Market Roundup – NYSE After Market Close Bullish as of January 2, 2026 05:00 ct

After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

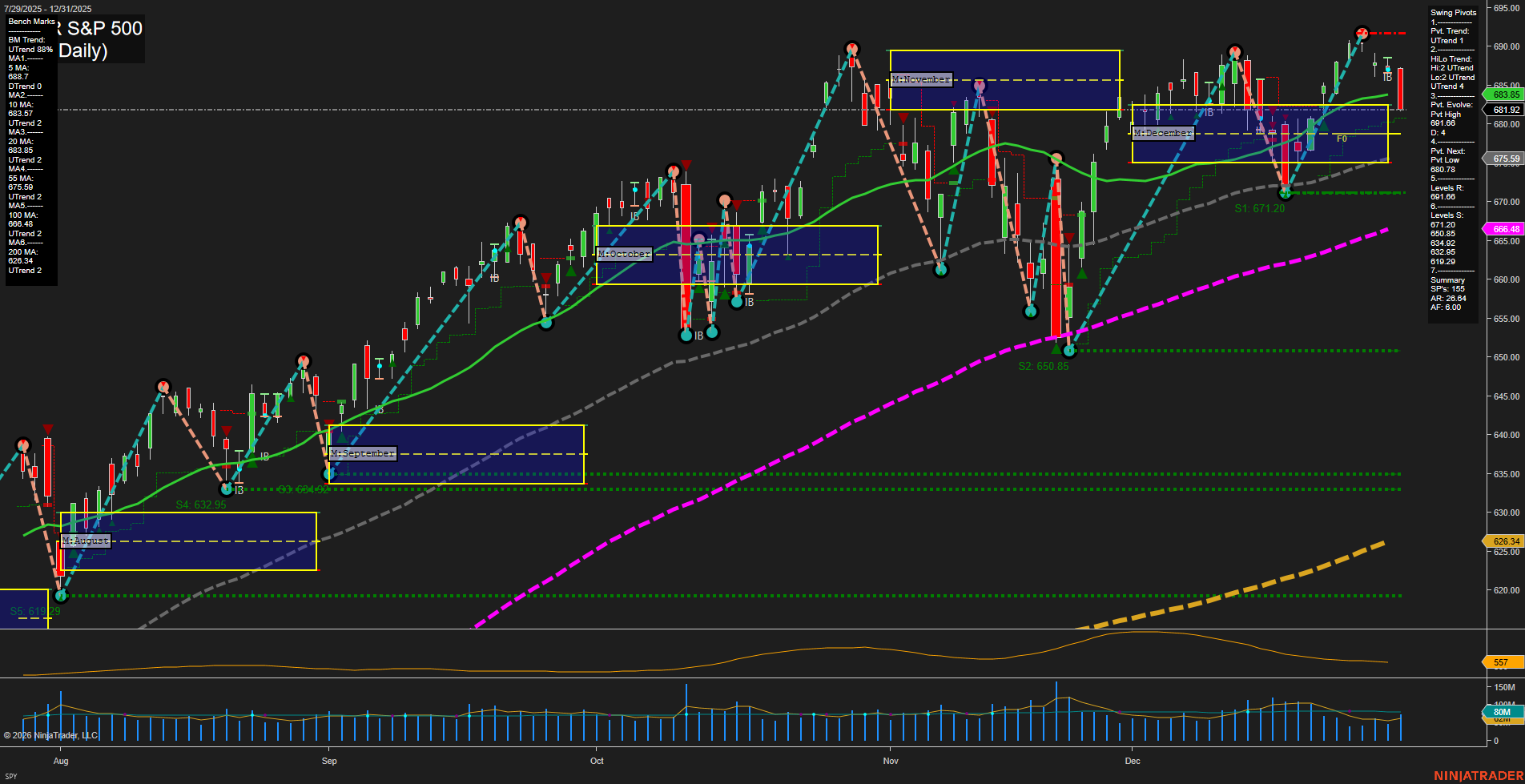

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- S&P 500 Outlook: The S&P 500 capped off a strong 2025, jumping over 16% from January and rallying ~41% from its April low. The index set new highs in December and delivered nearly 18% gains for the year despite heavy volatility from macro events, including tariffs and AI-related concerns. Analysts highlight that ETFs like SPYM are outperforming benchmarks such as SPY and VOO. Several sources note ambitions for a fourth-straight year of S&P 500 gains, supported by earnings and AI-driven optimism.

- Indices Performance: The FTSE 100 crossed 10,000 for the first time, reflecting robust global index performance. The S&P 500 delivered an approximately 80% total return over the past three years, driven by large-cap tech stocks, with market concentration remaining high; the ten largest stocks now make up over 40% of market capitalization.

- AI and Tech: NVIDIA leads the AI surge with a market cap rivaling Germany’s GDP. Asian tech leaders like SK Hynix and Samsung kicked off 2026 with outperformance, boosting risk appetite. However, the NASDAQ and tech-heavy QQQ ETF show signs of decelerating sales growth and heightened volatility, with QQQ under scrutiny for margin compression and steep historical drawdowns.

- Hedge Fund Performance: Citadel’s flagship fund returned 10.2% in 2025, while its tactical trading fund gained 18.6%. D.E. Shaw’s main funds also beat the S&P 500 benchmark, displaying hedge funds’ resilience in high-volatility environments.

- Sector Rotation & Laggards: Energy and utilities led on the first day of 2026 trading, with tech under pressure and Tesla declining. Small caps and regional banks showed strength, hinting at shifts in leadership.

- Commodities: Gold experienced weekly declines amid high volatility but maintains long-term bullish forecasts due to expectations of Fed easing. Oil markets are receiving a brighter longer-term outlook with geopolitical developments such as unrest in Iran. Metals like lithium and steel outperformed AI in regional indices.

- Market Risk & Sentiment: The transition into 2026 brings division: some see an AI/productivity-driven boom, others warn of crisis risks from debt, geopolitics, and policy errors. Technical indicators are deteriorating, with warnings of possible increased volatility if market participants face disappointments. Recent calm in stocks may be fleeting as trading resumes for the new year.

News Conclusion

- The major U.S. and global indices ended 2025 at or near record highs, aided by strong tech and AI momentum, and resilience amid geopolitical and macroeconomic shocks. Hedge funds and select active strategies outpaced passive benchmarks during periods of heightened volatility.

- Market leadership is shifting early in 2026, with energy, utilities, and select small caps gaining relative to tech and mega-cap growth. The concentration within leading indices remains elevated, raising risks should sentiment toward large tech turn.

- Gold and oil are poised as potential long-term beneficiaries of central bank rate policy and global uncertainty. Commodity price action is mixed with persistent volatility.

- Risks for 2026 center on stretched valuations, high index concentration, the potential for earnings disappointment, and shifting capital toward alternative sectors. Market outlooks are polarized, with some expecting continued gains from AI-related productivity but others warning of increased volatility and possible retrenched gains. Technical signals suggest caution as the year begins.

Market News Sentiment:

Market News Articles: 51

- Positive: 45.10%

- Neutral: 41.18%

- Negative: 13.73%

GLD,Gold Articles: 16

- Positive: 68.75%

- Neutral: 31.25%

USO,Oil Articles: 8

- Neutral: 37.50%

- Negative: 37.50%

- Positive: 25.00%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 2, 2026 05:00

- IBIT 50.94 Bullish 2.60%

- IJH 66.91 Bullish 1.38%

- NVDA 188.85 Bullish 1.26%

- IWM 248.78 Bullish 1.06%

- DIA 483.63 Bullish 0.64%

- GLD 398.28 Bullish 0.50%

- GOOG 315.32 Bullish 0.48%

- SPY 683.17 Bullish 0.18%

- TLT 87.03 Bearish -0.15%

- QQQ 613.12 Bearish -0.19%

- USO 68.96 Bearish -0.29%

- AAPL 271.01 Bearish -0.31%

- META 650.41 Bearish -1.47%

- AMZN 226.50 Bearish -1.87%

- MSFT 472.94 Bearish -2.21%

- TSLA 438.07 Bearish -2.59%

Market State of Play – Trader Snapshot (as of 01/02/2026 17:00:00)

ETF Stocks Overview

- Bullish Momentum:

- SPY (683.17) +0.18%: Slight upward movement in the S&P 500 ETF, reflecting strength in large caps.

- IWM (248.78) +1.06%: Significant bullish move in small caps, outpacing broader markets.

- IJH (66.91) +1.38%: Strong gains in mid-caps contribute to a positive risk-on environment.

- DIA (483.63) +0.64%: Dow components move higher, but gains are moderate relative to small and mid-cap peers.

- Bearish Pressure:

- QQQ (613.12) -0.19%: Nasdaq-tracking ETF underperforms, signaling tech sector headwinds.

- Mixed Picture:

- Large cap indices are generally positive, but tech-focused ETFs show divergence, highlighting sector rotation.

Mag7 Snapshot

- Bullish Standouts:

- NVDA (188.85) +1.26%: Leading performance within the group signals continued AI and semiconductor strength.

- GOOG (315.32) +0.48%: Alphabet posts a modest gain, contrasting with peer declines.

- Bearish Reversals:

- AAPL (271.01) -0.31%: Slight pressure in Apple shares after recent strength.

- META (650.41) -1.47%, AMZN (226.50) -1.87%, MSFT (472.94) -2.21%, TSLA (438.07) -2.59%: Broad weakness in large-cap tech, with Tesla and Microsoft experiencing sharper declines.

- Mixed/Rotational Action:

- Performance dispersion is notable among the Mag7, with only a couple of names (NVDA, GOOG) showing resilience as others face profit-taking or risk-off moves.

Other Key ETFs

- Bullish:

- IBIT (50.94) +2.60%: Robust performance in bitcoin-linked ETFs as digital asset momentum continues.

- GLD (398.28) +0.50%: Gold ETF trades higher, indicating ongoing safe-haven interest despite broader risk-on moves.

- Bearish:

- TLT (87.03) -0.15%: Slight decline in long-dated Treasuries may reflect higher rate expectations or shifting risk appetite.

- USO (68.96) -0.29%: Lower oil ETF prices suggest softening energy markets.

Summary

- Bullish sentiment is concentrated in small and mid-cap equities, select mega-cap tech (NVDA, GOOG), bitcoin, and gold ETFs.

- Bearish trends weigh on major technology leaders and some rate- and oil-sensitive ETFs.

- Rotation between sectors and asset classes is evident, with leadership shifting outside of the traditional mega-cap tech space.

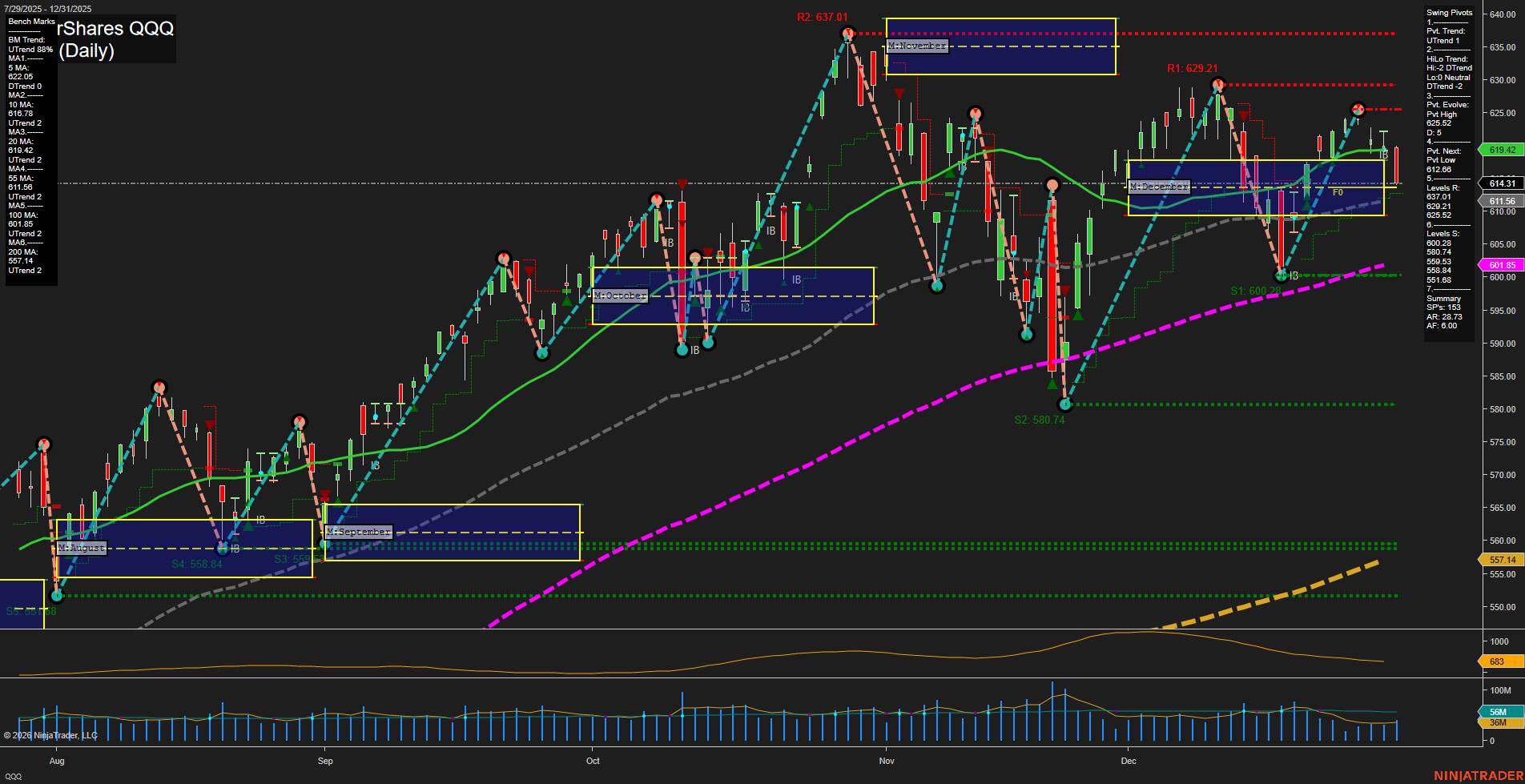

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts