After Market Close S&P 500 daily snapshot: news summary & sentiment, major ETFs, Magnificent 7 analysis, and QQQ daily view.

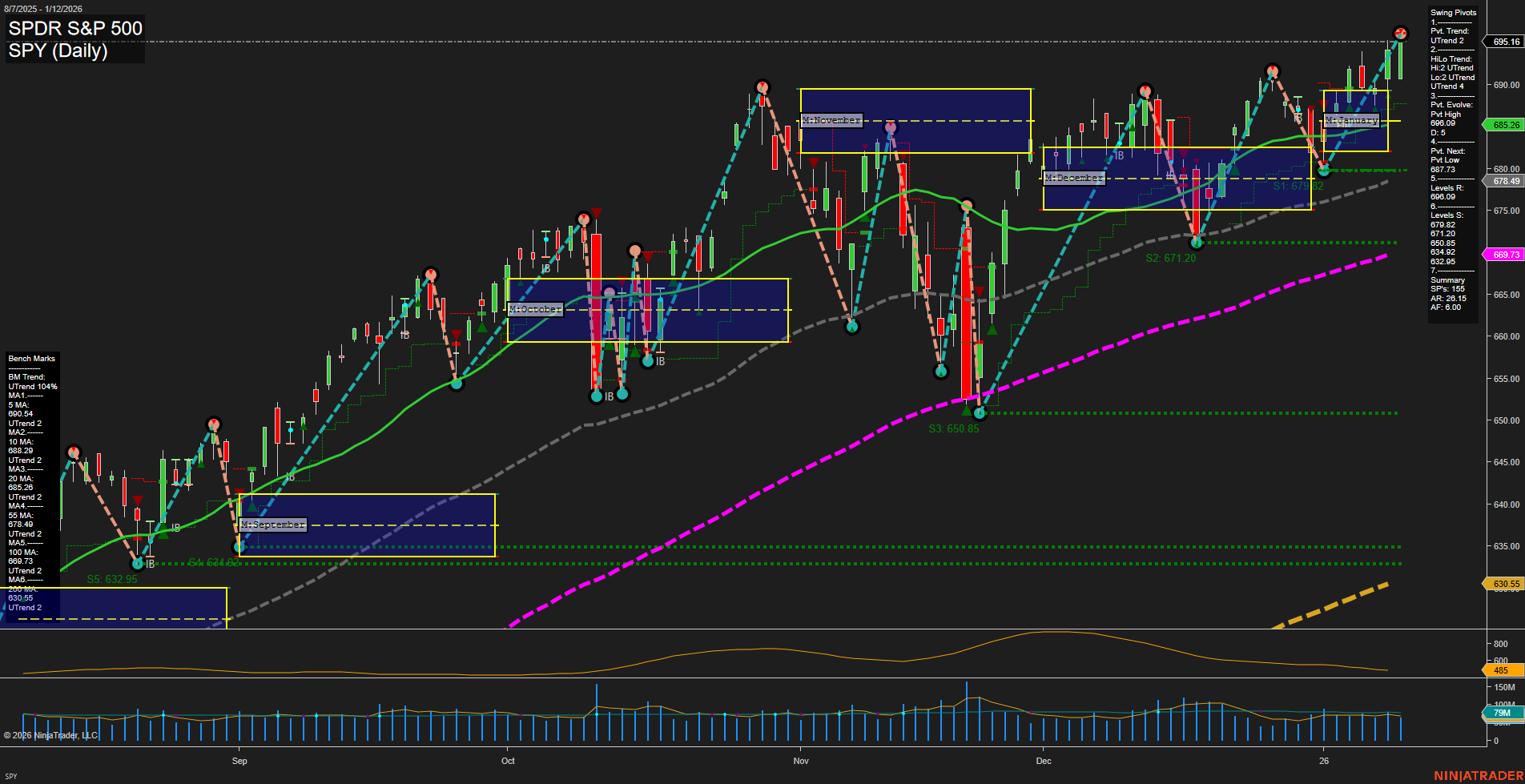

SPY Daily View

View weekly charts on: AlphaWebTrader HTF Charts

Market News Summary

- Federal Reserve Chair Jerome Powell is at the center of rare bipartisan and Wall Street support following a Department of Justice criminal probe related to testimony on Fed building renovations. High-level endorsements of Powell’s integrity, as well as notable public debate, are ongoing.

- Policy uncertainty and legal risks surrounding the Fed are contributing to market edginess, with some headlines highlighting “lawfare” engulfing the institution and investor concerns about excessive liquidity due to Washington’s interventions.

- Macroeconomic data show US inflation came in softer than expected, leading to calls for rate cuts. However, overall market sentiment remains cautious amid policy and fiscal headwinds.

- Oil markets are seeing heightened volatility with bullish trends confirmed for crude, driven by geopolitical developments and China’s strategic reserve purchases supporting global prices. Energy sector headlines reflect nervousness around regulatory policy, especially regarding US offshore wind.

- Precious metals markets remain in focus: analysts issue strong forecasts for gold and silver, with gold setting new highs and signals pointing to further upside, though opinions diverge on its role as a portfolio diversifier.

- The equity landscape is mixed. Technology stocks and select materials stocks show strength, benefiting ETFs with significant big-cap tech exposure. However, all major US indices have seen pullbacks, with particular weakness in small caps and consumer discretionary shares.

- Options market indicators and technical setups suggest renewed bull signals in some segments, while discussions continue about whether volatility will persist at elevated market levels.

- Analysts highlight a selection of “strong-buy” stocks, noting positive early trends for 2026, though trading remains cautious with fiscal flows and bank credit trends under review.

- China’s influence continues to be felt across markets, both as an oil demand stabilizer and as a key investment focus, with evolving strategies discussed by institutional players.

News Conclusion

- Markets are navigating a complex interplay of policy risk, legal uncertainty, and shifting inflation dynamics. While some sectors and asset classes are showing technical and fundamental strength, overall sentiment is tempered by ongoing debates over central bank independence, the durability of the economic recovery, and geopolitical developments impacting commodities.

- Financial headlines reflect a landscape in flux: legal pressures on the Fed, evolving inflation expectations, and active rotation across asset classes contribute to heightened volatility and selective sector performance.

- The coming sessions may see continued turbulence, with market participants digesting policy actions, regulatory developments, and geopolitical news for direction. Key sectors to watch include energy, precious metals, technology, and consumer discretionary industries.

Market News Sentiment:

Market News Articles: 55

- Neutral: 41.82%

- Positive: 32.73%

- Negative: 25.45%

GLD,Gold Articles: 11

- Neutral: 45.45%

- Negative: 27.27%

- Positive: 27.27%

USO,Oil Articles: 19

- Positive: 52.63%

- Negative: 26.32%

- Neutral: 21.05%

Market Data Snapshot

ETF Snapshot of major stock market ETFs, Mag7, and others as of: January 13, 2026 05:00

- IBIT 53.57 Bullish 3.28%

- USO 73.48 Bullish 2.55%

- GOOG 336.43 Bullish 1.11%

- NVDA 185.81 Bullish 0.47%

- AAPL 261.05 Bullish 0.31%

- IJH 69.36 Bullish 0.20%

- TLT 87.82 Bullish 0.17%

- IWM 261.35 Bearish -0.06%

- GLD 421.63 Bearish -0.14%

- QQQ 626.24 Bearish -0.15%

- SPY 693.77 Bearish -0.20%

- TSLA 447.20 Bearish -0.39%

- DIA 491.94 Bearish -0.80%

- MSFT 470.67 Bearish -1.36%

- AMZN 242.60 Bearish -1.57%

- META 631.09 Bearish -1.69%

Market Overview for ETF Stocks, Mag7, and Other Major ETFs

Snapshot Date: 01/13/2026 17:00:00

ETF Stocks Performance

- SPY: 693.77 (Bearish, -0.20%)

- QQQ: 626.24 (Bearish, -0.15%)

- IWM: 261.35 (Bearish, -0.06%)

- IJH: 69.36 (Bullish, 0.20%)

- DIA: 491.94 (Bearish, -0.80%)

Summary:

The large-cap and small-cap ETF landscape is predominantly registering bearish momentum, with SPY, QQQ, IWM, and DIA all in the red. The only exception is IJH, posting a modest bullish uptick. The tone indicates broad-based caution, particularly in large-cap equities.

Magnificent 7 Stocks (Mag7)

- AAPL (Apple): 261.05 (Bullish, 0.31%)

- MSFT (Microsoft): 470.67 (Bearish, -1.36%)

- GOOG (Alphabet): 336.43 (Bullish, 1.11%)

- AMZN (Amazon): 242.60 (Bearish, -1.57%)

- META (Meta): 631.09 (Bearish, -1.69%)

- NVDA (Nvidia): 185.81 (Bullish, 0.47%)

- TSLA (Tesla): 447.20 (Bearish, -0.39%)

Summary:

Performance is mixed among the Mag7, with GOOG, AAPL, and NVDA showing strength, while MSFT, AMZN, META, and TSLA are experiencing sell pressure. This mix highlights ongoing rotation and volatility among tech leadership.

Other Key ETFs

- IBIT (Bitcoin ETF): 53.57 (Bullish, 3.28%)

- USO (Oil): 73.48 (Bullish, 2.55%)

- GLD (Gold): 421.63 (Bearish, -0.14%)

- TLT (Long-term Treasuries): 87.82 (Bullish, 0.17%)

Summary:

Non-equity ETFs show notable bullishness, especially in IBIT (crypto) and USO (energy), indicating risk-on sentiment in alternative assets. TLT shows minor strength, while gold is slightly weaker.

State of Play

- Long (Bullish): IBIT, USO, GOOG, NVDA, AAPL, IJH, TLT

- Short (Bearish): IWM, GLD, QQQ, SPY, TSLA, DIA, MSFT, AMZN, META

- Mixed/Rotation: Tech leadership is split; equity index ETFs lean bearish, while crypto and energy ETFs are notably strong.

Conclusion: As of the latest session, equity indices and several top tech names are under pressure, with strength concentrated in select technology stocks and alternative assets. Rotational action and sector divergence are pronounced.

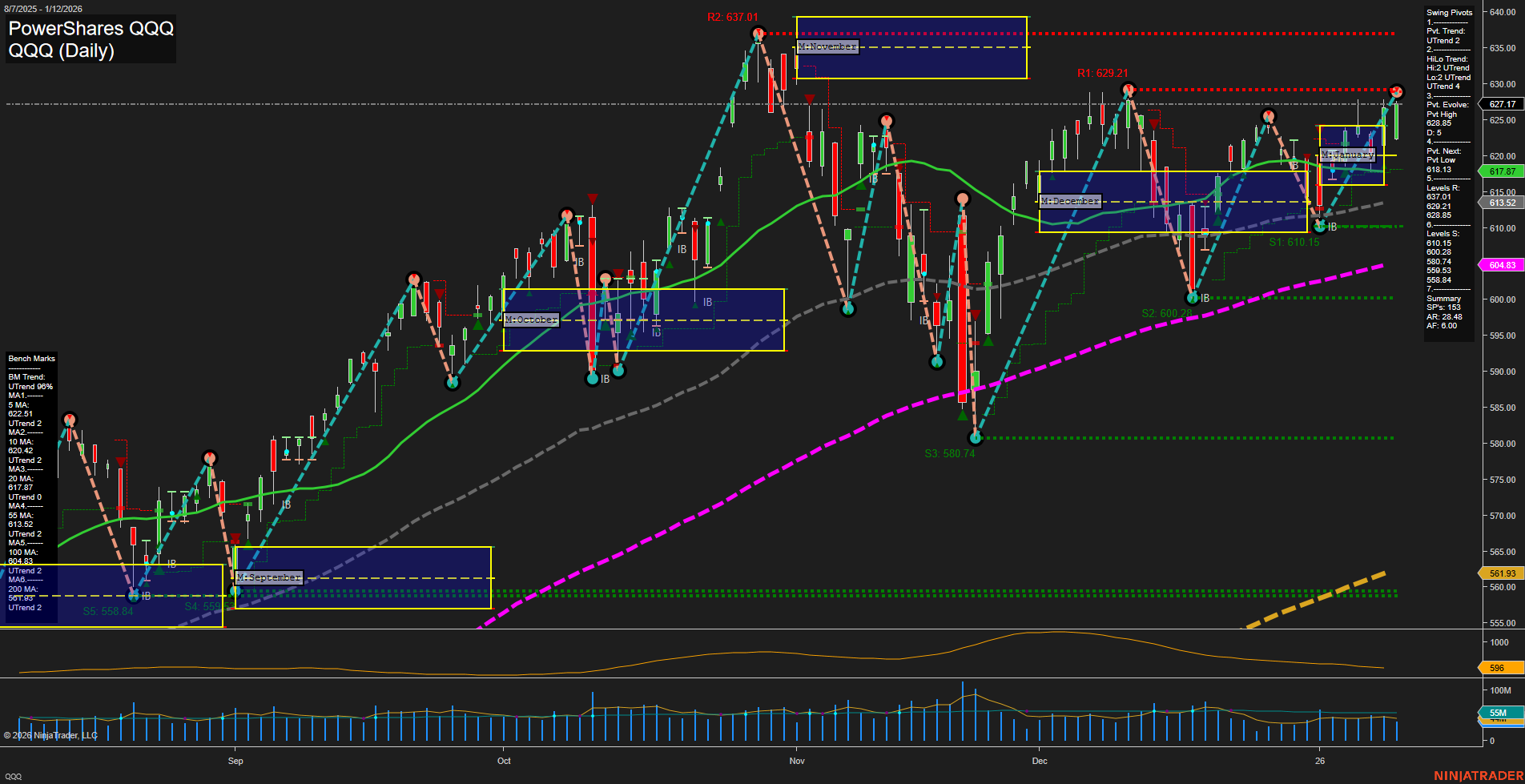

Tech Daily View

View weekly charts on: AlphaWebTrader HTF Charts