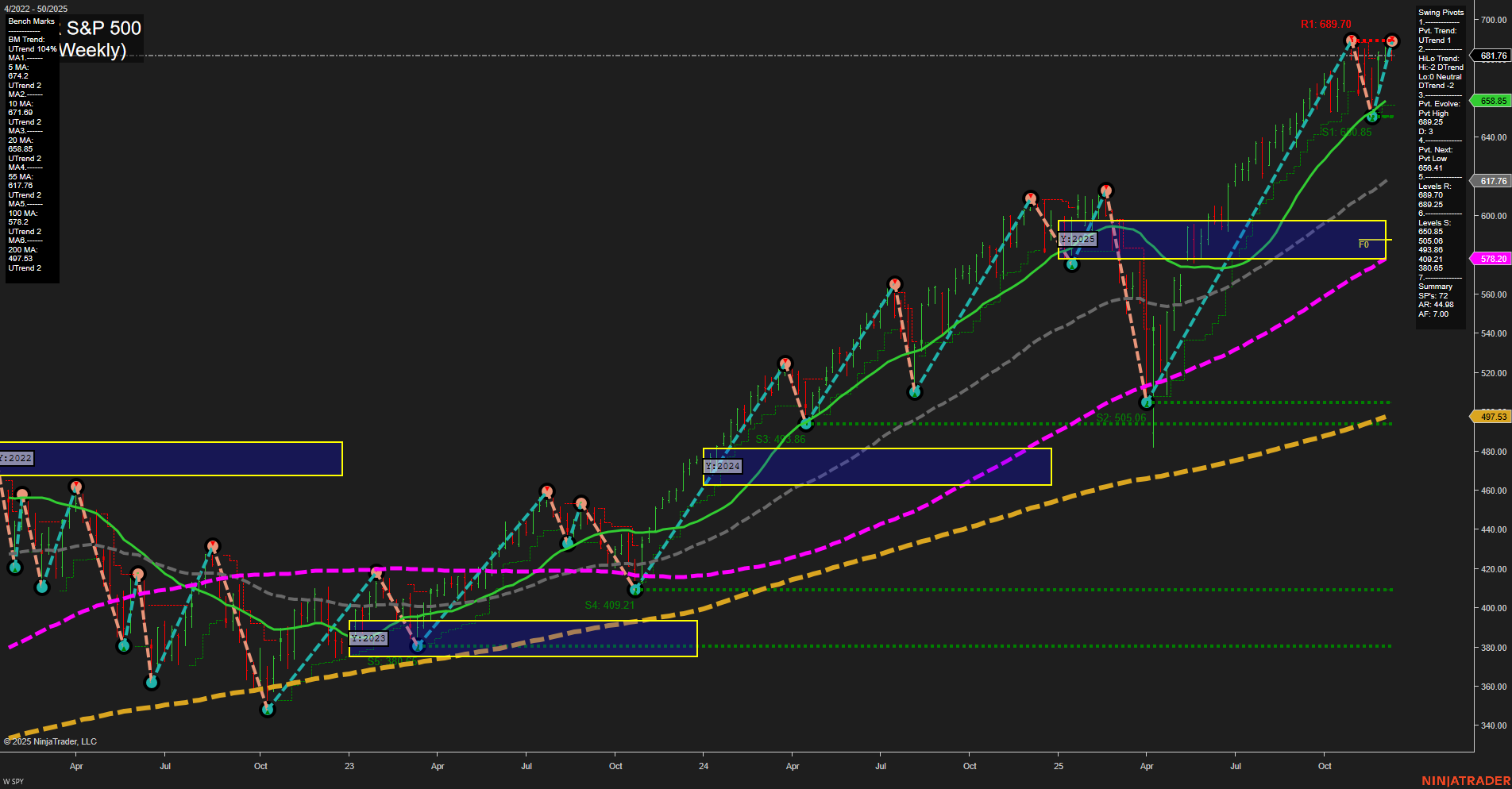

SPY Weekly View

View weekly charts on: AlphaWebTrader HTF Charts

Holiday Radar

No U.S. market holidays pending in the next 7 days.

Earnings Radar

Monitoring for earnings releases by the Magnificent 7, AI-tech-related firms, and major financial institutions.

- MU Release: 2025-12-17 T:AMC

Micron Technology (MU) is set to report earnings after market close on December 17, 2025. With broad market attention still focused on upcoming announcements from heavyweights like Nvidia (NVDA) and the rest of the MAG7 group, overall index futures activity may experience lower momentum and reduced volume in the lead-up to these tech sector events. As traders await signals from AI and semiconductor names, including MU, the anticipation could contribute to more cautious positioning and restrained moves in the indices until the earnings news is released. This period of uncertainty typically translates to subdued price action, with participants watching the tech sector closely for cues that could set the tone for broader market sentiment post-announcements.

For full details visit: Yahoo Earnings Calendar

EcoNews Radar U.S. Events

EcoNews Summary

- Tuesday (08:20–09:45): A concentrated cluster of high-impact USD events: ADP Weekly Employment Change, Average Hourly Earnings m/m, Core Retail Sales m/m, Non-Farm Employment Change, Retail Sales m/m, Unemployment Rate surge at 08:30, followed by Flash Manufacturing PMI and Flash Services PMI at 09:45. These releases focus on labor market and consumer activity, key drivers for futures indices volatility.

- Thursday (08:30): Multiple top-tier inflation readings: CPI y/y, Core CPI m/m, CPI m/m, Unemployment Claims. These set market expectations for Fed policy and inflation trajectory, heavily influencing index futures movement.

- Oil Event Wednesday (10:30): Crude Oil Inventories is the only medium-impact event mentioned here, as it can influence inflation sentiment and sector rotation, especially if oil prices are elevated.

- Friday (10:00): Medium-impact data with Existing Home Sales and Revised UoM Consumer Sentiment can provide late-week catalysts, especially during the 10 AM time cycle, known for potential market reversals or continuation moves.

EcoNews Conclusion

- Tuesday and Thursday contain clustered high-impact events, likely increasing market momentum and volume early in the US session.

- Watch for pronounced index price swings tied to labor and inflation data.

- Crude Oil Inventories Wednesday adds possible sector rotation risk if oil prices are high, contributing to inflation and broader market sentiment.

- Be aware that Friday’s 10 AM releases (Existing Home Sales, UoM Sentiment) may provide catalysts for reversal or continuation patterns.

- Overall, upcoming labor, inflation, and consumer data will set the tone for risk sentiment and price action in index futures.

For full details visit: Forex Factory EcoNews

Market News Summary

- S&P 500: Multiple Wall Street forecasts see the S&P 500 continuing its rally, with end-2026 targets ranging from above 7,500 to as high as 7,900. Drivers cited include robust AI-fueled investment, favorable fiscal and monetary policy, healthy mega cap earnings, and steady earnings-per-share growth despite high valuation levels.

- Indices Performance: The S&P 500 reached a new record high above 6,900. Recent price action features notable intraday volatility and a string of winning sessions.

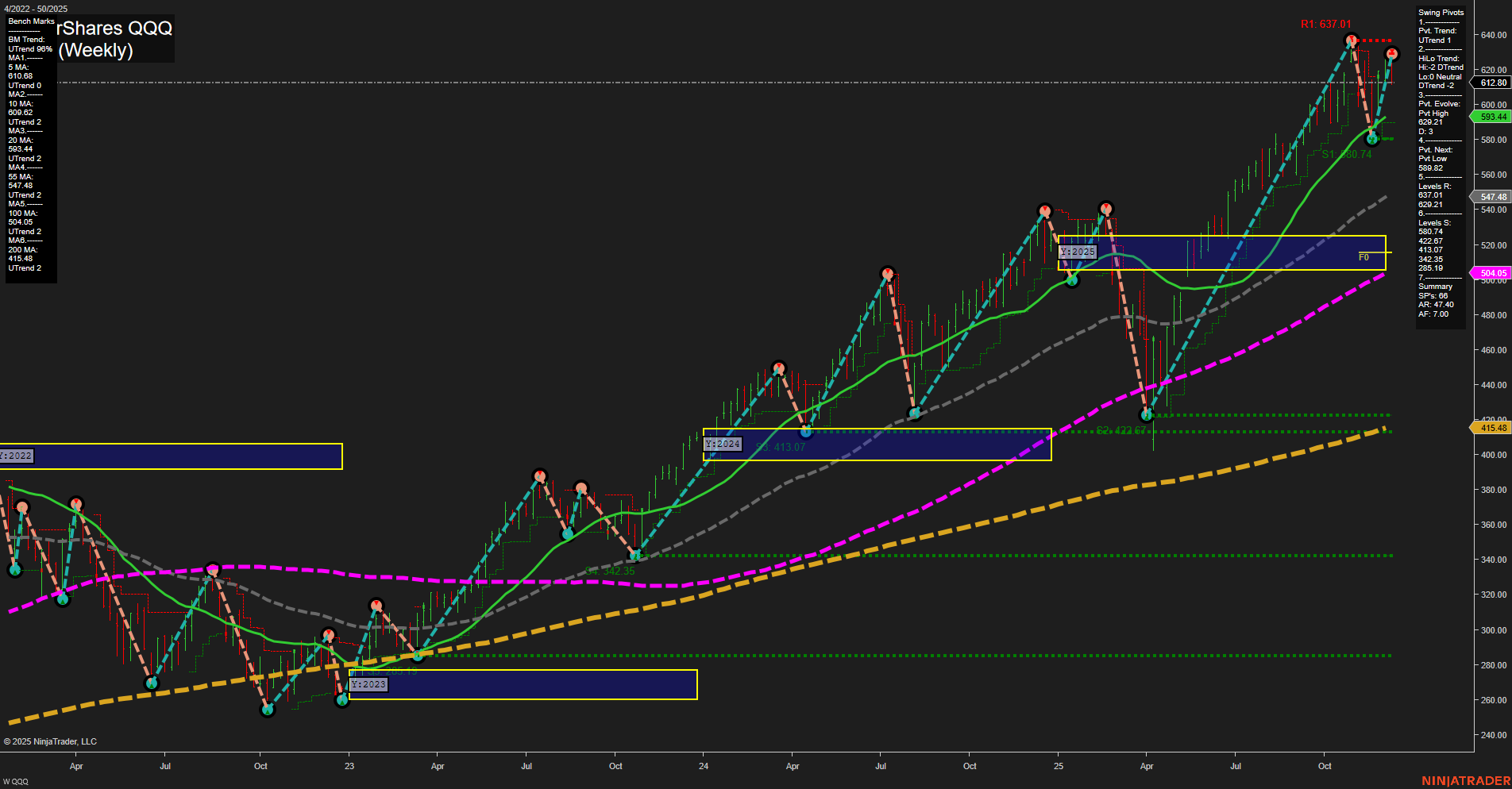

- Technical Risks: Technical signals highlight some caution, particularly for the QQQ Nasdaq-tracking ETF, where weakness has appeared on short-term charts, suggesting possible downside risk.

- Commodities: Crude oil futures remain under pressure, closing near lows amid oversupply and tepid demand. Gold trades close to record highs, with CPI and jobs data looming as catalysts. Platinum has surged nearly 90% this year, supported by capital rotation, constrained supply, and robust industrial demand, with analysts eyeing further upside in 2026.

- ETF & Sector Views: Small-cap ETFs such as IWM and IWO show contrasting sector profiles: IWM offers more diversification and yield, while IWO is concentrated in healthcare and tech. For tech exposure, QQQ and MGK have had similar multi-year returns, but QQQ features greater sector mix and liquidity.

- Macro & Policy: The Federal Reserve aims for a strong economy and 2% inflation before the current chair exits in May 2026. Uncertainty over future leadership remains, though current rhetoric suggests attempts to insulate monetary policy from political influence.

- Market Structure & Risk: Talk of bubbles persists as growth stock valuations soar and cash piles up with investors like Berkshire Hathaway. Meanwhile, sector rotations and evolving models highlight the importance of timely adaptation amid inflection points, but the consensus is that systematic strategies and valuation context matter more than surface-level fears.

- Notable IPO Activity: SpaceX is soliciting investment banks for a possible initial public offering, fueling anticipation around one of the largest prospective entrants to public markets.

- Potential Volatility: Upcoming inflation and jobs data, plus end-of-year trading, could inject additional volatility into equity and futures markets.

News Conclusion

- Major equity benchmarks like the S&P 500 are being projected for further gains in the next year, underpinned by resilient earnings, innovation, and still-accommodative policy.

- Valuations are elevated but currently justified by earnings and growth metrics; relative attractiveness over bonds remains intact.

- Technical signals show some signs of caution, especially for leading growth sectors, while breadth and sector rotation remain prominent features.

- Commodity markets are diverging: oil remains weak due to oversupply, gold holds steady awaiting macro data, and platinum outperforms on new demand trends.

- ETF and sector rotation strategies reflect ongoing shifts across risk and return profiles, with small-caps and tech-related funds under heightened scrutiny.

- Policy and leadership dynamics at the Fed are in focus, although the institution is presenting a steady hand amid a favorable macro backdrop.

- Anticipated IPO activity and macroeconomic data releases are key calendar items that could move markets in the near term.

Market News Sentiment:

Market News Articles: 13

- Positive: 61.54%

- Neutral: 23.08%

- Negative: 15.38%

GLD,Gold Articles: 2

- Neutral: 50.00%

- Positive: 50.00%

USO,Oil Articles: 1

- Negative: 100.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: December 14, 2025 06:15

- TSLA 458.96 Bullish 2.70%

- GLD 395.44 Bullish 0.56%

- AAPL 278.28 Bullish 0.09%

- DIA 485.40 Bearish -0.51%

- USO 68.81 Bearish -0.64%

- TLT 87.34 Bearish -0.96%

- GOOG 310.52 Bearish -1.01%

- MSFT 478.53 Bearish -1.02%

- SPY 681.76 Bearish -1.08%

- META 644.23 Bearish -1.30%

- IJH 67.17 Bearish -1.31%

- IWM 253.85 Bearish -1.53%

- IBIT 51.20 Bearish -1.73%

- AMZN 226.19 Bearish -1.78%

- QQQ 613.62 Bearish -1.91%

- NVDA 175.02 Bearish -3.27%

Higher Time Frame Analysis

Summary of the current state of US Indices Futures based on higher time-frame (HTF) technical analysis as of: 2025-12-14: 18:15 CT.

US Indices Futures

- ES Short-term bearish (WSFG, pivots, MA down), Intermediate neutral (MSFG up, conflicting HiLo/MA), Long-term bullish (YSFG, benchmarks, price above key support).

- NQ Volatile correction, Short/intermediate bearish (beneath WSFG and MSFG NTZ, swing pivots down), Long-term bullish (YSFG/MA up), price well above yearly NTZ, key supports at 25118/23904.

- YM No current data available (error fetching weekly and daily technicals).

- EMD All timeframes bullish (above YSFG, MSFG, WSFG NTZ, all MA up), swing pivots uptrend with new highs, resistance at 3352/3523, strong trend continuation above support at 3107.

- RTY All timeframes bullish (above WSFG, MSFG, YSFG NTZ), robust momentum, swing pivots uptrend (high at 2566/2562), all MA benchmarks up, volatility high, support at 1743.

- FDAX All timeframes bullish (above all session fib grid NTZ, moving averages up), uptrend confirmed by swing pivots (high at 24481), resistance at 24891, support at 22963, elevated volume/volatility.

Overall State

- Short-Term: Mixed (Bearish ES/NQ, Bullish EMD/RTY/FDAX)

- Intermediate-Term: Mixed (Neutral ES/NQ, Bullish EMD/RTY/FDAX)

- Long-Term: Bullish (All indices reflecting bullish YSFG trends and major MA benchmarks)

Conclusion

Current HTF context across US indices futures reflects a corrective or consolidating phase for ES and NQ, with both trading below short-term grid NTZ levels and exhibiting bearish or neutral trends over the weekly/monthly fib grids; however, the long-term structure remains bullish as price is positioned above major YSFG levels and all primary moving averages. EMD, RTY, and FDAX display persistent bullish conditions across all timeframes, validated by upward orientation in swing pivots, benchmarks, and session fib grids, with price continuously setting or testing new swing highs. Key support levels are defined below recent pivots for all instruments, preserving broader uptrend structure even if short-term pullbacks arise. Volatility and volume remain robust, particularly in NQ, RTY, and FDAX, consistent with directional moves or breakout attempts, while correlation across indices favors trend persistence outside of short/intermediate-term corrections.

Note: Intra-day counter-trend pullbacks or retracements may occur, HTF is context for informational usage and market structure. Glossary: Session Fib Grids periods of YSFG:’Yearly’, MSFG:’Monthly’, WSFG:’Weekly’

For full details visit: AlphaWebTrader Technicals

Tech Weekly View

View weekly charts on: AlphaWebTrader HTF Charts